This version of the form is not currently in use and is provided for reference only. Download this version of

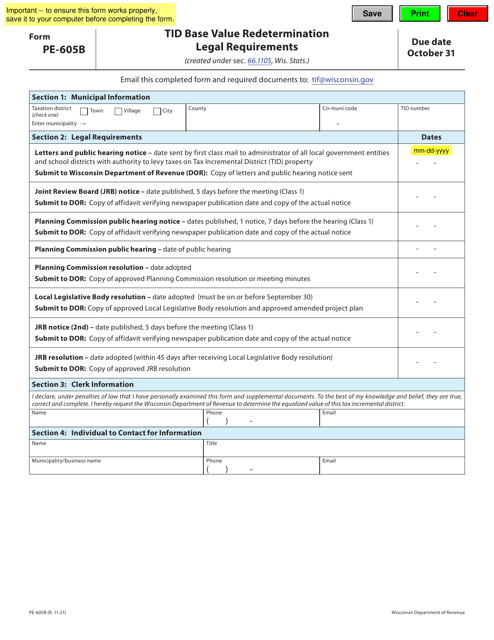

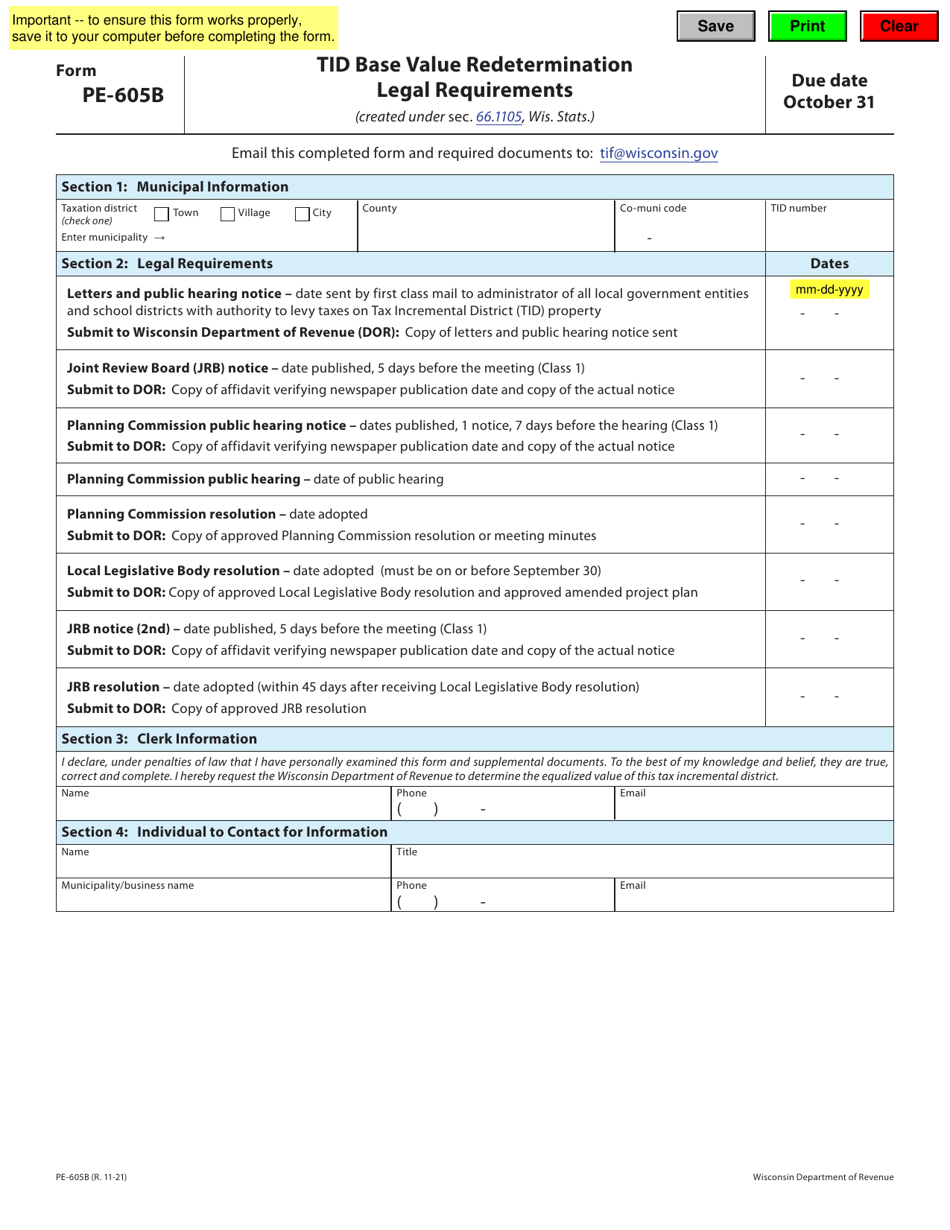

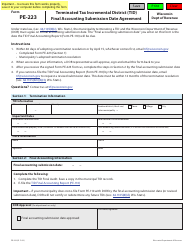

Form PE-605B

for the current year.

Form PE-605B Tid Base Value Redetermination - Legal Requirements - Wisconsin

What Is Form PE-605B?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PE-605B?

A: Form PE-605B is a document used for Base Value Redetermination in Wisconsin.

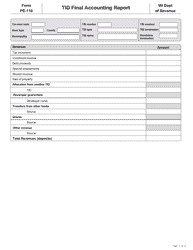

Q: What is Base Value Redetermination?

A: Base Value Redetermination is the process of reassessing the value of a property for tax purposes.

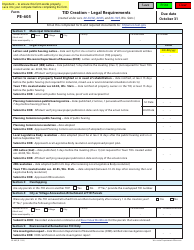

Q: What are the legal requirements for Form PE-605B?

A: The legal requirements for Form PE-605B are specific to Wisconsin's tax laws and regulations.

Q: Who needs to fill out Form PE-605B?

A: Property owners in Wisconsin who want to request a base value redetermination need to fill out Form PE-605B.

Q: What information is needed to fill out Form PE-605B?

A: Information such as property details, reasoning for the redetermination, and supporting documentation may be required to fill out Form PE-605B.

Q: Is there a deadline to submit Form PE-605B?

A: The deadline to submit Form PE-605B may vary, so it's important to check the instructions and requirements provided by the Wisconsin Department of Revenue.

Q: Can I appeal the decision made based on Form PE-605B?

A: Yes, property owners have the right to appeal the decision if they disagree with the outcome of the base value redetermination.

Q: Are there any fees associated with submitting Form PE-605B?

A: It's best to review the instructions or guidelines provided by the Wisconsin Department of Revenue for any fees or charges associated with submitting Form PE-605B.

Q: Can I get assistance with filling out Form PE-605B?

A: If needed, individuals may reach out to the Wisconsin Department of Revenue for assistance or clarification when filling out Form PE-605B.

Q: Does Form PE-605B apply to both residential and commercial properties?

A: Yes, Form PE-605B can be used for base value redetermination of both residential and commercial properties in Wisconsin.

Q: What happens after submitting Form PE-605B?

A: After submitting Form PE-605B, the Wisconsin Department of Revenue will review the request and make a decision on the base value redetermination.

Q: Is Form PE-605B specific to Wisconsin only?

A: Yes, Form PE-605B is specific to the state of Wisconsin and its tax laws.

Q: Can I submit Form PE-605B electronically?

A: It's advisable to check the instructions or guidelines provided by the Wisconsin Department of Revenue to see if electronic submission is allowed for Form PE-605B.

Q: Can I request a base value redetermination multiple times?

A: Depending on the circumstances, property owners may be able to request a base value redetermination multiple times.

Q: Are there any consequences if I don't submit Form PE-605B?

A: If you don't submit Form PE-605B, the base value of your property for tax purposes may not be reassessed.

Q: How long does it take to receive a decision after submitting Form PE-605B?

A: The timeframe for receiving a decision on the base value redetermination can vary, so it's best to check with the Wisconsin Department of Revenue for an estimate.

Q: What should I do if I made an error on Form PE-605B?

A: If you made an error on Form PE-605B, it's important to contact the Wisconsin Department of Revenue to rectify the situation and provide the correct information.

Q: Can I submit additional supporting documents with Form PE-605B?

A: Yes, additional supporting documents that are relevant to the base value redetermination can be submitted along with Form PE-605B.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PE-605B by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.