This version of the form is not currently in use and is provided for reference only. Download this version of

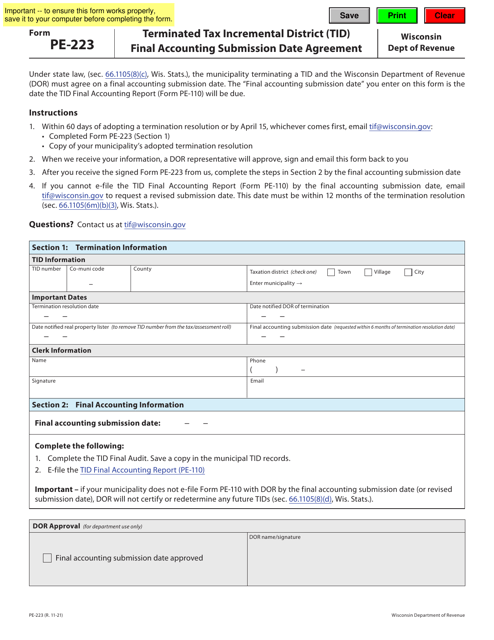

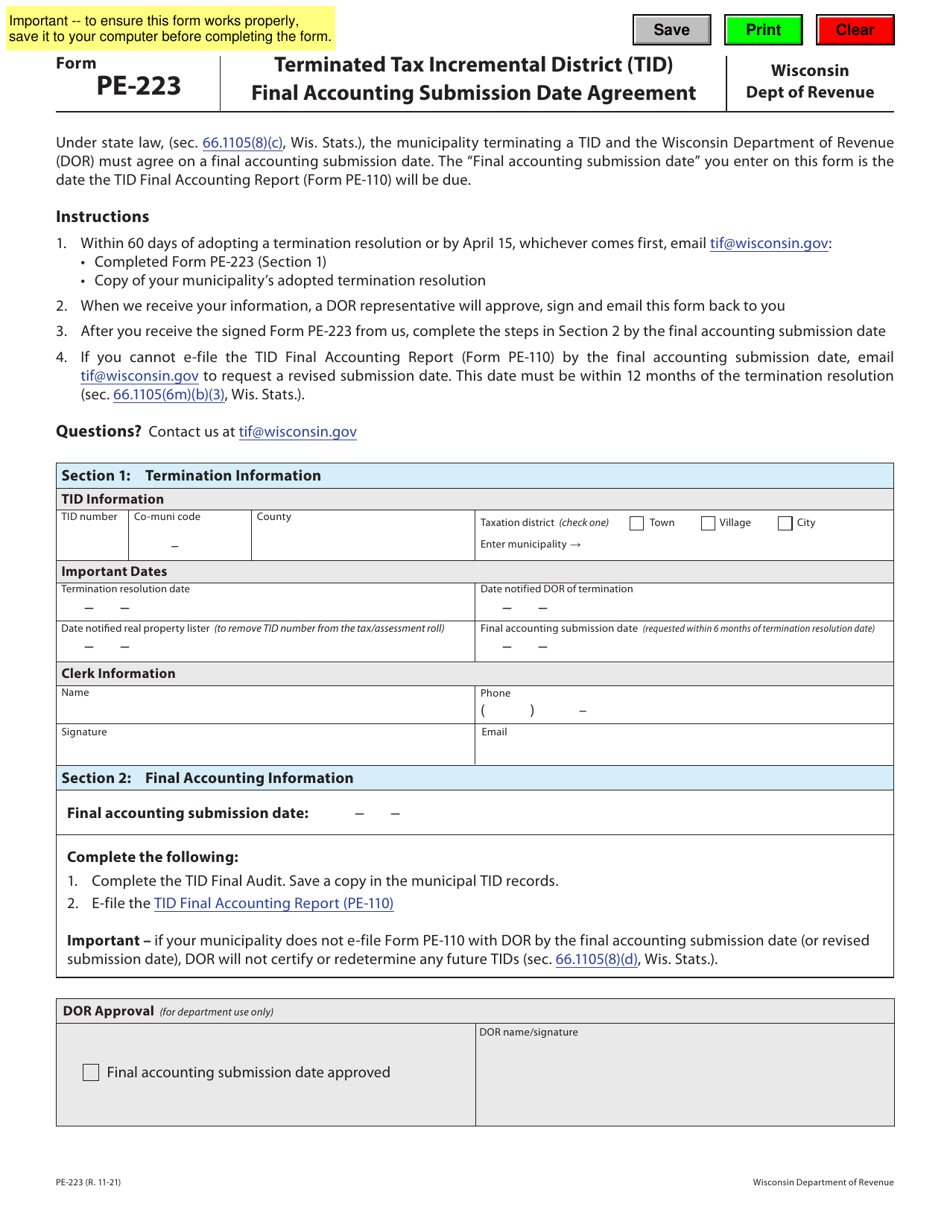

Form PE-223

for the current year.

Form PE-223 Terminated Tax Incremental District (Tid) Final Accounting Submission Date Agreement - Wisconsin

What Is Form PE-223?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PE-223?

A: Form PE-223 is the Terminated Tax Incremental District (TID) Final Accounting Submission Date Agreement.

Q: What is a Tax Incremental District (TID)?

A: A Tax Incremental District (TID) is a designated area where property taxes can be used to fund infrastructure improvements and economic development projects.

Q: What is the purpose of Form PE-223?

A: Form PE-223 is used to submit the final accounting for a terminated Tax Incremental District (TID).

Q: What information is required on Form PE-223?

A: Form PE-223 requires information such as the TID number, termination date, final project costs, and the amount of unspent project funds.

Q: When is the deadline for submitting Form PE-223?

A: The deadline for submitting Form PE-223 is determined by the agreement between the municipality and the Wisconsin Department of Revenue.

Q: Who is responsible for filling out Form PE-223?

A: The municipality or local government that is responsible for the terminated Tax Incremental District (TID) is responsible for filling out Form PE-223.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PE-223 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.