This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

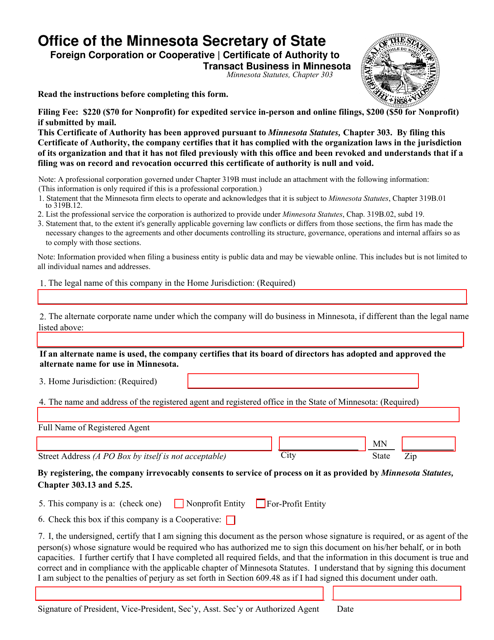

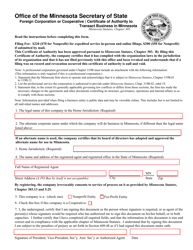

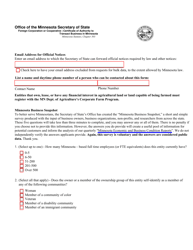

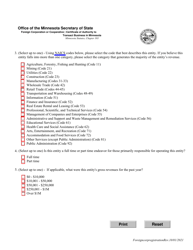

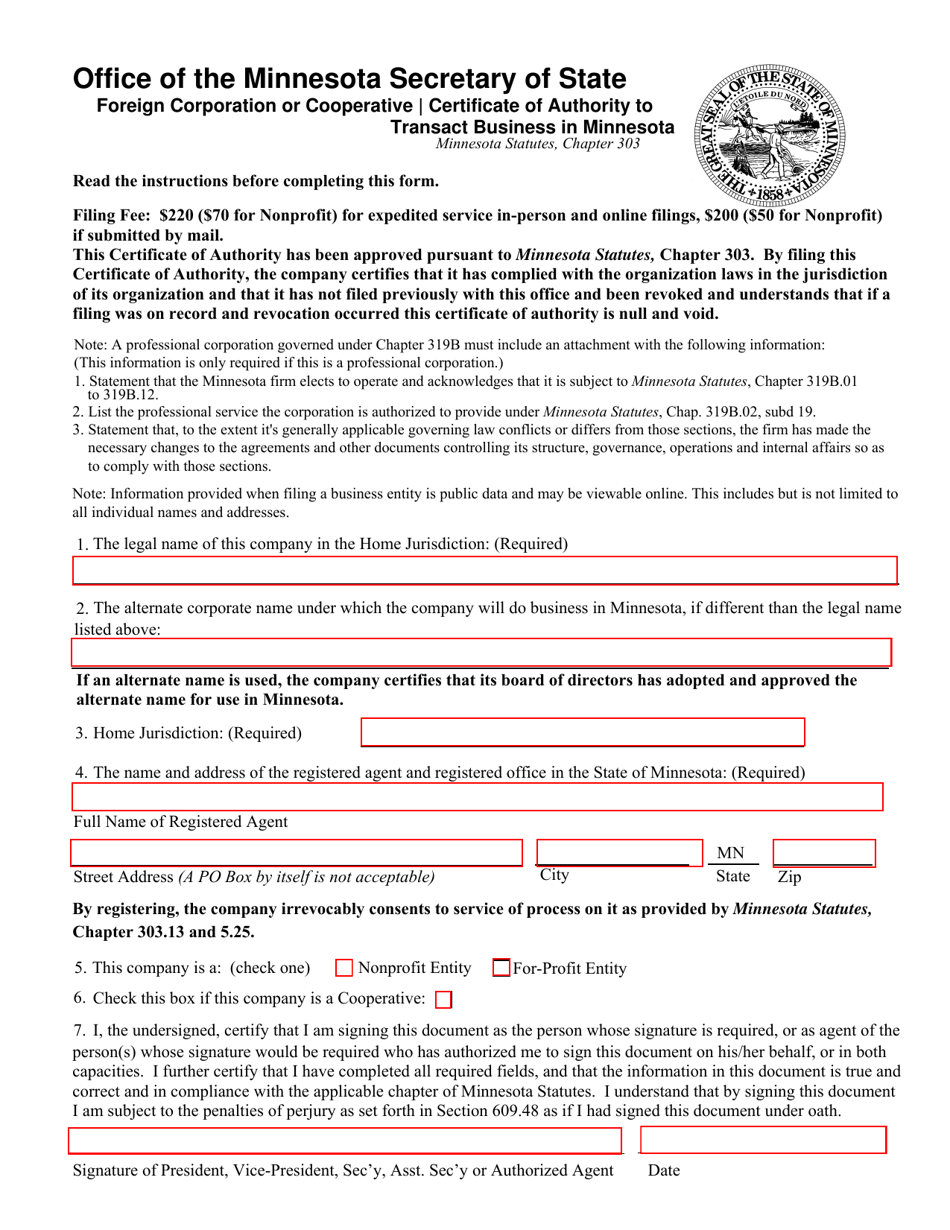

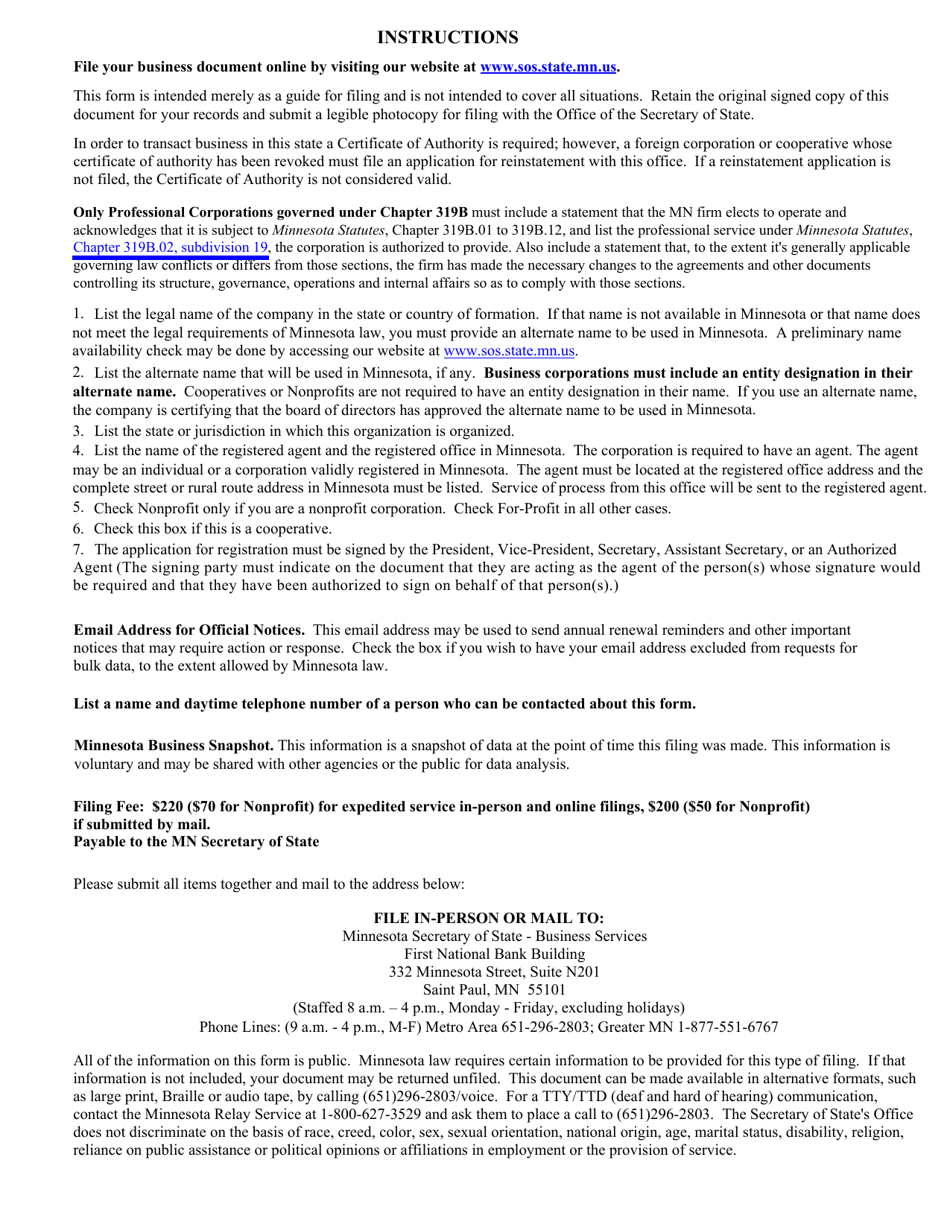

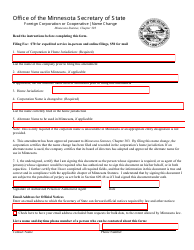

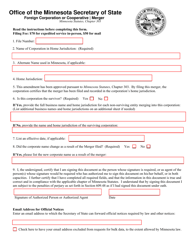

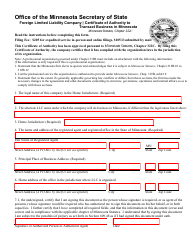

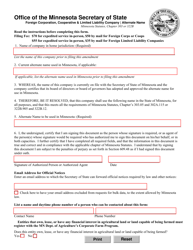

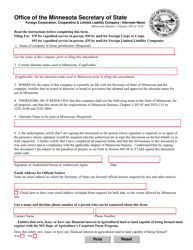

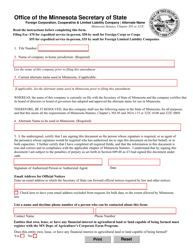

Foreign Corporation or Cooperative Certificate of Authority to Transact Business in Minnesota - Minnesota

Foreign Corporation or Cooperative Certificate of Authority to Transact Business in Minnesota is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a Foreign Corporation or Cooperative?

A: A foreign corporation or cooperative refers to a business entity that is incorporated outside of Minnesota.

Q: What is a Certificate of Authority?

A: A Certificate of Authority is a document issued by the state of Minnesota that grants permission to a foreign corporation or cooperative to do business in the state.

Q: Why would a foreign corporation or cooperative need a Certificate of Authority?

A: A foreign corporation or cooperative needs a Certificate of Authority to legally conduct business activities in the state of Minnesota.

Q: What are the requirements to obtain a Certificate of Authority?

A: The requirements to obtain a Certificate of Authority include submitting the necessary application forms, paying the required fees, and providing certain documents.

Q: How long does it take to process the application for a Certificate of Authority?

A: The processing time for a Certificate of Authority application can vary. It is recommended to allow sufficient time for the application to be reviewed and processed by the Minnesota Secretary of State.

Q: What happens if a foreign corporation or cooperative does business in Minnesota without a Certificate of Authority?

A: If a foreign corporation or cooperative engages in business activities in Minnesota without a Certificate of Authority, it may be subject to penalties and legal consequences. It is important to comply with the state's regulations and obtain the necessary authorization.

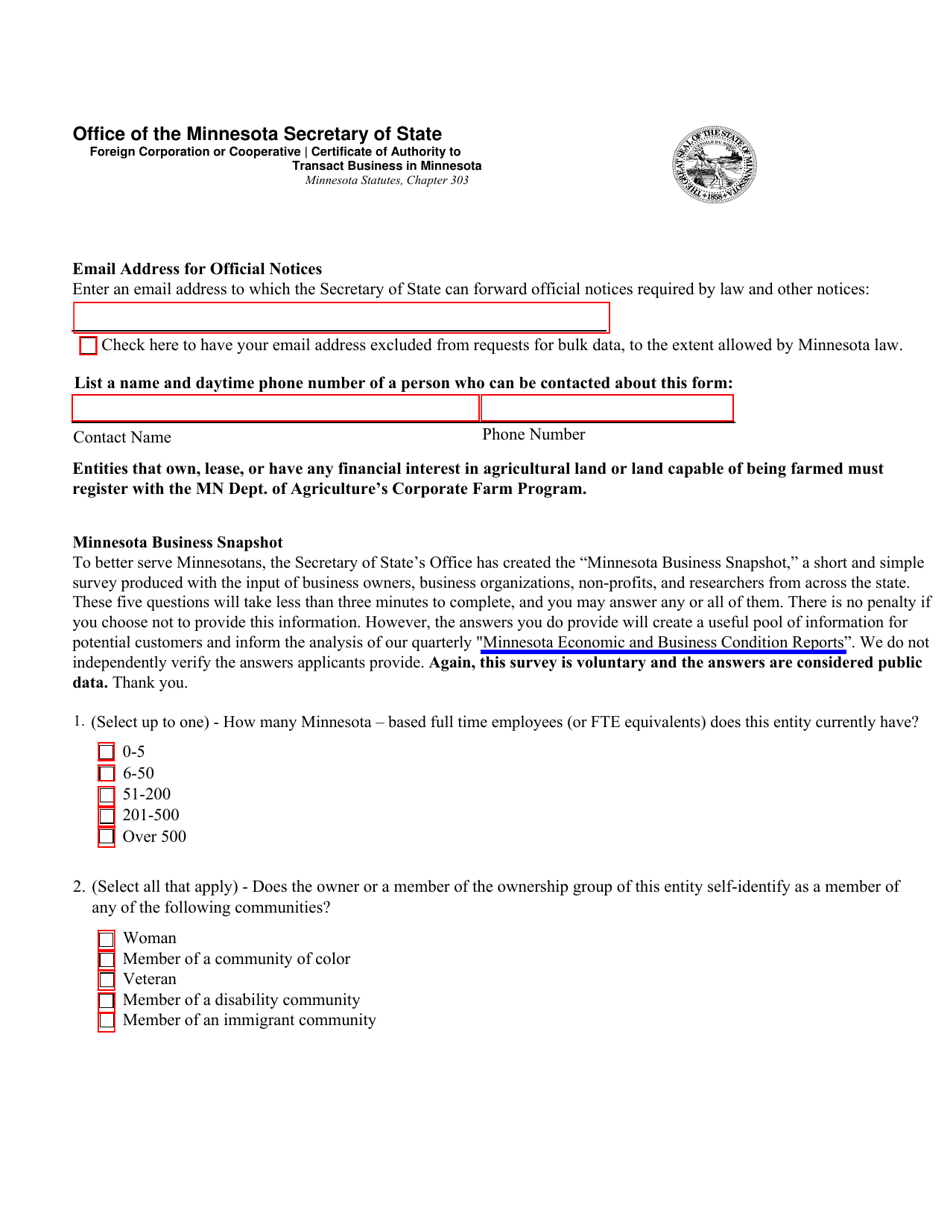

Q: Are there any ongoing requirements for a foreign corporation or cooperative with a Certificate of Authority?

A: Yes, there are ongoing requirements for a foreign corporation or cooperative with a Certificate of Authority, such as filing annual reports and maintaining a registered agent in Minnesota.

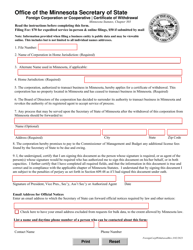

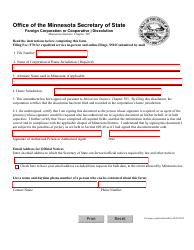

Q: Can a foreign corporation or cooperative withdraw its Certificate of Authority?

A: Yes, a foreign corporation or cooperative can voluntarily withdraw its Certificate of Authority by filing the appropriate paperwork with the Minnesota Secretary of State.

Form Details:

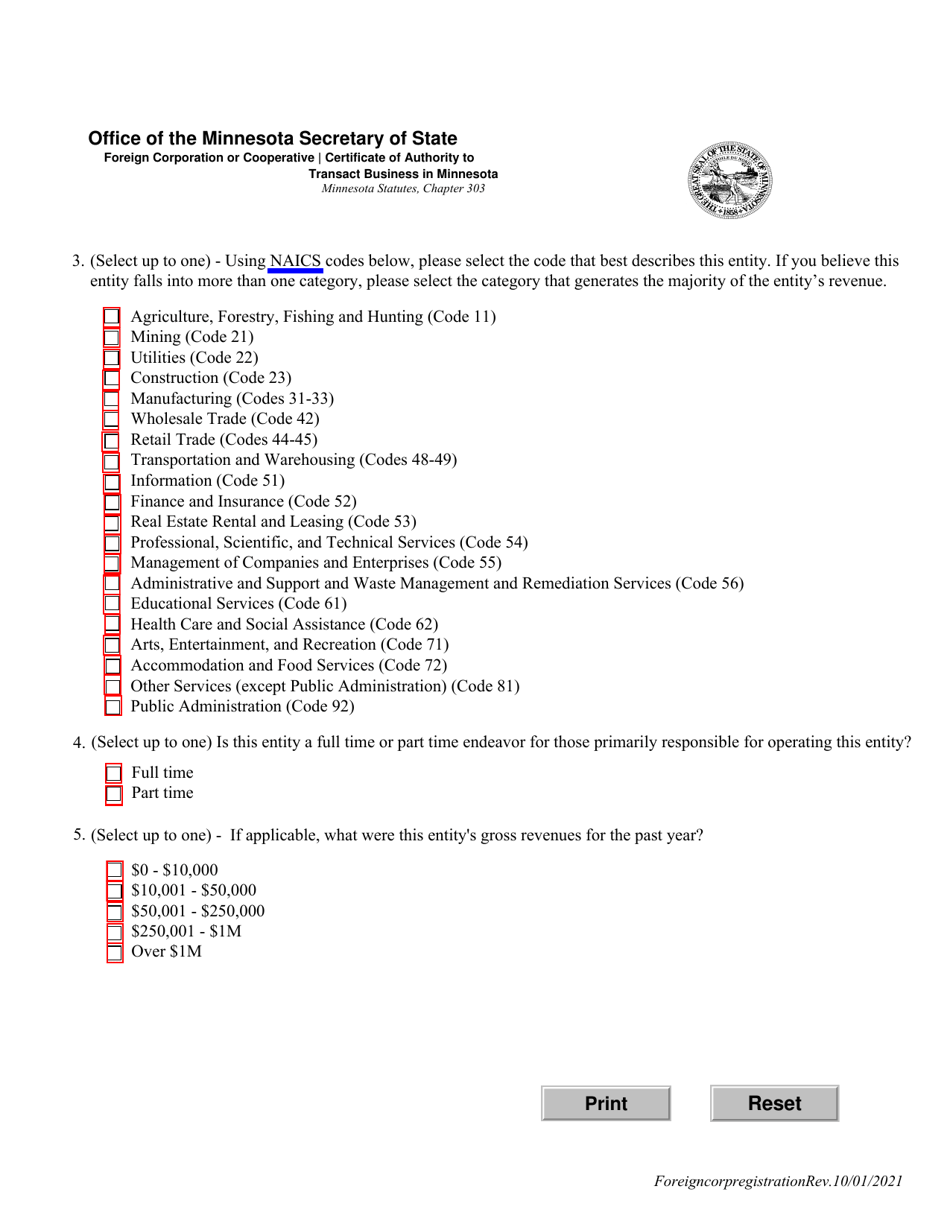

- Released on October 1, 2021;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.