This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

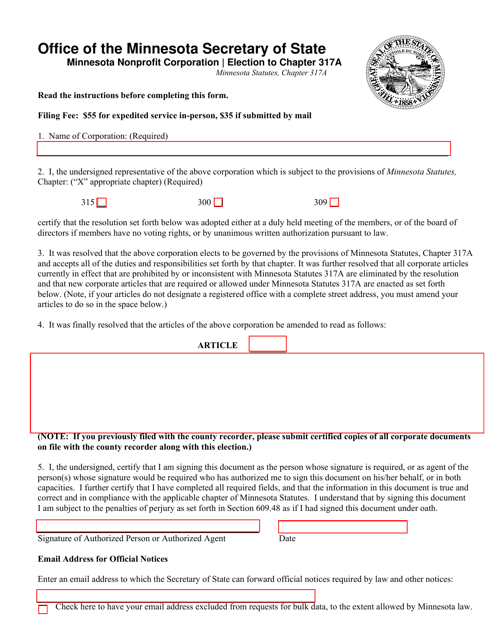

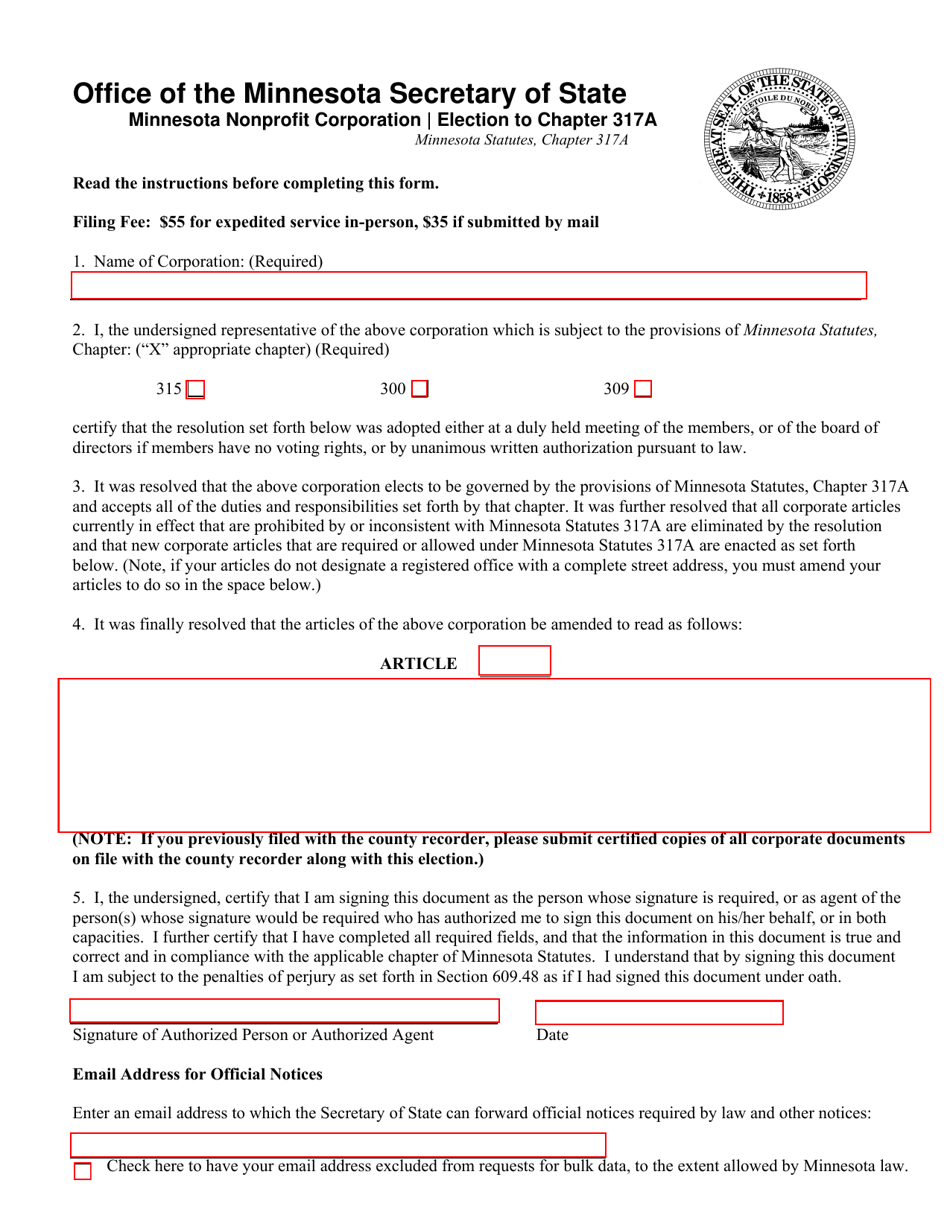

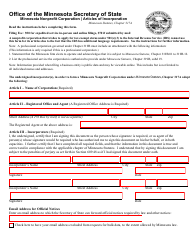

Minnesota Nonprofit Corporation Election to Chapter 317a - Minnesota

Minnesota Nonprofit Corporation Election to Chapter 317a is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a nonprofit corporation?

A: A nonprofit corporation is an organization that is formed for educational, charitable, religious, scientific, literary, or other purposes, and is exempt from certain taxes.

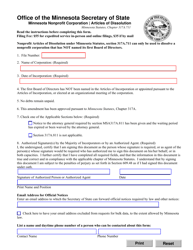

Q: What is Chapter 317a in Minnesota?

A: Chapter 317a is a section of the Minnesota statutes that governs nonprofit corporations.

Q: What is an election to Chapter 317a?

A: An election to Chapter 317a is a decision made by a nonprofit corporation in Minnesota to be governed by the provisions of Chapter 317a.

Q: Why would a nonprofit corporation choose to elect Chapter 317a?

A: A nonprofit corporation may choose to elect Chapter 317a in order to take advantage of the benefits and protections provided by the statute.

Q: What are some of the benefits of electing Chapter 317a?

A: Some benefits of electing Chapter 317a include simplified governance requirements, limited liability protection for directors and officers, and the ability to engage in certain business activities.

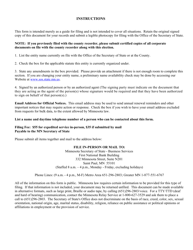

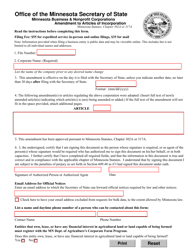

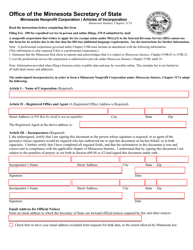

Q: How does a nonprofit corporation elect Chapter 317a?

A: To elect Chapter 317a, a nonprofit corporation must file a written election with the Minnesota Secretary of State.

Q: Are there any requirements or restrictions for electing Chapter 317a?

A: Yes, there are certain requirements and restrictions for electing Chapter 317a, such as having a clear and definite purpose, complying with certain reporting and filing requirements, and meeting certain governance standards.

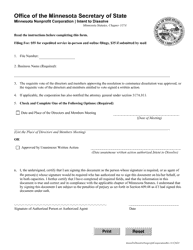

Q: Can a nonprofit corporation switch back to a different statute after electing Chapter 317a?

A: Yes, a nonprofit corporation can elect to be governed by a different statute after electing Chapter 317a, but it requires a formal process and approval from the Minnesota Attorney General.

Q: Are there any fees associated with electing Chapter 317a?

A: Yes, there are filing fees associated with electing Chapter 317a. The exact fees depend on the size and type of the nonprofit corporation.

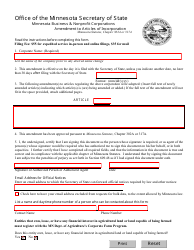

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.