This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

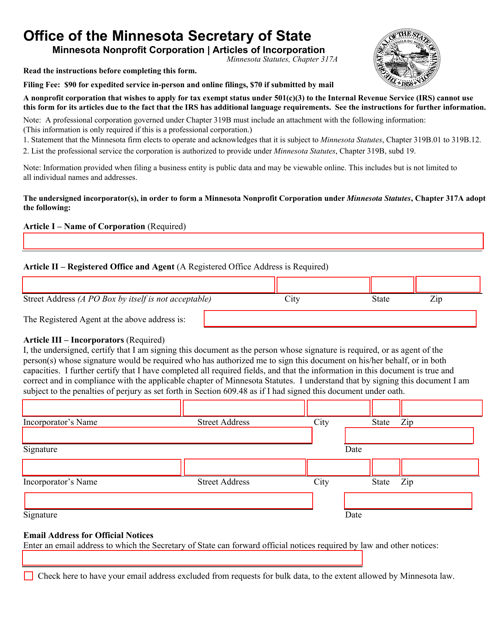

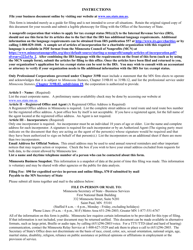

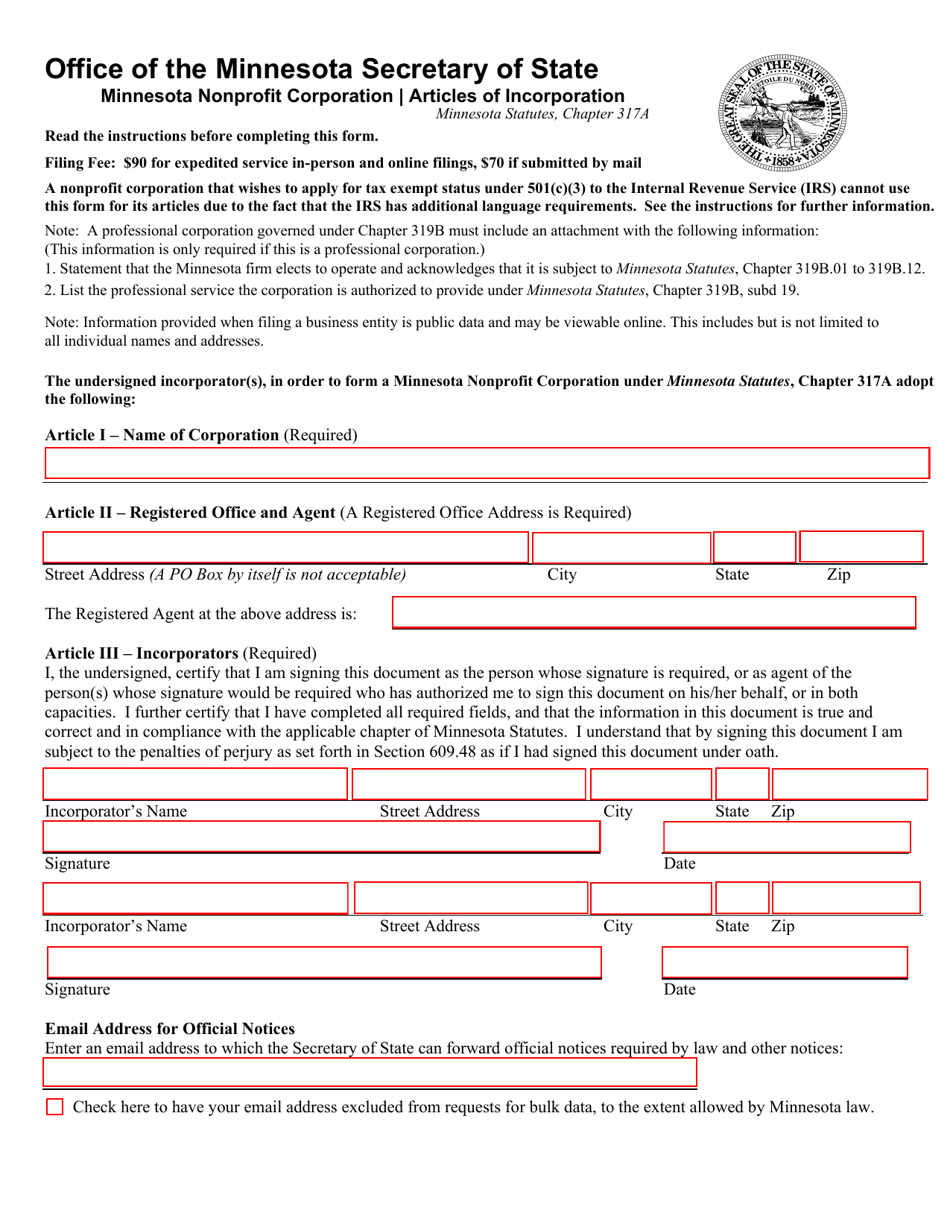

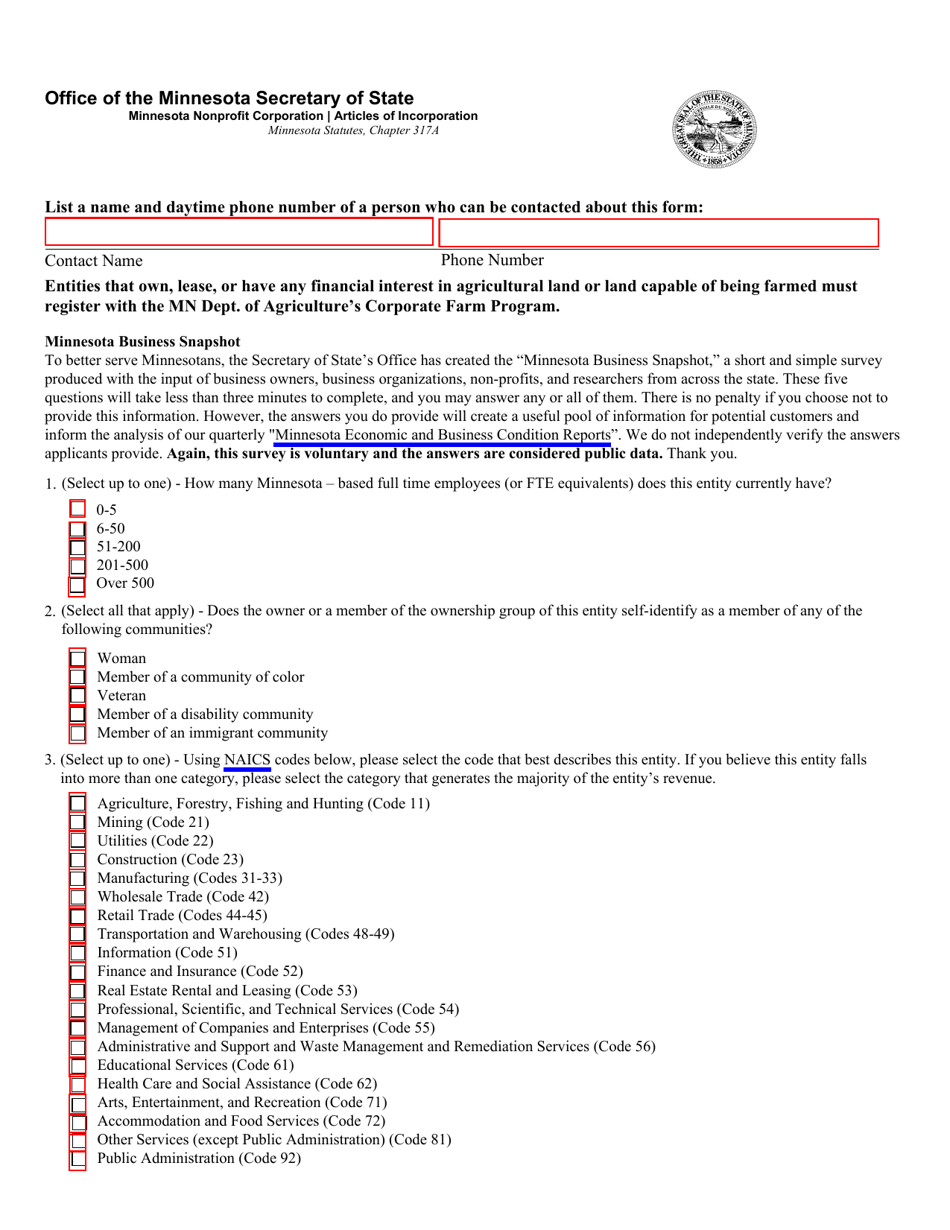

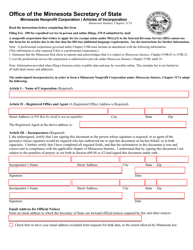

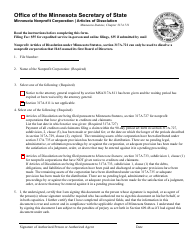

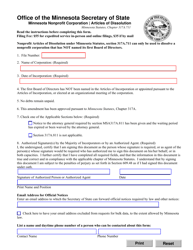

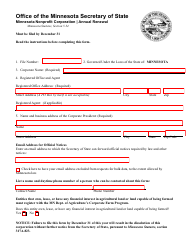

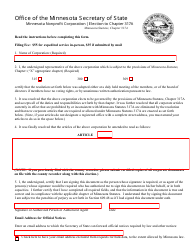

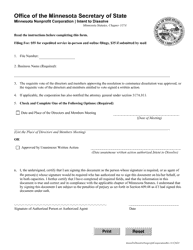

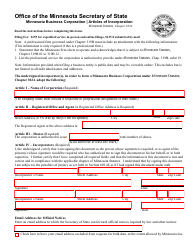

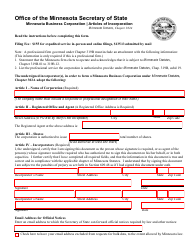

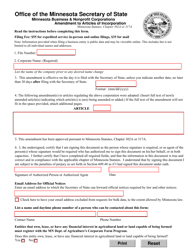

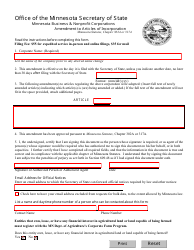

Minnesota Nonprofit Corporation Articles of Incorporation - Minnesota

Minnesota Nonprofit Corporation Articles of Incorporation is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is the purpose of the Minnesota Nonprofit Corporation Articles of Incorporation?

A: The purpose of the Articles of Incorporation is to legally establish a nonprofit corporation in Minnesota.

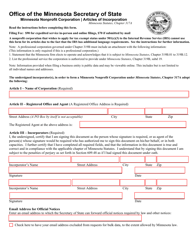

Q: What information is required in the Articles of Incorporation?

A: The Articles of Incorporation must include the corporation's name, its purpose, the address of its initial registered office, the name and address of its initial registered agent, and the names and addresses of the incorporators.

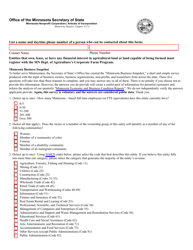

Q: Can a nonprofit corporation have a paid staff?

A: Yes, a nonprofit corporation can have paid staff in order to carry out its mission and operations.

Q: What is the process for filing the Articles of Incorporation?

A: The process involves filling out the required form, paying the filing fee, and submitting the form to the Minnesota Secretary of State.

Q: What is the filing fee for the Articles of Incorporation?

A: The filing fee for the Articles of Incorporation in Minnesota is $70.

Q: Can a nonprofit corporation engage in for-profit activities?

A: Yes, a nonprofit corporation can engage in certain for-profit activities as long as they are related to its nonprofit purpose.

Q: Can individuals serve as directors of a nonprofit corporation?

A: Yes, individuals can serve as directors of a nonprofit corporation as long as they meet certain eligibility requirements and fulfill their duties.

Q: What are the benefits of incorporating a nonprofit?

A: Incorporating a nonprofit provides legal protection for the organization's members and allows it to apply for tax-exempt status, among other benefits.

Q: What is required to maintain tax-exempt status for a nonprofit corporation?

A: To maintain tax-exempt status, a nonprofit corporation must comply with certain IRS regulations and file annual informational tax returns.

Q: What is the role of the Minnesota Secretary of State in relation to nonprofit corporations?

A: The Minnesota Secretary of State oversees the filing and maintenance of nonprofit corporations in the state and can provide information and assistance on the incorporation process.

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.