This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

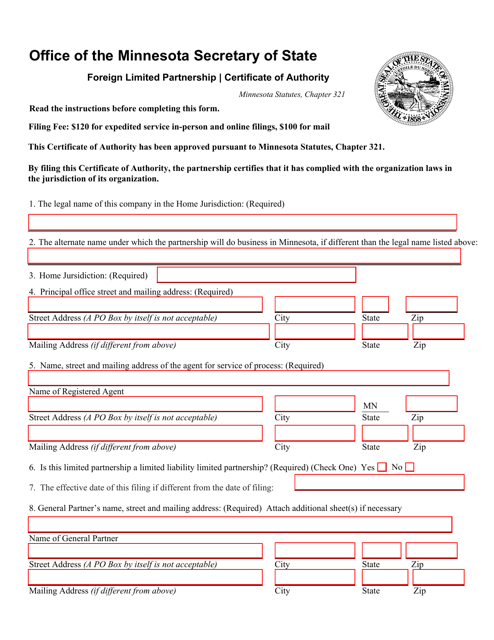

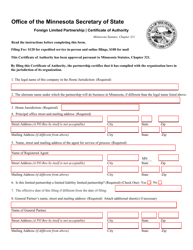

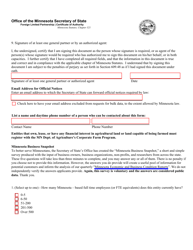

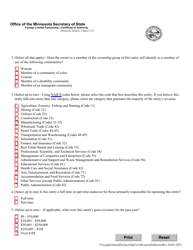

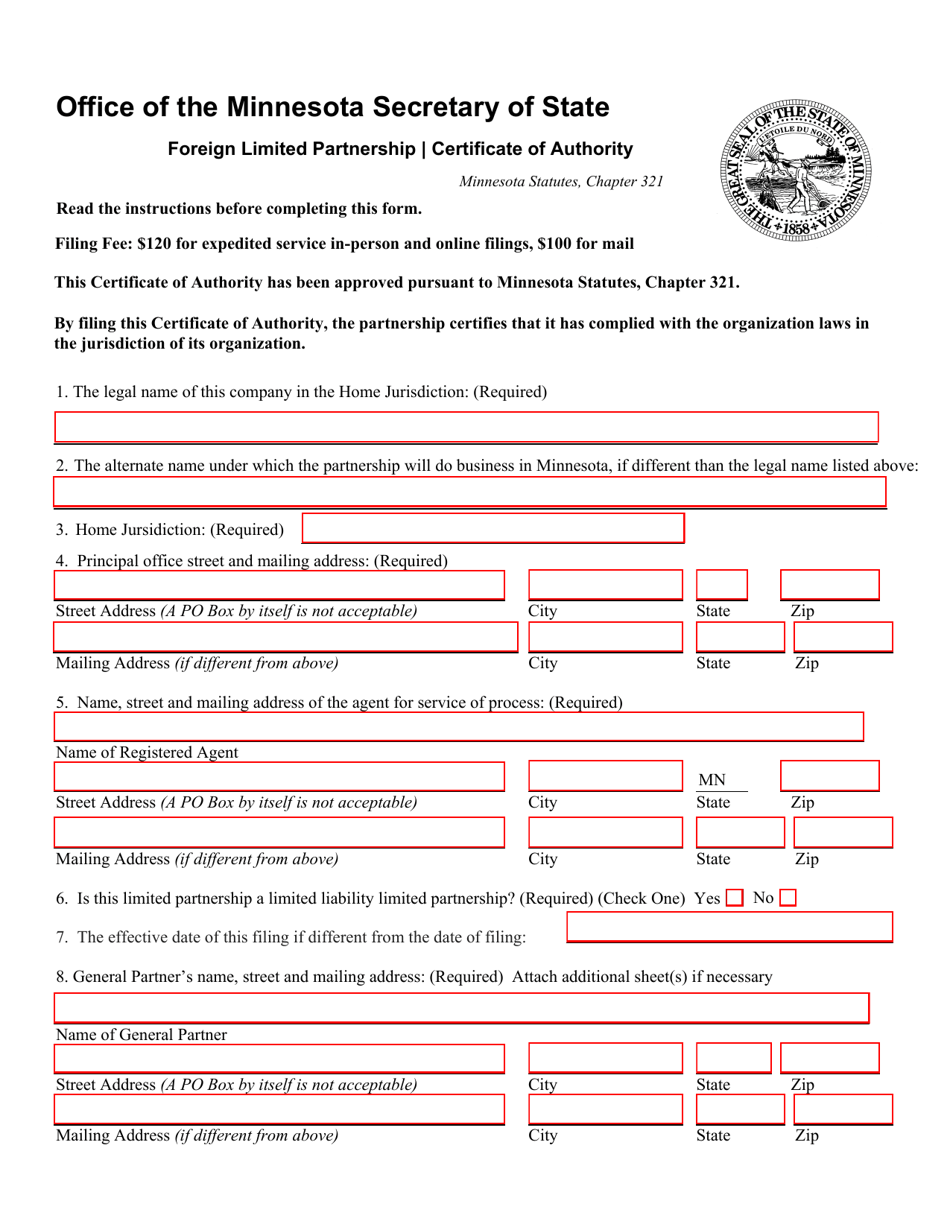

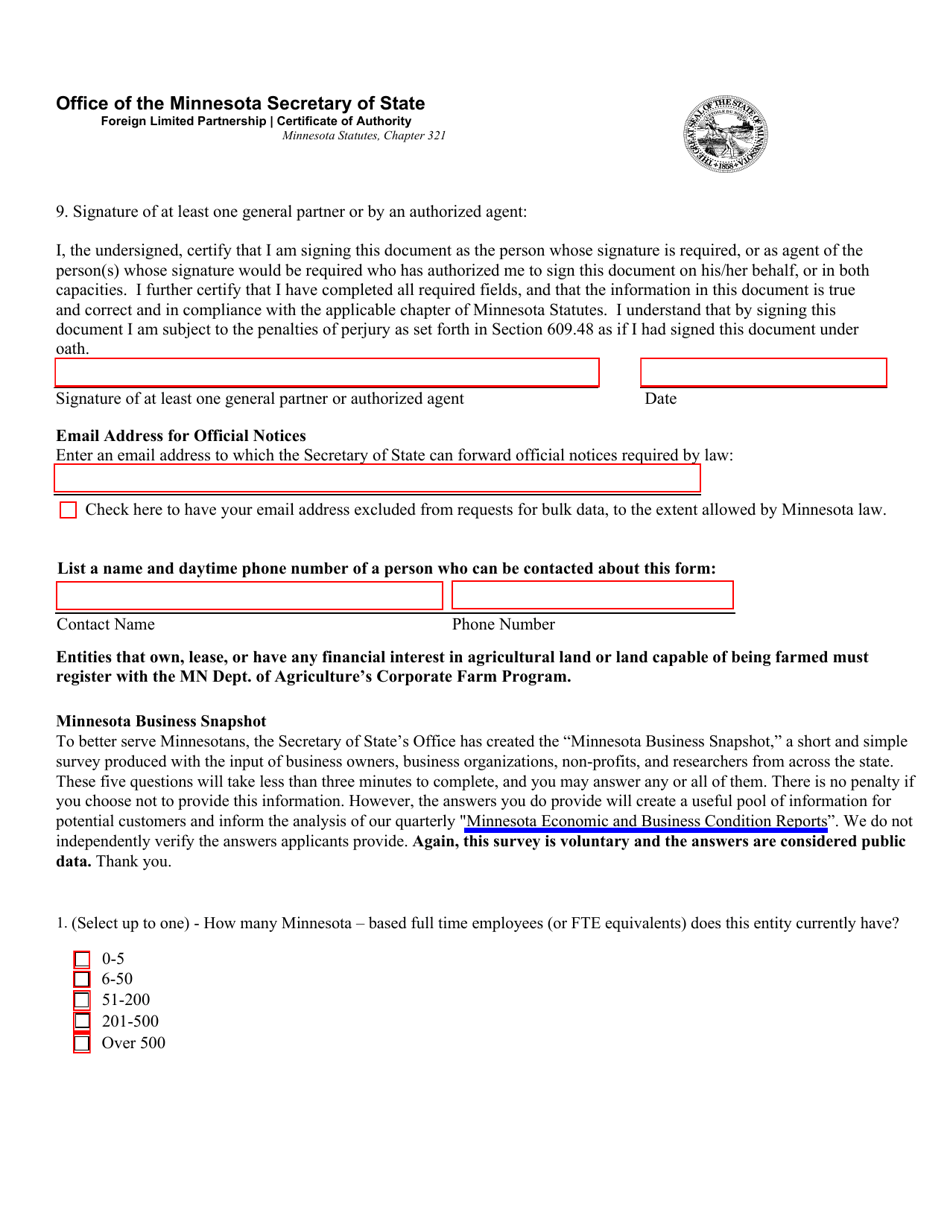

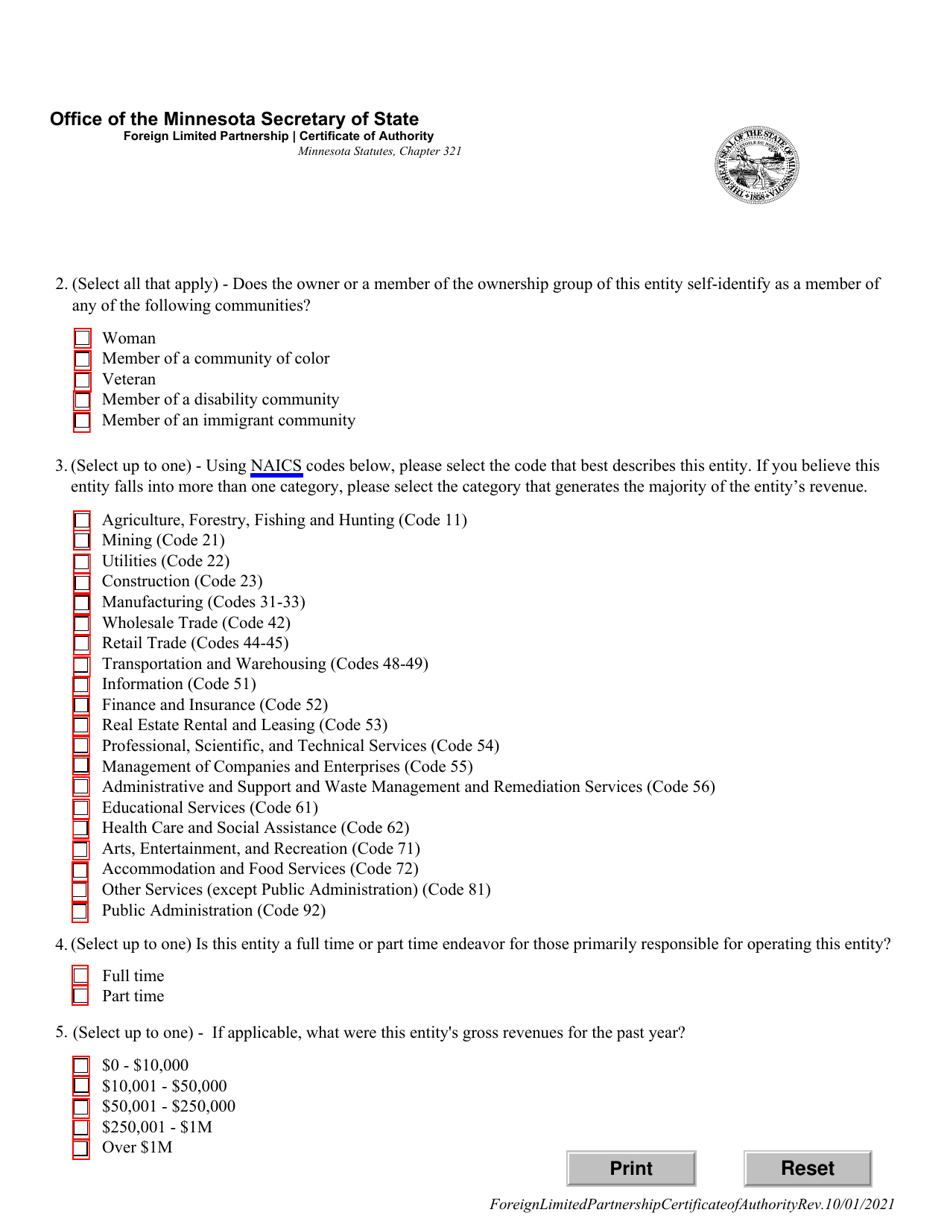

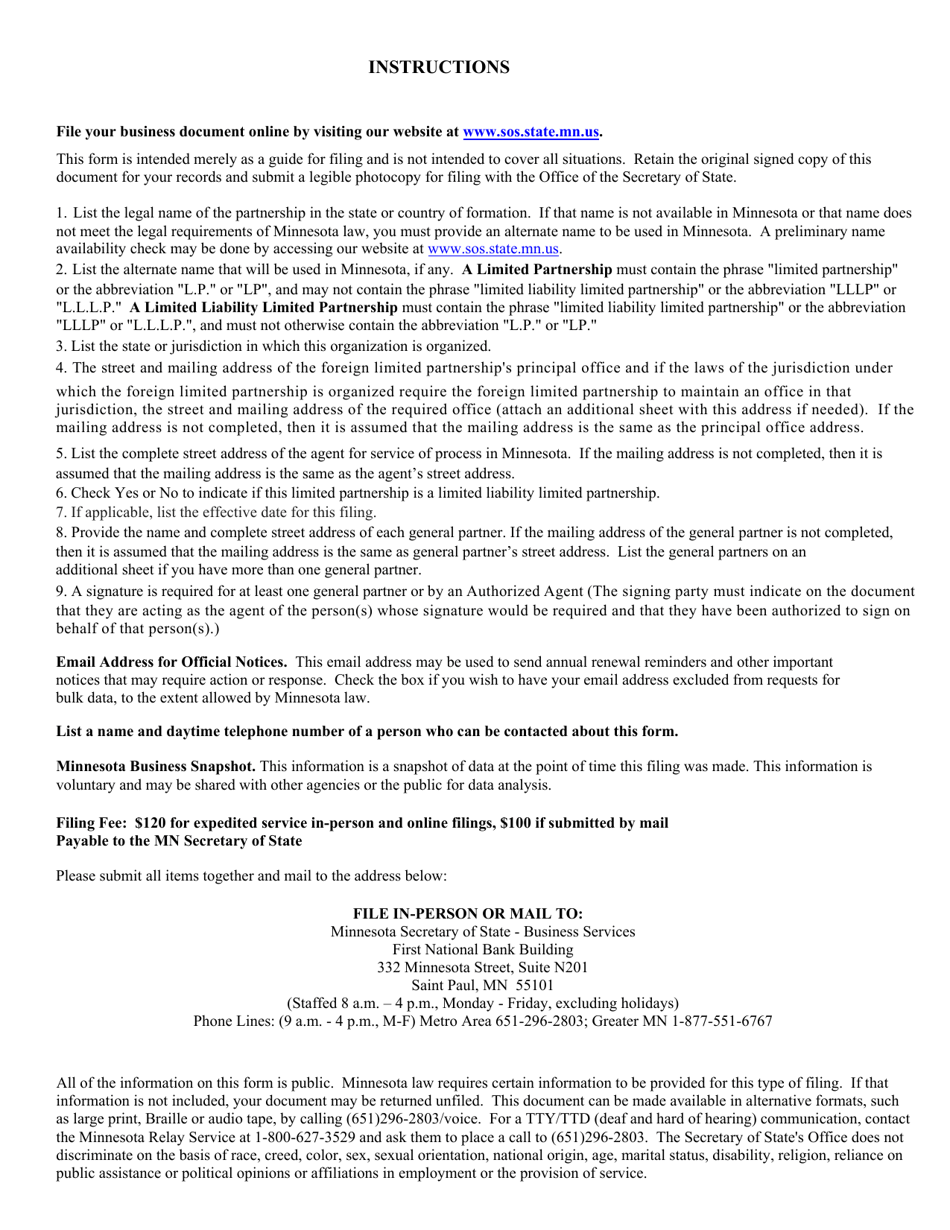

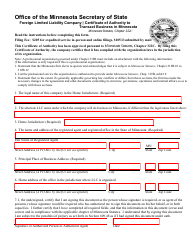

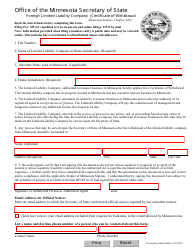

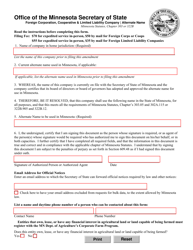

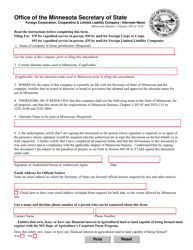

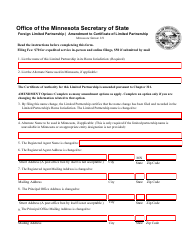

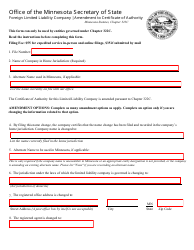

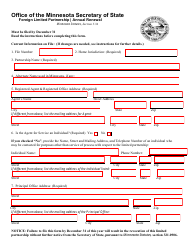

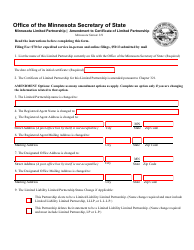

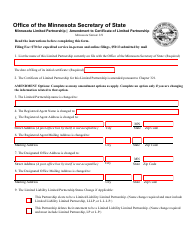

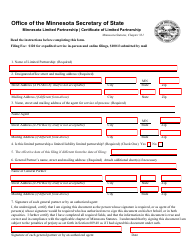

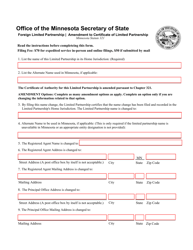

Foreign Limited Partnership Certificate of Authority - Minnesota

Foreign Limited Partnership Certificate of Authority is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a Foreign Limited Partnership Certificate of Authority?

A: A Foreign Limited Partnership Certificate of Authority is a document issued by the state of Minnesota that grants permission to a limited partnership formed in another state to do business in Minnesota.

Q: Why would a limited partnership need a Foreign Limited Partnership Certificate of Authority?

A: A limited partnership needs a Foreign Limited Partnership Certificate of Authority in order to legally conduct business in Minnesota.

Q: How can a limited partnership obtain a Foreign Limited Partnership Certificate of Authority in Minnesota?

A: To obtain a Foreign Limited Partnership Certificate of Authority in Minnesota, a limited partnership must file an application with the Minnesota Secretary of State and pay the required fees.

Q: What are the requirements for obtaining a Foreign Limited Partnership Certificate of Authority in Minnesota?

A: The requirements for obtaining a Foreign Limited Partnership Certificate of Authority in Minnesota include having a registered agent in Minnesota, providing certain business information, and paying the necessary fees.

Q: What happens if a limited partnership fails to obtain a Foreign Limited Partnership Certificate of Authority in Minnesota?

A: If a limited partnership fails to obtain a Foreign Limited Partnership Certificate of Authority in Minnesota, it may face penalties and may not be able to bring legal actions in Minnesota.

Q: Is a Foreign Limited Partnership Certificate of Authority the same as a business license?

A: No, a Foreign Limited Partnership Certificate of Authority is not the same as a business license. It is specifically for limited partnerships formed in other states that want to do business in Minnesota.

Q: Can a limited partnership from another country obtain a Foreign Limited Partnership Certificate of Authority in Minnesota?

A: No, only limited partnerships formed in another state within the United States can obtain a Foreign Limited Partnership Certificate of Authority in Minnesota.

Q: How long is a Foreign Limited Partnership Certificate of Authority valid in Minnesota?

A: A Foreign Limited Partnership Certificate of Authority is typically valid for a specific period of time, often one year, but it may be subject to renewal.

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.