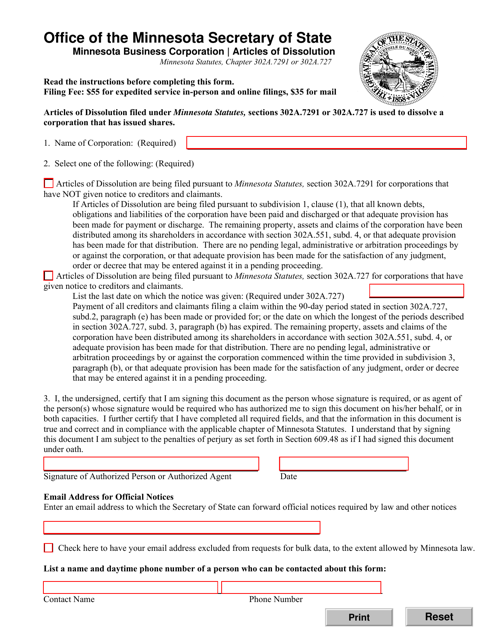

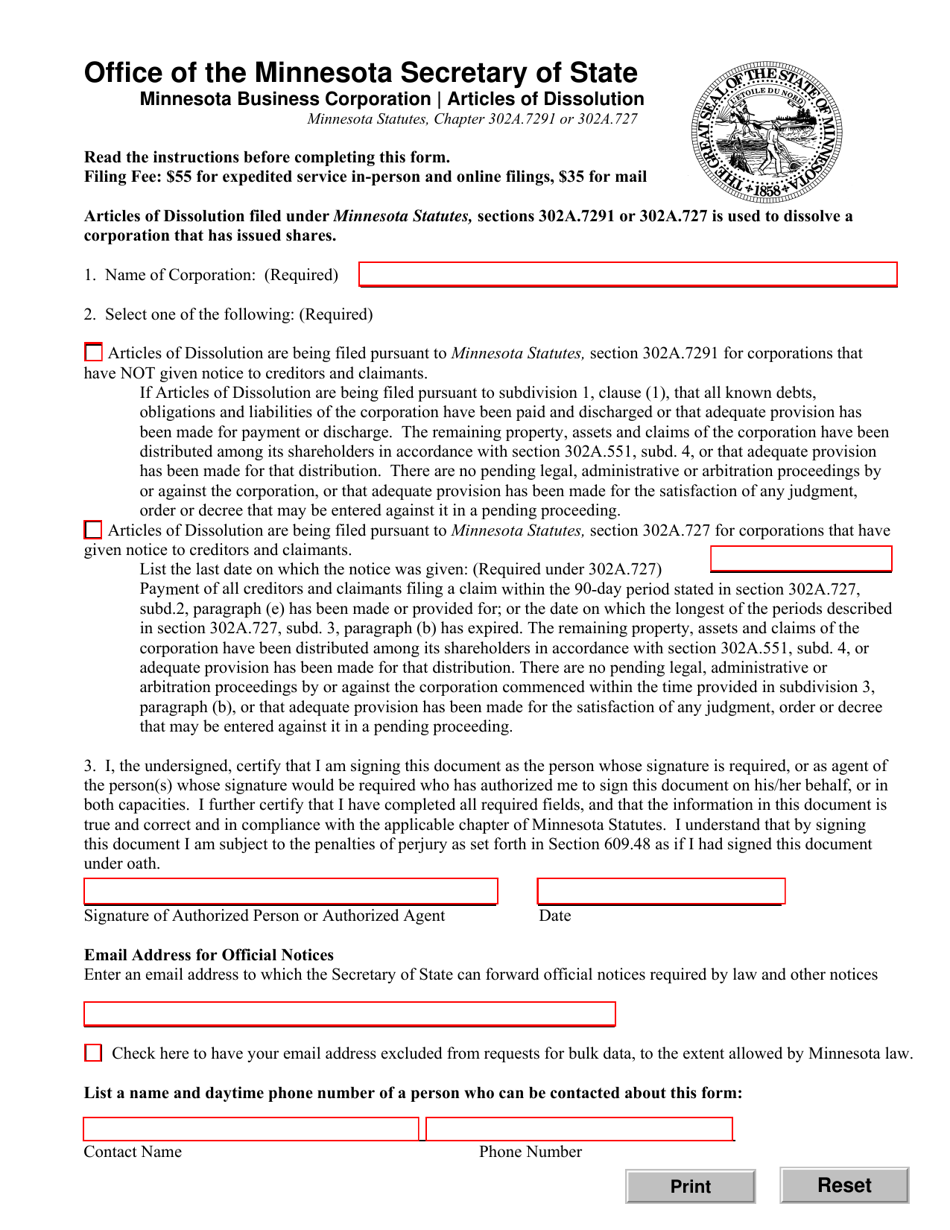

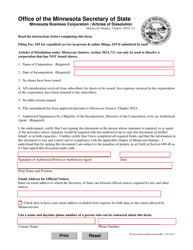

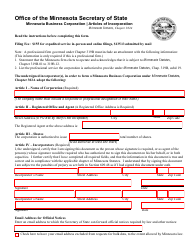

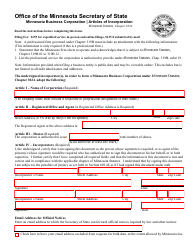

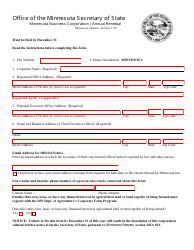

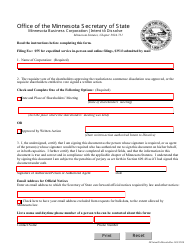

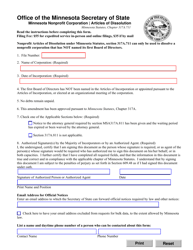

Minnesota Business Corporation Articles of Dissolution When Shares Have Been Issued - Minnesota

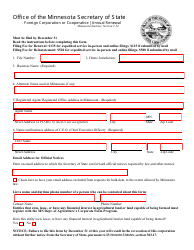

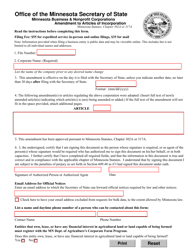

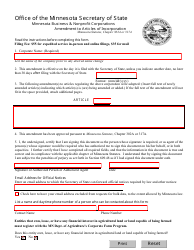

Minnesota Business Corporation Articles of Dissolution When Shares Have Been Issued is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is the Minnesota Business Corporation Articles of Dissolution?

A: The Minnesota Business Corporation Articles of Dissolution is a legal document that must be filed with the state to officially dissolve a corporation in Minnesota.

Q: When should I file the Minnesota Business Corporation Articles of Dissolution?

A: You should file the Minnesota Business Corporation Articles of Dissolution when you have decided to permanently close your corporation and cease all business activities.

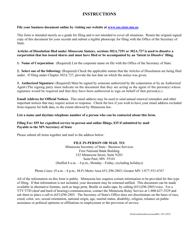

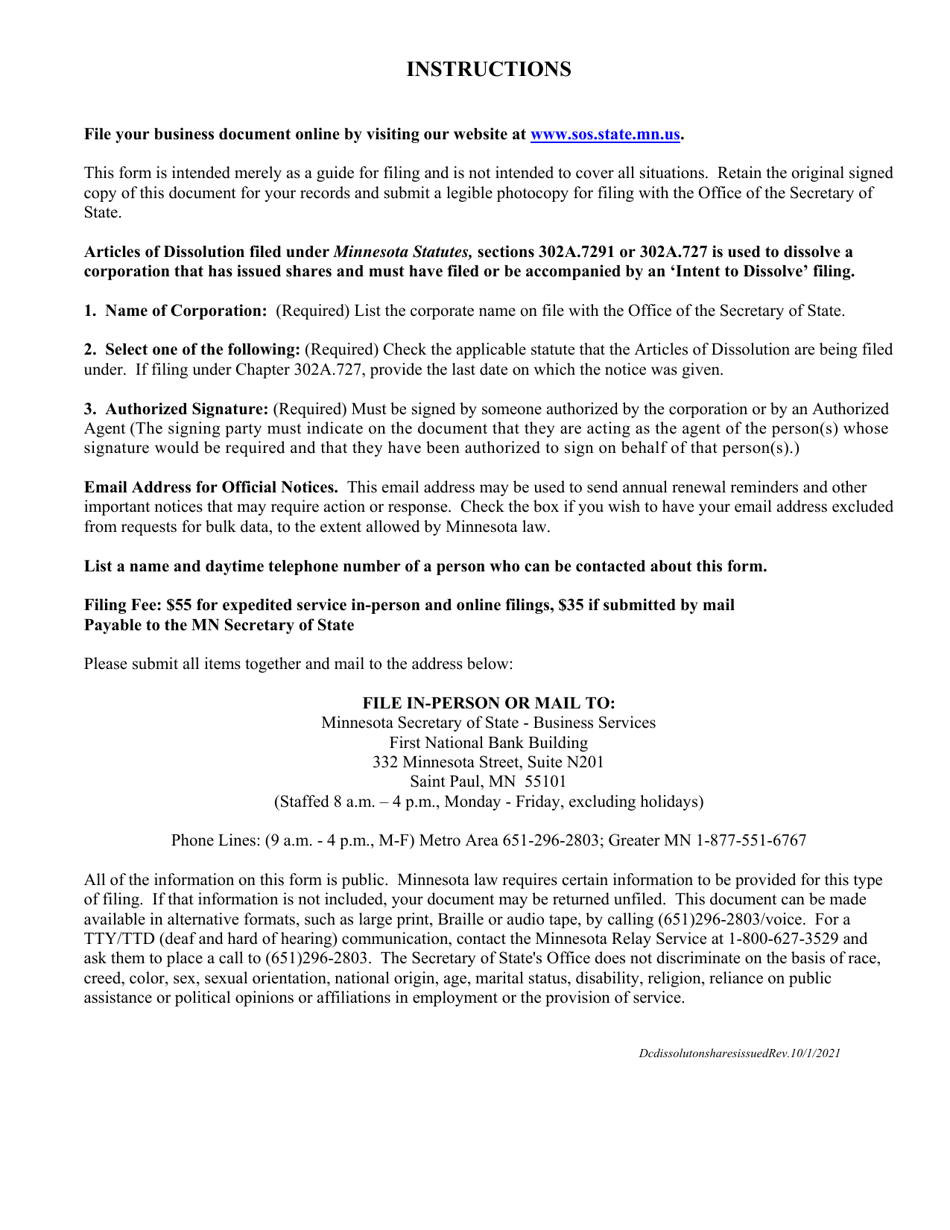

Q: What is the process for filing the Minnesota Business Corporation Articles of Dissolution?

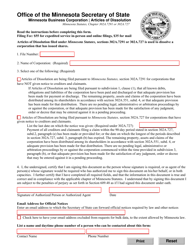

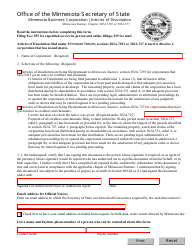

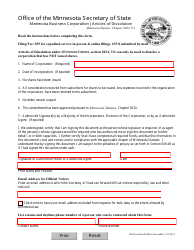

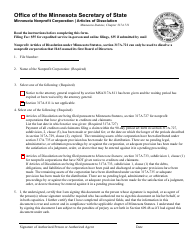

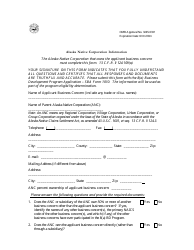

A: To file the Minnesota Business Corporation Articles of Dissolution, you must complete the form provided by the Minnesota Secretary of State, pay the required filing fee, and submit the form to the Secretary of State.

Q: What information is required on the Minnesota Business Corporation Articles of Dissolution?

A: The Minnesota Business Corporation Articles of Dissolution requires information such as the corporation's name, date of dissolution, the reason for dissolution, and a statement confirming the distribution of remaining assets and liabilities.

Q: What happens after I file the Minnesota Business Corporation Articles of Dissolution?

A: After you file the Minnesota Business Corporation Articles of Dissolution, the Secretary of State will review the form and, if approved, will issue a certificate of dissolution.

Q: Can I dissolve my corporation if shares have been issued?

A: Yes, you can still dissolve your corporation even if shares have been issued. The Minnesota Business Corporation Articles of Dissolution provides a process for addressing the distribution of the corporation's assets and liabilities.

Q: Do I need to notify creditors and shareholders of the corporation's dissolution?

A: Yes, as part of the dissolution process, you are required to provide notice to both creditors and shareholders of the corporation's intent to dissolve. This notice should include information on how to submit any claims or objections.

Q: What are the consequences of not filing the Minnesota Business Corporation Articles of Dissolution?

A: If you do not file the Minnesota Business Corporation Articles of Dissolution, your corporation will continue to exist and may still be subject to certain legal and financial obligations.

Q: Can I reinstate my corporation after filing the Minnesota Business Corporation Articles of Dissolution?

A: Yes, under certain circumstances, you may be able to reinstate your corporation after filing the Minnesota Business Corporation Articles of Dissolution. You should consult with an attorney or the Minnesota Secretary of State for more information on the reinstatement process.

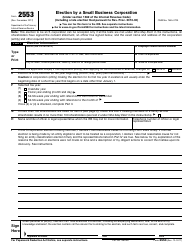

Form Details:

- Released on October 1, 2021;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.