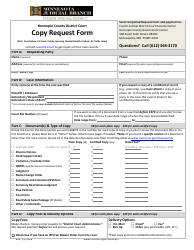

Form UCC12 Tax Lien Standard Search or Copy Request - Minnesota

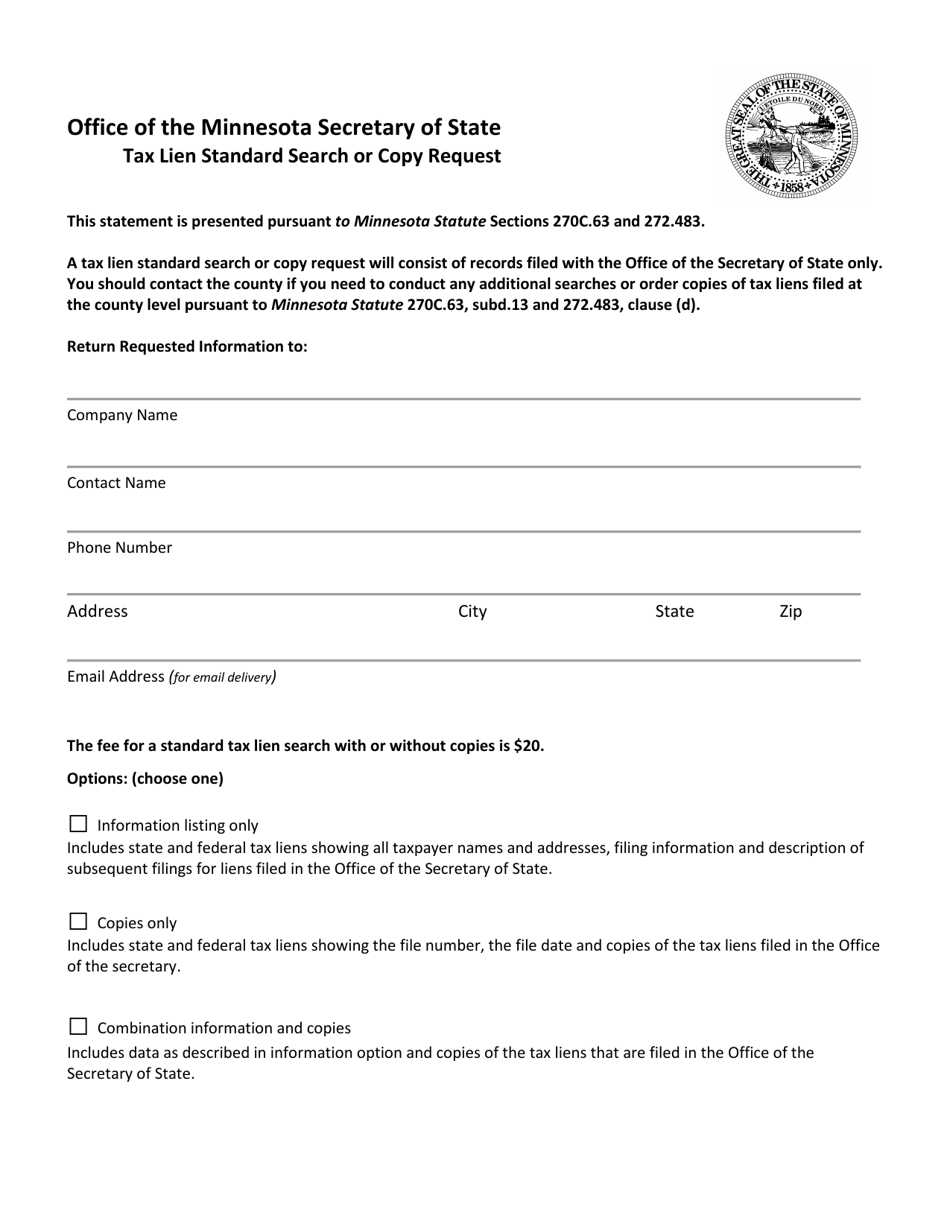

What Is Form UCC12?

This is a legal form that was released by the Minnesota Secretary of State - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

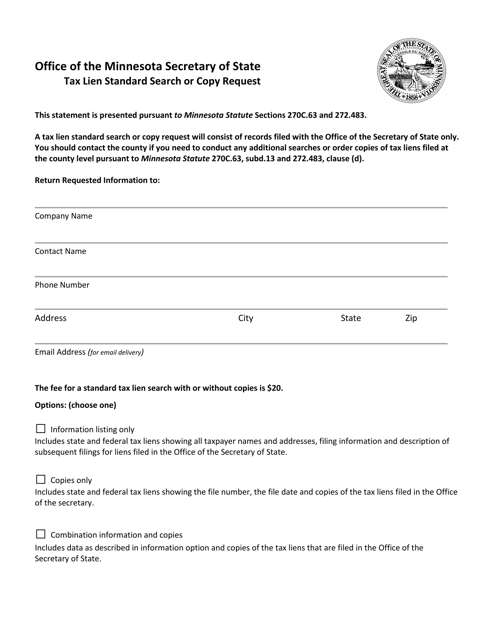

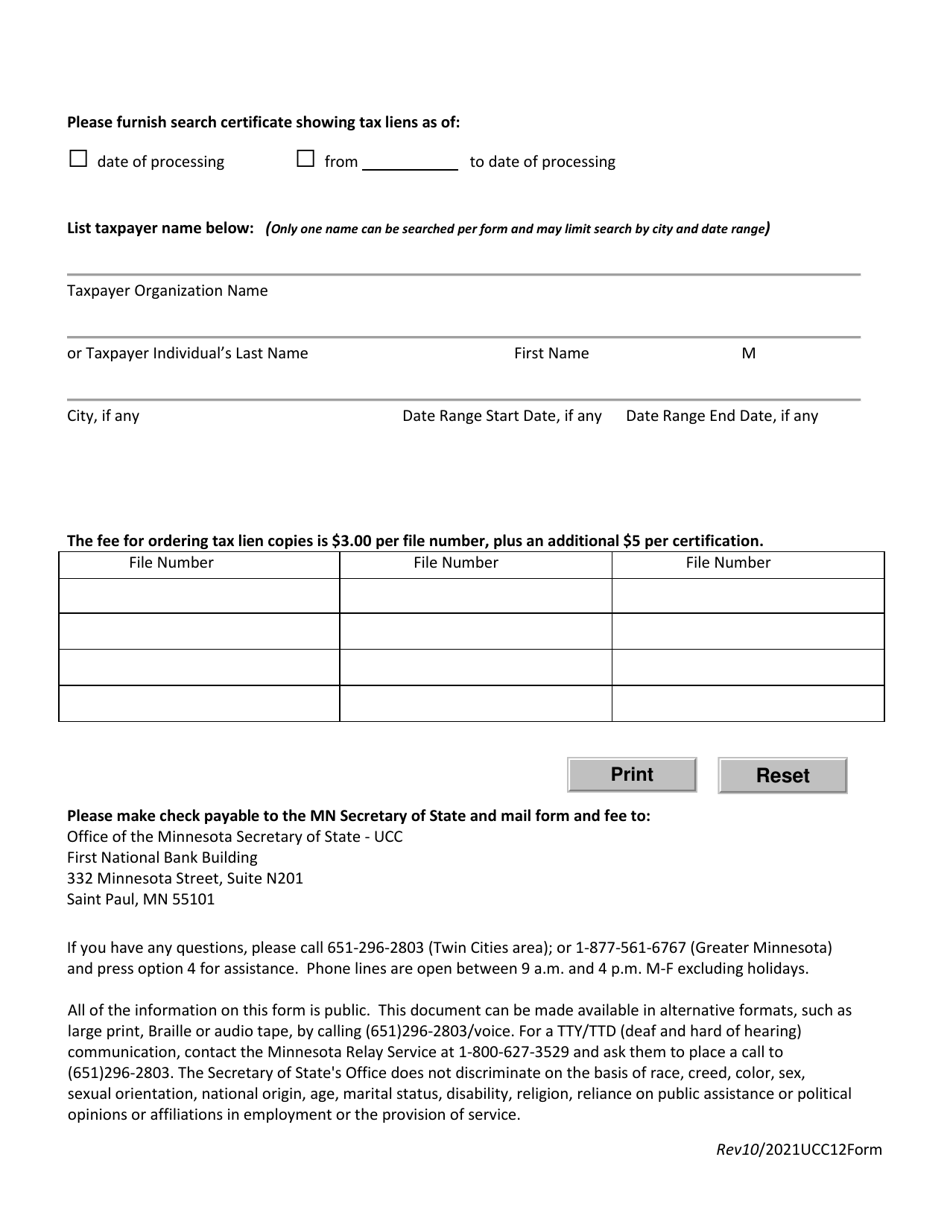

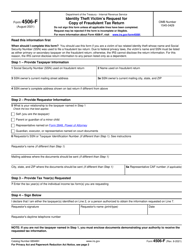

Q: What is a UCC12 Tax Lien Standard Search or Copy Request?

A: A UCC12 Tax Lien Standard Search or Copy Request is a document used to request information about tax liens in Minnesota.

Q: Who can request a UCC12 Tax Lien Standard Search or Copy?

A: Any individual or organization can request a UCC12 Tax Lien Standard Search or Copy.

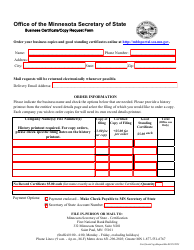

Q: How can I request a UCC12 Tax Lien Standard Search or Copy?

A: You can request a UCC12 Tax Lien Standard Search or Copy by submitting a completed Form UCC12 to the Minnesota Secretary of State.

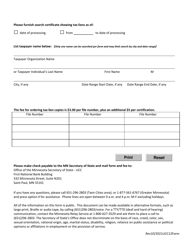

Q: What information do I need to provide on the UCC12 form?

A: You will need to provide the debtor's name and address, as well as your contact information.

Q: How long does it take to process a UCC12 Tax Lien Standard Search or Copy request?

A: The processing time for a UCC12 Tax Lien Standard Search or Copy request can vary, but typically takes a few business days.

Q: What will I receive after requesting a UCC12 Tax Lien Standard Search or Copy?

A: After your request is processed, you will receive a copy of the tax lien information associated with the debtor.

Q: Can I request UCC12 Tax Lien Standard Search or Copy for any state?

A: No, the UCC12 Tax Lien Standard Search or Copy request is specific to Minnesota.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Minnesota Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCC12 by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.