This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8898

for the current year.

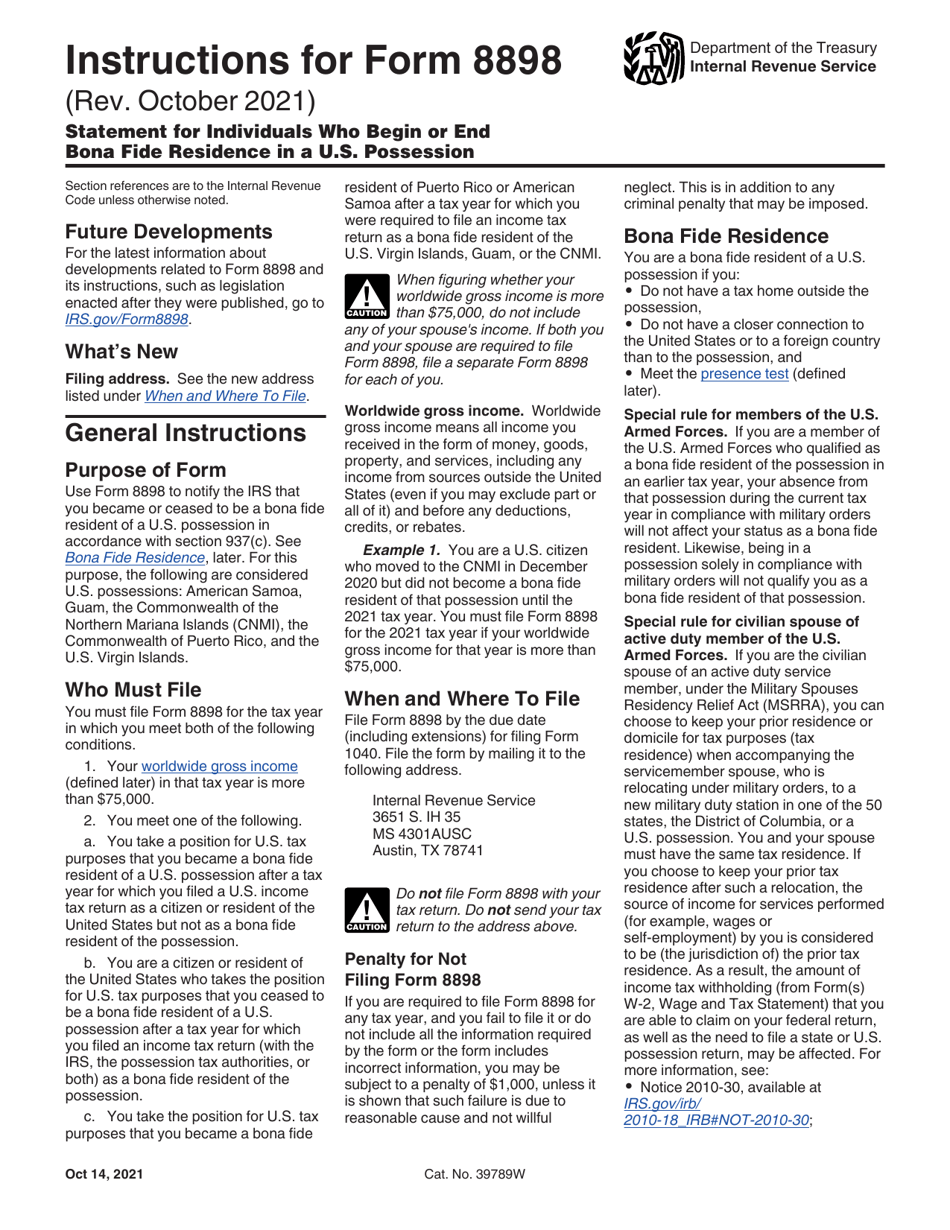

Instructions for IRS Form 8898 Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Possession

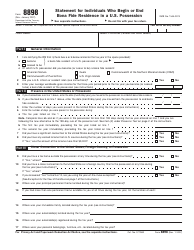

This document contains official instructions for IRS Form 8898 , Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Possession - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8898 is available for download through this link.

FAQ

Q: What is IRS Form 8898?

A: IRS Form 8898 is a statement for individuals who begin or end bona fide residence in a U.S. possession.

Q: Who needs to file IRS Form 8898?

A: Individuals who have started or ended their bona fide residence in a U.S. possession during the tax year need to file IRS Form 8898.

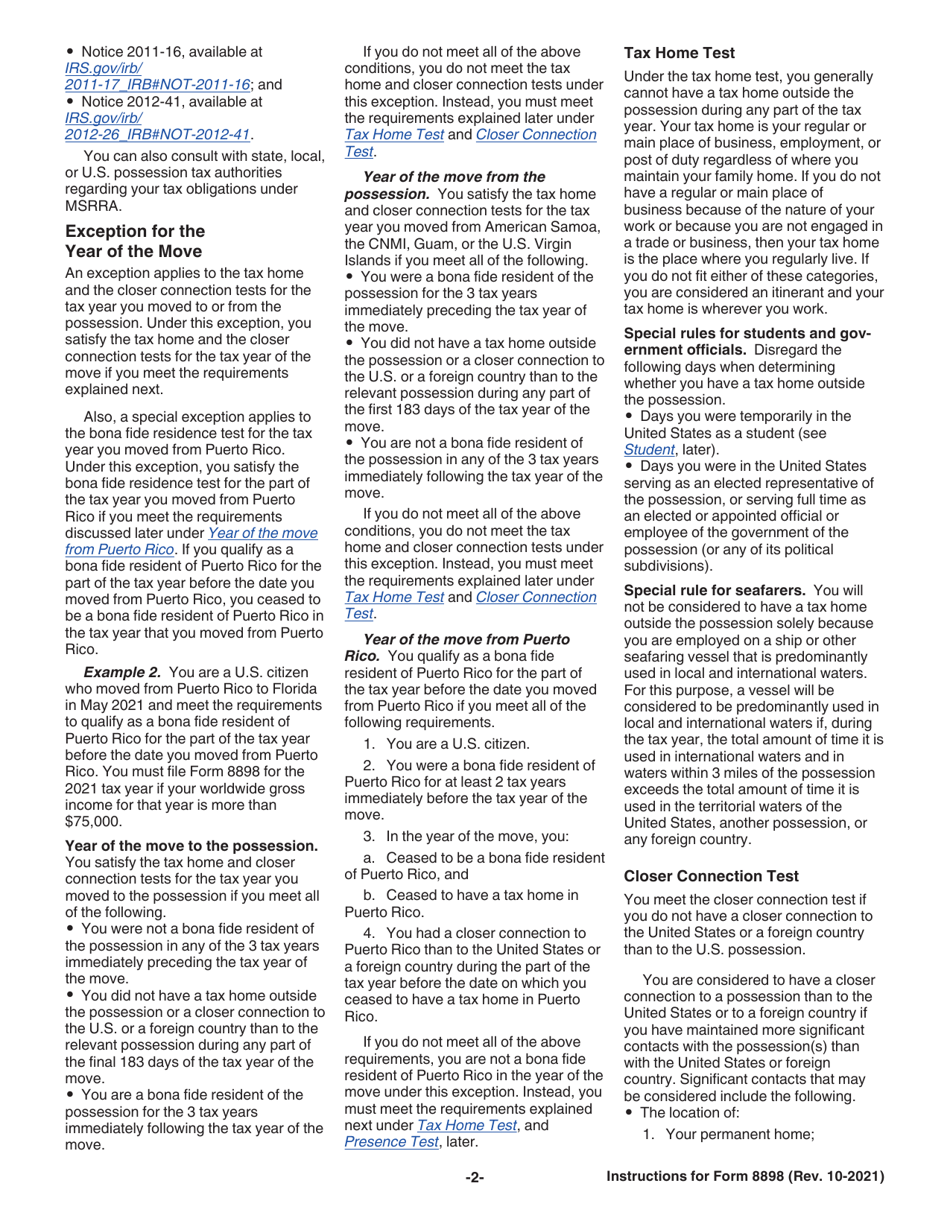

Q: What is meant by 'bona fide residence'?

A: 'Bona fide residence' refers to a person's legitimate, actual, and non-temporary residence in a U.S. possession.

Q: What information is required on IRS Form 8898?

A: IRS Form 8898 requires individuals to provide details about their bona fide residence in a U.S. possession, including the dates of residence and any exceptions or exclusions to income.

Q: When is the deadline to file IRS Form 8898?

A: The deadline to file IRS Form 8898 is typically the same as the deadline for filing your federal income tax return, which is April 15th, unless an extension has been granted.

Q: Can I e-file IRS Form 8898?

A: No, IRS Form 8898 must be filed by mail and cannot be e-filed.

Q: Are there any penalties for not filing IRS Form 8898?

A: Yes, there may be penalties for failing to file IRS Form 8898, such as potential fines or restrictions on certain tax benefits.

Q: Do I need to file IRS Form 8898 every year?

A: No, IRS Form 8898 only needs to be filed for the tax year in which you begin or end your bona fide residence in a U.S. possession.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.