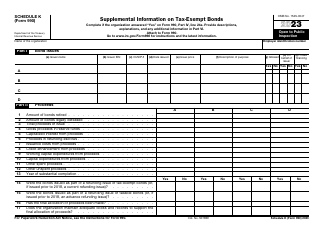

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule G

for the current year.

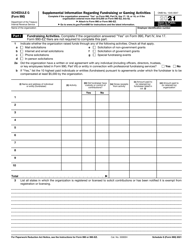

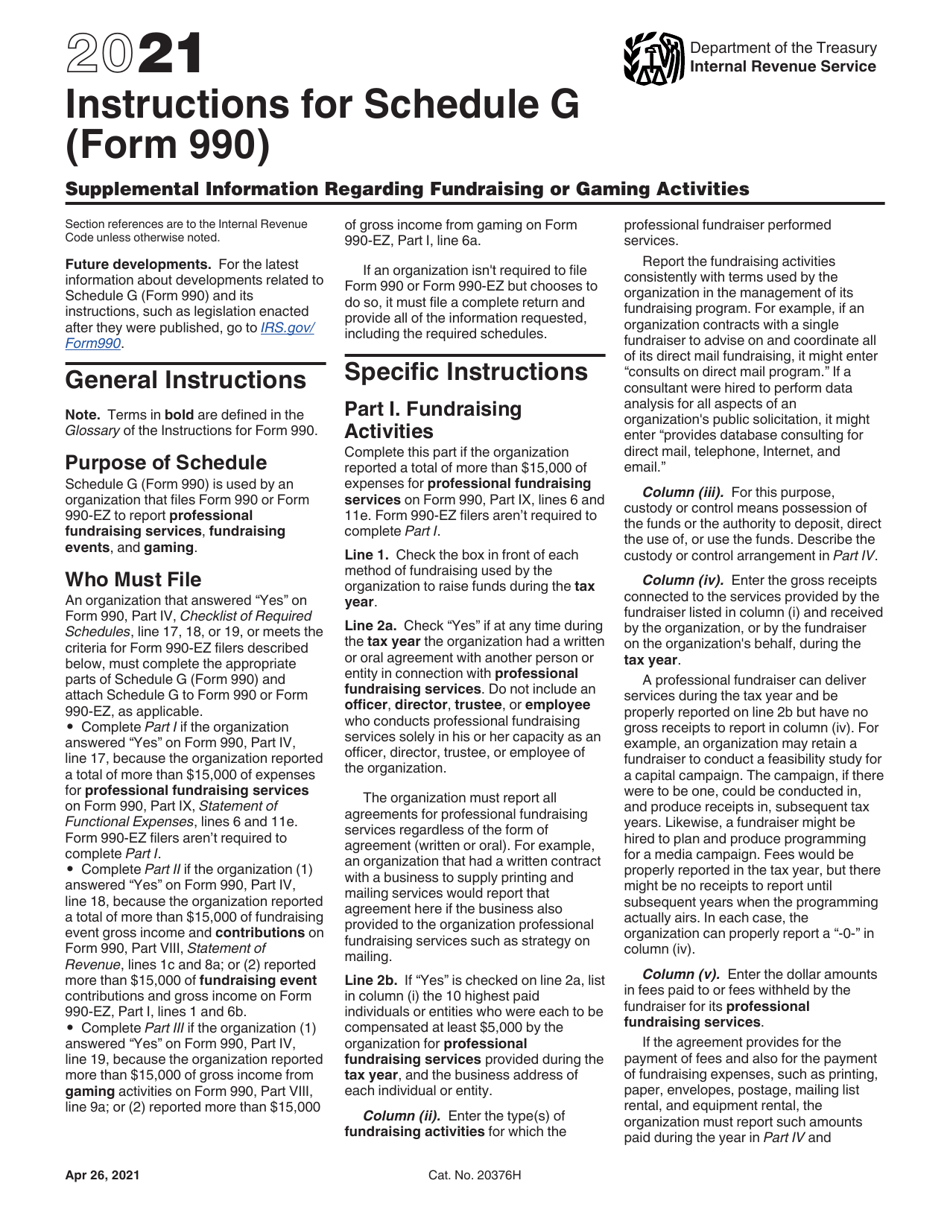

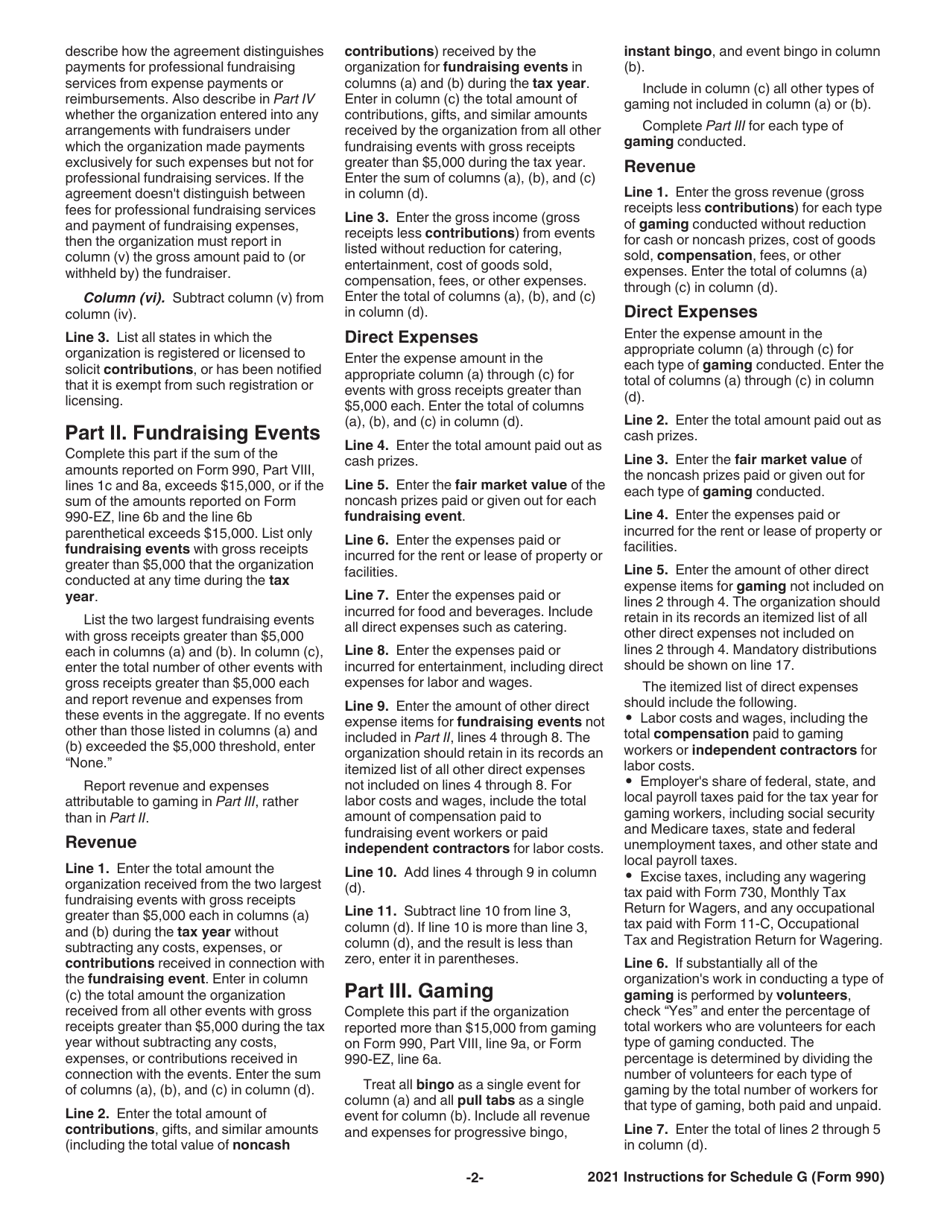

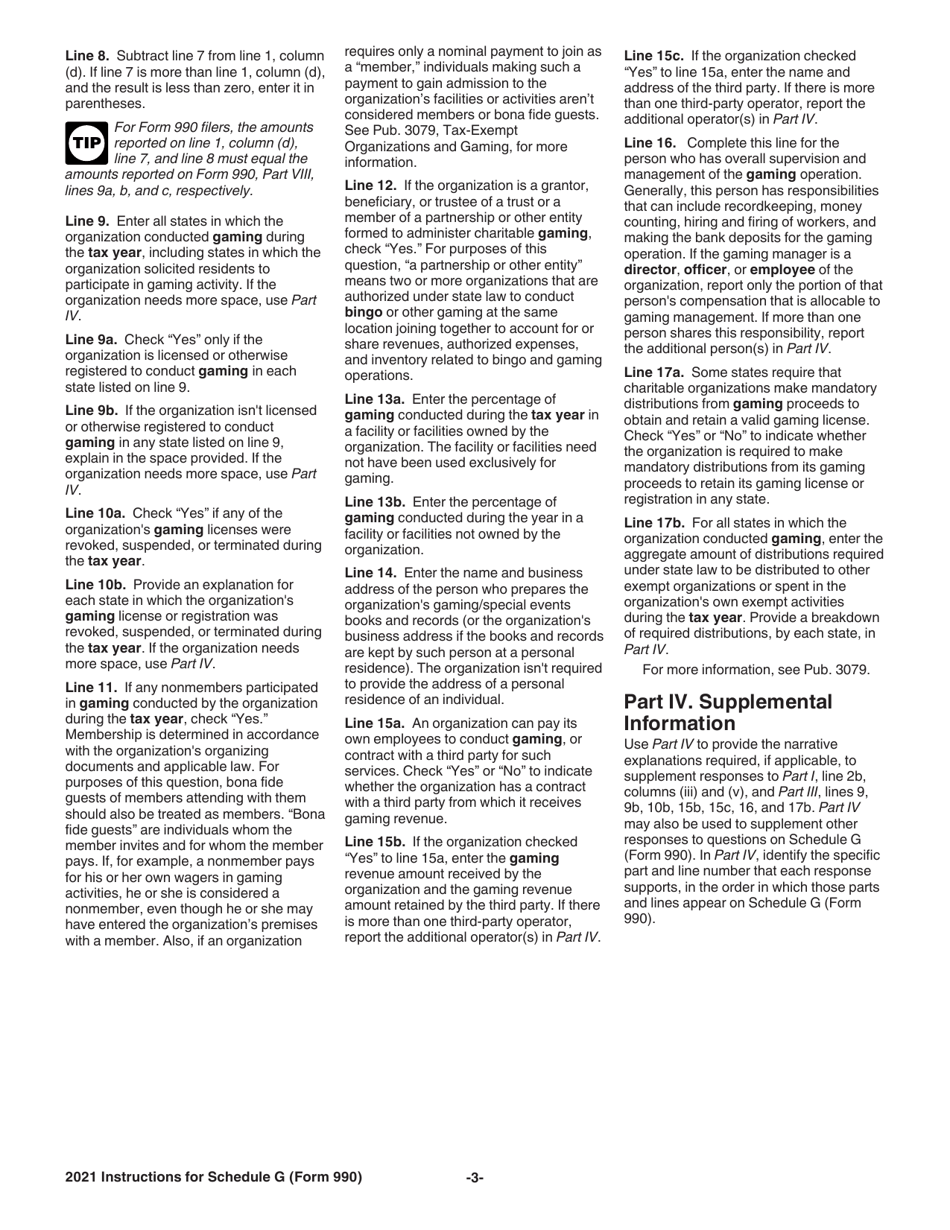

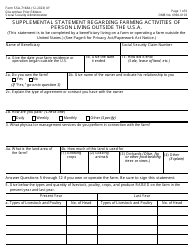

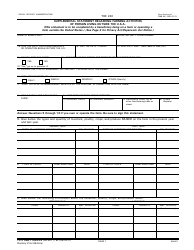

Instructions for IRS Form 990 Schedule G Supplemental Information Regarding Fundraising or Gaming Activities

This document contains official instructions for IRS Form 990 Schedule G, Supplemental Information Regarding Fundraising or Gaming Activities - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule G is available for download through this link.

FAQ

Q: What is IRS Form 990 Schedule G?

A: IRS Form 990 Schedule G is a supplemental form that provides information regarding fundraising or gaming activities.

Q: Why is Schedule G required?

A: Schedule G is required by the Internal Revenue Service (IRS) to obtain additional information about fundraising or gaming activities conducted by an organization.

Q: Who needs to file Schedule G?

A: Nonprofit organizations that engage in fundraising or gaming activities need to file Schedule G along with their Form 990.

Q: What kind of information is required in Schedule G?

A: Schedule G requires organizations to provide details about their fundraising activities, including the types of fundraising events and the amounts raised.

Q: How does Schedule G affect tax-exempt status?

A: Schedule G does not directly affect an organization's tax-exempt status, but it helps the IRS monitor fundraising activities to ensure compliance with tax regulations.

Instruction Details:

- This 3-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.