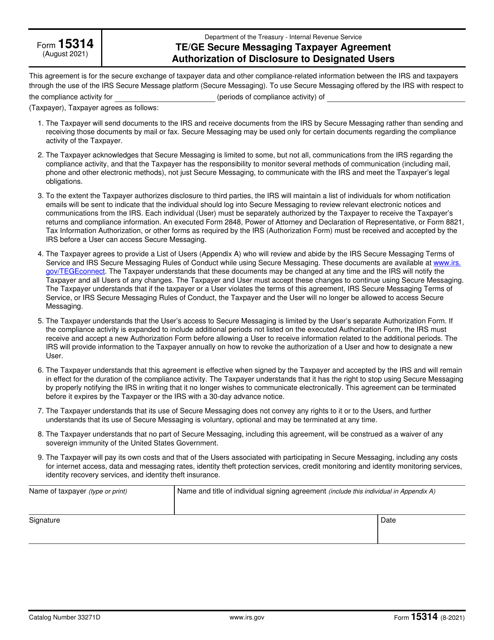

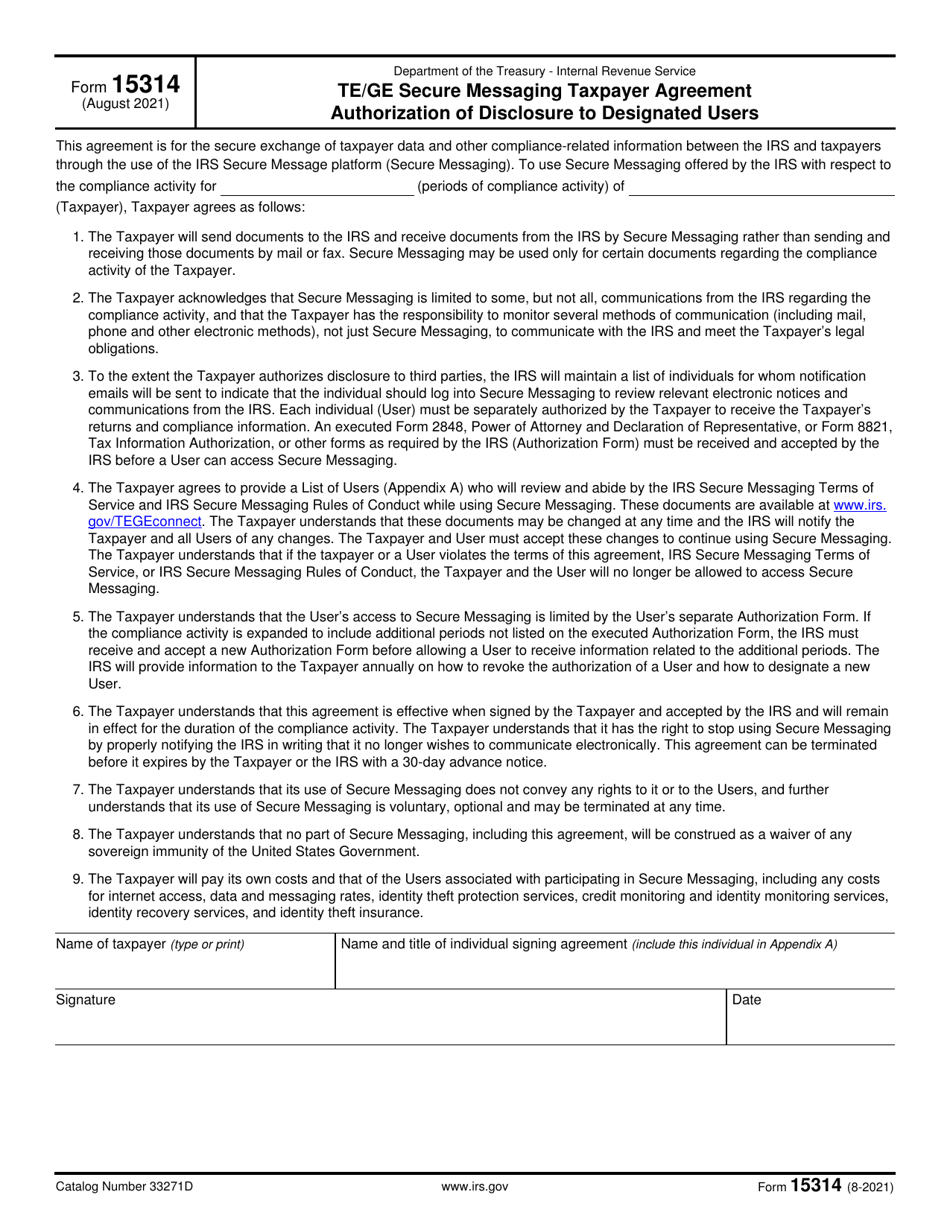

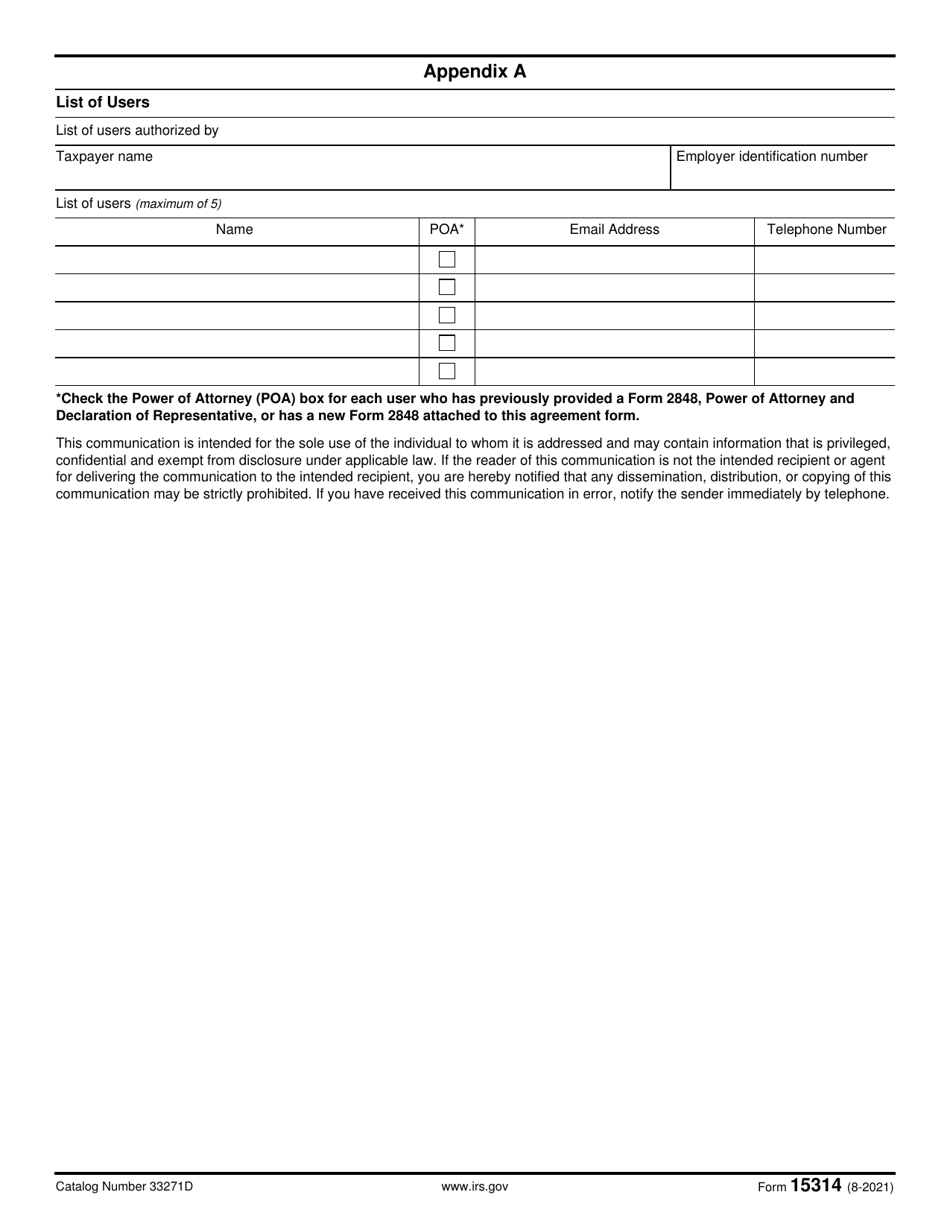

IRS Form 15314 Te / Ge Secure Messaging Taxpayer Agreement Authorization of Disclosure to Designated Users

What Is IRS Form 15314?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 15314?

A: IRS Form 15314 is a form used for secure messaging taxpayer agreement and authorization of disclosure to designated users.

Q: What does Te/Ge stand for?

A: Te/Ge stands for Tax Exempt and Government Entities.

Q: What is the purpose of Form 15314?

A: The purpose of Form 15314 is to authorize the disclosure of taxpayer information to designated users through secure messaging.

Q: Who needs to fill out Form 15314?

A: Taxpayers who want to authorize the disclosure of their information to designated users through secure messaging need to fill out Form 15314.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 15314 through the link below or browse more documents in our library of IRS Forms.