This version of the form is not currently in use and is provided for reference only. Download this version of

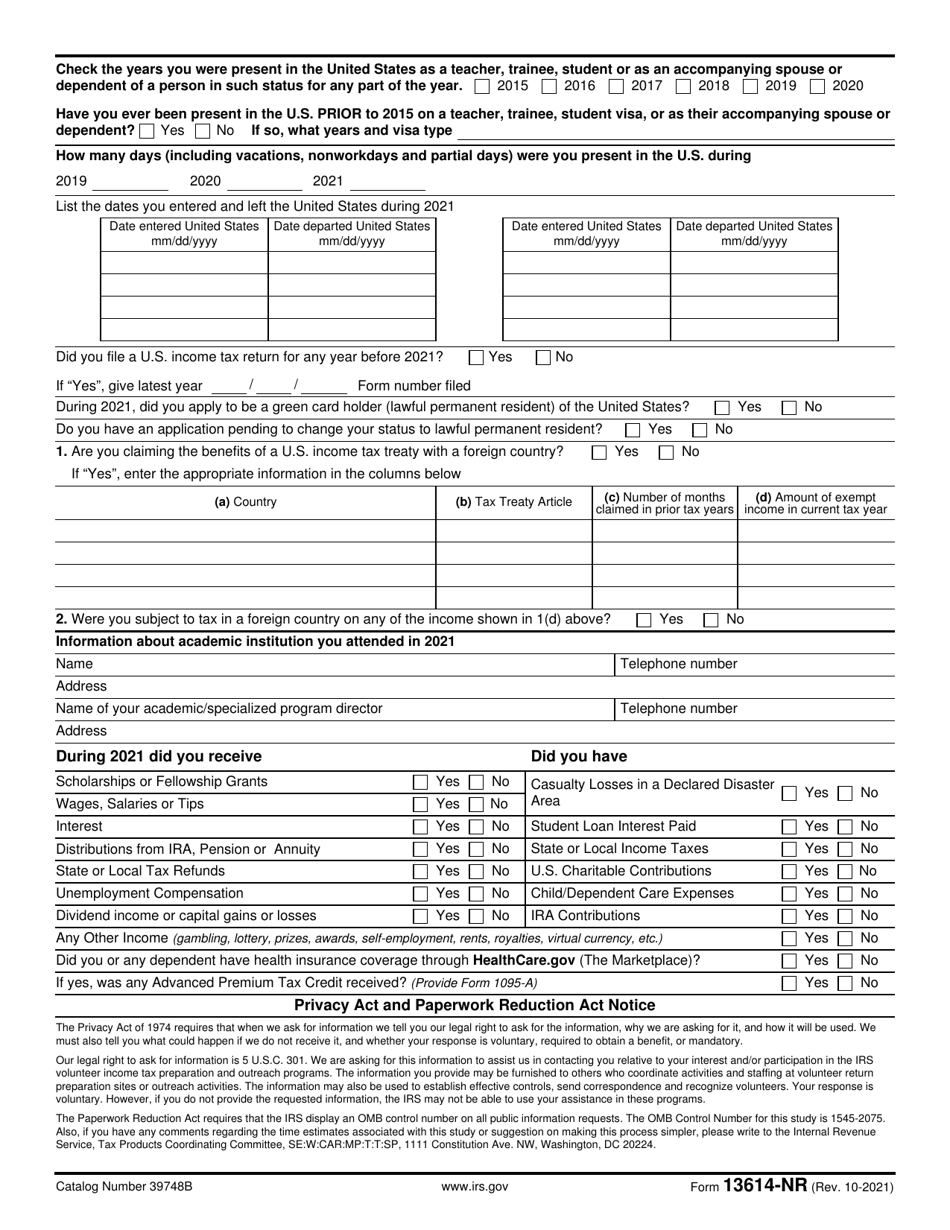

IRS Form 13614-NR

for the current year.

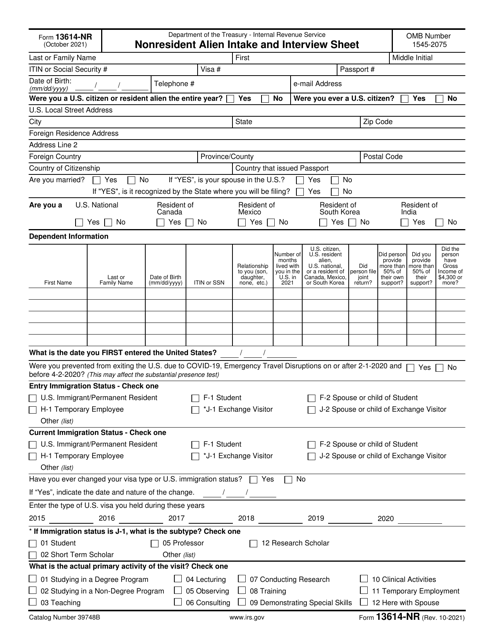

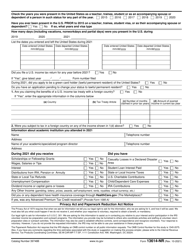

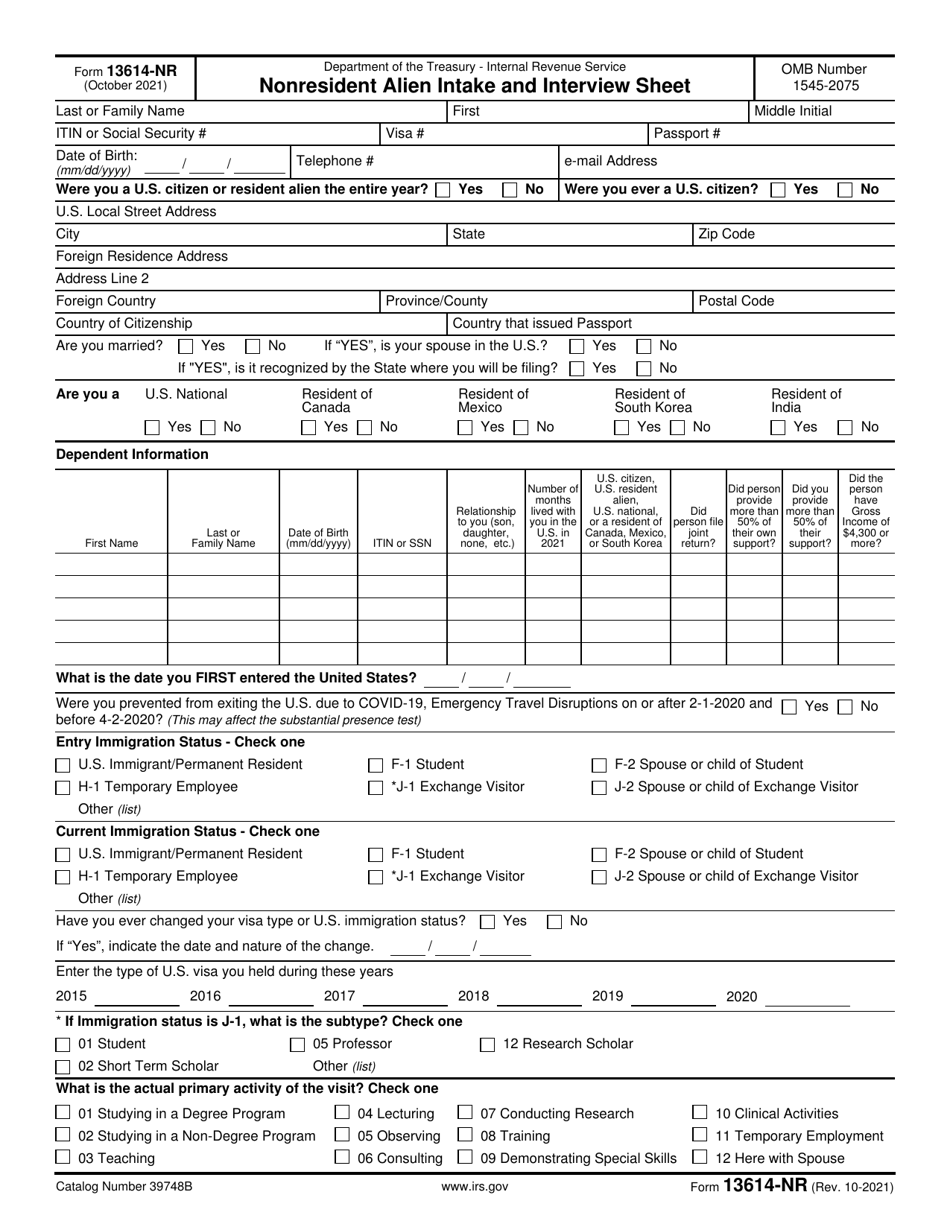

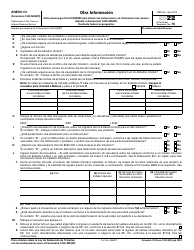

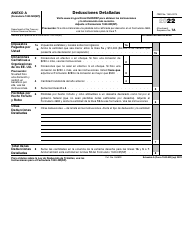

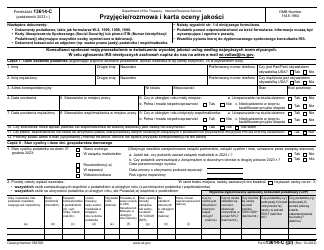

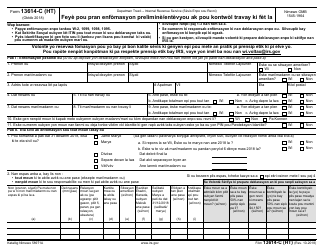

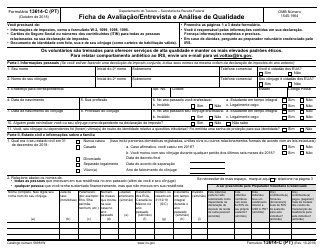

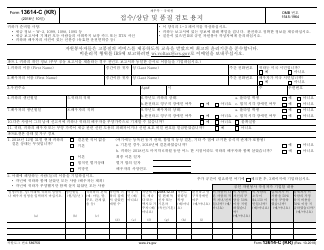

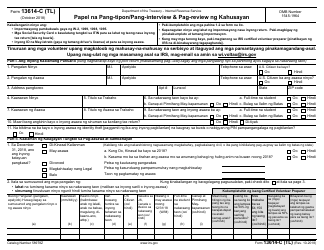

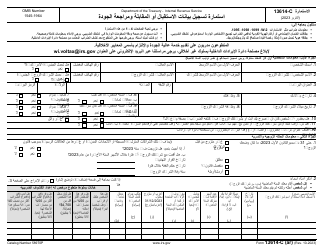

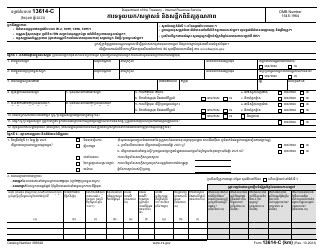

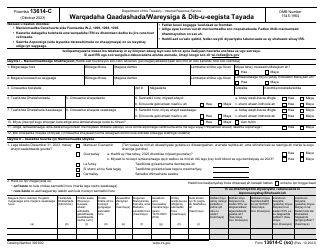

IRS Form 13614-NR Nonresident Alien Intake and Interview Sheet

What Is IRS Form 13614-NR?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2021. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13614-NR?

A: IRS Form 13614-NR is a Nonresident Alien Intake and Interview Sheet used by the IRS for nonresident aliens to provide their personal and financial information.

Q: Who should use IRS Form 13614-NR?

A: Nonresident aliens should use IRS Form 13614-NR to provide their information to the IRS.

Q: What is the purpose of IRS Form 13614-NR?

A: The purpose of IRS Form 13614-NR is to gather information about nonresident aliens in order to determine their tax obligations and eligibility for certain tax benefits.

Q: Is IRS Form 13614-NR mandatory?

A: While IRS Form 13614-NR is not mandatory to file a tax return, it is recommended for nonresident aliens to complete the form in order to provide accurate information to the IRS.

Q: Can a nonresident alien file a tax return using IRS Form 13614-NR?

A: No, IRS Form 13614-NR is not used to file a tax return. Nonresident aliens should use the appropriate form, such as Form 1040NR or Form 1040NR-EZ, to file their tax return.

Q: Are there any penalties for not filling out IRS Form 13614-NR?

A: There are no specific penalties for not filling out IRS Form 13614-NR. However, providing inaccurate or incomplete information to the IRS may result in penalties or additional tax liabilities.

Q: What information is required on IRS Form 13614-NR?

A: IRS Form 13614-NR requires nonresident aliens to provide personal information, such as name, address, and Social Security Number or Individual Taxpayer Identification Number, as well as financial information, such as income and deductions.

Q: Can a nonresident alien claim tax benefits on IRS Form 13614-NR?

A: Yes, nonresident aliens can claim certain tax benefits on IRS Form 13614-NR, such as treaty-based exemptions or deductions, if they are eligible.

Q: How should IRS Form 13614-NR be submitted?

A: IRS Form 13614-NR can be submitted by mail or in person at a local IRS office. The form should not be attached to a tax return, but kept for record-keeping purposes.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13614-NR through the link below or browse more documents in our library of IRS Forms.