This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1040-V

for the current year.

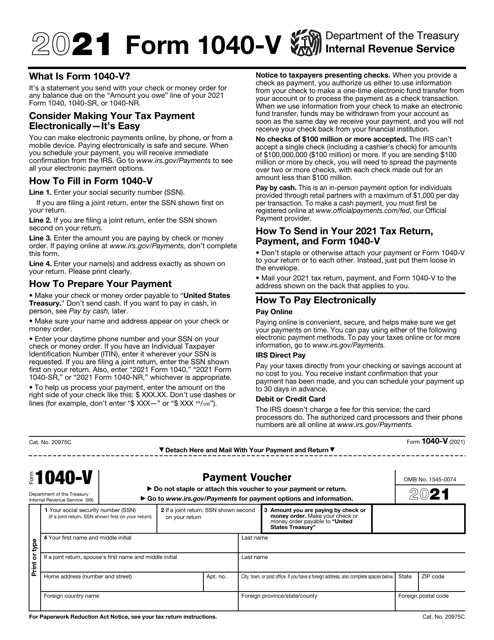

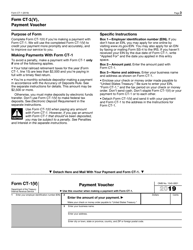

IRS Form 1040-V Payment Voucher

What Is IRS Form 1040-V?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1040-V?

A: IRS Form 1040-V is a payment voucher that you can use when you need to make a payment with your Form 1040 tax return.

Q: When should I use Form 1040-V?

A: You should use Form 1040-V when you want to make a payment with your federal income tax return.

Q: What type of payments can I make using Form 1040-V?

A: You can make various types of payments using Form 1040-V, including paying any balance due on your tax return, making an estimated tax payment, or paying a penalty.

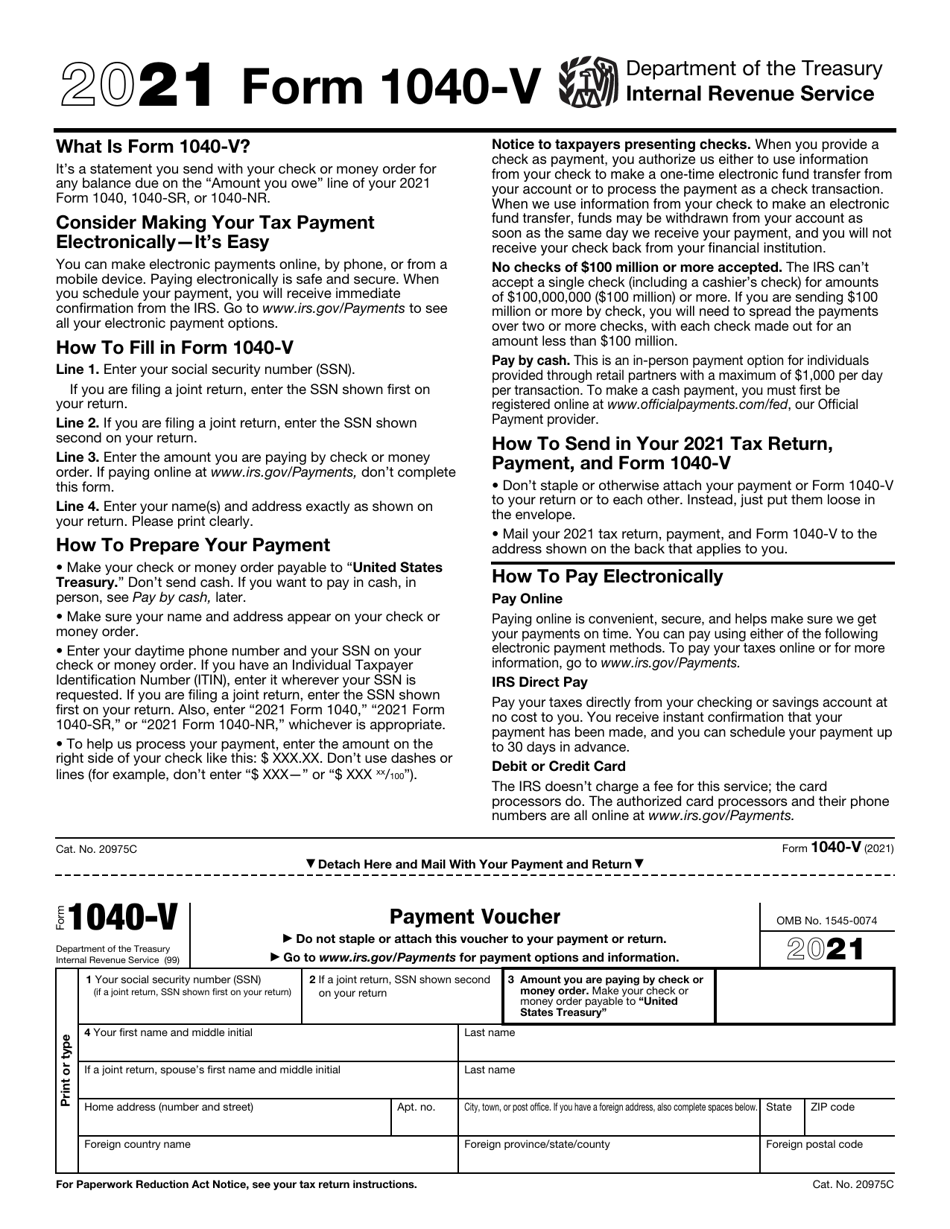

Q: How do I fill out Form 1040-V?

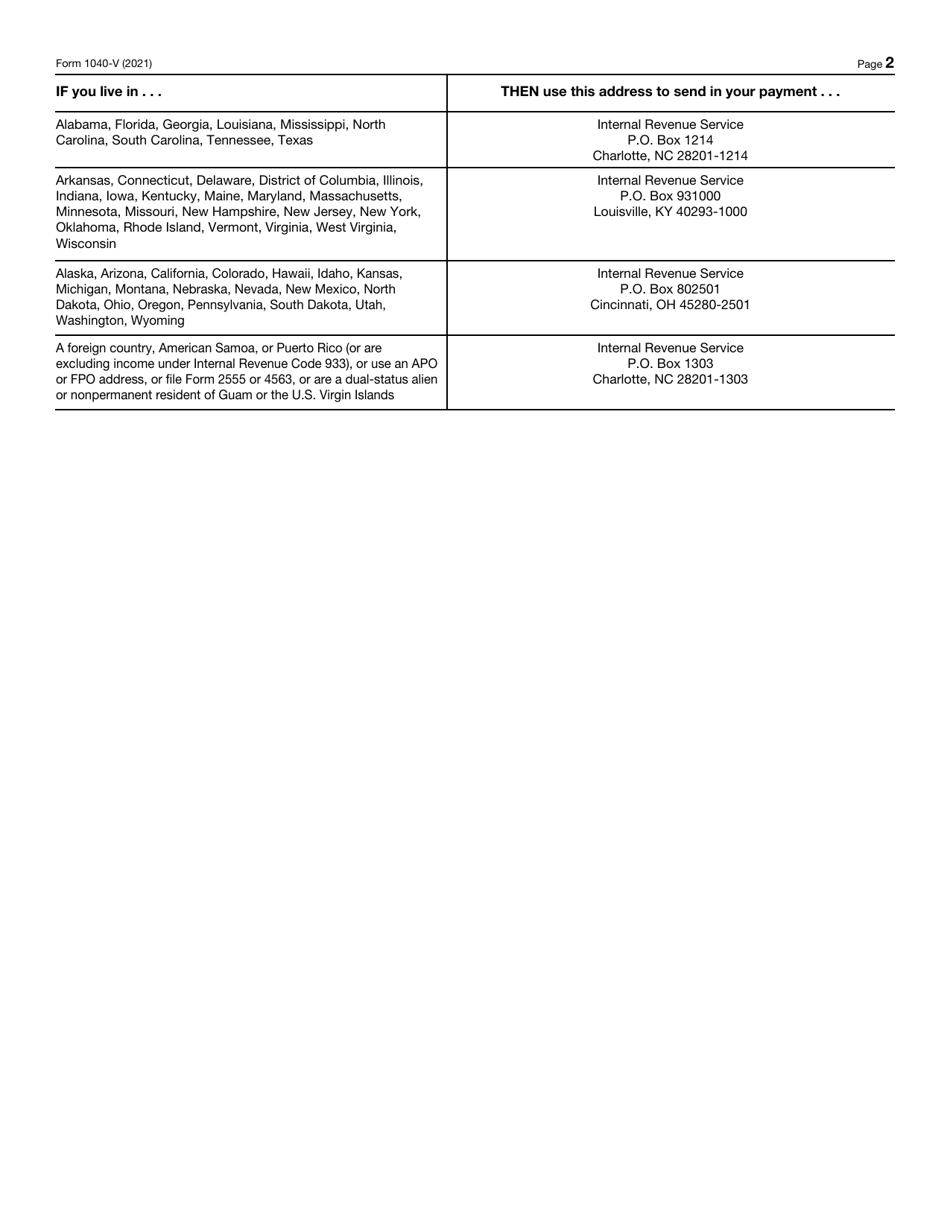

A: To fill out Form 1040-V, you will need to enter your name, address, payment amount, and other required information. Make sure to follow the instructions provided with the form.

Q: What happens if I don't include Form 1040-V with my payment?

A: If you don't include Form 1040-V with your payment, the IRS may not be able to properly credit your payment and you may be subject to penalties or interest.

Q: Can I use Form 1040-V if I am making a payment for a different type of tax return?

A: No, Form 1040-V is specifically for payments with the Form 1040 tax return. If you need to make a payment for a different type of tax return, you should use the appropriate payment voucher for that form.

Q: Is Form 1040-V the same as Form 1040?

A: No, Form 1040-V is a separate form used for making payments with the Form 1040 tax return. Form 1040 is the actual tax return form where you report your income and claim deductions and credits.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-V through the link below or browse more documents in our library of IRS Forms.