This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 941-X

for the current year.

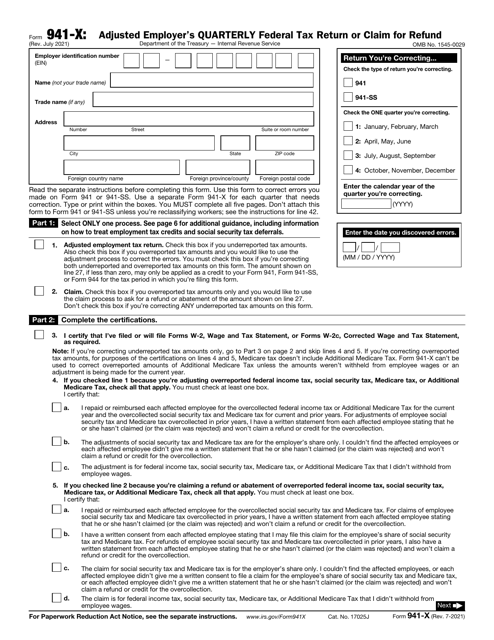

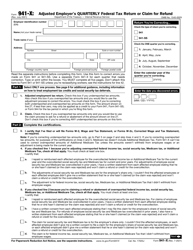

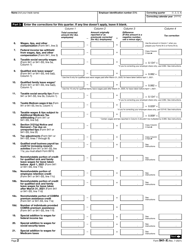

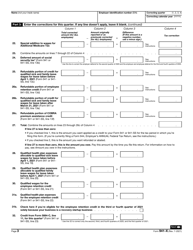

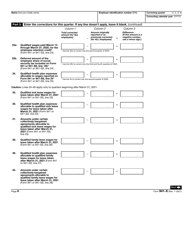

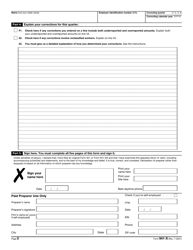

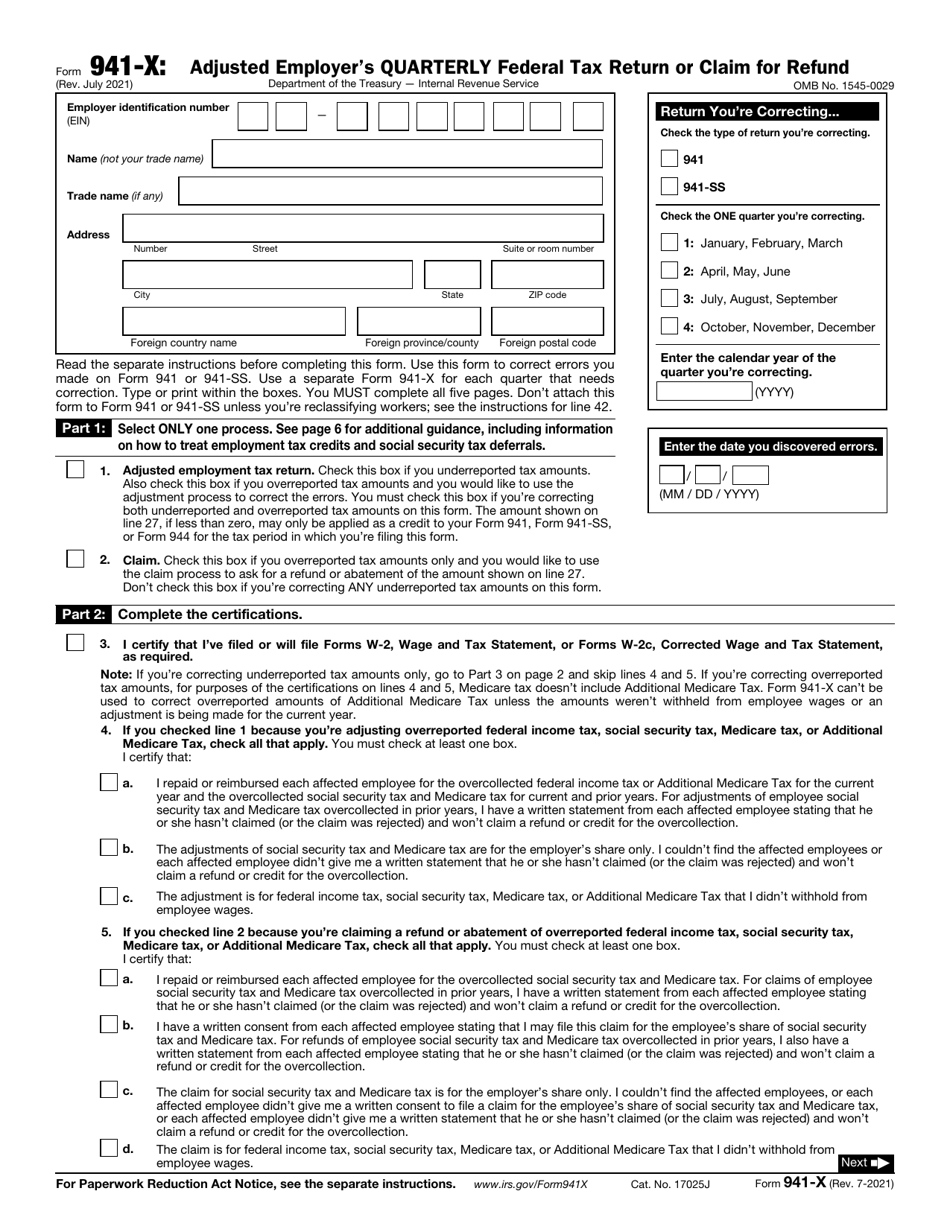

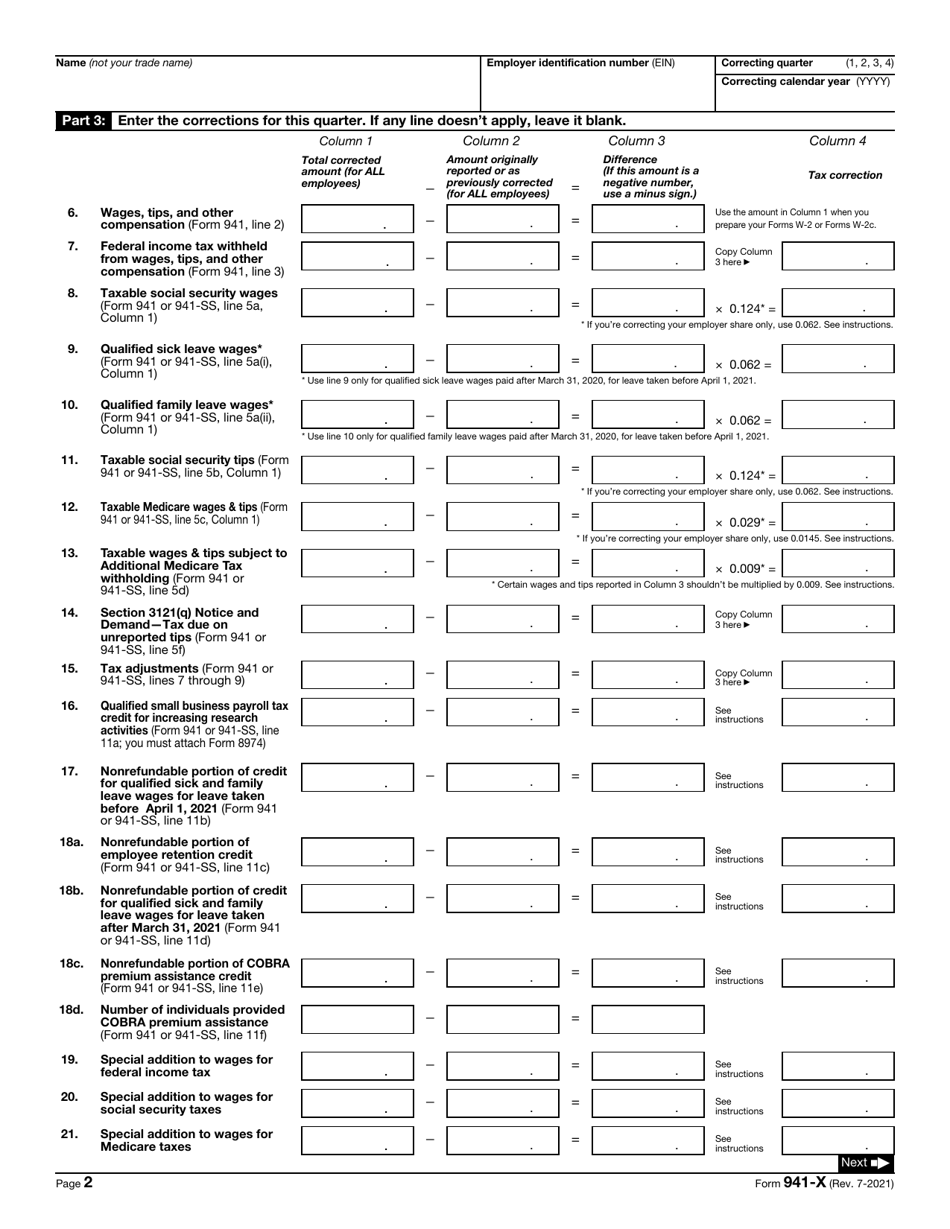

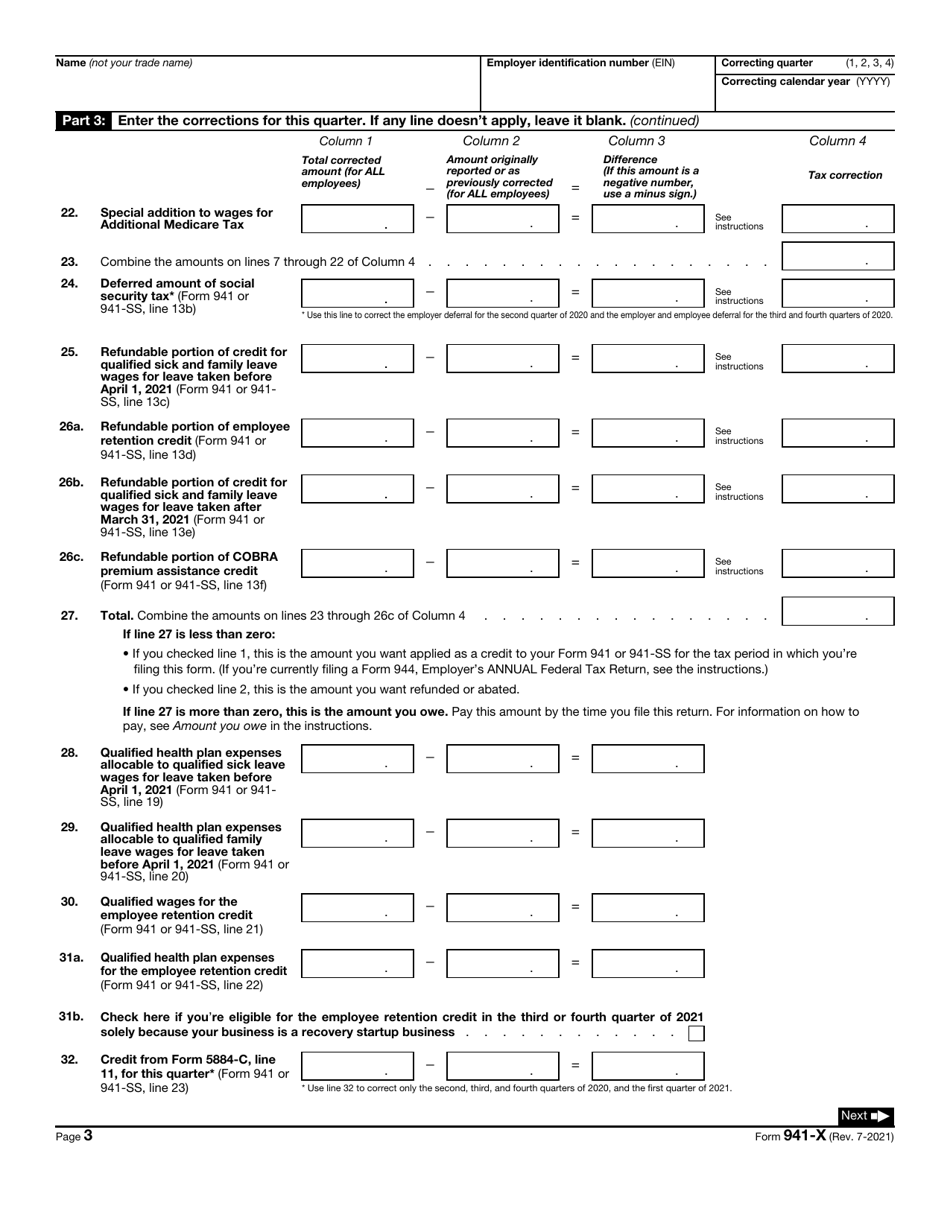

IRS Form 941-X Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund

What Is IRS Form 941-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 941-X?

A: IRS Form 941-X is the Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund.

Q: When should I use IRS Form 941-X?

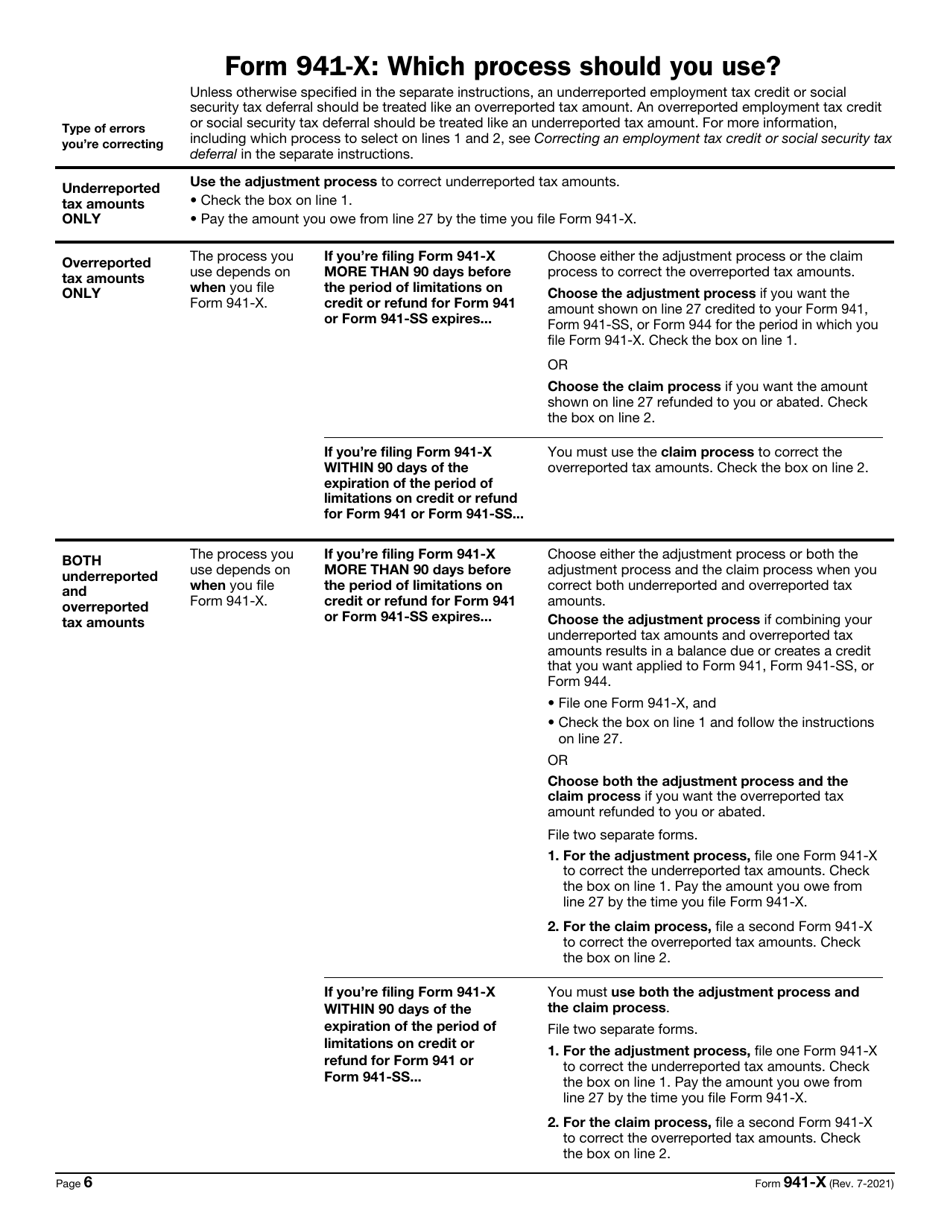

A: You should use IRS Form 941-X to correct errors on previously filed Forms 941, such as reporting adjustments to wages, tips, and taxes.

Q: Can I use IRS Form 941-X to claim a refund?

A: Yes, you can use IRS Form 941-X to claim a refund if you overpaid taxes or made an error in your previous filings.

Q: Is there a deadline to file IRS Form 941-X?

A: Yes, you should file IRS Form 941-X within 3 years from the date you filed the original Form 941, or 2 years from the date you paid the tax, whichever is later.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 941-X through the link below or browse more documents in our library of IRS Forms.