This version of the form is not currently in use and is provided for reference only. Download this version of

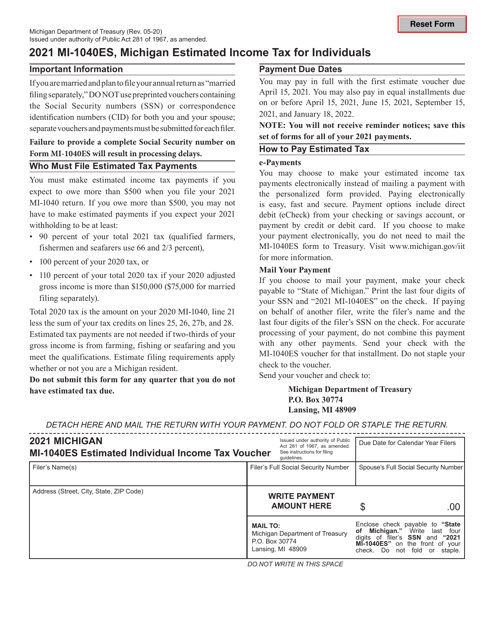

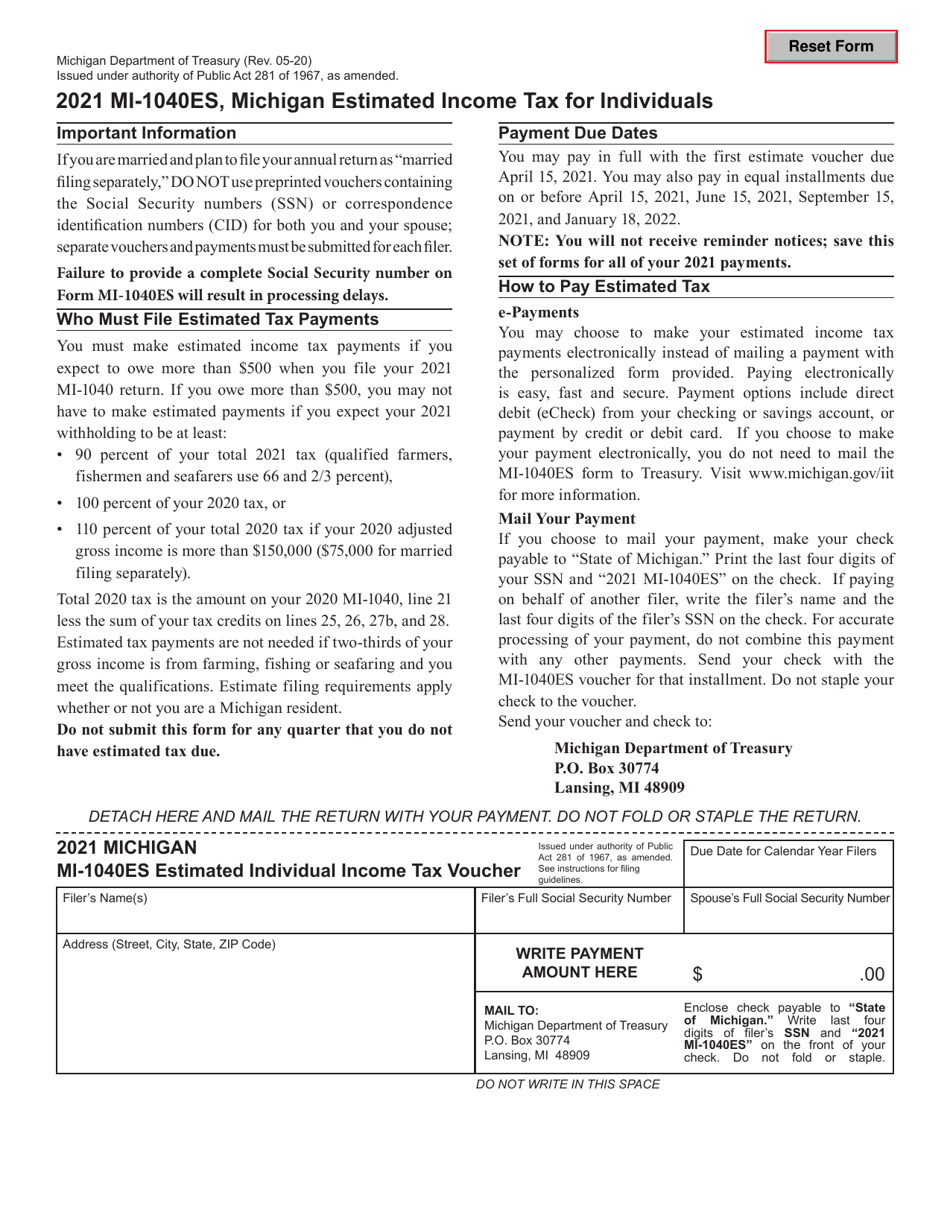

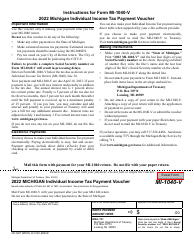

Form MI-1040ES

for the current year.

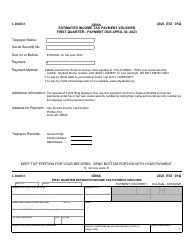

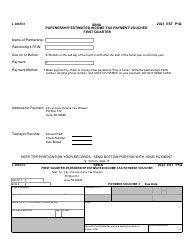

Form MI-1040ES Estimated Individual Income Tax Voucher - Michigan

What Is Form MI-1040ES?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

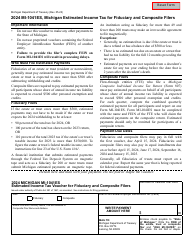

Q: What is the MI-1040ES form?

A: The MI-1040ES form is the Estimated Individual Income Tax Voucher for Michigan.

Q: What is the purpose of the MI-1040ES form?

A: The purpose of the MI-1040ES form is to make estimated tax payments for individual income tax in Michigan.

Q: Who needs to use the MI-1040ES form?

A: Individuals who expect to owe more than $500 in state income tax for the year are required to make estimated tax payments using the MI-1040ES form.

Q: When are estimated tax payments due?

A: Estimated tax payments are due on a quarterly basis - April 15th, June 15th, September 15th, and January 15th of the following year.

Q: How do I fill out the MI-1040ES form?

A: You need to provide your name, Social Security number, address, and estimate your taxable income and the amount of tax you owe for the year.

Q: What happens if I don't make estimated tax payments?

A: If you don't make estimated tax payments and end up owing more than $500 in state income tax, you may be subject to penalties and interest.

Q: Can I amend my estimated tax payments?

A: Yes, if your estimated tax payments need to be adjusted, you can file an amended MI-1040ES form.

Form Details:

- Released on May 1, 2020;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040ES by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.