This version of the form is not currently in use and is provided for reference only. Download this version of

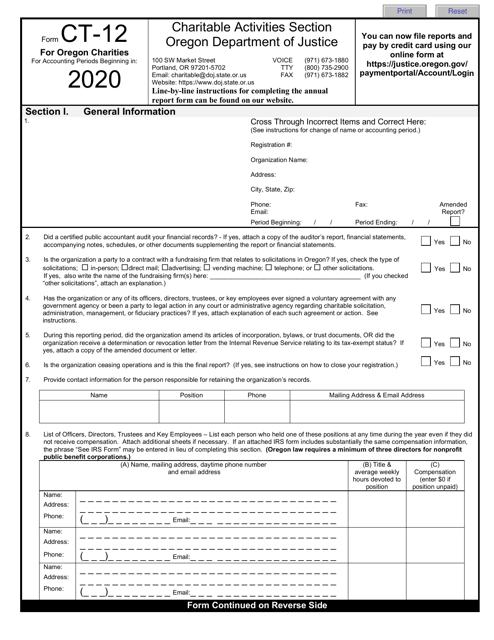

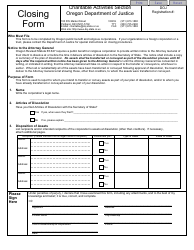

Form CT-12

for the current year.

Form CT-12 Charitable Activities Form for Oregon Charities - Oregon

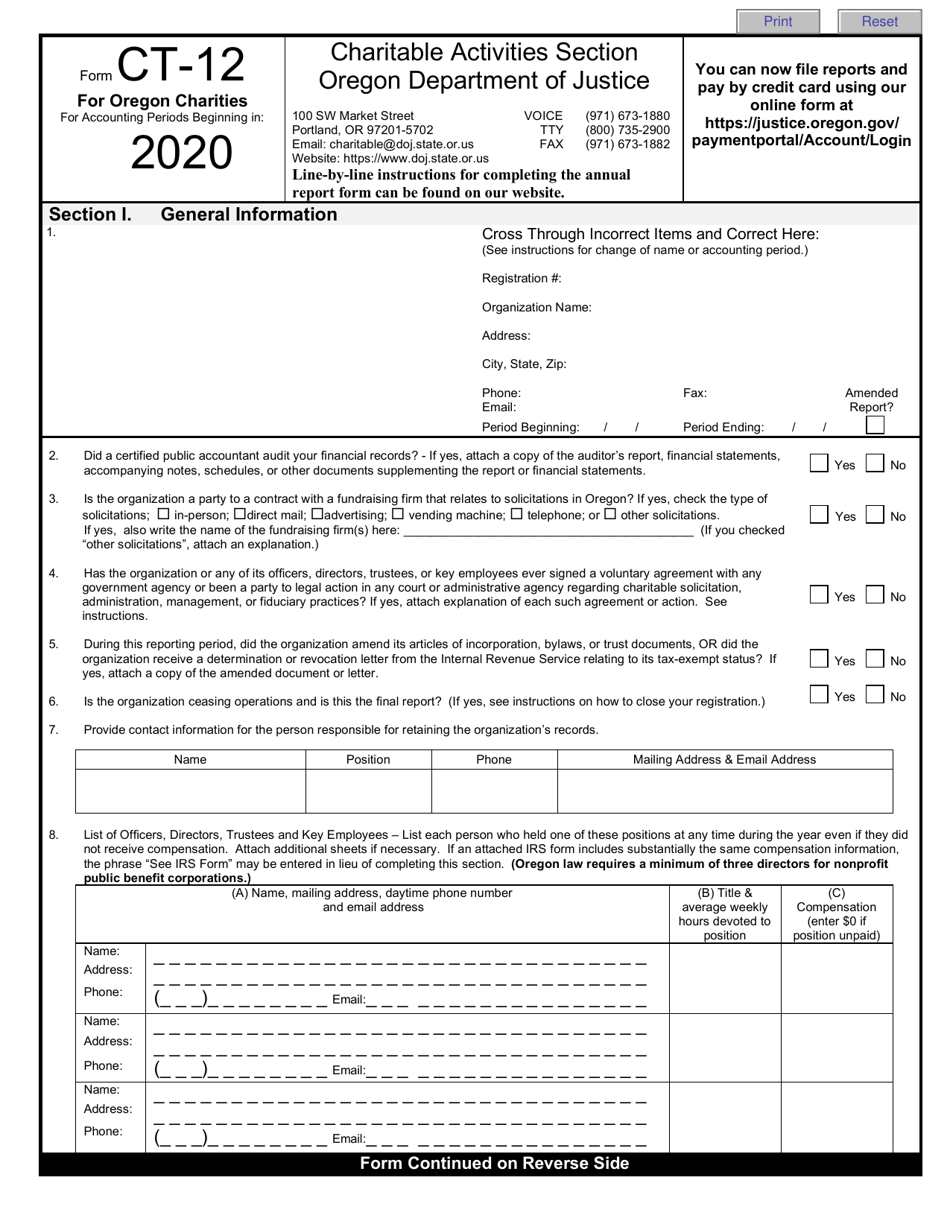

What Is Form CT-12?

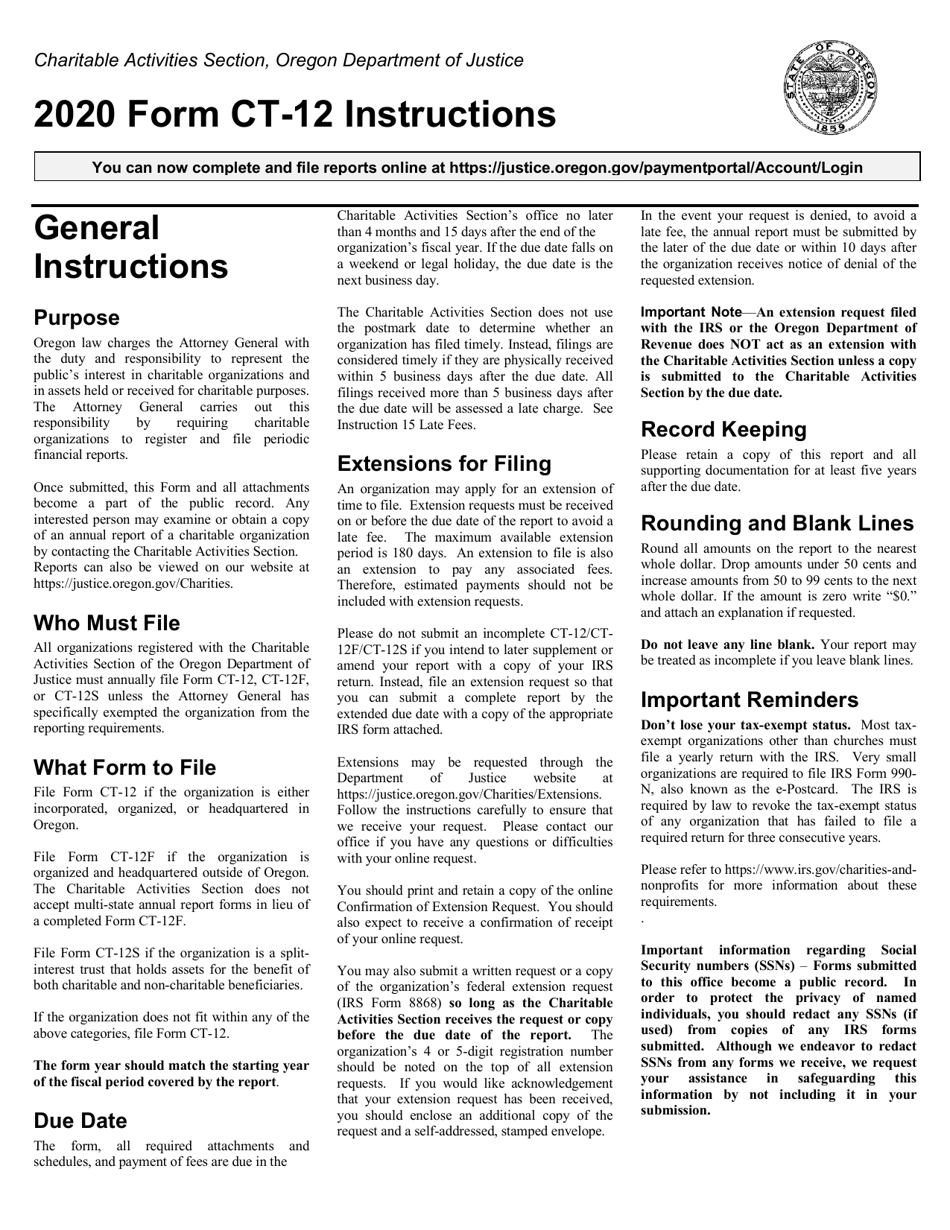

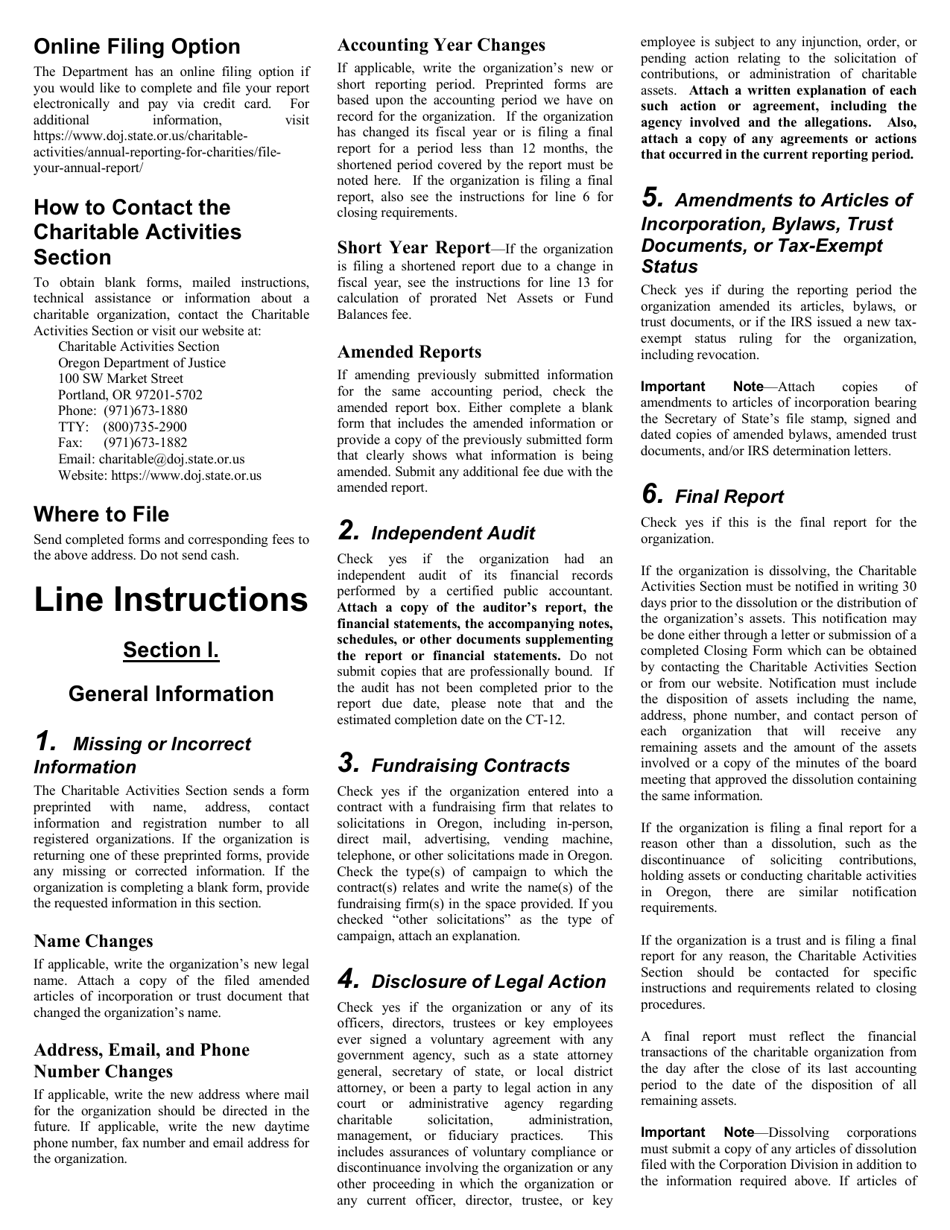

This is a legal form that was released by the Oregon Department of Justice - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

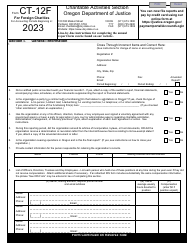

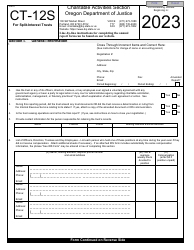

Q: What is Form CT-12?

A: Form CT-12 is a tax form for Oregon charities engaged in charitable activities.

Q: Who needs to file Form CT-12?

A: Oregon charities engaged in charitable activities need to file Form CT-12.

Q: What are charitable activities?

A: Charitable activities refer to activities undertaken by organizations for charitable purposes, such as providing assistance to those in need or advancing a charitable cause.

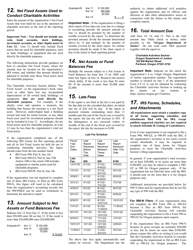

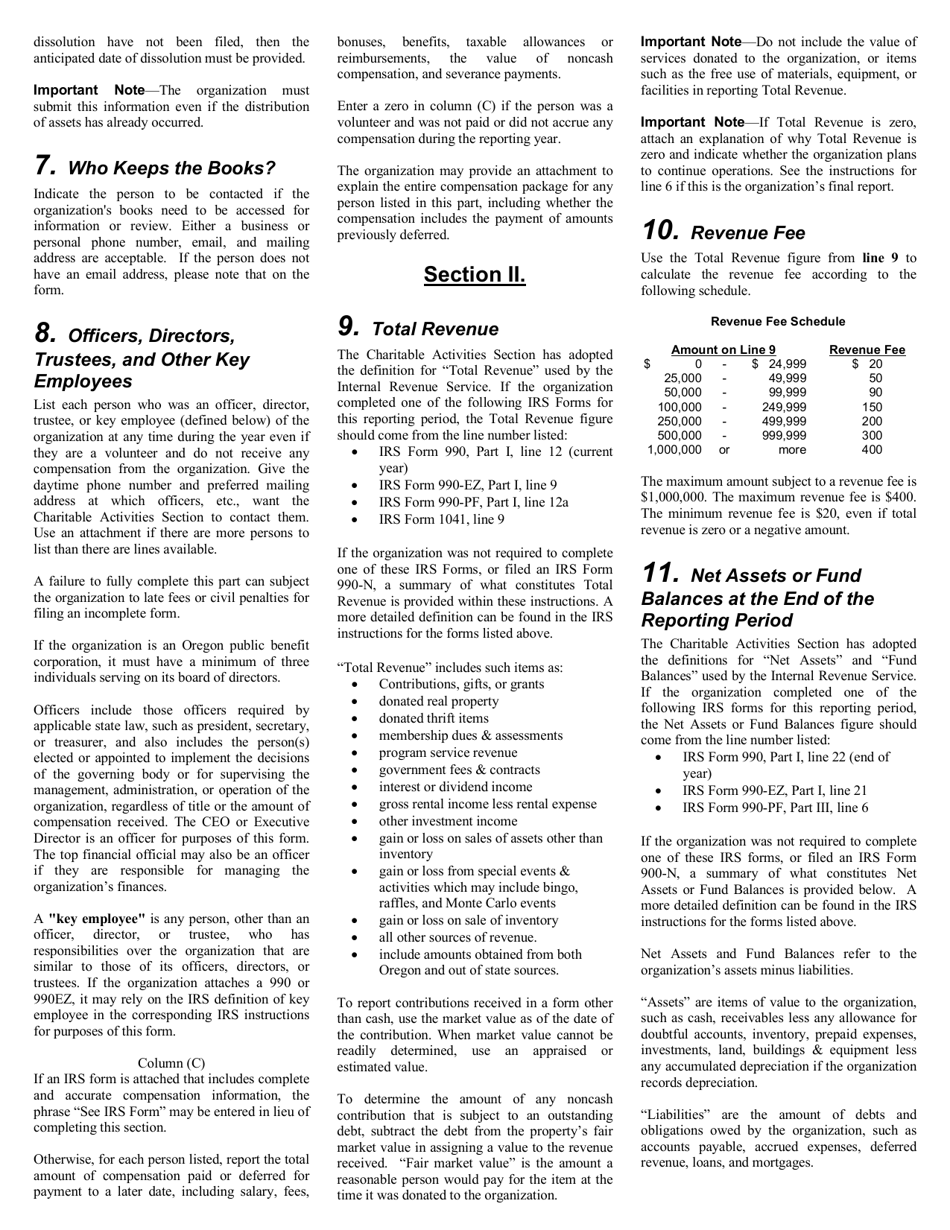

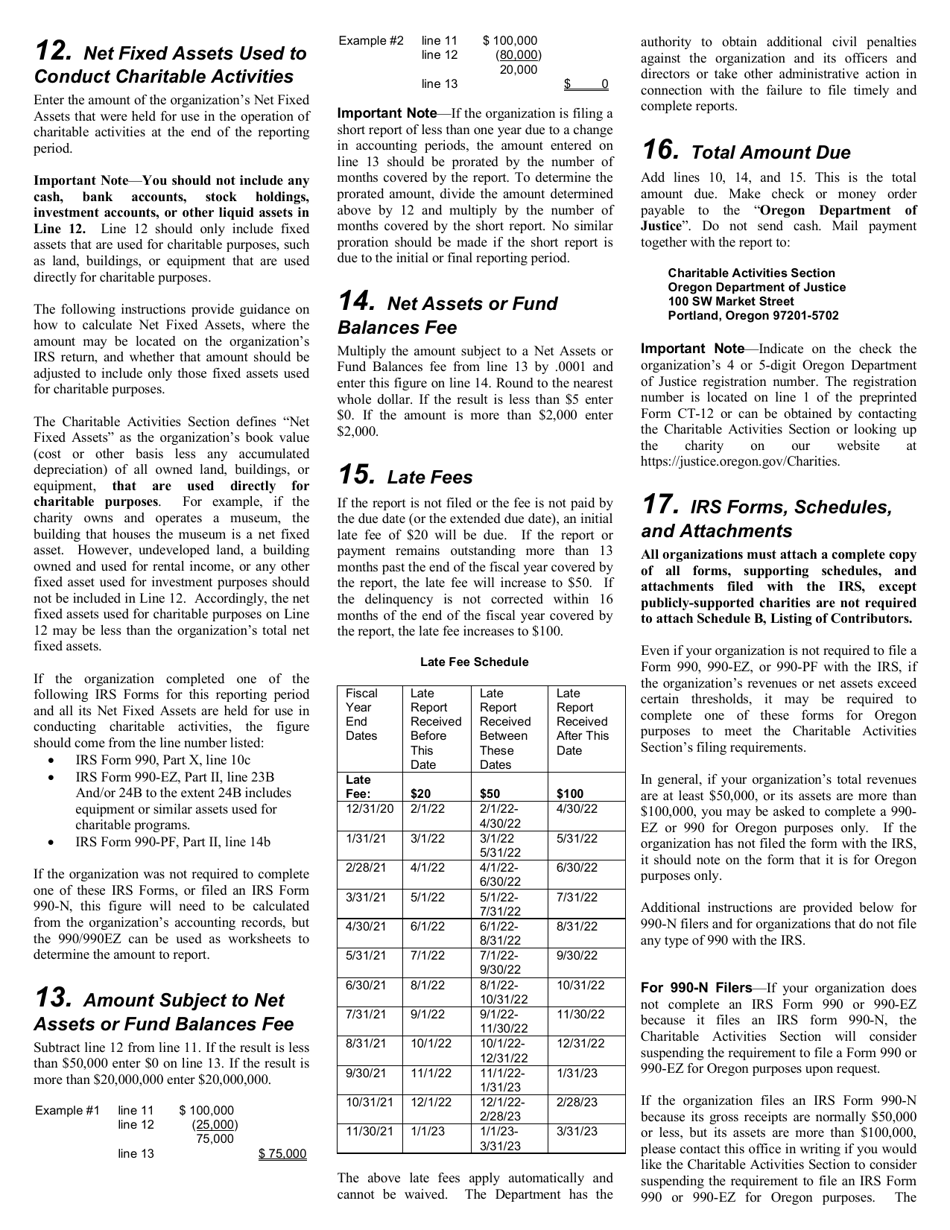

Q: What information is required on Form CT-12?

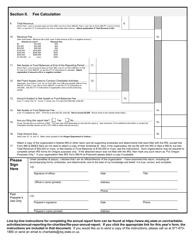

A: Form CT-12 requires information about the organization's charitable activities, gross revenue, expenses, and other financial details.

Q: When is Form CT-12 due?

A: Form CT-12 is typically due on the 15th day of the fifth month after the end of the organization's fiscal year.

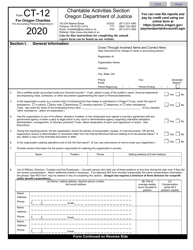

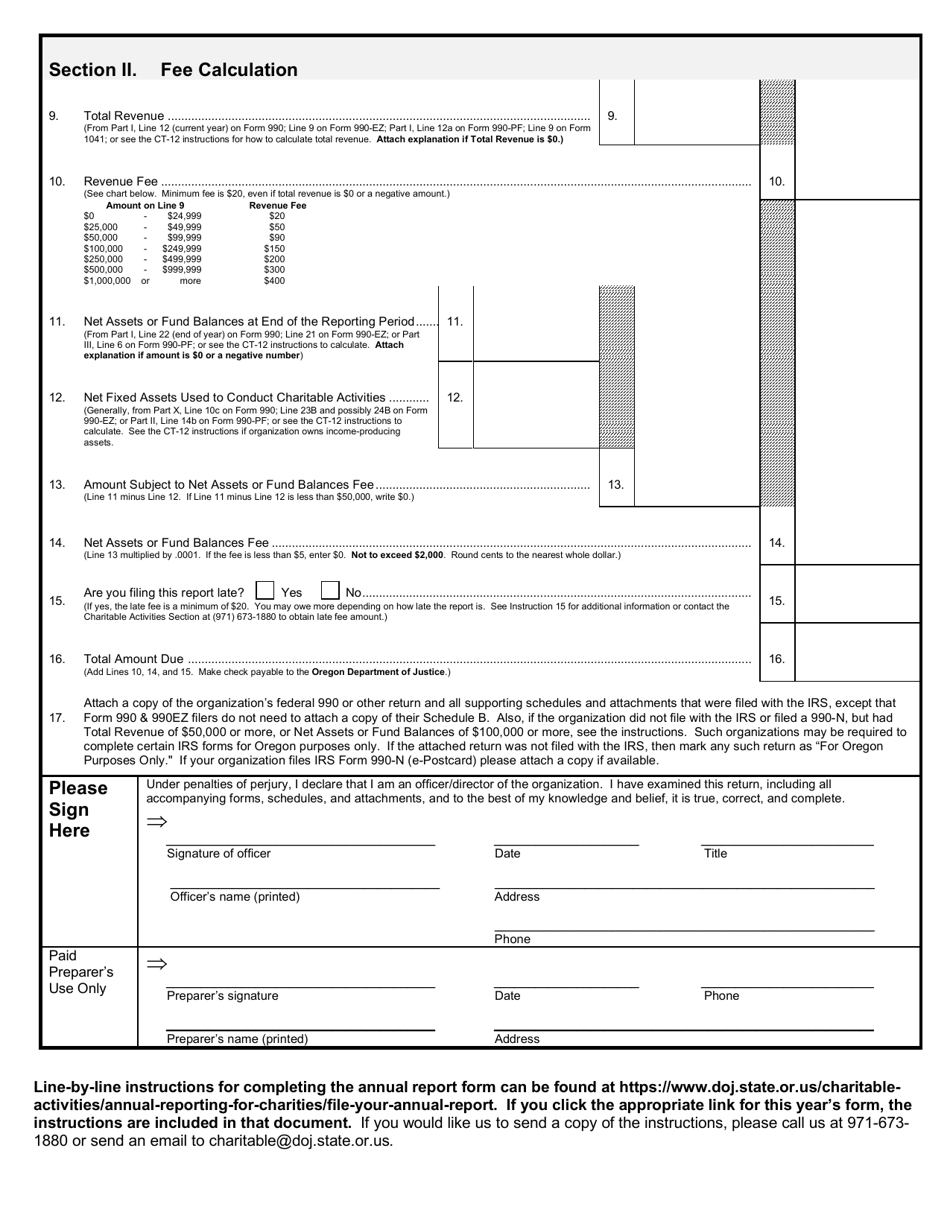

Q: Is there a fee for filing Form CT-12?

A: Yes, there is a fee associated with filing Form CT-12. The fee amount may vary.

Q: Are there any penalties for not filing Form CT-12?

A: Yes, there may be penalties for not filing Form CT-12, including late filing penalties and potential loss of tax-exempt status.

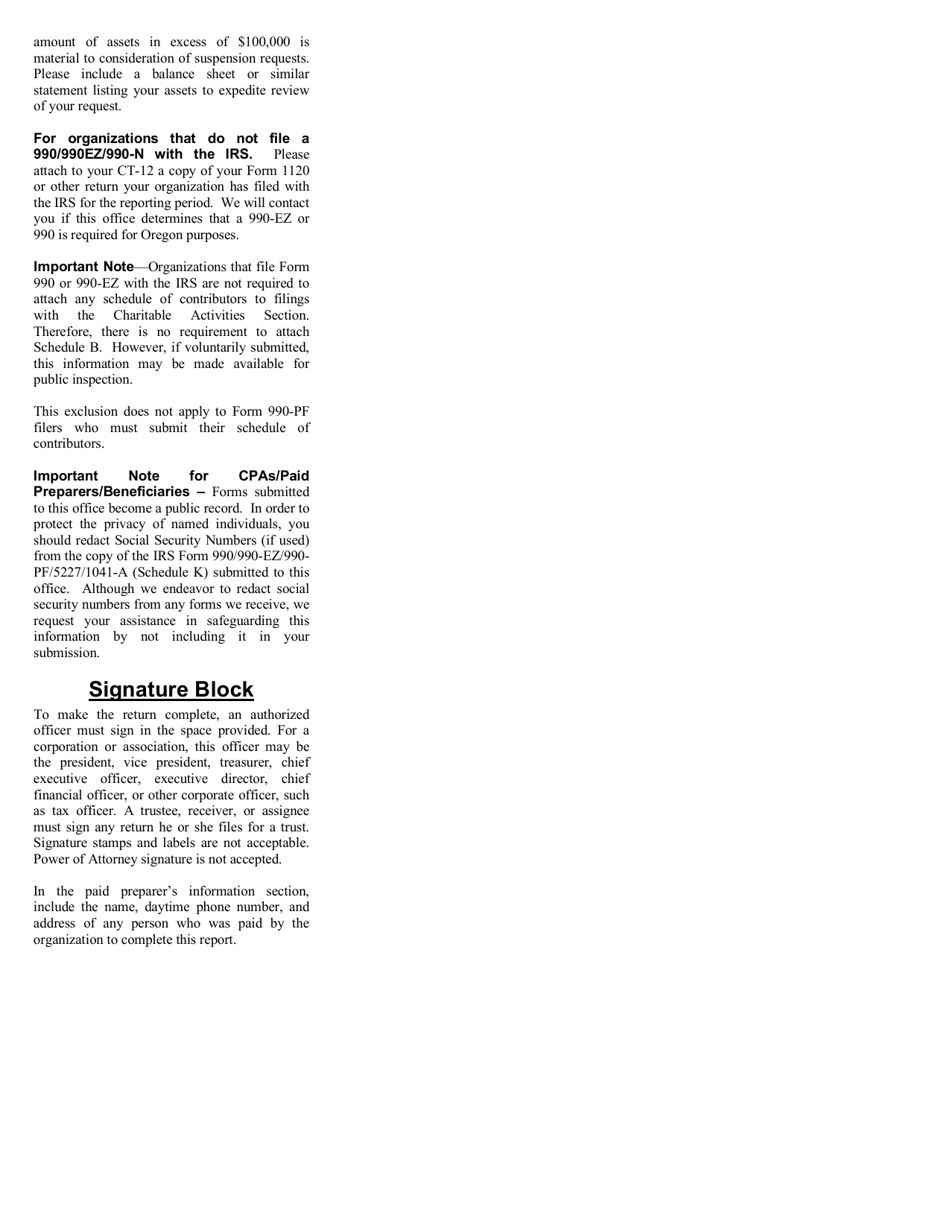

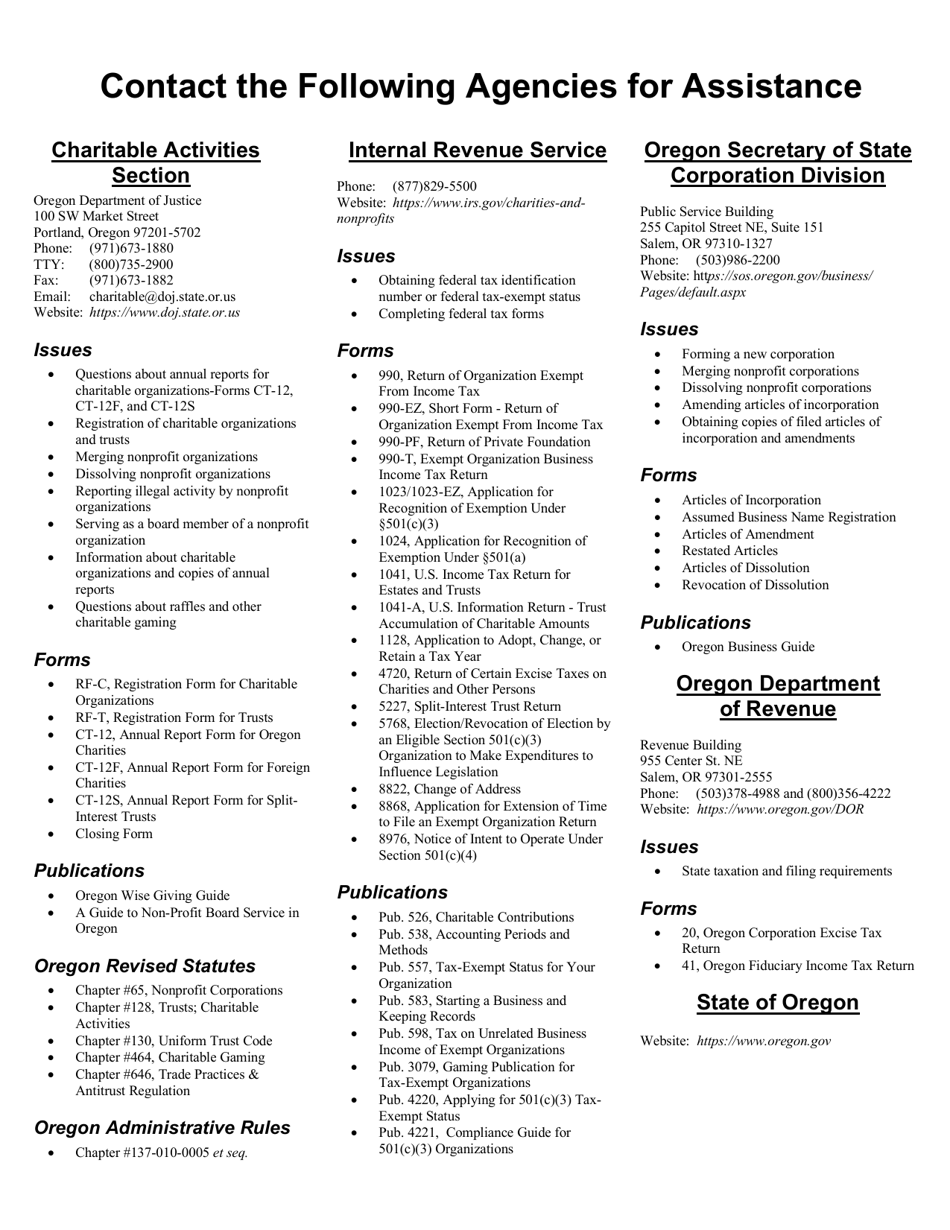

Q: What should I do if I need assistance with Form CT-12?

A: If you need assistance with Form CT-12, you can contact the Oregon Department of Revenue for guidance and support.

Form Details:

- The latest edition provided by the Oregon Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-12 by clicking the link below or browse more documents and templates provided by the Oregon Department of Justice.