This version of the form is not currently in use and is provided for reference only. Download this version of

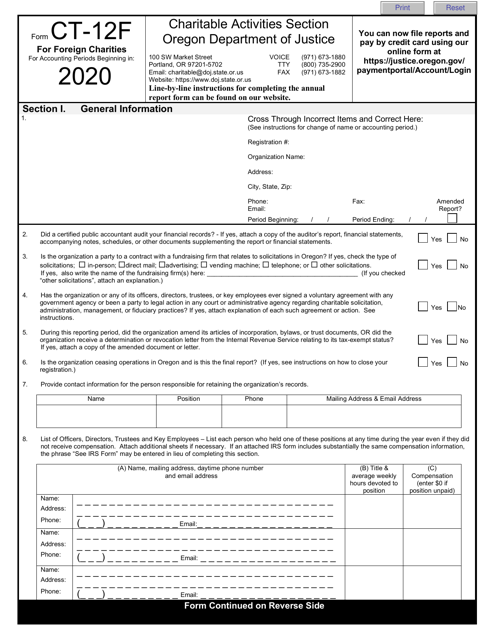

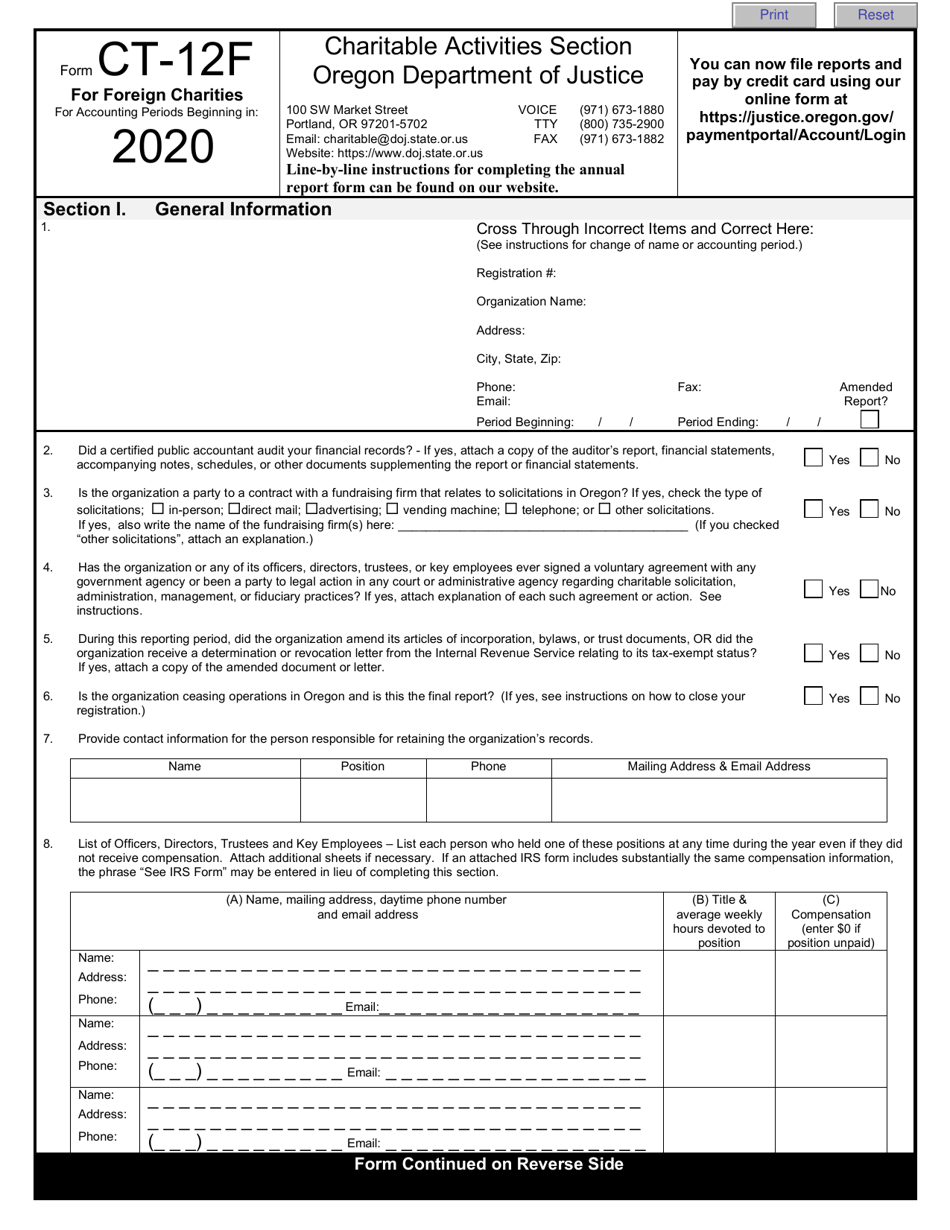

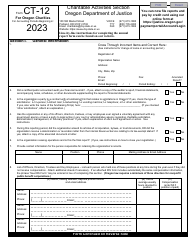

Form CT-12F

for the current year.

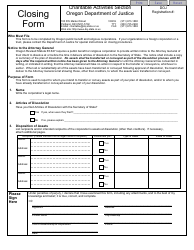

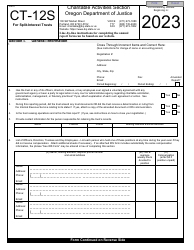

Form CT-12F Charitable Activities Form for Foreign Charities - Oregon

What Is Form CT-12F?

This is a legal form that was released by the Oregon Department of Justice - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-12F?

A: Form CT-12F is the Charitable Activities Form for Foreign Charities in Oregon.

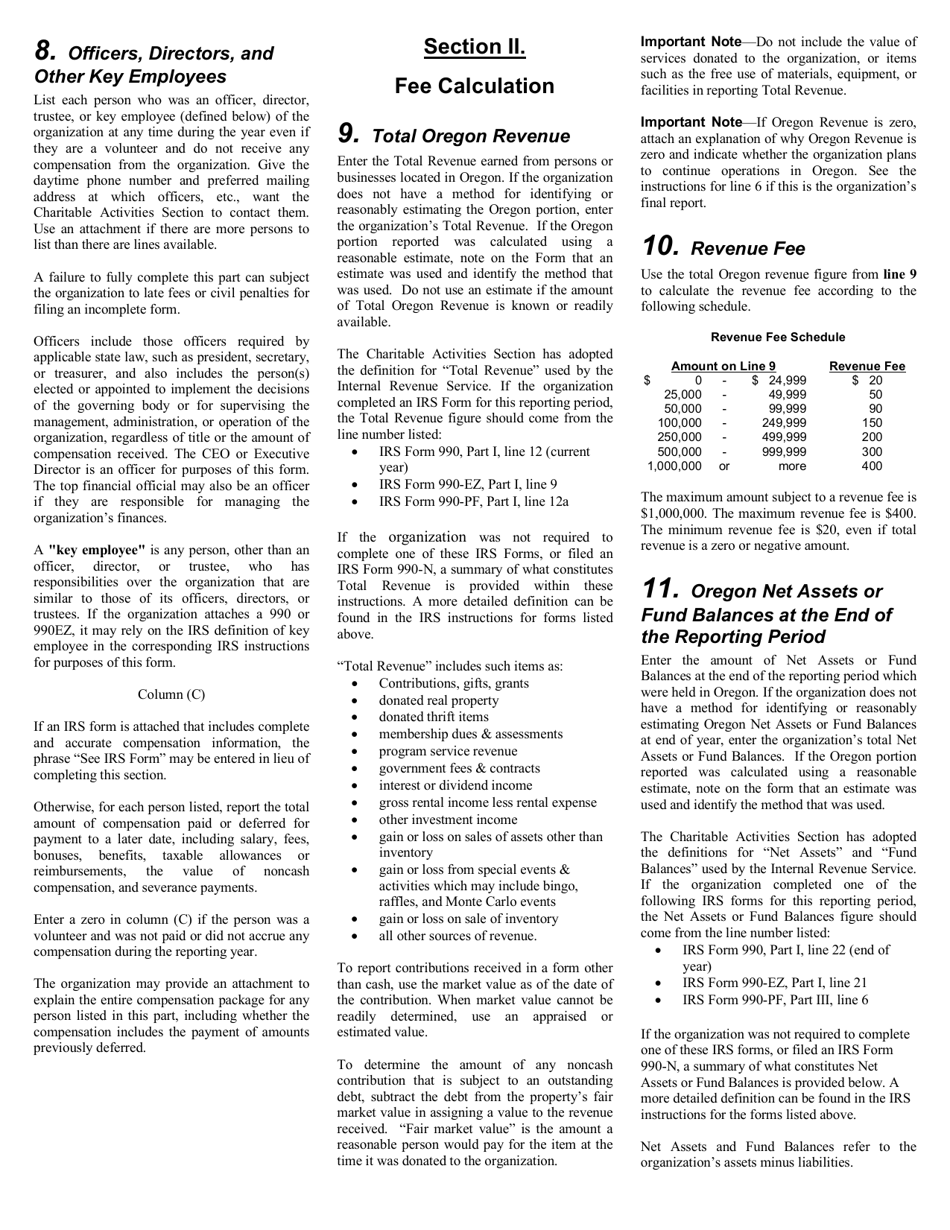

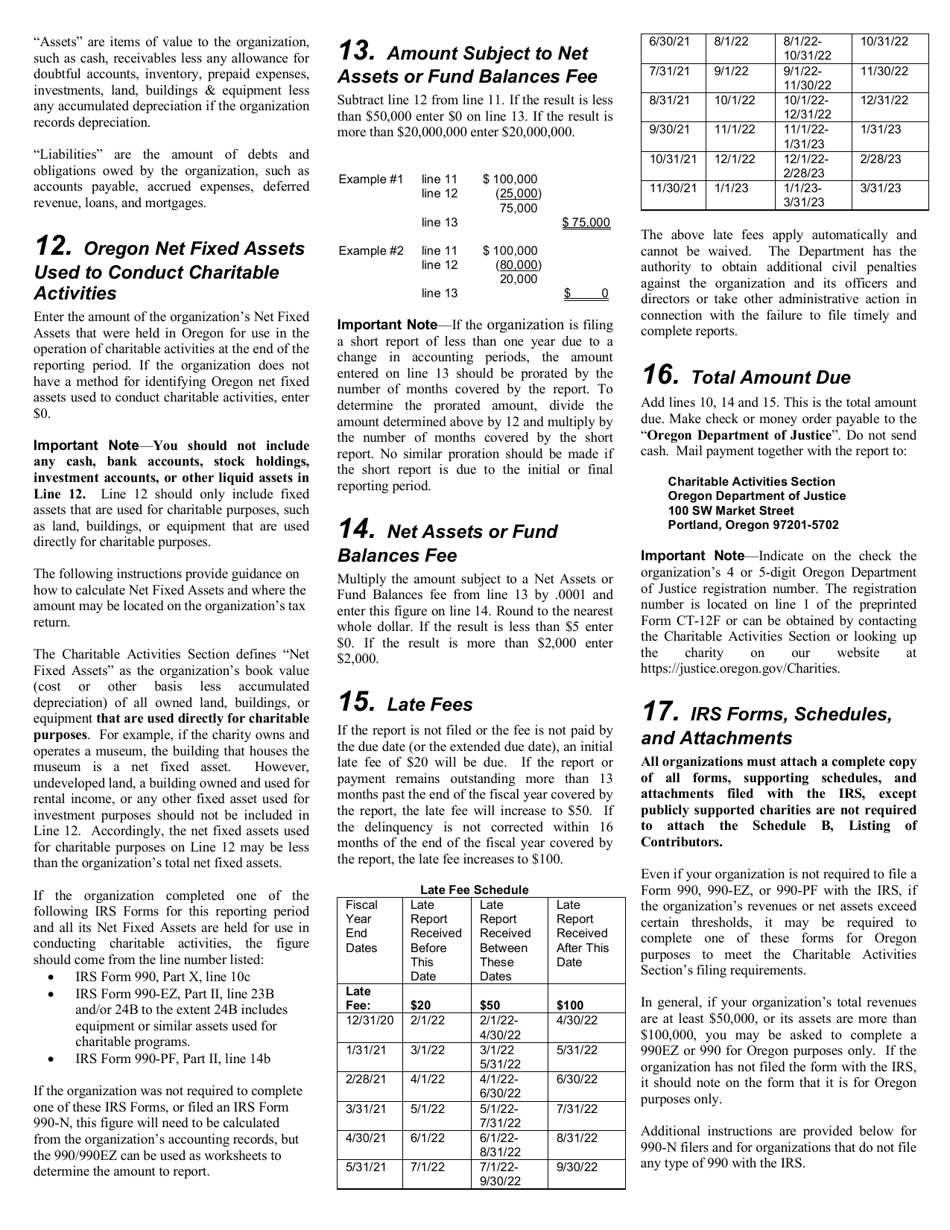

Q: What is the purpose of Form CT-12F?

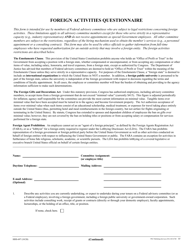

A: Form CT-12F is used by foreign charities to report their activities in Oregon.

Q: Who is required to file Form CT-12F?

A: Foreign charities that engage in charitable activities in Oregon are required to file Form CT-12F.

Q: When is Form CT-12F due?

A: Form CT-12F is due on or before the 15th day of the fifth month following the close of the charity's fiscal year.

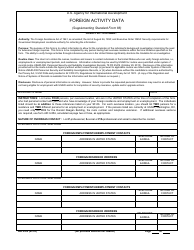

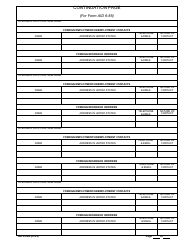

Q: What information is required on Form CT-12F?

A: Form CT-12F requires information about the charity's activities in Oregon, revenue, expenses, and other financial information.

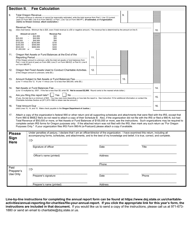

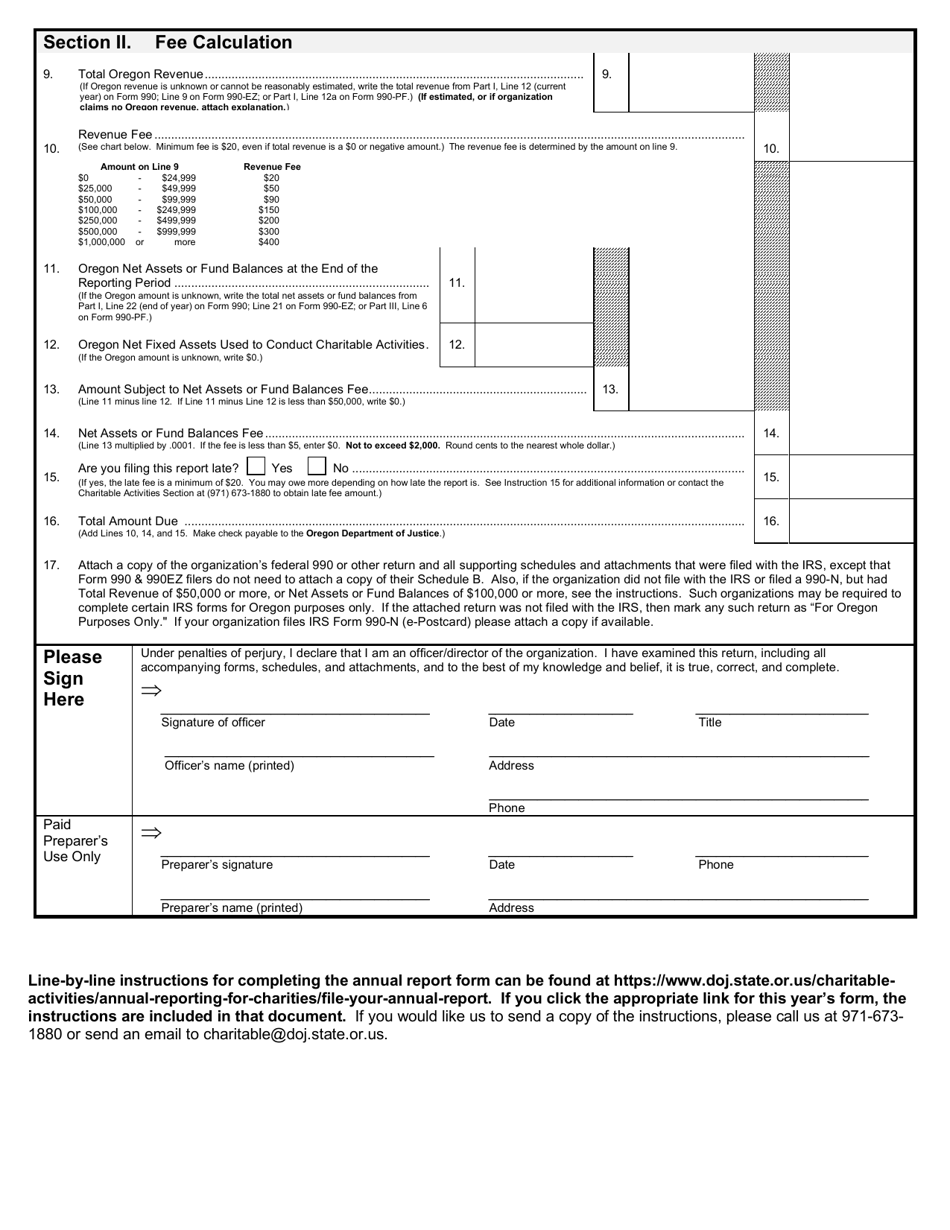

Q: Are there any filing fees for Form CT-12F?

A: No, there are no filing fees for Form CT-12F.

Q: What are the consequences of not filing Form CT-12F?

A: Failure to file Form CT-12F may result in penalties and loss of eligibility for solicitation in Oregon.

Form Details:

- The latest edition provided by the Oregon Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-12F by clicking the link below or browse more documents and templates provided by the Oregon Department of Justice.