This version of the form is not currently in use and is provided for reference only. Download this version of

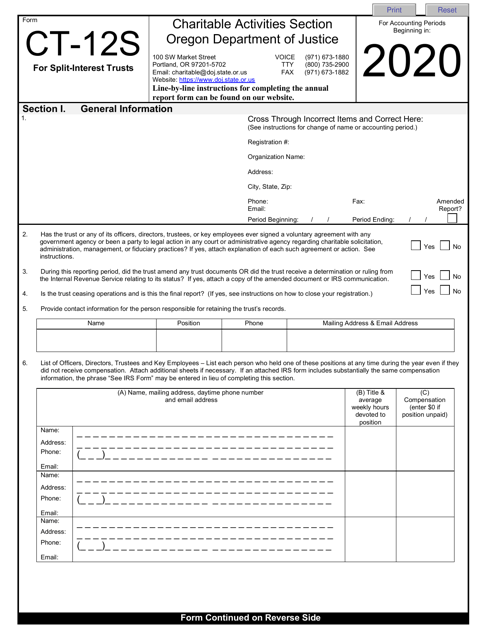

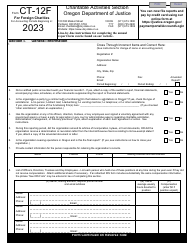

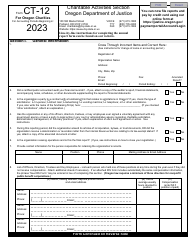

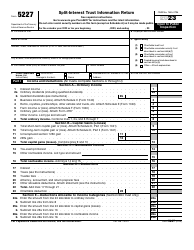

Form CT-12S

for the current year.

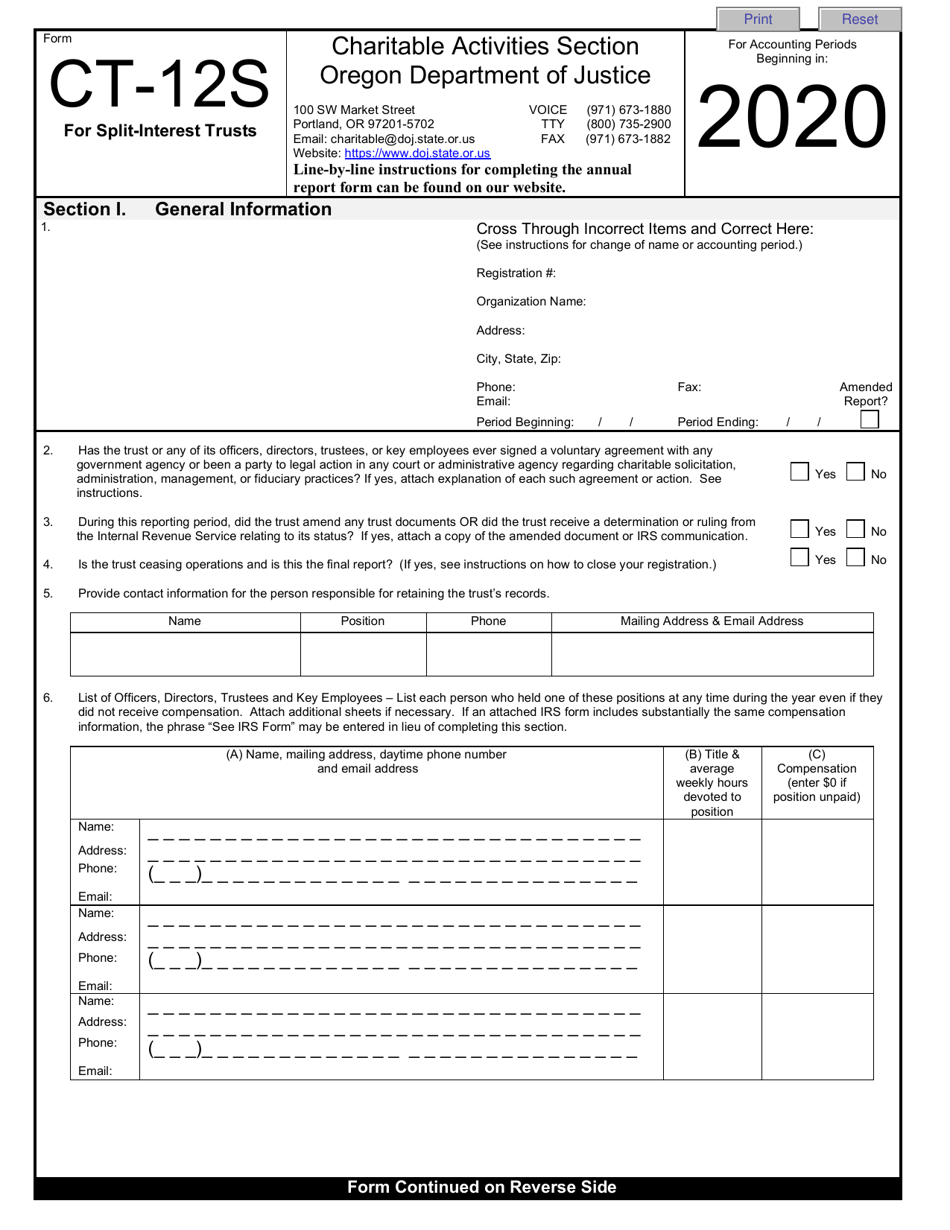

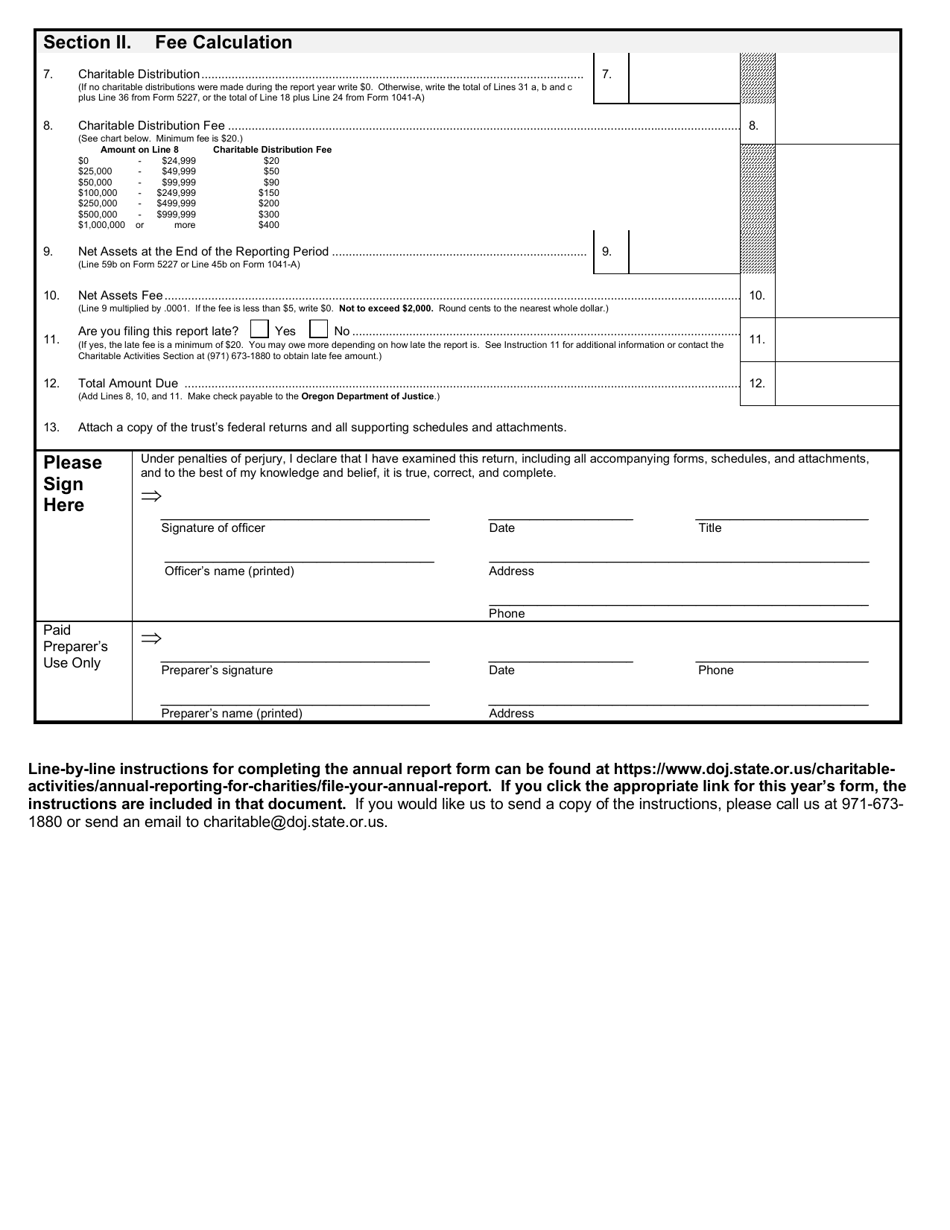

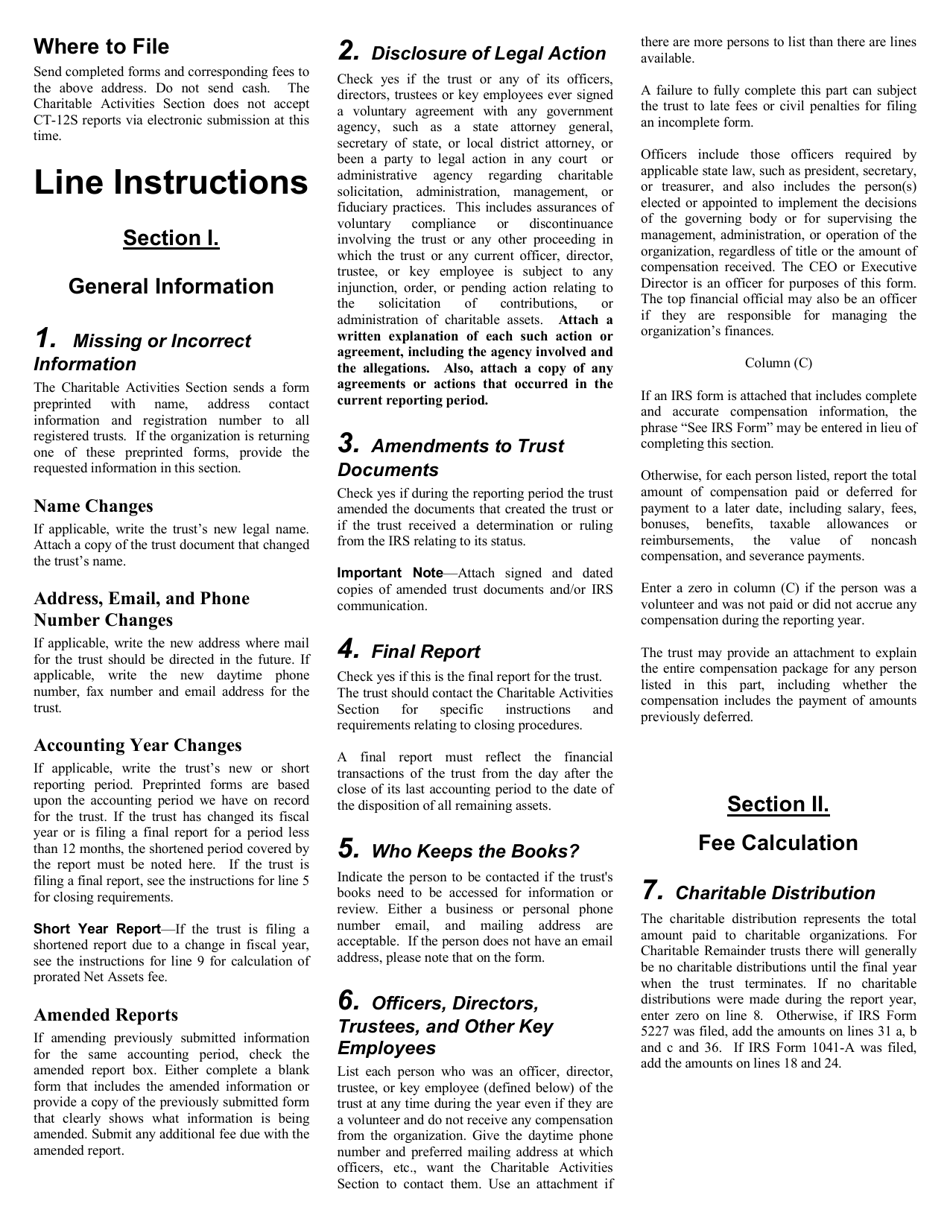

Form CT-12S Charitable Activities Form for Split-Interest Trusts - Oregon

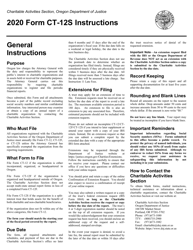

What Is Form CT-12S?

This is a legal form that was released by the Oregon Department of Justice - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-12S?

A: Form CT-12S is a form for reporting charitable activities for split-interest trusts in Oregon.

Q: What is a split-interest trust?

A: A split-interest trust is a trust that divides its assets between charitable and non-charitable beneficiaries.

Q: Who needs to file Form CT-12S?

A: Split-interest trusts engaged in charitable activities in Oregon need to file Form CT-12S.

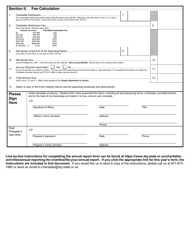

Q: What information is required on Form CT-12S?

A: Form CT-12S requires information about the trust, its charitable activities, and the distribution of income.

Q: When is the deadline for filing Form CT-12S?

A: The deadline for filing Form CT-12S in Oregon is the same as the federal deadline for filing Form 990-T.

Form Details:

- The latest edition provided by the Oregon Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-12S by clicking the link below or browse more documents and templates provided by the Oregon Department of Justice.