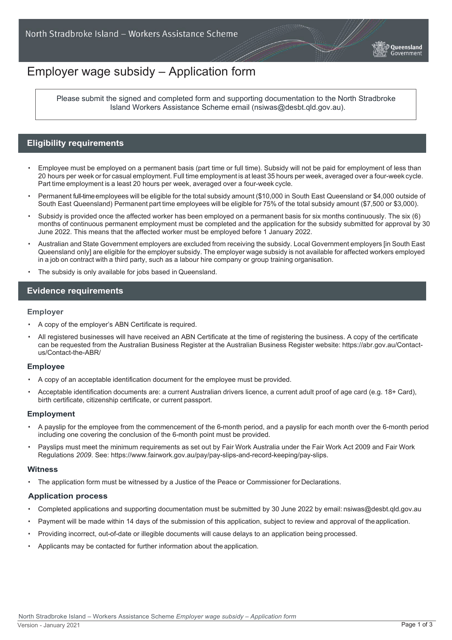

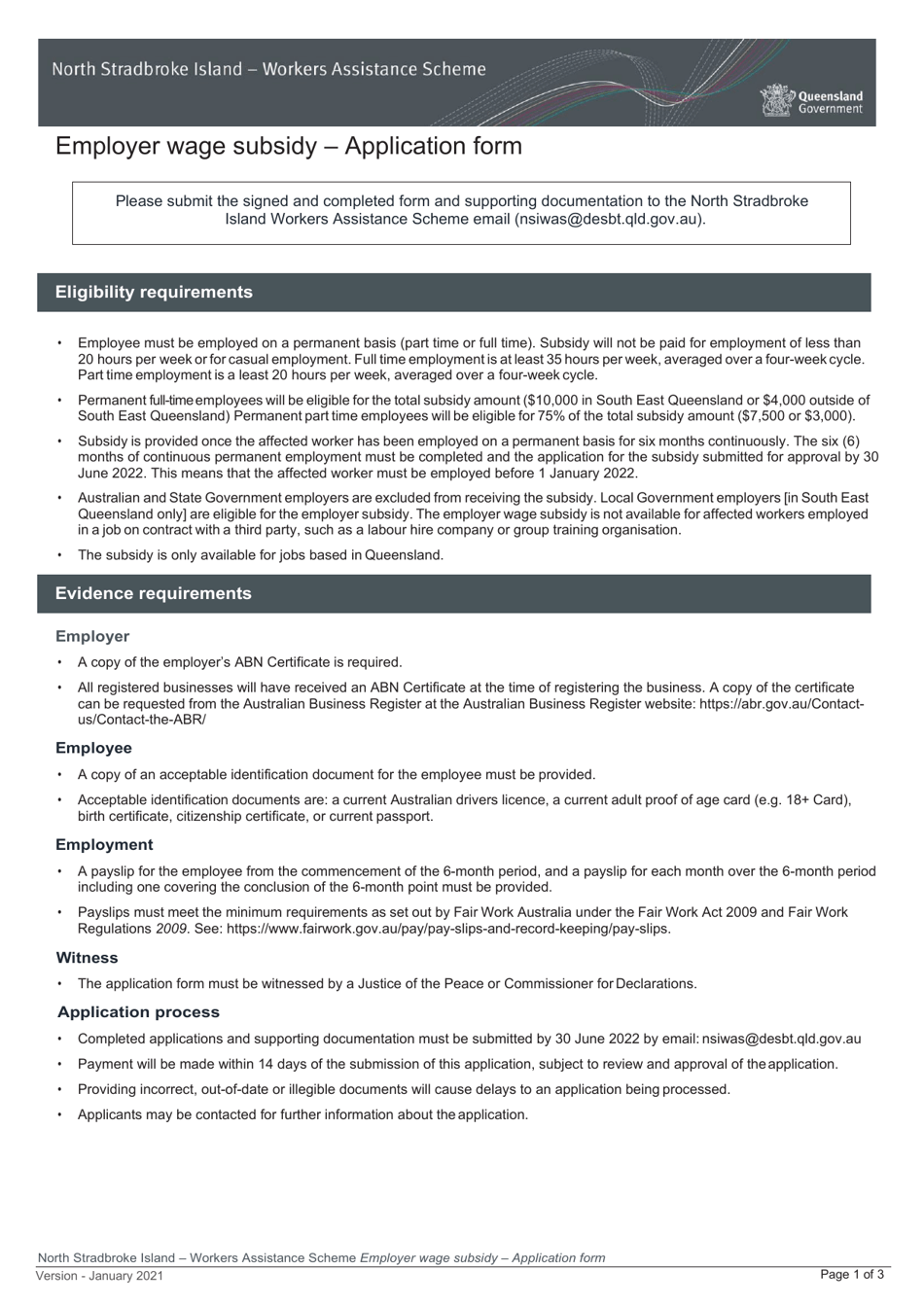

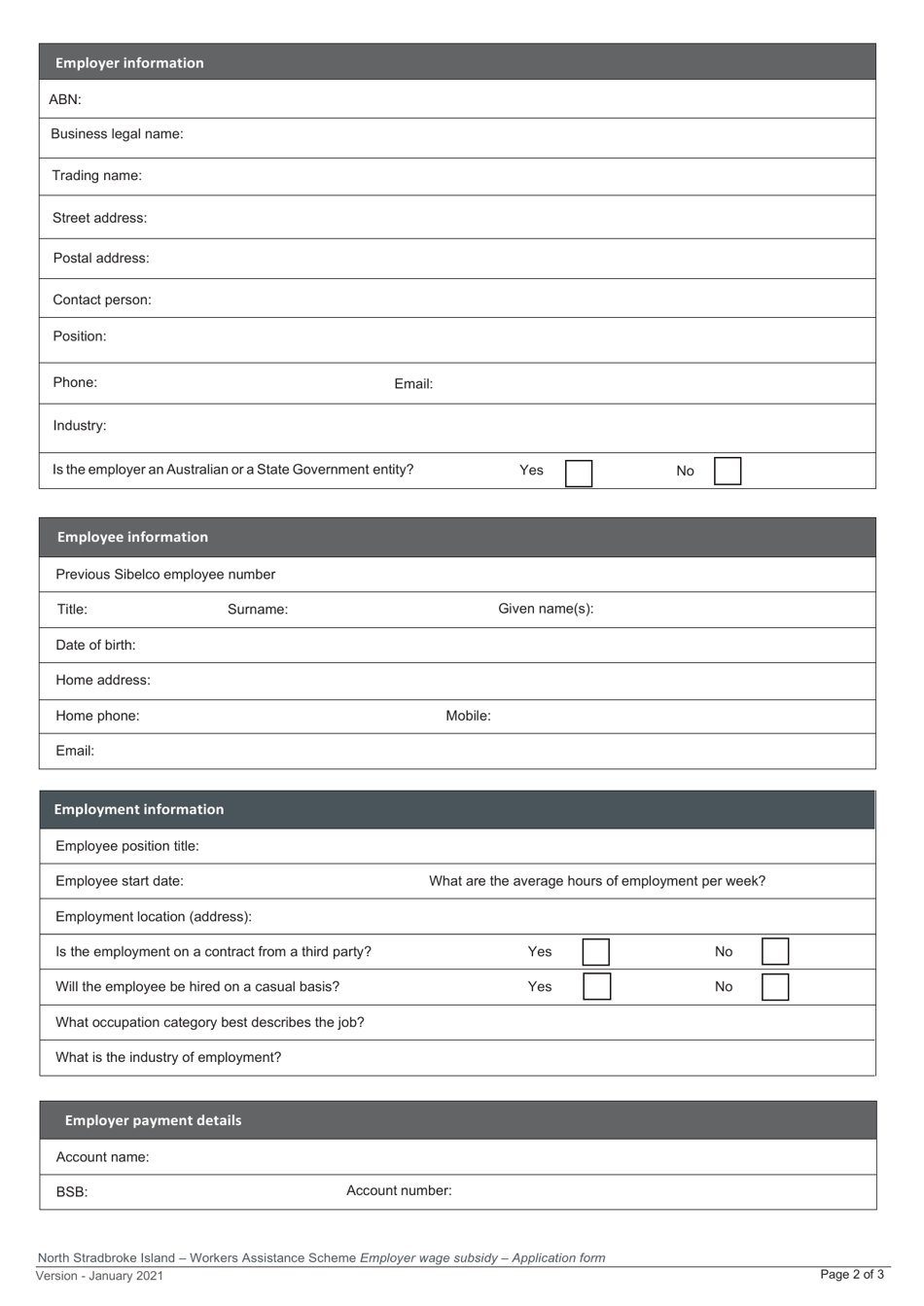

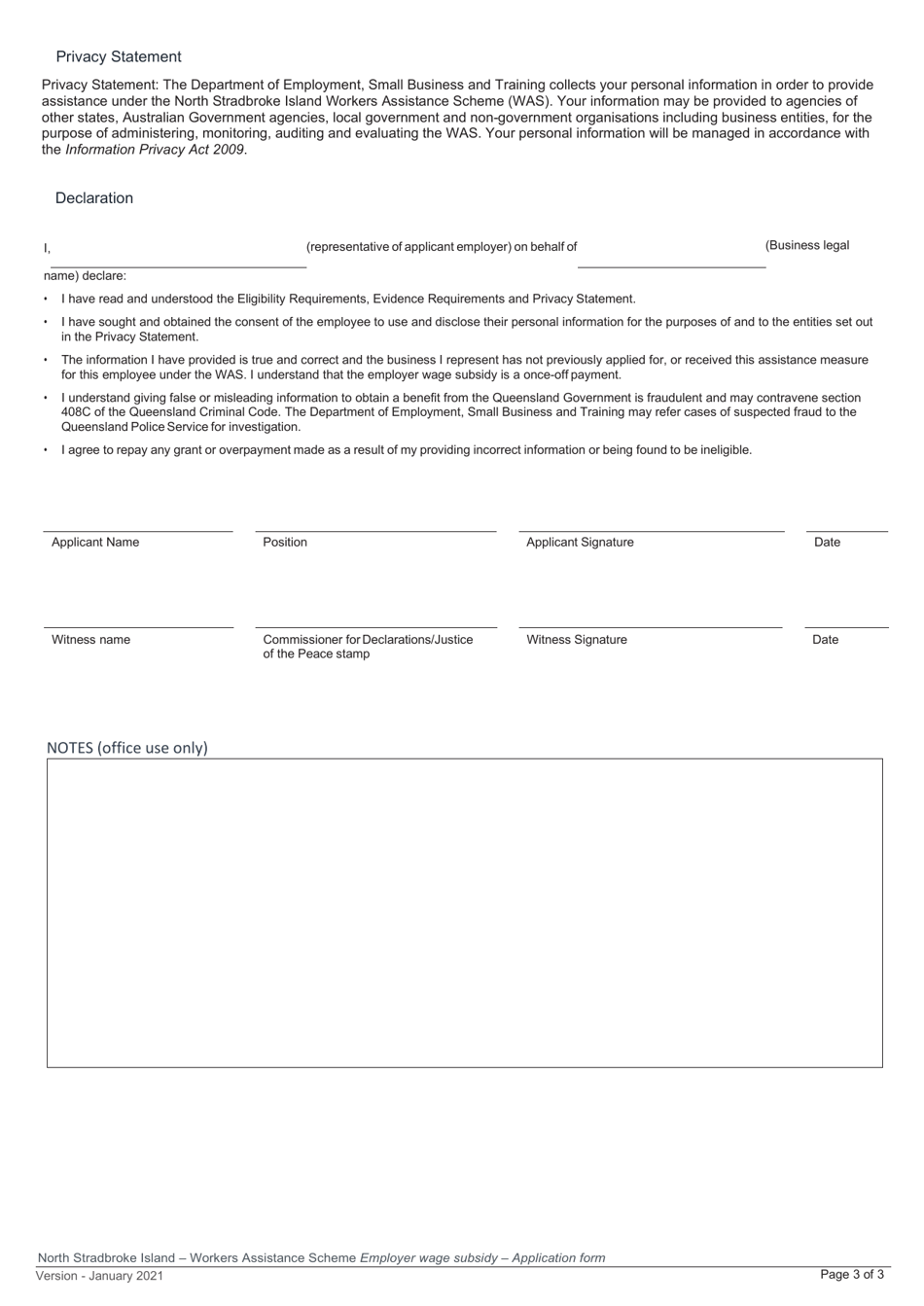

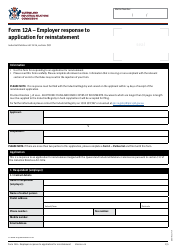

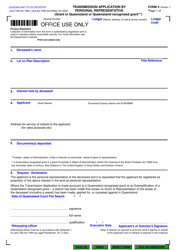

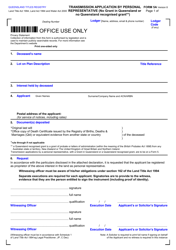

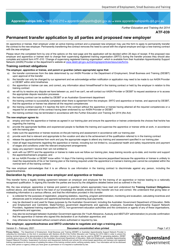

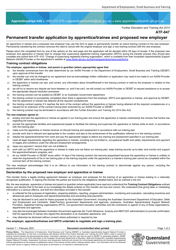

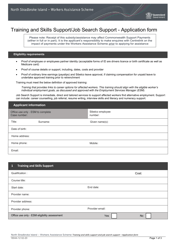

Employer Wage Subsidy Application Form - Queensland, Australia

The Employer Wage Subsidy Application Form in Queensland, Australia is used by employers to apply for a subsidy that helps them cover the wages of eligible employees. This program aims to support businesses that have been adversely affected by the COVID-19 pandemic and assist them in retaining their workforce. The subsidy provides financial assistance to employers who have experienced a significant decline in revenue. The exact details and eligibility criteria can be found on the official government website in Queensland.

The employer wage subsidy application form in Queensland, Australia is typically filed by eligible employers who are seeking to apply for the subsidy. The specific process for filing the form may vary, but generally, it is the responsibility of the employer to complete and submit the application. For detailed information and guidance, it is recommended to visit the official website of the Queensland government or contact the relevant authorities.

FAQ

Q: What is the Employer Wage Subsidy Application Form?

A: The Employer Wage Subsidy Application Form is a document used by employers in Queensland, Australia to apply for a wage subsidy offered by the government.

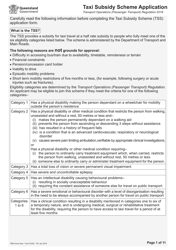

Q: Who is eligible to apply for the Employer Wage Subsidy?

A: Employers in Queensland, Australia who have experienced a decline in business revenue due to the impact of COVID-19 may be eligible to apply for the Employer Wage Subsidy.

Q: What is the purpose of the Employer Wage Subsidy?

A: The purpose of the Employer Wage Subsidy is to provide financial assistance to eligible employers, helping them retain their employees and avoid layoffs during periods of economic downturn.

Q: How much financial assistance does the Employer Wage Subsidy provide?

A: The amount of financial assistance provided by the Employer Wage Subsidy may vary depending on the specific circumstances of the employer, the number of eligible employees, and the decline in business revenue. It is advised to consult the application form and relevant guidelines for detailed information.

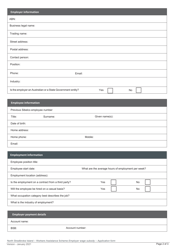

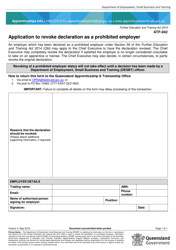

Q: What are the requirements for applying for the Employer Wage Subsidy?

A: To apply for the Employer Wage Subsidy, employers need to meet certain criteria, including being located in Queensland, Australia, having a registered business with employees, demonstrating a decline in revenue, and adhering to the program guidelines set by the government.

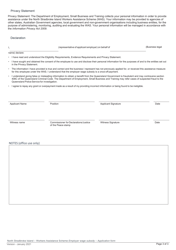

Q: How can I submit my Employer Wage Subsidy application?

A: The application can be submitted by completing the form electronically or by mail, as per the instructions provided in the application package.

Q: Is there a deadline for submitting the Employer Wage Subsidy application?

A: Specific deadlines may apply for submitting the Employer Wage Subsidy application. It is important to check the application form and related guidelines for the most up-to-date information.

Q: What supporting documents are required for the Employer Wage Subsidy application?

A: Supporting documents may include financial statements, tax records, payroll records, and any other documents requested in the application form. It is recommended to read the application package carefully to ensure all required documents are submitted.

Q: How long does it take to receive a decision on the Employer Wage Subsidy application?

A: The processing time for the Employer Wage Subsidy application may vary. Applicants are advised to check with the relevant government department for an estimate of the processing time and to follow up on the status of their application if necessary.