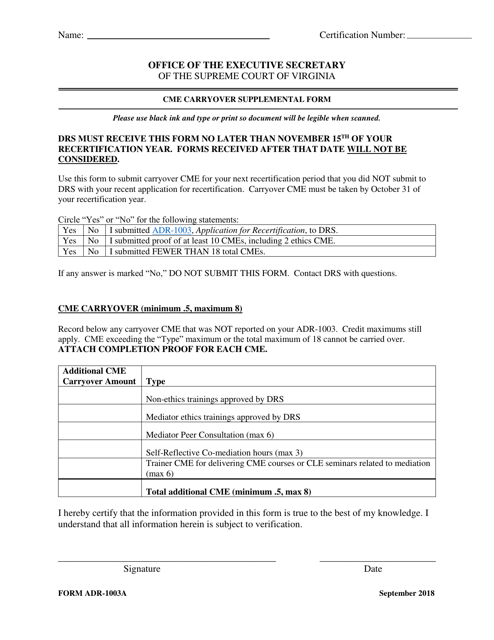

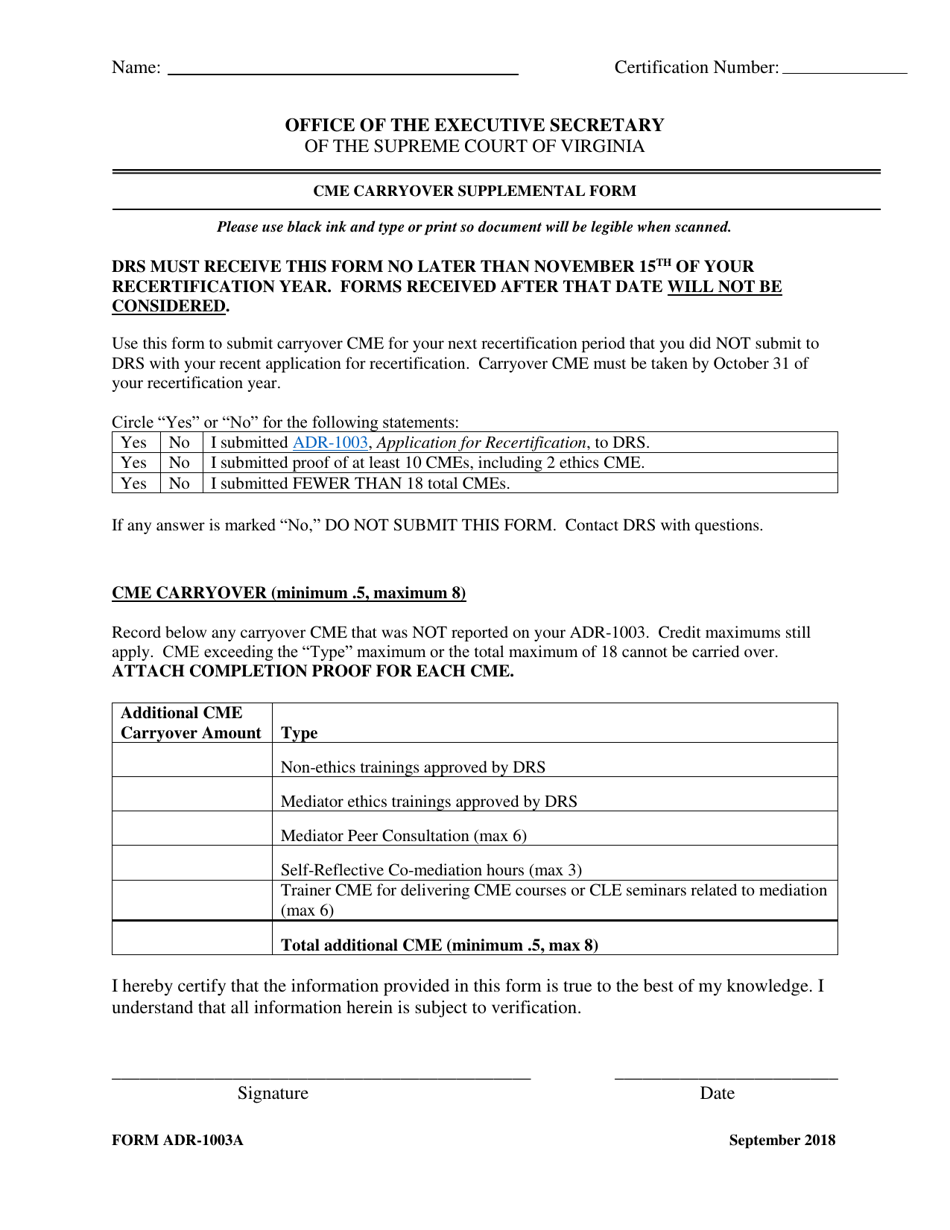

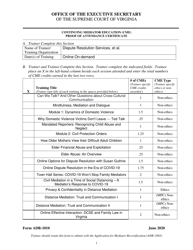

Form ADR-1003A Cme Carryover Supplemental Form - Virginia

What Is Form ADR-1003A?

This is a legal form that was released by the Supreme Court of Virginia - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADR-1003A?

A: Form ADR-1003A is the Carryover Supplemental Form for the Virginia Corporate Income Tax Return.

Q: What is the purpose of Form ADR-1003A?

A: Form ADR-1003A is used to report any net operating loss or tax credits carried over from previous years.

Q: Who needs to file Form ADR-1003A?

A: Anyone who has a net operating loss or tax credits carried over to the current tax year needs to file Form ADR-1003A.

Q: When should I file Form ADR-1003A?

A: Form ADR-1003A should be filed along with your Virginia Corporate Income Tax Return.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Supreme Court of Virginia;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADR-1003A by clicking the link below or browse more documents and templates provided by the Supreme Court of Virginia.