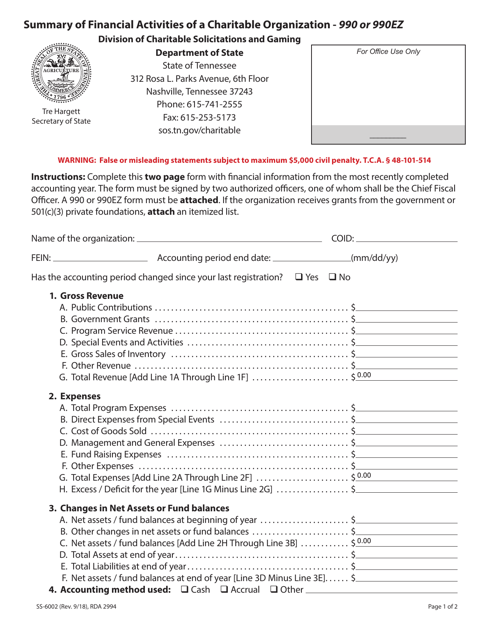

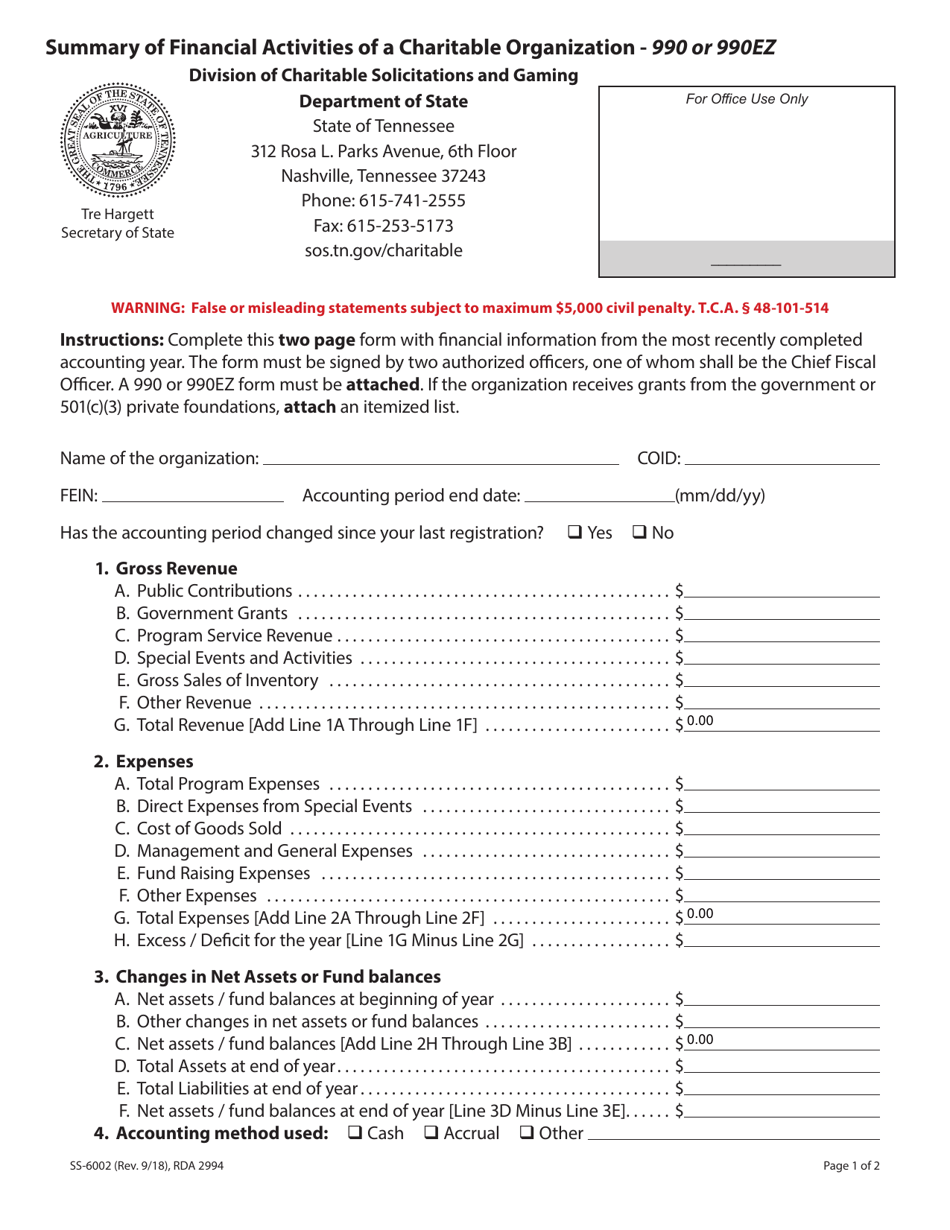

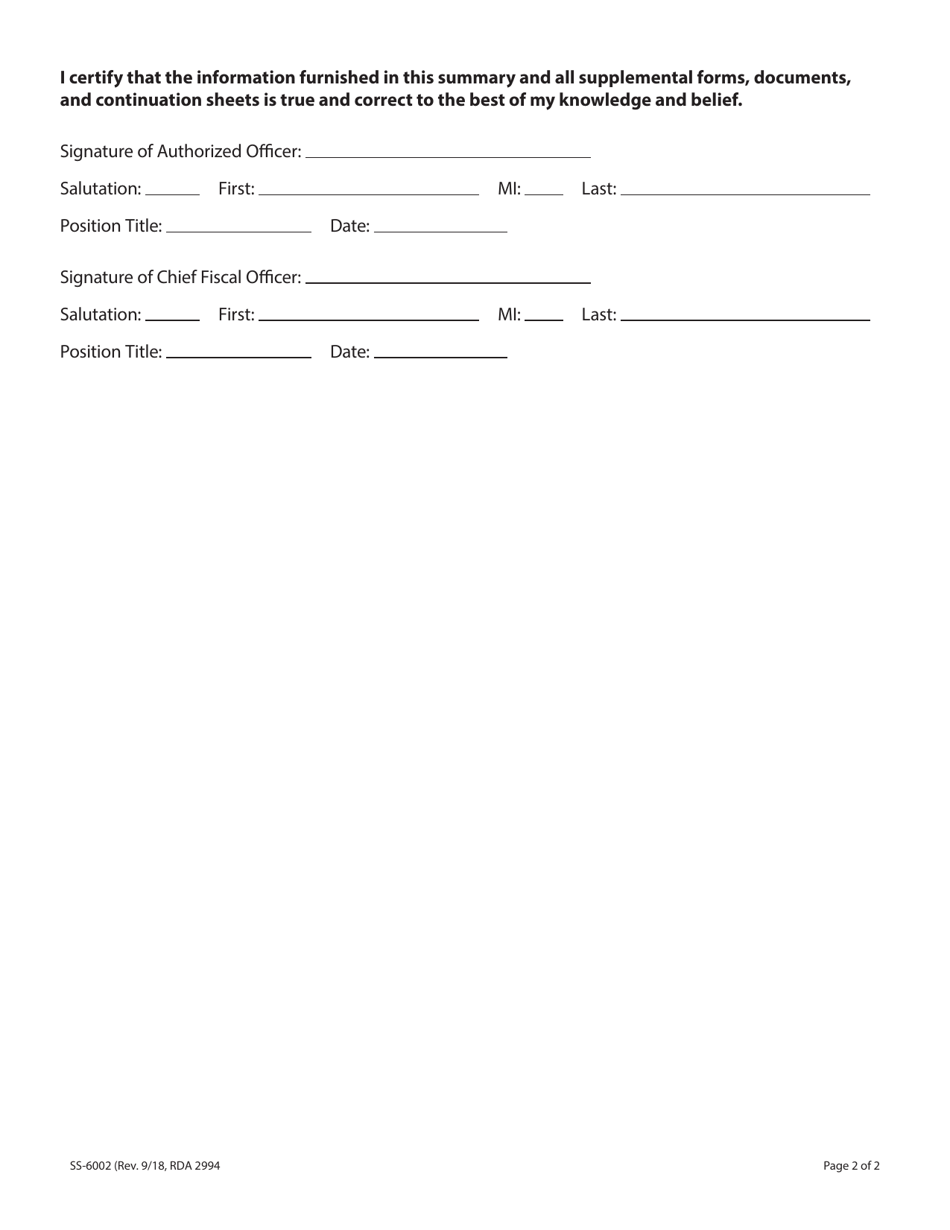

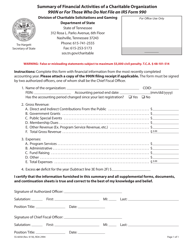

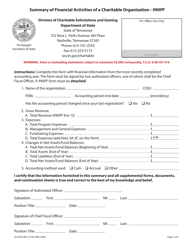

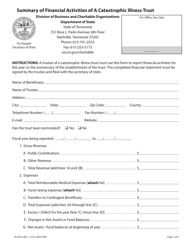

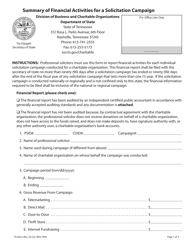

Form SS-6002 Summary of Financial Activities of a Charitable Organization - 990 or 990ez - Tennessee

What Is Form SS-6002?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-6002?

A: Form SS-6002 is the Summary of Financial Activities of a Charitable Organization.

Q: What is the purpose of Form SS-6002?

A: The purpose of Form SS-6002 is to provide a summary of the financial activities of a charitable organization in Tennessee.

Q: What is Form 990?

A: Form 990 is the Annual Return/Report of Organization Exempt from Income Tax, which is filed by tax-exempt organizations to provide information on their financial activities.

Q: What is Form 990EZ?

A: Form 990EZ is a simplified version of Form 990, which can be used by small tax-exempt organizations with gross receipts less than $200,000 and total assets less than $500,000.

Q: Who needs to file Form SS-6002?

A: Charitable organizations in Tennessee that are required to file Form 990 or 990EZ with the IRS need to file Form SS-6002 as well.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-6002 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.