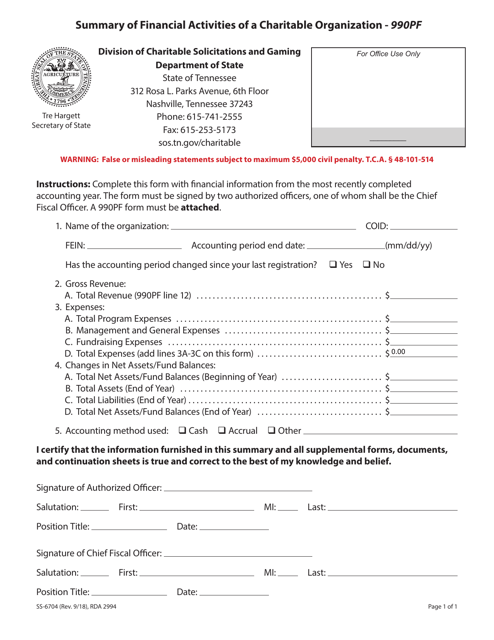

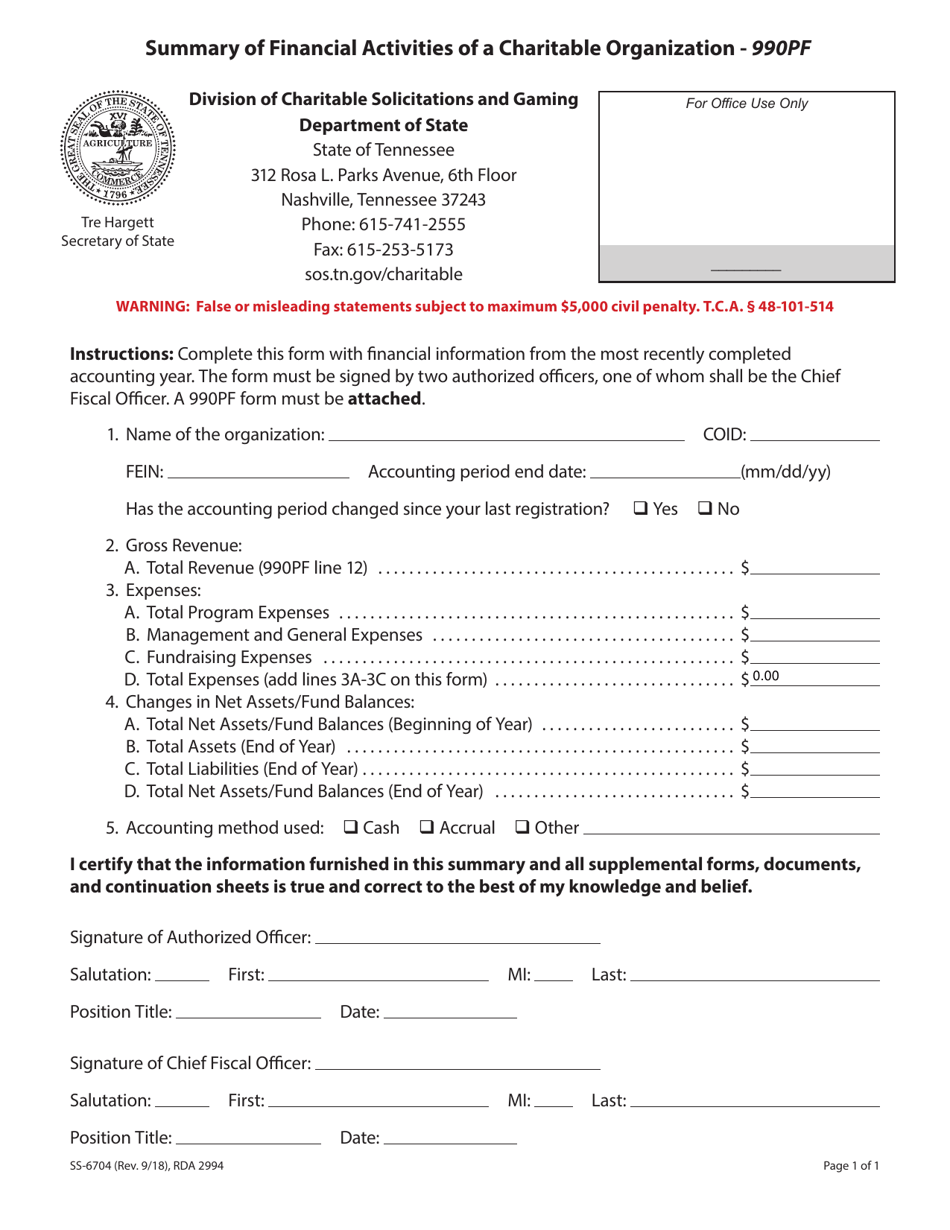

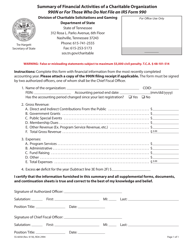

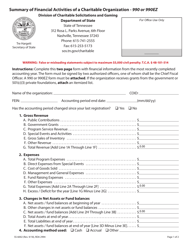

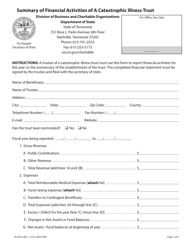

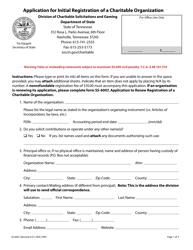

Form SS-6704 Summary of Financial Activities of a Charitable Organization - 990pf - Tennessee

What Is Form SS-6704?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-6704?

A: Form SS-6704 is a summary of financial activities for a charitable organization in Tennessee.

Q: What is a 990pf?

A: A 990pf is a tax form filed by private foundations to provide the IRS with information about their financial activities and grants.

Q: What does Form SS-6704 include?

A: Form SS-6704 includes a summary of the financial activities of a charitable organization, including income, expenses, and grants.

Q: Who needs to file Form SS-6704?

A: Charitable organizations in Tennessee that are required to file a 990pf form with the IRS also need to file Form SS-6704.

Q: What is the purpose of Form SS-6704?

A: The purpose of Form SS-6704 is to provide a summary of the financial activities of a charitable organization in Tennessee.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-6704 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.