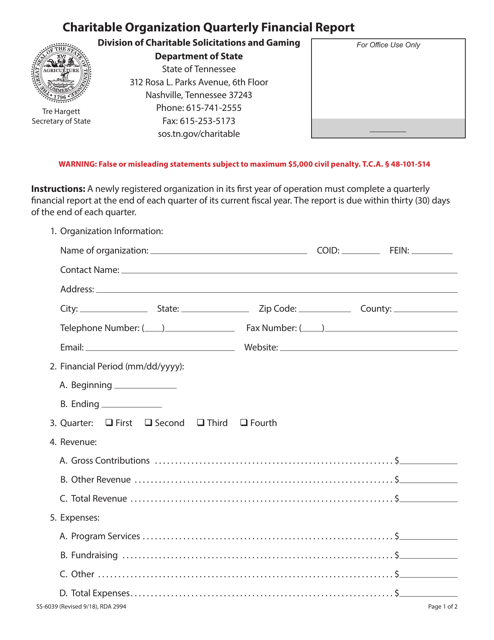

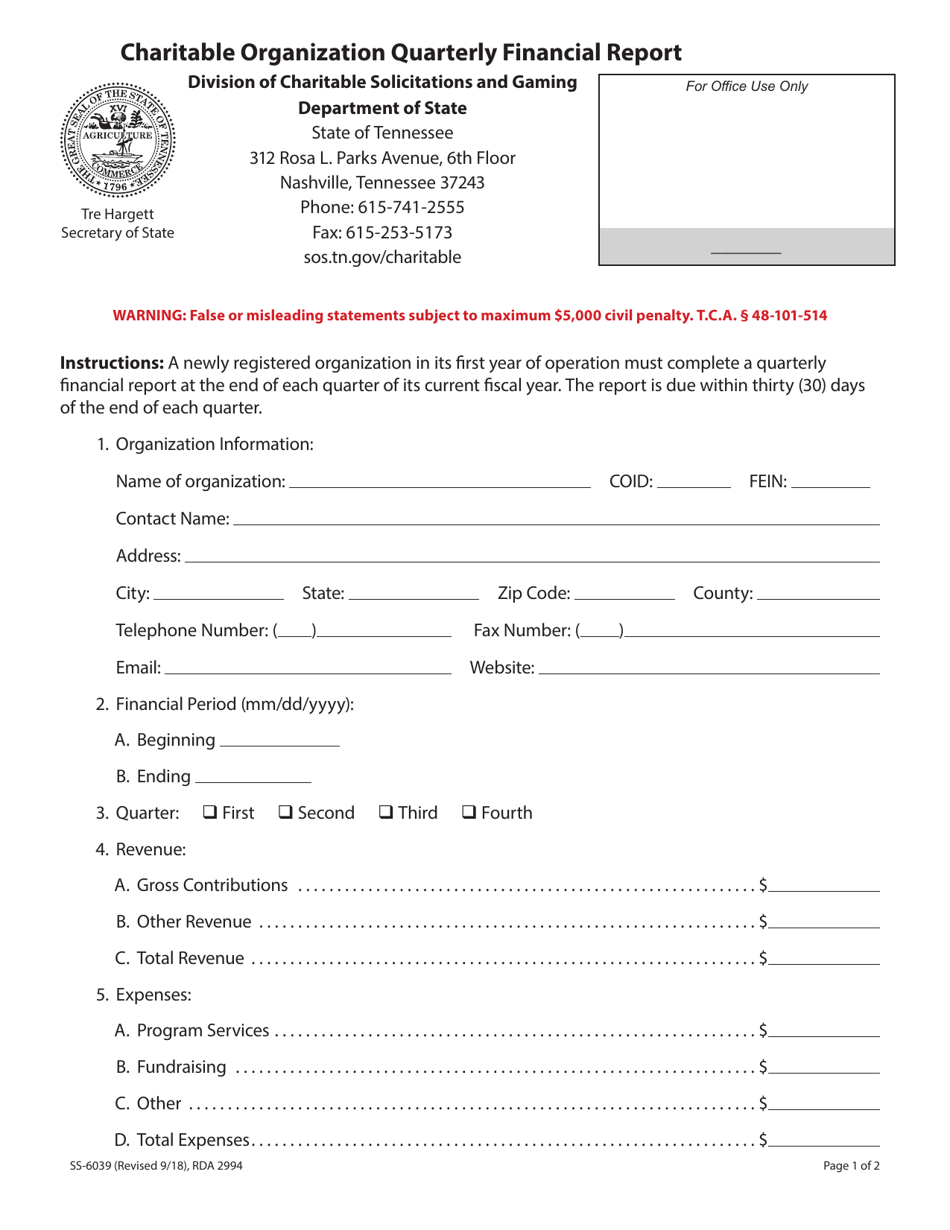

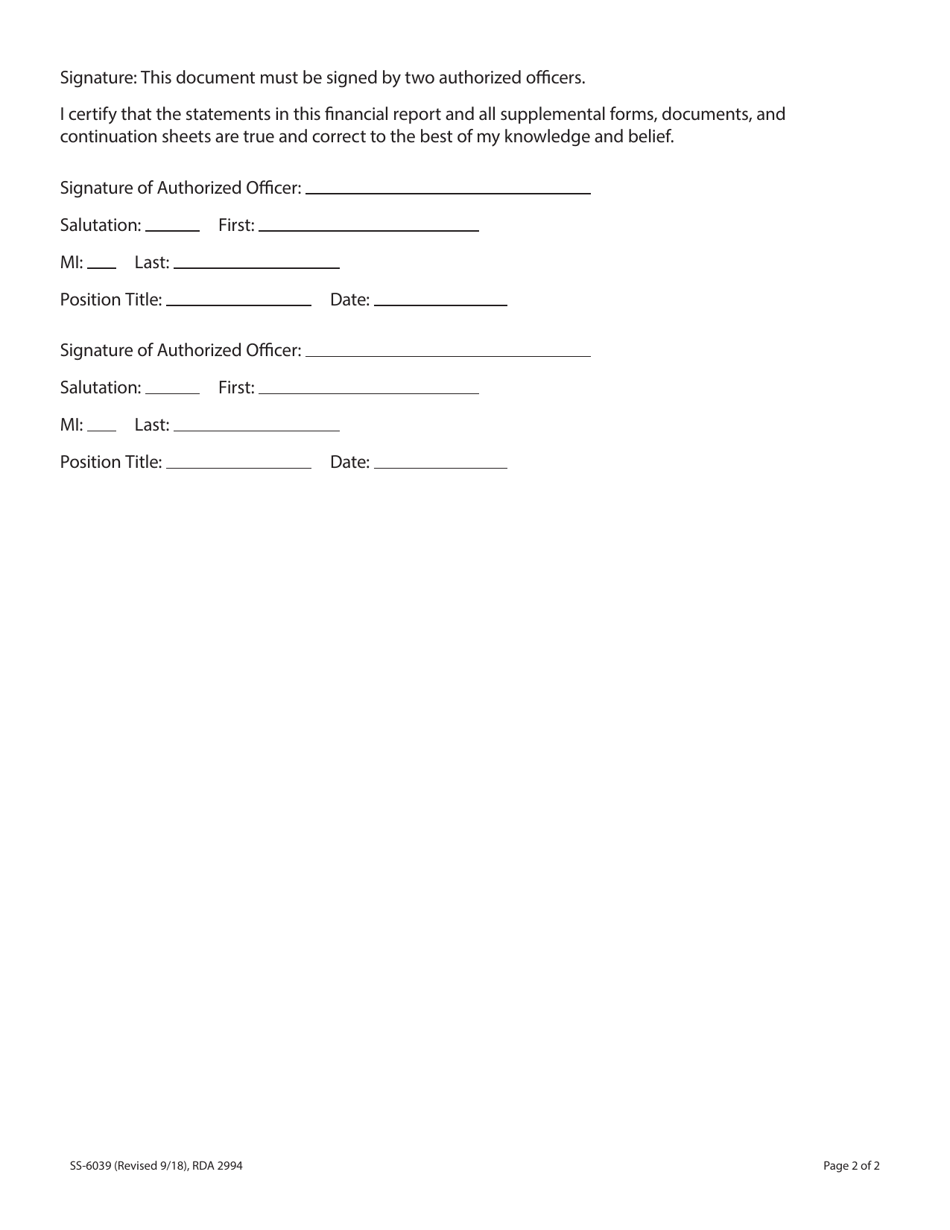

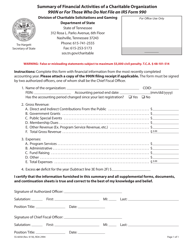

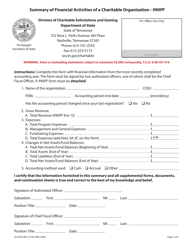

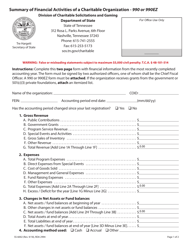

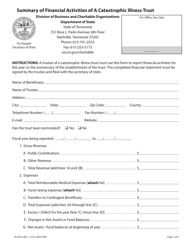

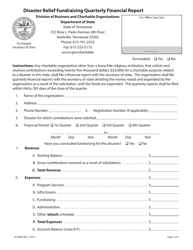

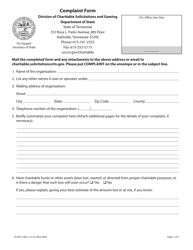

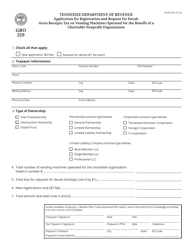

Form SS-6039 Charitable Organization Quarterly Financial Report - Tennessee

What Is Form SS-6039?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-6039?

A: Form SS-6039 is the Charitable Organization Quarterly Financial Report for the state of Tennessee.

Q: Who needs to file Form SS-6039?

A: Charitable organizations in Tennessee are required to file Form SS-6039.

Q: What is the purpose of Form SS-6039?

A: The purpose of Form SS-6039 is for charitable organizations to report their financial information on a quarterly basis.

Q: What information is required on Form SS-6039?

A: Form SS-6039 requires charitable organizations to provide details about their income, expenses, and other financial information.

Q: How often do charitable organizations need to file Form SS-6039?

A: Charitable organizations in Tennessee must file Form SS-6039 on a quarterly basis.

Q: When is the deadline to file Form SS-6039?

A: The deadline to file Form SS-6039 is 45 days after the end of the quarter.

Q: Are there any penalties for not filing Form SS-6039?

A: Yes, there are penalties for not filing Form SS-6039, including late fees and potential loss of tax-exempt status.

Q: Is there a fee to file Form SS-6039?

A: No, there is no fee to file Form SS-6039.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-6039 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.