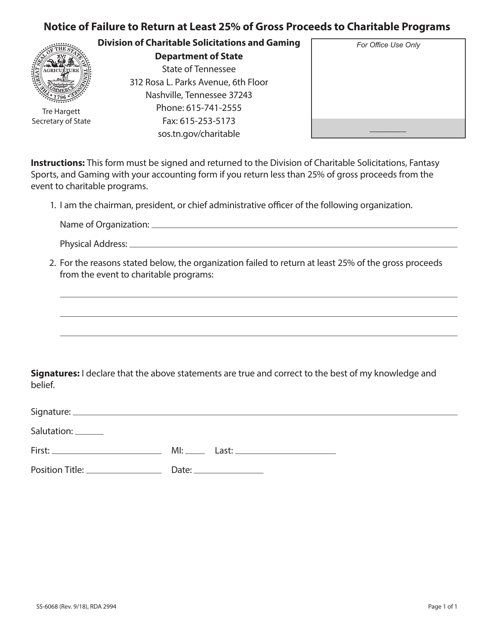

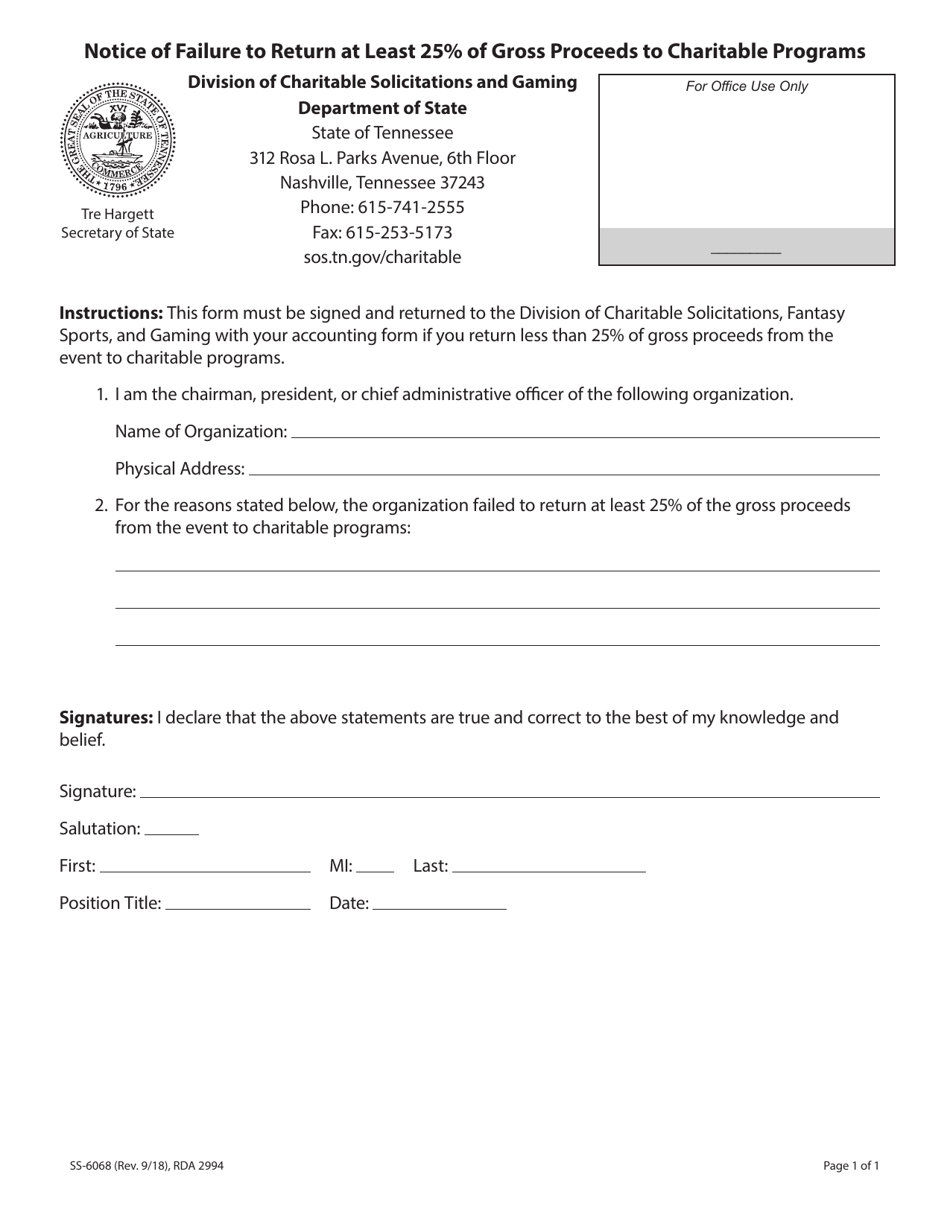

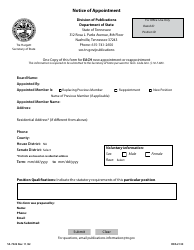

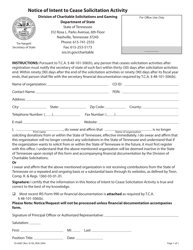

Form SS-6068 Notice of Failure to Return at Least 25% of Gross Proceeds to Charitable Programs - Tennessee

What Is Form SS-6068?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-6068?

A: Form SS-6068 is the Notice of Failure to Return at Least 25% of Gross Proceeds to Charitable Programs.

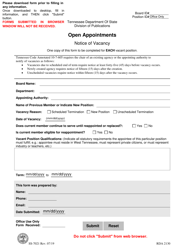

Q: What does Form SS-6068 relate to?

A: Form SS-6068 relates to the failure to return at least 25% of gross proceeds to charitable programs in Tennessee.

Q: Who is required to file Form SS-6068?

A: Anyone who fails to return at least 25% of gross proceeds to charitable programs in Tennessee is required to file Form SS-6068.

Q: What happens if I fail to file Form SS-6068?

A: If you fail to file Form SS-6068, you may be subject to penalties and other enforcement actions by the state of Tennessee.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-6068 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.