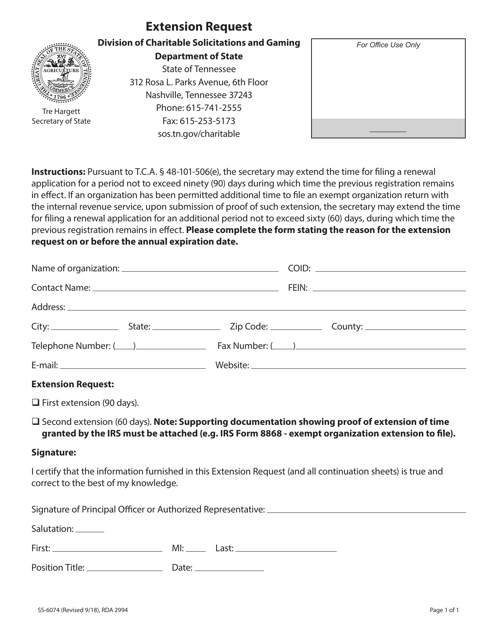

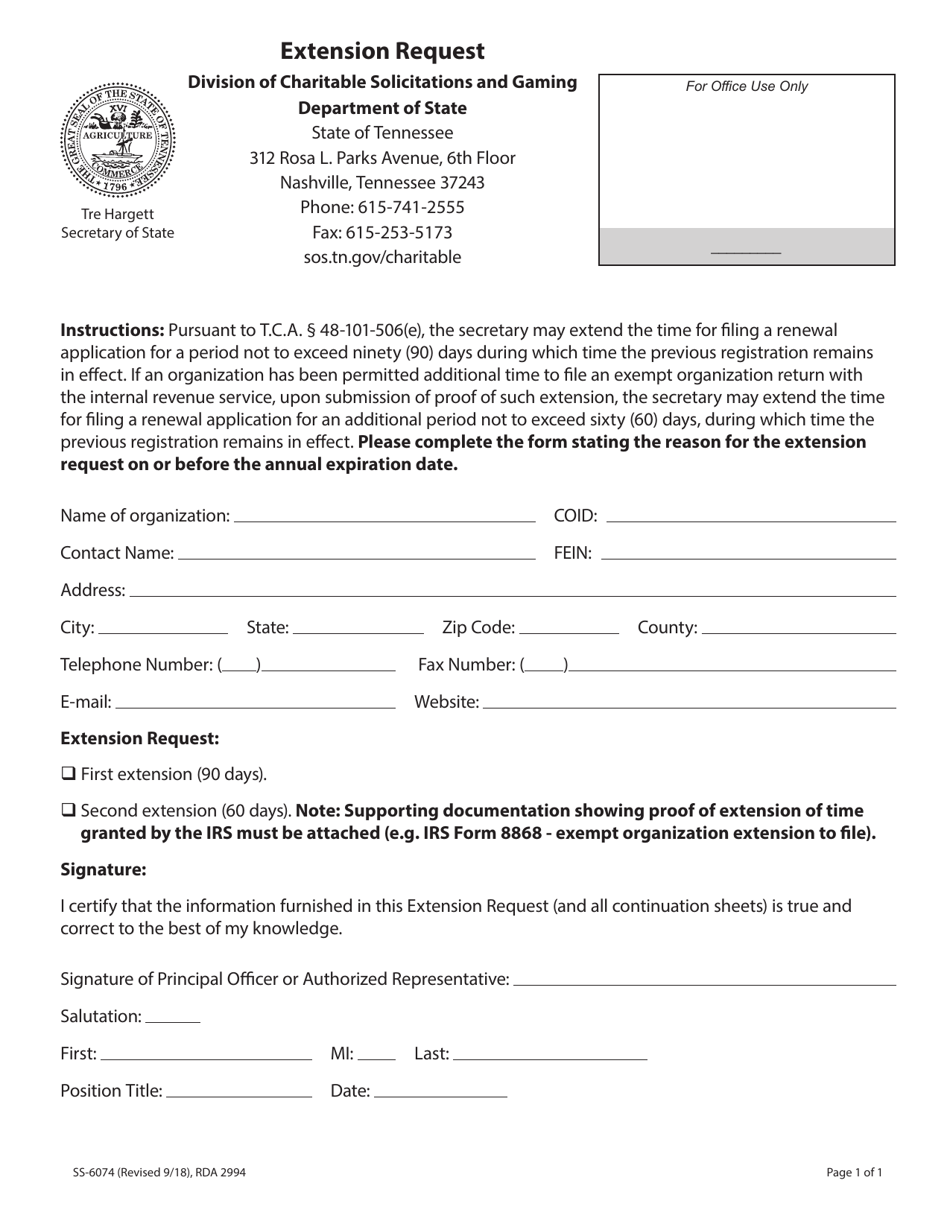

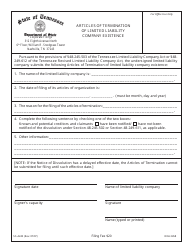

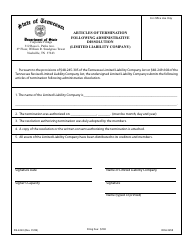

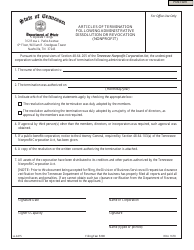

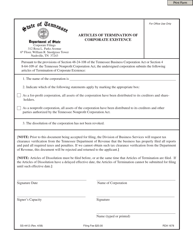

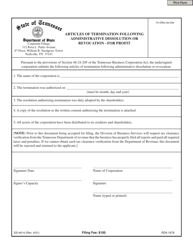

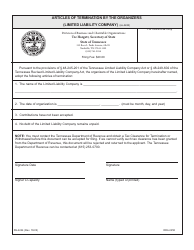

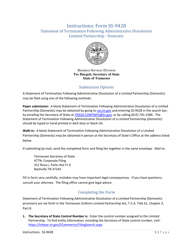

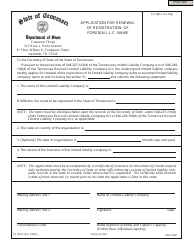

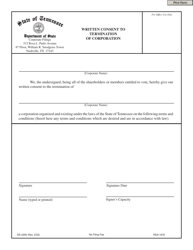

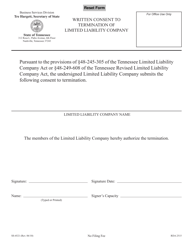

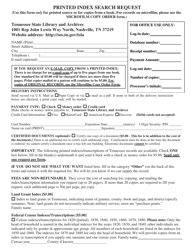

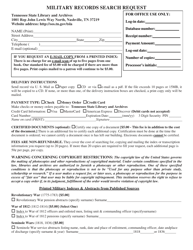

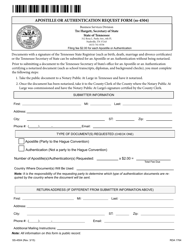

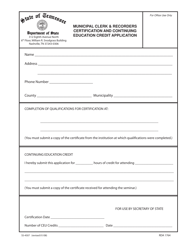

Form SS-6074 Extension Request - Tennessee

What Is Form SS-6074?

This is a legal form that was released by the Tennessee Secretary of State - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SS-6074?

A: Form SS-6074 is an extension request form for the state of Tennessee.

Q: What can I use Form SS-6074 for?

A: You can use Form SS-6074 to request an extension of time to file your Tennessee tax return.

Q: When is the deadline to file Form SS-6074?

A: The deadline to file Form SS-6074 is the same as the deadline to file your Tennessee tax return.

Q: What information do I need to provide on Form SS-6074?

A: You will need to provide your name, Social Security number, and the reason for requesting an extension.

Q: Can I e-file Form SS-6074?

A: No, Form SS-6074 cannot be e-filed. It must be mailed to the Tennessee Department of Revenue.

Q: Is there a fee to file Form SS-6074?

A: No, there is no fee to file Form SS-6074.

Q: How long of an extension does Form SS-6074 provide?

A: Form SS-6074 provides an extension of 6 months to file your Tennessee tax return.

Q: What should I do if I can't file Form SS-6074 by the deadline?

A: If you are unable to file Form SS-6074 by the deadline, you may be subject to penalties and interest on any unpaid tax.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Tennessee Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SS-6074 by clicking the link below or browse more documents and templates provided by the Tennessee Secretary of State.