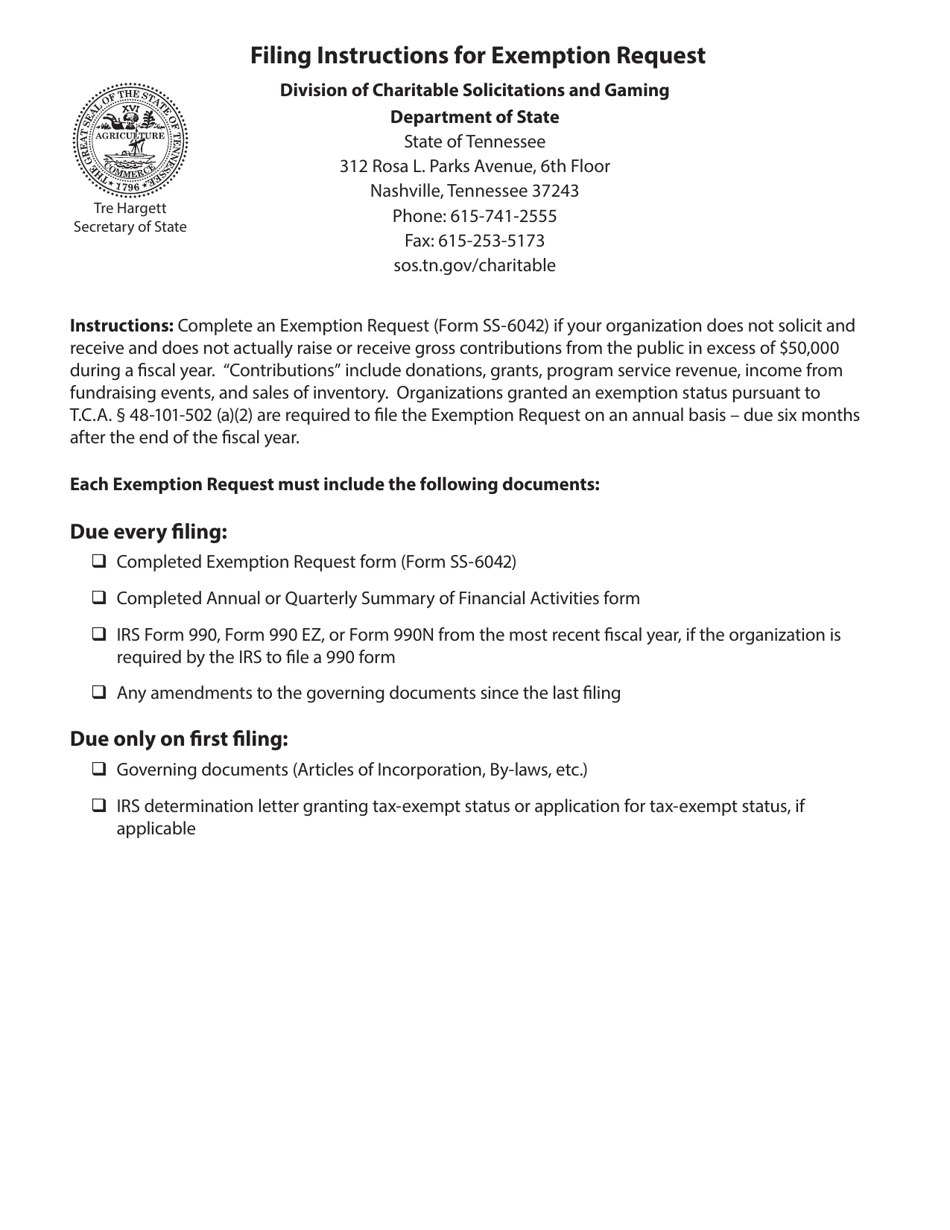

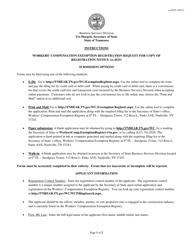

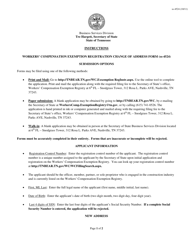

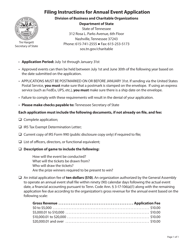

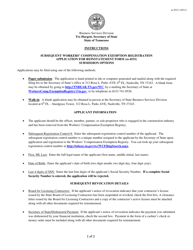

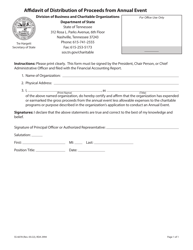

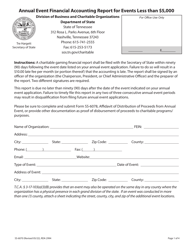

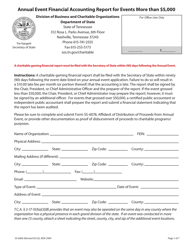

Instructions for Form SS-6042 Annual Request for $50,000 and Under Exemption - Tennessee

This document contains official instructions for Form SS-6042 , Annual Request for $50,000 and Under Exemption - a form released and collected by the Tennessee Secretary of State. An up-to-date fillable Form SS-6042 is available for download through this link.

FAQ

Q: What is Form SS-6042?

A: Form SS-6042 is an Annual Request for $50,000 and Under Exemption in Tennessee.

Q: Who needs to file Form SS-6042?

A: Anyone who wants to claim an exemption of $50,000 or less from the Tennessee franchise and excise tax must file this form.

Q: What is the purpose of Form SS-6042?

A: The purpose of this form is to request an exemption from the Tennessee franchise and excise tax for amounts of $50,000 or less.

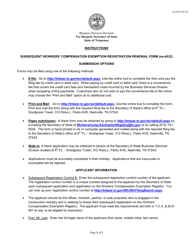

Q: How often do I need to file Form SS-6042?

A: You need to file this form annually to claim the exemption for each tax year.

Q: Is there a deadline to file Form SS-6042?

A: Yes, this form must be filed by the 15th day of the fourth month following the close of the tax year.

Q: What information do I need to provide on Form SS-6042?

A: You will need to provide your name, address, tax identification number, and details about your business.

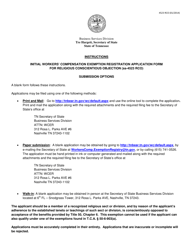

Q: Is there a fee for filing Form SS-6042?

A: No, there is no fee for filing this form.

Q: What happens after I file Form SS-6042?

A: The Department of Revenue will review your request and notify you if your exemption is approved or denied.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Tennessee Secretary of State.