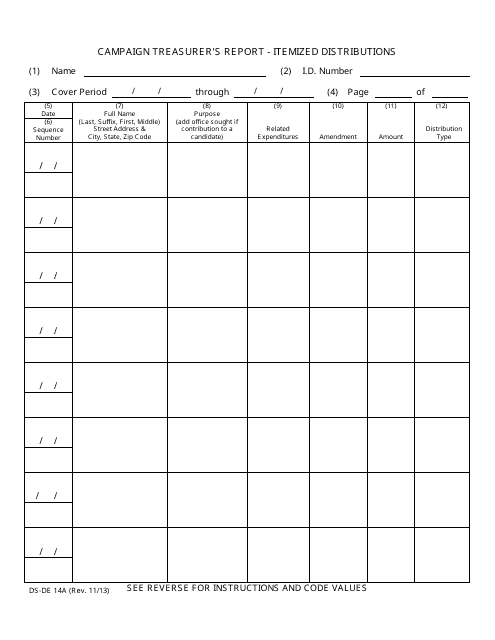

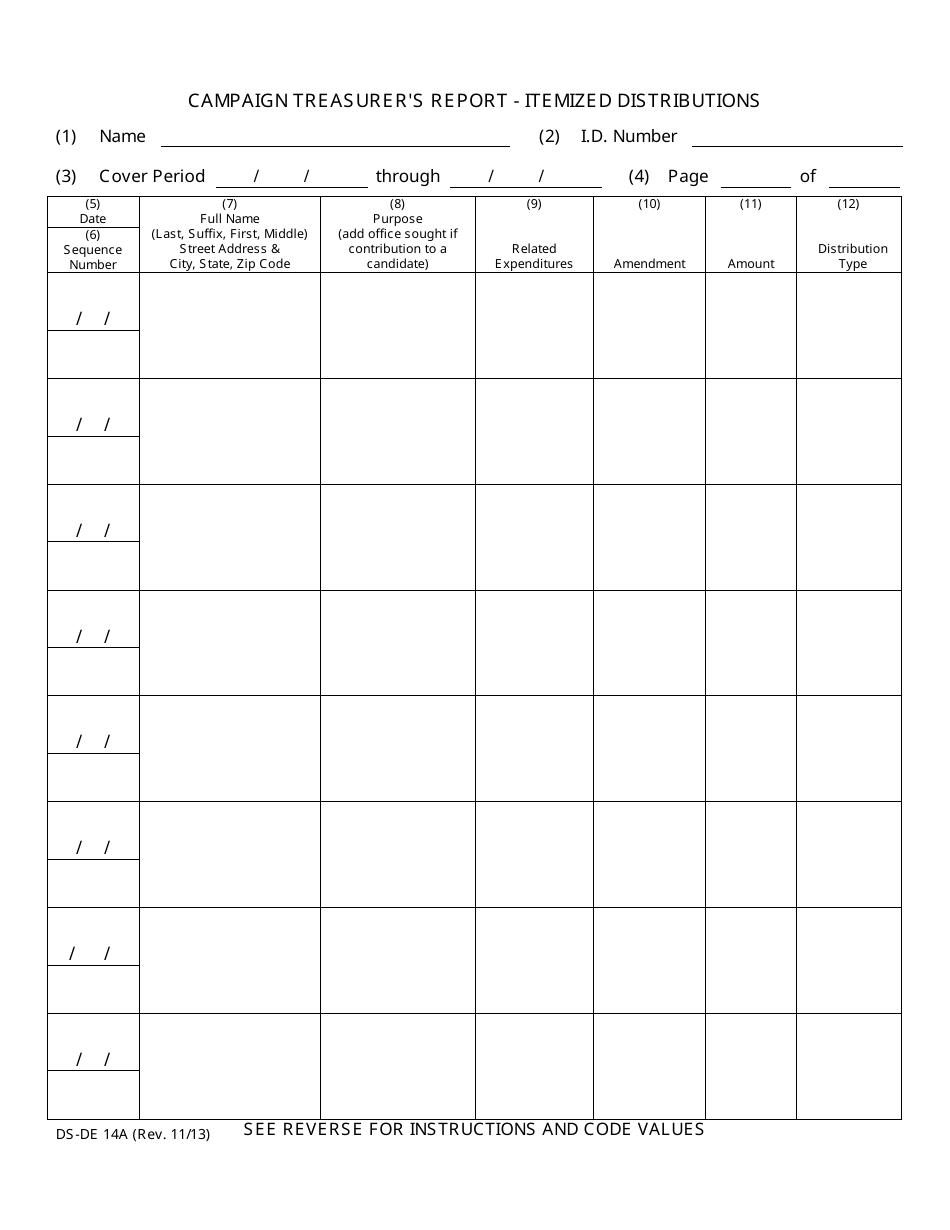

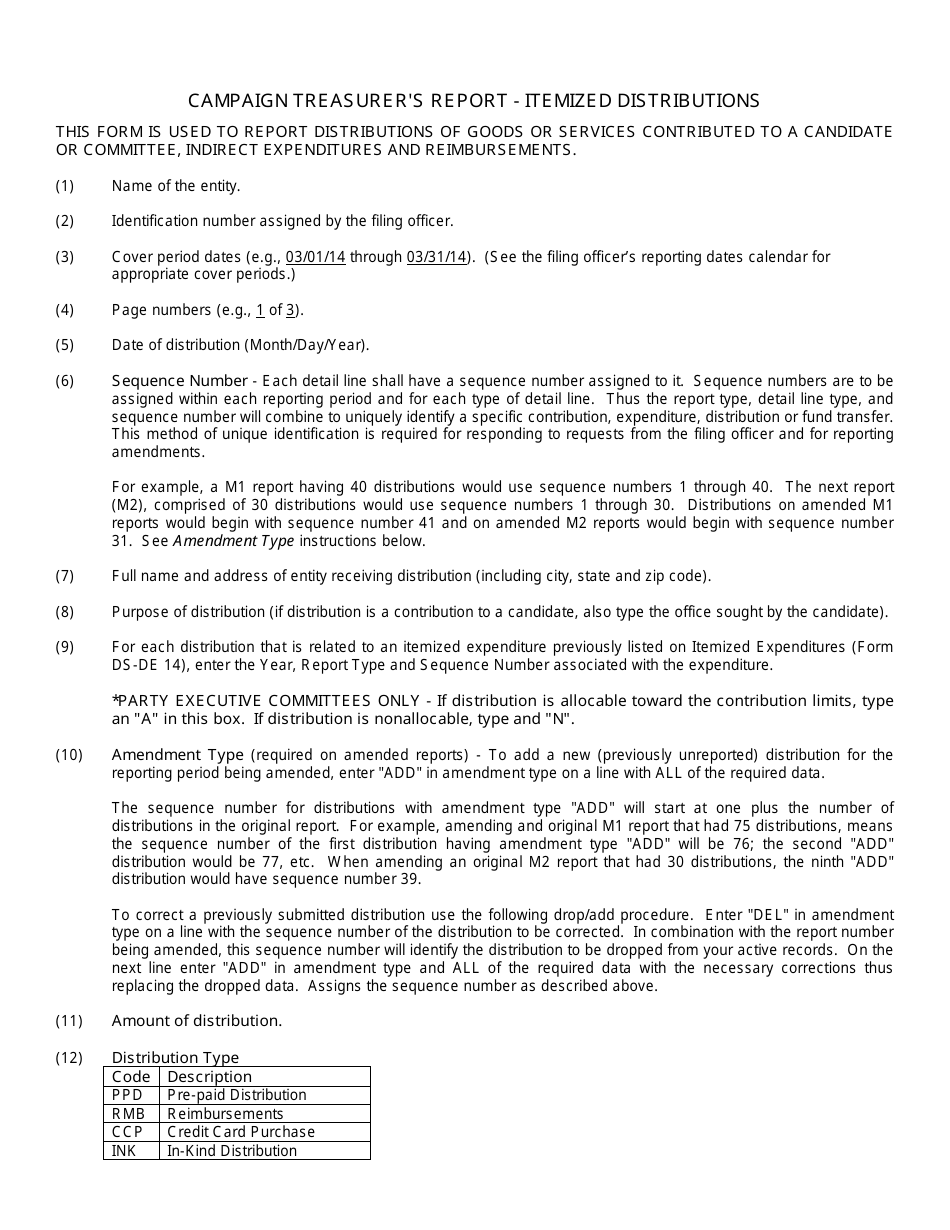

Form DS-DE14A Campaign Treasurer's Report - Itemized Distributions - Florida

What Is Form DS-DE14A?

This is a legal form that was released by the Florida Department of State (Secretary of State) - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DS-DE14A?

A: Form DS-DE14A is the Campaign Treasurer's Report for Itemized Distributions in Florida.

Q: Who needs to file Form DS-DE14A?

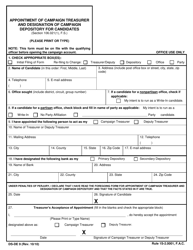

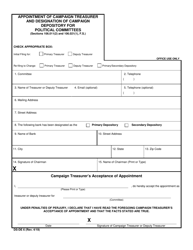

A: The campaign treasurer is responsible for filing Form DS-DE14A.

Q: What is the purpose of Form DS-DE14A?

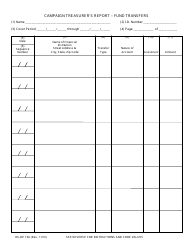

A: Form DS-DE14A is used to report itemized distributions made by a political committee or candidate.

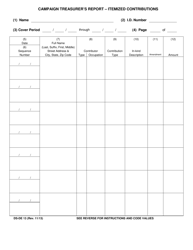

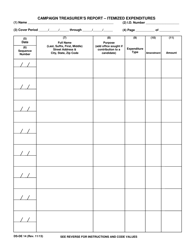

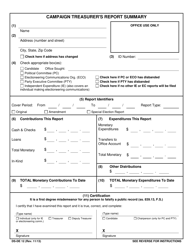

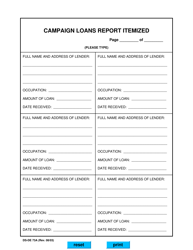

Q: What information is required on Form DS-DE14A?

A: Form DS-DE14A requires the disclosure of the name and address of the recipient, the amount of the distribution, and the purpose of the distribution.

Q: When is Form DS-DE14A due?

A: Form DS-DE14A is due on the 10th day of each month for the previous month's activity, and a final report is due within 90 days after the end of the election or termination of the committee or candidate.

Q: Are there any penalties for not filing Form DS-DE14A?

A: Yes, failure to file Form DS-DE14A or filing a false report may result in penalties and fines.

Q: Is Form DS-DE14A specific to Florida?

A: Yes, Form DS-DE14A is specific to the state of Florida and is not used for reporting in other states.

Q: Is there a fee to file Form DS-DE14A?

A: No, there is no fee to file Form DS-DE14A.

Q: Are there any additional reporting requirements for political committees or candidates in Florida?

A: Yes, in addition to Form DS-DE14A, political committees and candidates may be required to file other financial disclosure reports.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Florida Department of State (Secretary of State);

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DS-DE14A by clicking the link below or browse more documents and templates provided by the Florida Department of State (Secretary of State).