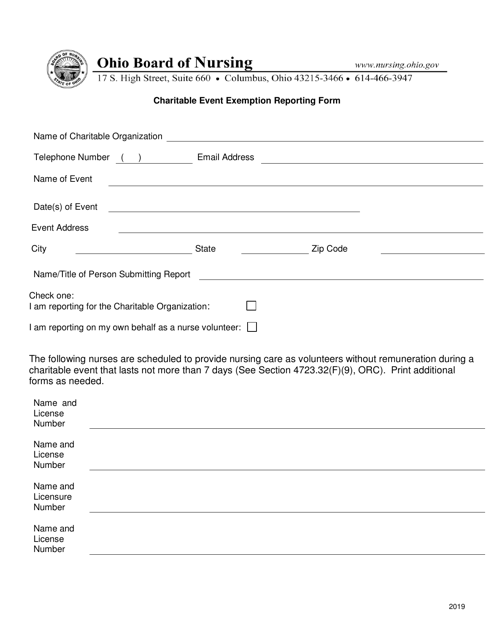

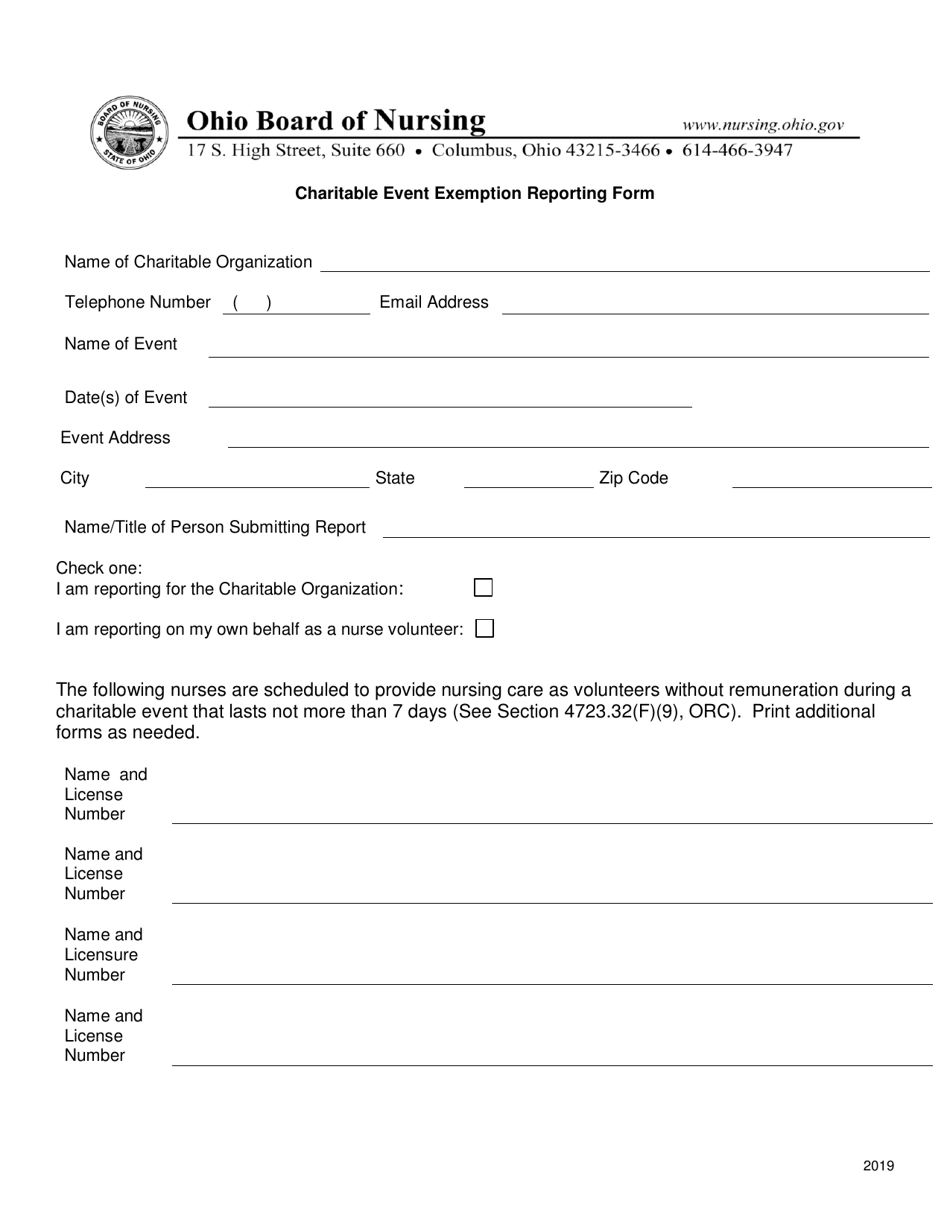

Charitable Event Exemption Reporting Form - Ohio

Charitable Event Exemption Reporting Form is a legal document that was released by the Ohio Board of Nursing - a government authority operating within Ohio.

FAQ

Q: What is the Charitable Event Exemption Reporting Form?

A: The Charitable Event Exemption Reporting Form is a document required in Ohio to report information about charitable events.

Q: Who needs to file the Charitable Event Exemption Reporting Form?

A: Organizations that hold charitable events in Ohio may need to file the form.

Q: What information is required on the form?

A: The form requires information about the organization, the event, and any financial transactions related to the event.

Q: How often does the form need to be filed?

A: The form needs to be filed annually for each charitable event held.

Q: Are all charitable events exempt from reporting?

A: No, only certain events are exempt. The form is required for events that meet certain criteria.

Q: What are the consequences of not filing the form?

A: Failure to file the form may result in penalties or loss of tax-exempt status for the organization.

Q: Is there a fee to file the Charitable Event Exemption Reporting Form?

A: No, there is no fee to file the form.

Form Details:

- Released on January 1, 2019;

- The latest edition currently provided by the Ohio Board of Nursing;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Board of Nursing.