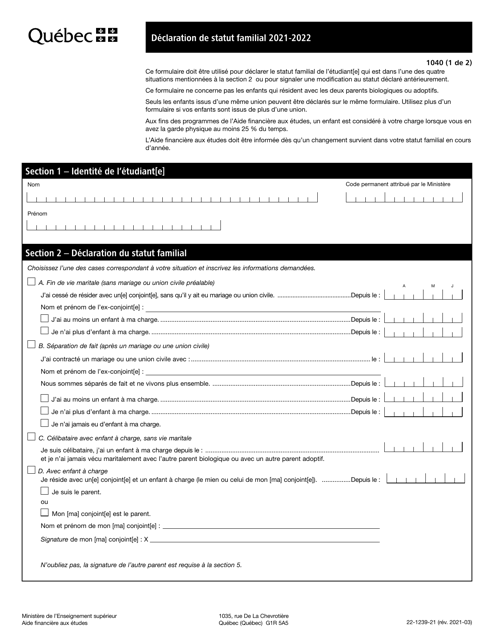

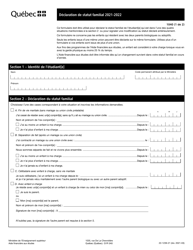

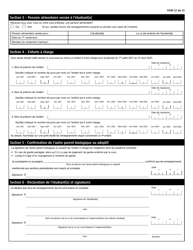

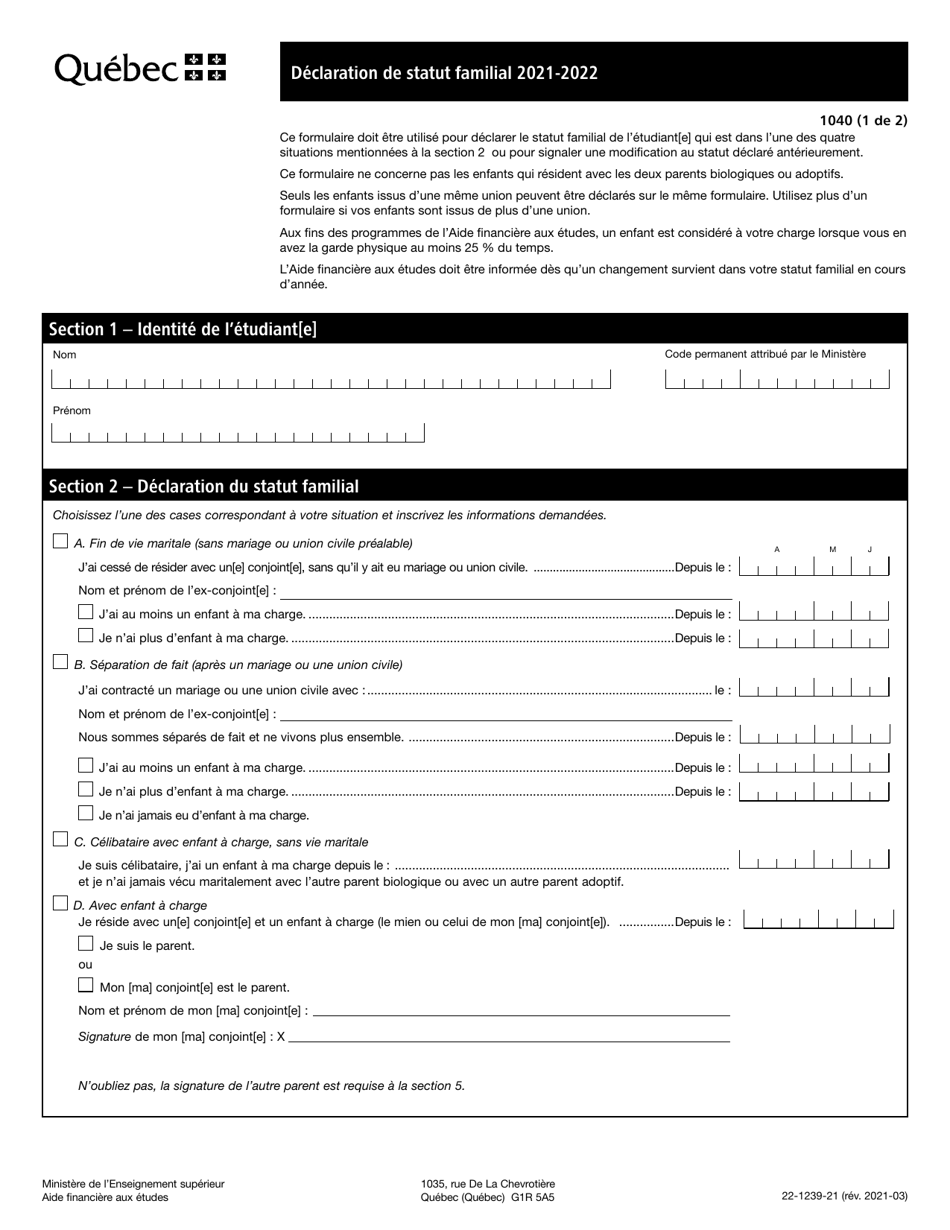

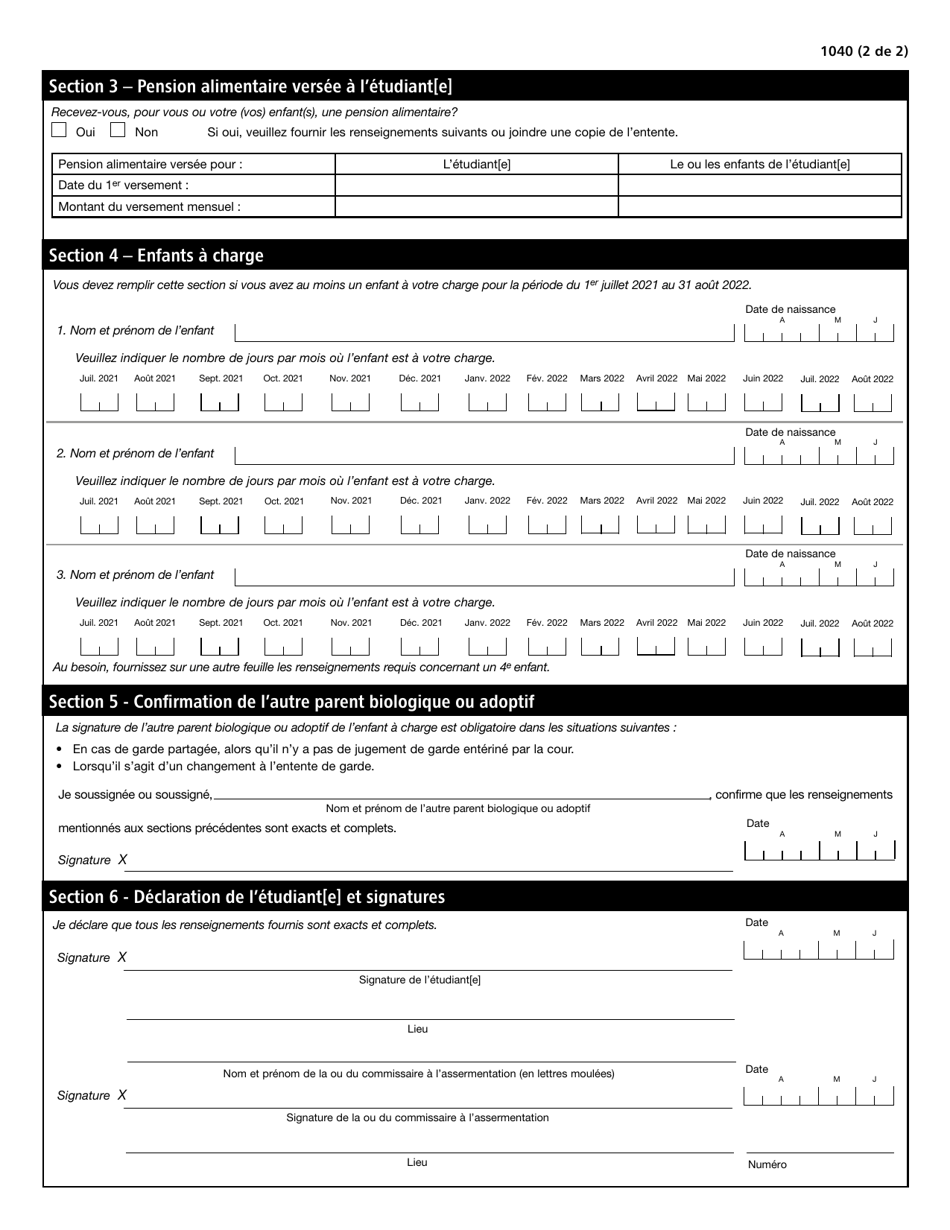

Forme 1040 (22-1239-21) Declaration De Statut Familial - Quebec, Canada (French)

Forme 1040 (22-1239-21) Declaration De Statut Familial is a tax form used in Quebec, Canada. It is specifically used for declaring your family status for income tax purposes. This form is written in French and is used to indicate whether you are single, married, divorced, or widowed. By completing this form, individuals in Quebec provide the government with information about their marital status, which may have an impact on their tax obligations and benefits.

The Form 1040 (22-1239-21) Declaration De Statut Familial in Quebec, Canada (French) is filed by individuals who are residents of Quebec and need to declare their marital or civil union status for tax purposes. This form is used to provide information about their family situation, such as whether they are married, in a civil union, divorced, separated, or widowed.

FAQ

Q: What is Form 1040 (22-1239-21)?

A: Form 1040 (22-1239-21) is a Declaration De Statut Familial form used in the province of Quebec, Canada. It is used to declare the marital status and other family-related information.

Q: Is Form 1040 (22-1239-21) specific to Quebec only?

A: Yes, Form 1040 (22-1239-21) is specific to the province of Quebec in Canada. It is used to comply with the provincial tax laws and regulations.

Q: What information is required to fill out Form 1040 (22-1239-21)?

A: Form 1040 (22-1239-21) requires information related to marital status, such as whether you are single, married, divorced, or widowed. It also asks for details about your spouse and dependents, if applicable.

Q: When is the deadline to submit Form 1040 (22-1239-21)?

A: The deadline to submit Form 1040 (22-1239-21) in Quebec, Canada is usually April 30th of each year. However, it is recommended to check the specific deadline for the current tax year as it may vary.

Q: Are there any penalties for not filing Form 1040 (22-1239-21)?

A: Yes, there may be penalties for not filing Form 1040 (22-1239-21) or filing it late. These penalties can include financial penalties and interest charges on any outstanding tax amounts.