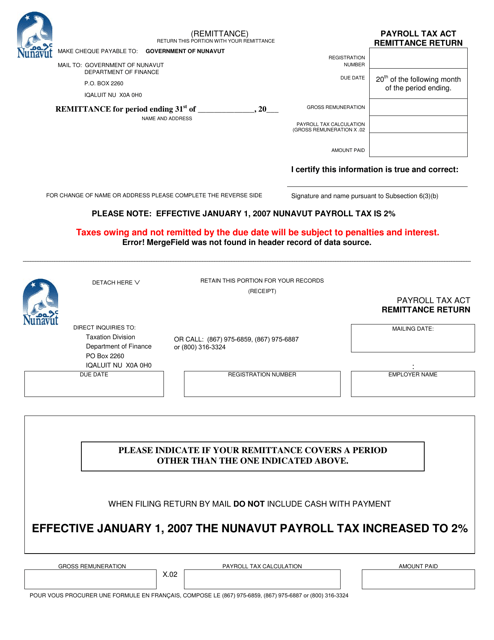

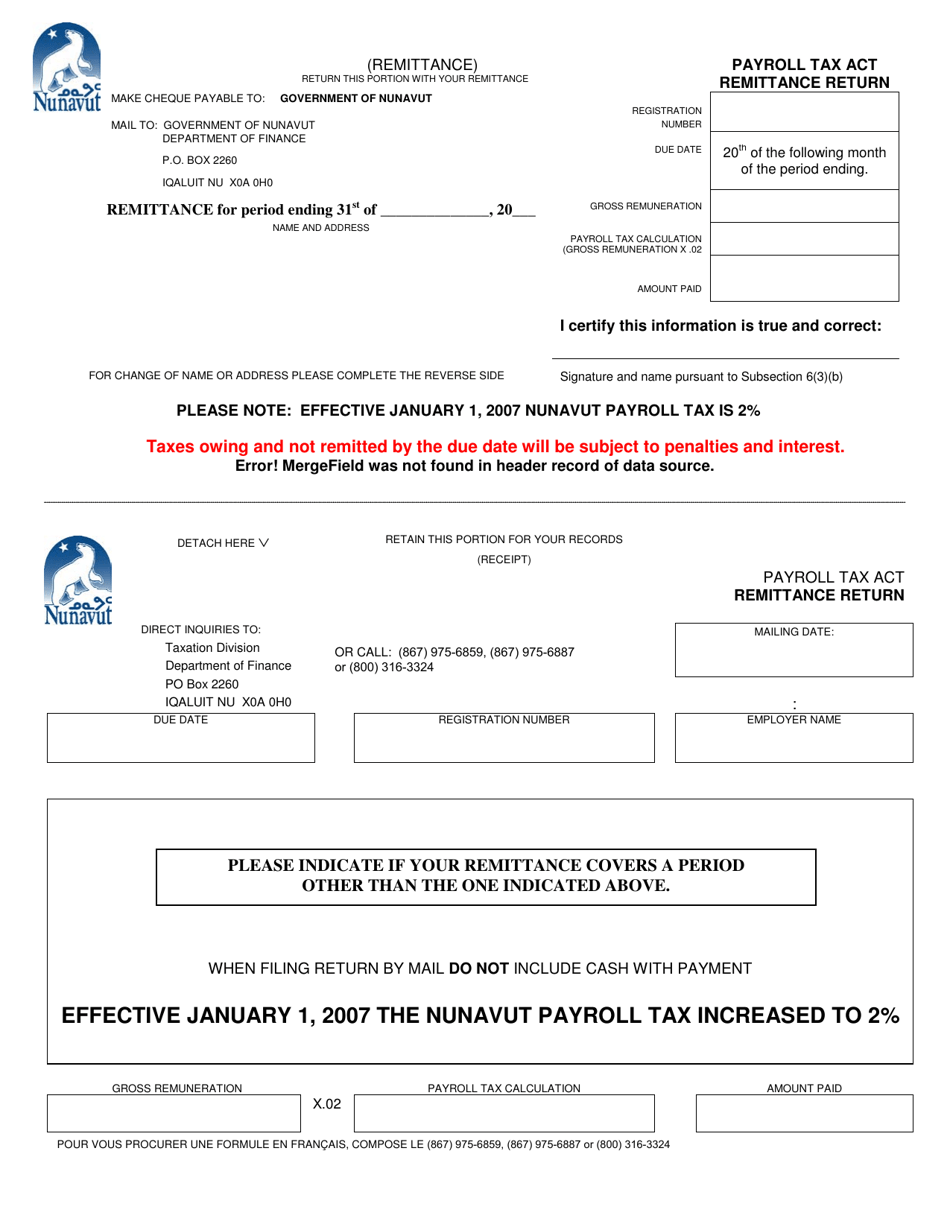

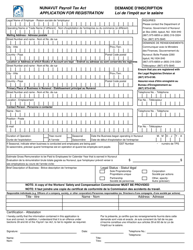

Payroll Tax Act Remittance Return - Nunavut, Canada

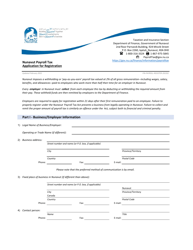

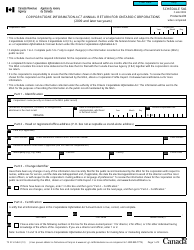

The Payroll Tax Act Remittance Return in Nunavut, Canada is used for employers to remit payroll taxes to the government. These taxes are collected from employees' wages to fund various social programs and government services.

In Nunavut, Canada, the Payroll Tax Act Remittance Return is filed by the employer.

FAQ

Q: What is the Payroll Tax Act Remittance Return?

A: The Payroll Tax Act Remittance Return is a form used by employers to report and remit payroll taxes to the Nunavut government.

Q: Who is required to file the Payroll Tax Act Remittance Return?

A: Employers in Nunavut, Canada are required to file the Payroll Tax Act Remittance Return if they have employees and meet certain payroll tax thresholds.

Q: What is the purpose of the Payroll Tax Act Remittance Return?

A: The purpose of the Payroll Tax Act Remittance Return is to ensure that employers report and remit the payroll taxes they owe to the Nunavut government.

Q: How often is the Payroll Tax Act Remittance Return filed?

A: The Payroll Tax Act Remittance Return is generally filed on a monthly basis, but certain employers may be eligible to file on a quarterly basis.

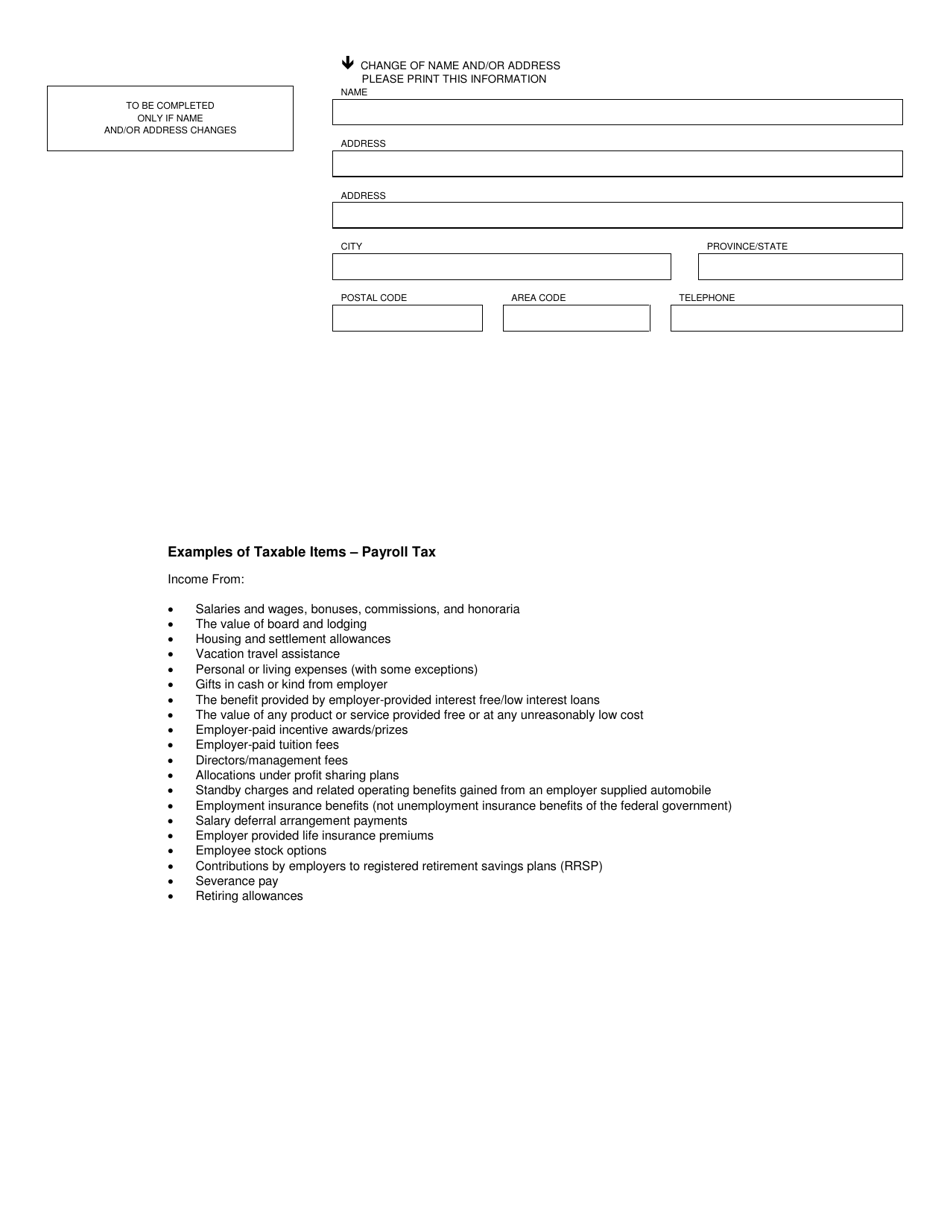

Q: What information is required to complete the Payroll Tax Act Remittance Return?

A: To complete the Payroll Tax Act Remittance Return, employers will need to provide information such as their business details, employee details, and payroll tax calculations.

Q: Are there any penalties for late or incorrect filing of the Payroll Tax Act Remittance Return?

A: Yes, there may be penalties for late or incorrect filing of the Payroll Tax Act Remittance Return. It is important for employers to submit accurate and timely returns to avoid penalties.