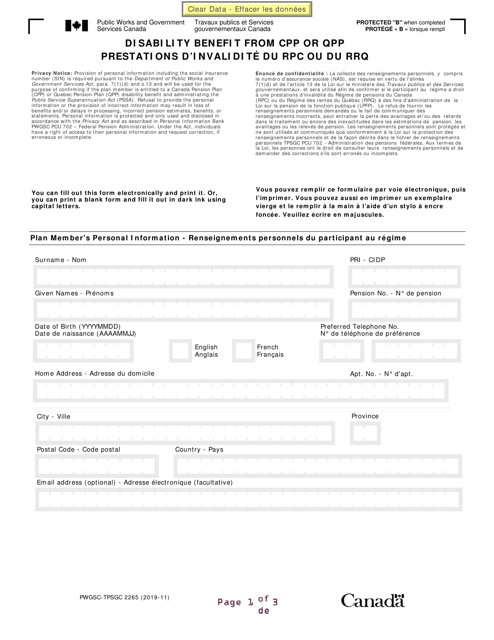

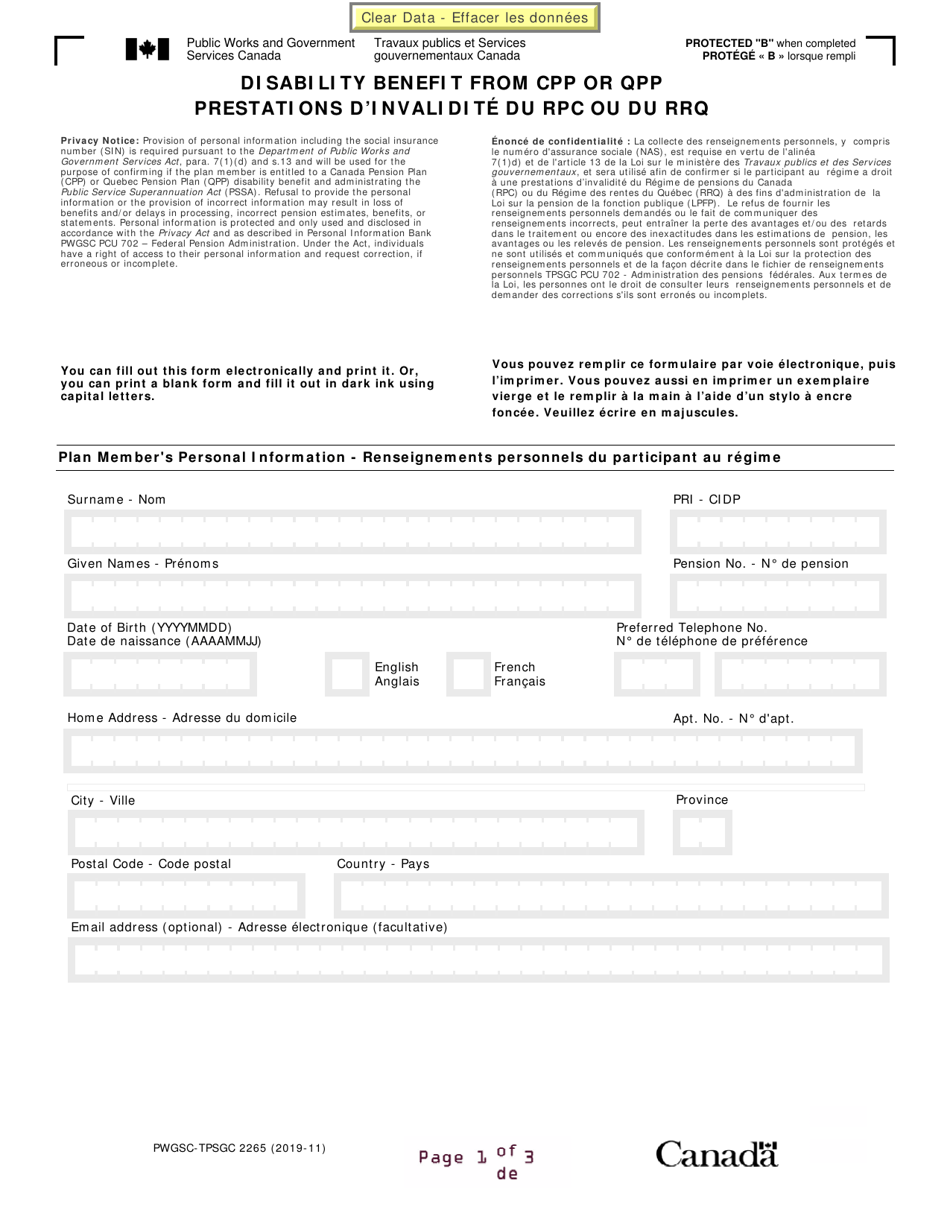

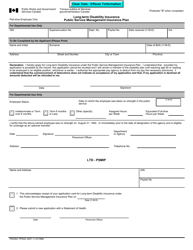

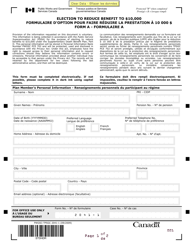

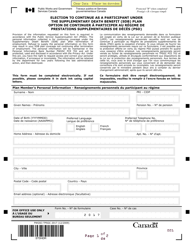

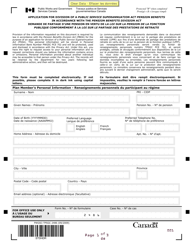

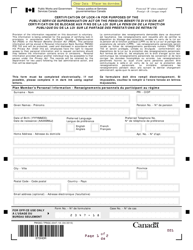

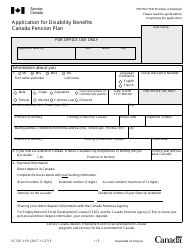

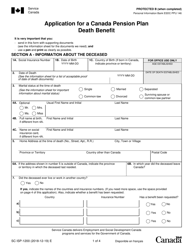

Form PWGSC-TPSGC2265 Disability Benefit From Cpp or Qpp - Canada (English / French)

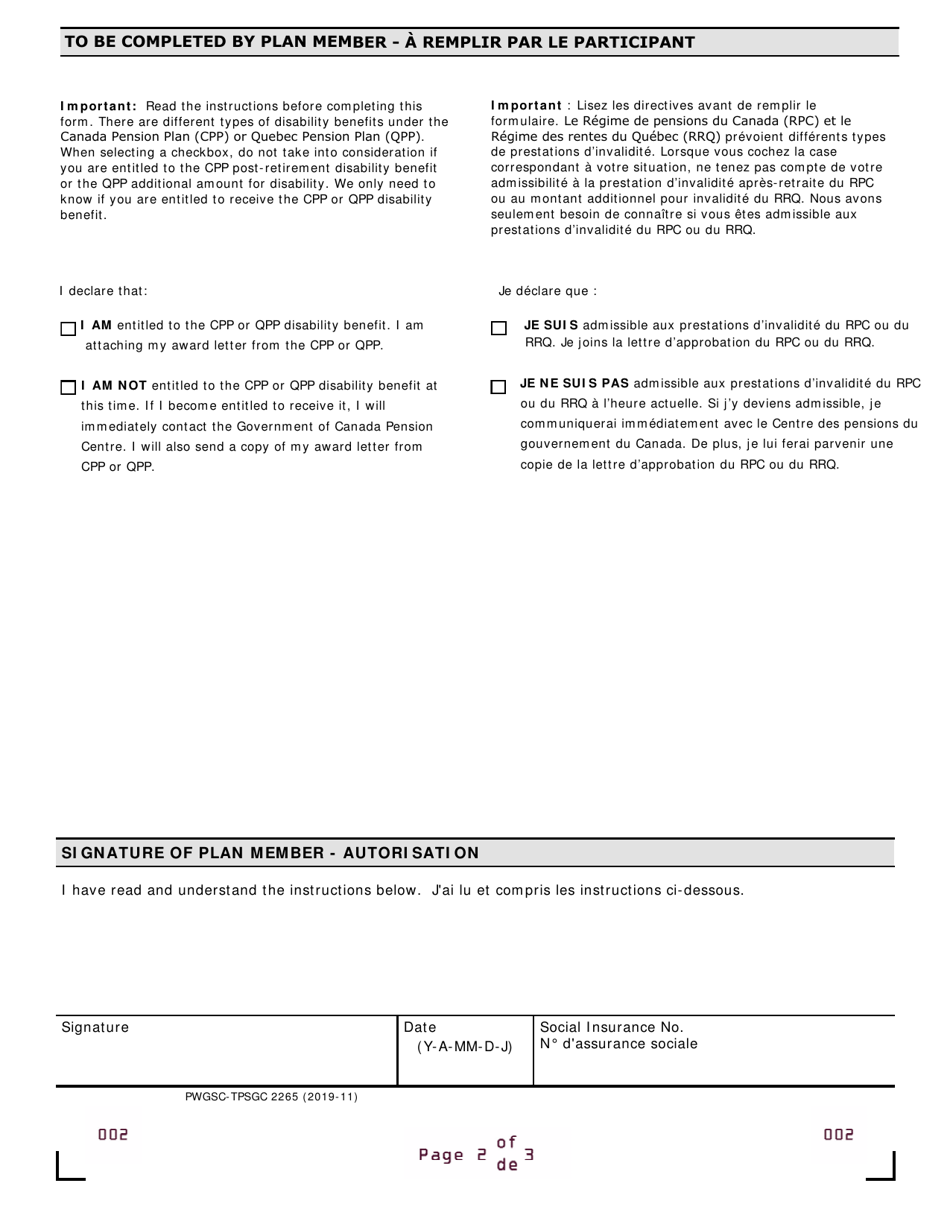

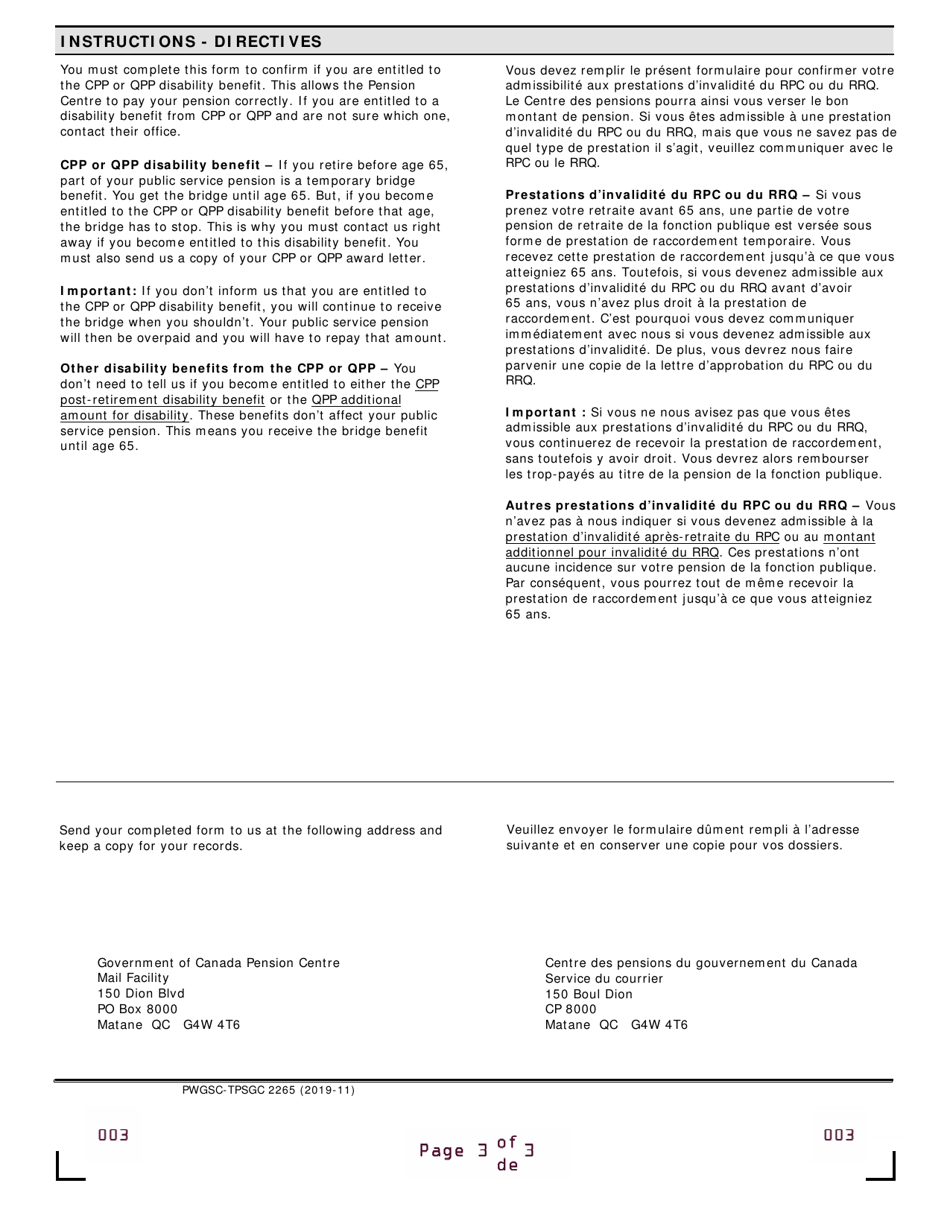

Form PWGSC-TPSGC2265, Disability Benefit From CPP or QPP, is used in Canada to apply for disability benefits under the Canada Pension Plan (CPP) or the Quebec Pension Plan (QPP). This form is available in both English and French.

The form PWGSC-TPSGC2265 for disability benefits from CPP or QPP in Canada can be filed by the individual with a disability.

FAQ

Q: What is Form PWGSC-TPSGC2265?

A: Form PWGSC-TPSGC2265 is a form used in Canada to apply for the Disability Benefit from the Canada Pension Plan (CPP) or the Quebec Pension Plan (QPP).

Q: Who can use Form PWGSC-TPSGC2265?

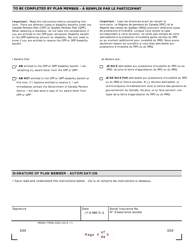

A: Canadian residents who have a severe and prolonged disability that prevents them from working and who have made contributions to the CPP or QPP may use Form PWGSC-TPSGC2265 to apply for the Disability Benefit.

Q: What is the Disability Benefit from CPP or QPP?

A: The Disability Benefit is a monthly payment provided by the CPP or QPP to individuals who have a severe and prolonged disability that prevents them from working.

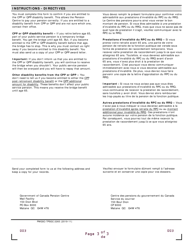

Q: What documents do I need to submit with Form PWGSC-TPSGC2265?

A: You will need to submit medical documents and other supporting documents that provide evidence of your disability.

Q: How long does it take to process an application for the Disability Benefit?

A: The processing time for applications can vary, but it generally takes several months to receive a decision on your application.

Q: How much can I receive from the Disability Benefit?

A: The amount of the Disability Benefit is based on the contributions you have made to the CPP or QPP and other factors. The maximum monthly benefit amount for 2021 is $1,203.75 for CPP and $1,429.61 for QPP.

Q: Can I receive other benefits while receiving the Disability Benefit?

A: You may be eligible for other benefits, such as provincial disability benefits or tax credits, while receiving the Disability Benefit. It is best to consult with Service Canada for more information on the specific benefits available to you.

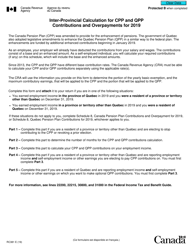

Q: What is the difference between CPP and QPP?

A: CPP, or the Canada Pension Plan, is a federal program that provides income support and benefits to retired or disabled individuals across Canada, except in Quebec. QPP, or the Quebec Pension Plan, is a similar program specific to residents of Quebec.