This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1213(OAS)

for the current year.

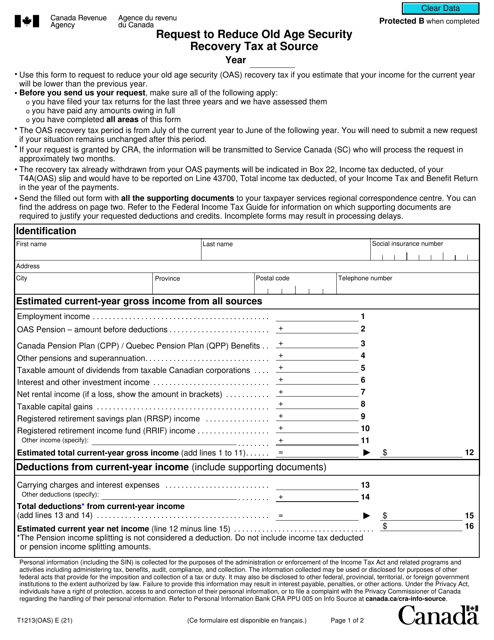

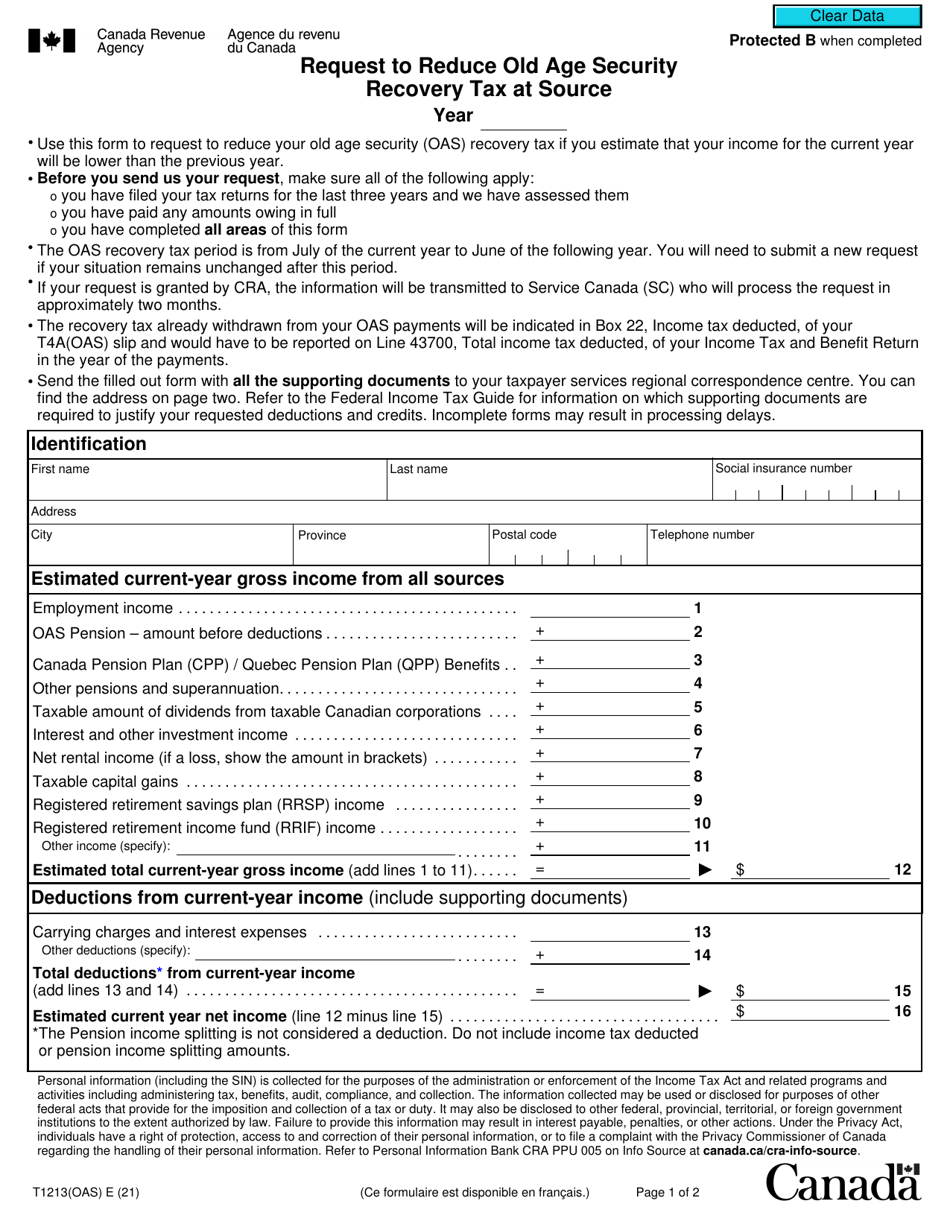

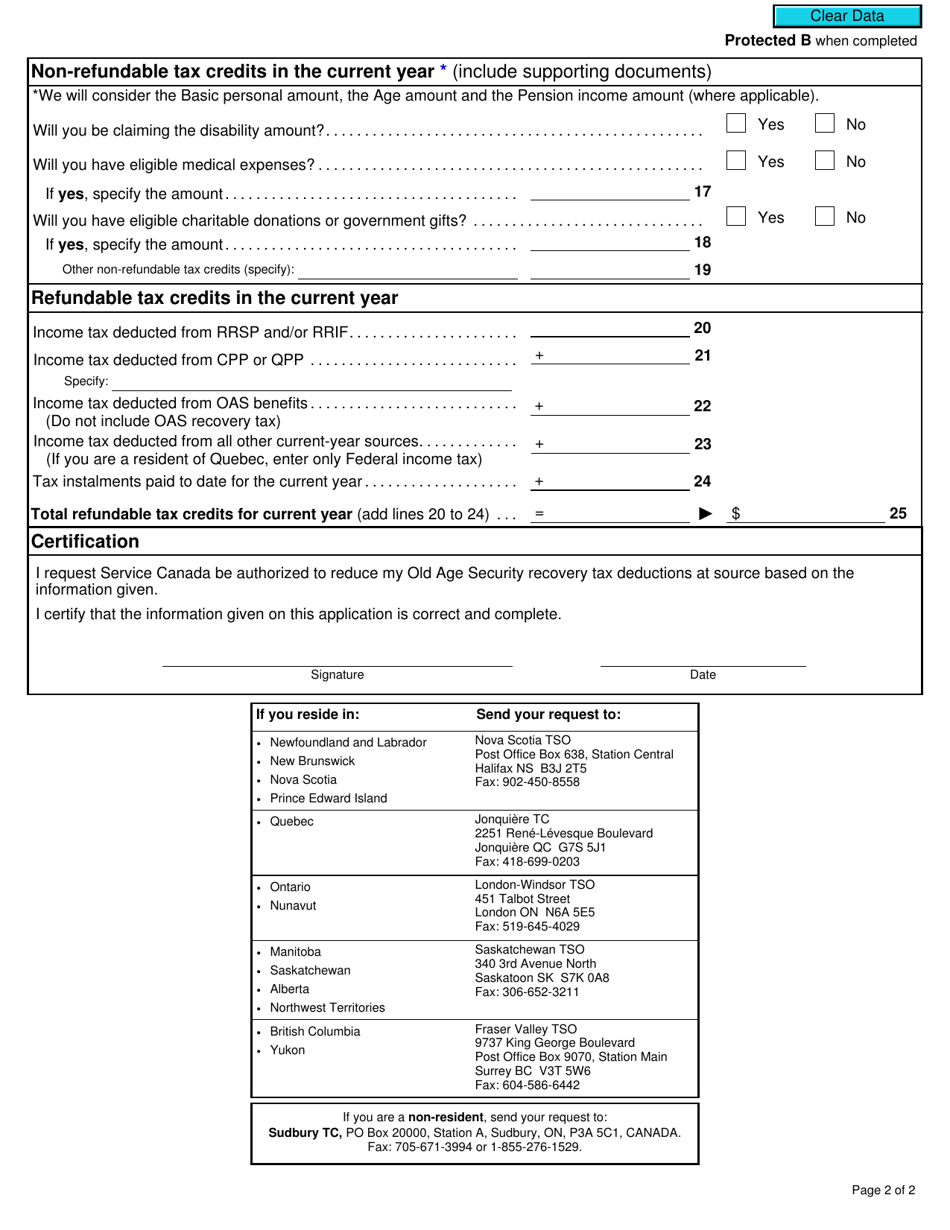

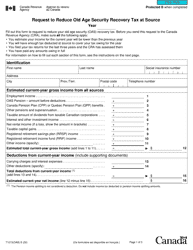

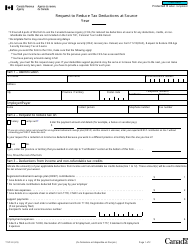

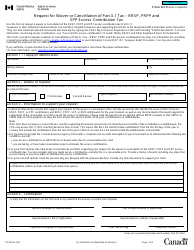

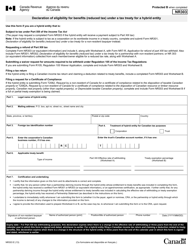

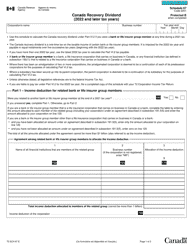

Form T1213(OAS) Request to Reduce Old Age Security Recovery Tax at Source - Canada

Form T1213(OAS) Request to Reduce Old Age Security Recovery Tax at Source is used in Canada to request a reduction in the Old Age Security (OAS) recovery tax that is deducted at source from your monthly OAS pension. This form allows you to provide additional information about your income and expenses that may qualify you for a reduction in the amount deducted from your OAS pension. By submitting this form, you may be able to reduce or eliminate the amount of tax that is deducted from your OAS pension every month.

The Form T1213(OAS) to request a reduction in the Old Age Security Recovery Tax at source is filed by individuals who receive Old Age Security (OAS) benefits in Canada.

FAQ

Q: What is Form T1213(OAS)?

A: Form T1213(OAS) is a request form used in Canada to reduce the Old Age Security (OAS) recovery tax at source.

Q: What is the Old Age Security (OAS) recovery tax?

A: The Old Age Security (OAS) recovery tax is a tax that is deducted from your OAS pension if your net income exceeds a certain threshold.

Q: Who can use Form T1213(OAS)?

A: Form T1213(OAS) can be used by individuals who are eligible for the Old Age Security (OAS) pension and want to request a reduction in the OAS recovery tax at source.

Q: What is the purpose of Form T1213(OAS)?

A: The purpose of Form T1213(OAS) is to provide the Canada Revenue Agency (CRA) with information about your financial situation to determine if you qualify for a reduction in the OAS recovery tax.

Q: How do I fill out Form T1213(OAS)?

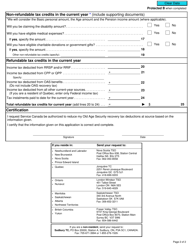

A: You need to provide your personal information, including your social insurance number, and details about your income and deductions. You also need to include supporting documents and sign the form.

Q: Is there a deadline for submitting Form T1213(OAS)?

A: There is no specific deadline for submitting Form T1213(OAS), but it is recommended to submit it well in advance to allow time for processing.

Q: Will I automatically qualify for a reduction in the OAS recovery tax if I submit Form T1213(OAS)?

A: No, the Canada Revenue Agency (CRA) will review your application and determine if you qualify for a reduction in the OAS recovery tax based on your financial situation.

Q: What happens after I submit Form T1213(OAS)?

A: After you submit Form T1213(OAS), the Canada Revenue Agency (CRA) will review your application and notify you of their decision. If approved, the reduction in the OAS recovery tax will be implemented.