This version of the form is not currently in use and is provided for reference only. Download this version of

Form T1-OVP-S

for the current year.

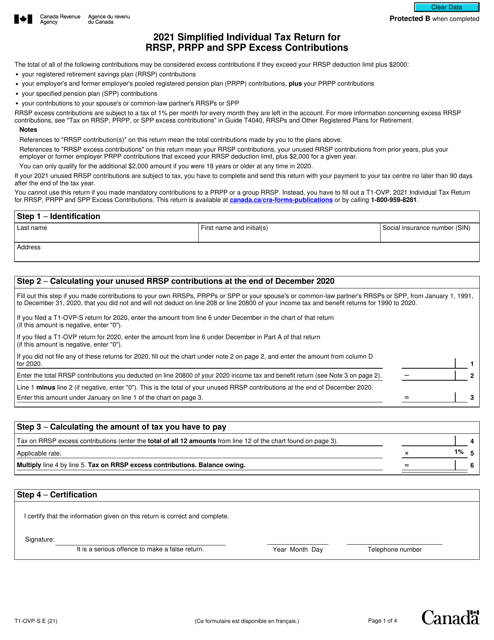

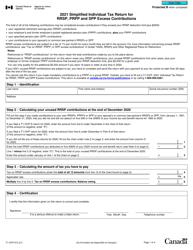

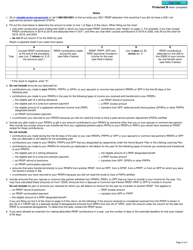

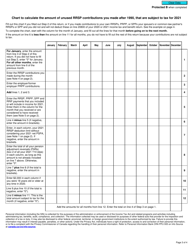

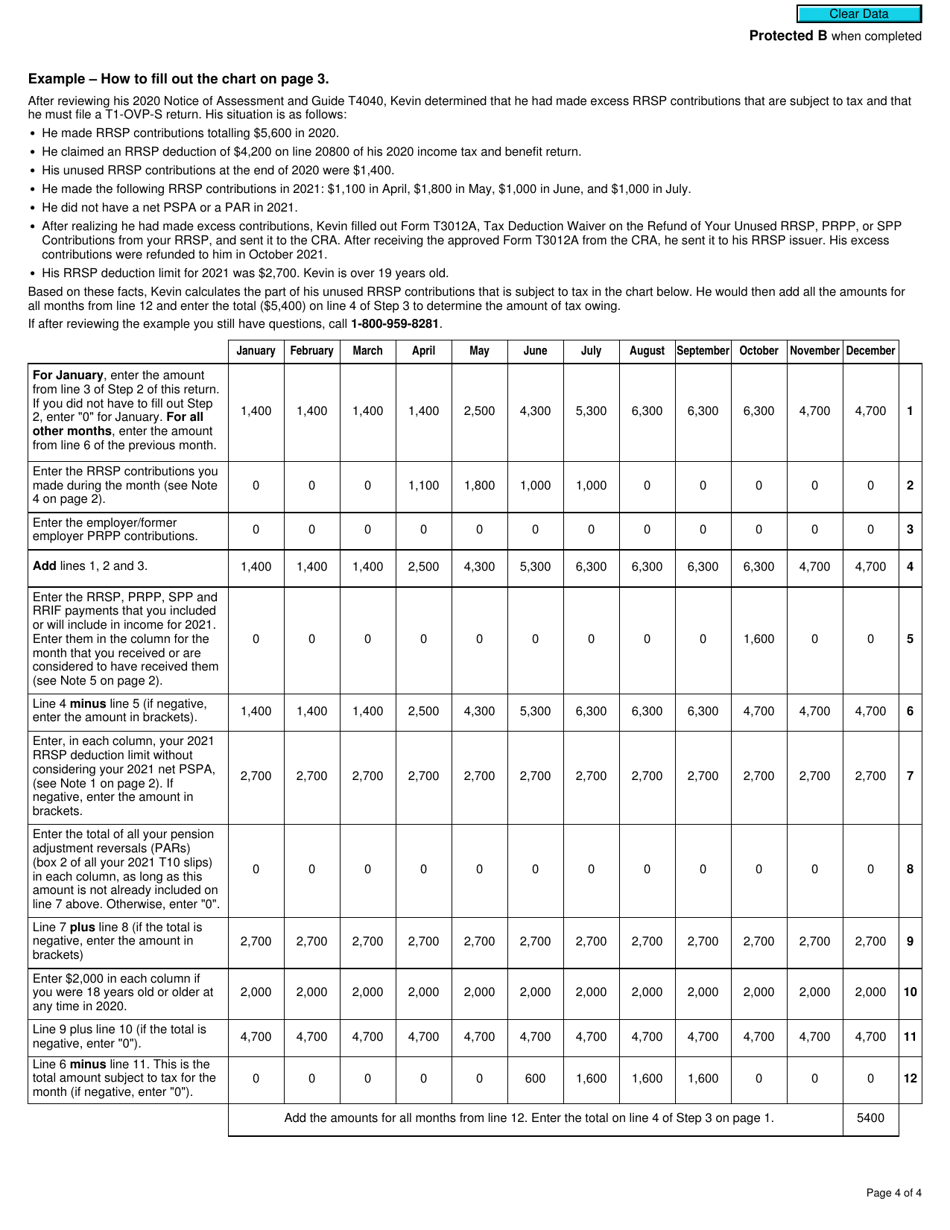

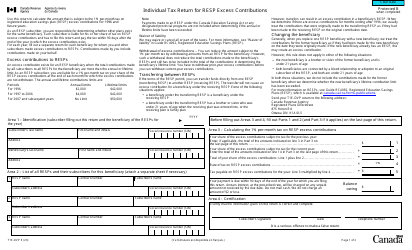

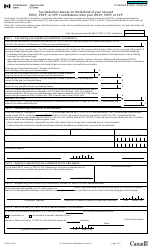

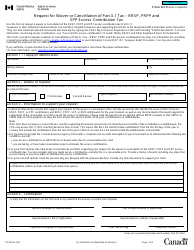

Form T1-OVP-S Simplified Individual Tax Return for Rrsp, Prpp and Spp Excess Contributions - Canada

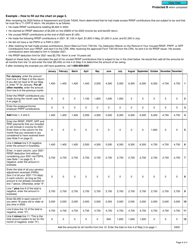

Form T1-OVP-S Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions is used by individuals in Canada to report and pay taxes on any excess contributions made to their Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP).

The Form T1-OVP-S Simplified Individual Tax Return for RRSP, PRPP, and SPP Excess Contributions in Canada is filed by individuals who have made excess contributions to their Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Saskatchewan Pension Plan (SPP).

FAQ

Q: What is Form T1-OVP-S?

A: Form T1-OVP-S is the Simplified Individual Tax Return specifically for RRSP, PRPP, and SPP excess contributions in Canada.

Q: What is RRSP?

A: RRSP stands for Registered Retirement Savings Plan. It is a savings account that individuals use to save for retirement in Canada.

Q: What is PRPP?

A: PRPP stands for Pooled Registered Pension Plan. It is a retirement savings option available in Canada, mainly for self-employed individuals and employees of participating employers.

Q: What is SPP?

A: SPP stands for Specified Pension Plan. It is a type of pension plan in Canada.

Q: Who needs to use Form T1-OVP-S?

A: Anyone who has made excess contributions to their RRSP, PRPP, or SPP in Canada needs to use Form T1-OVP-S to report and rectify those excess contributions.

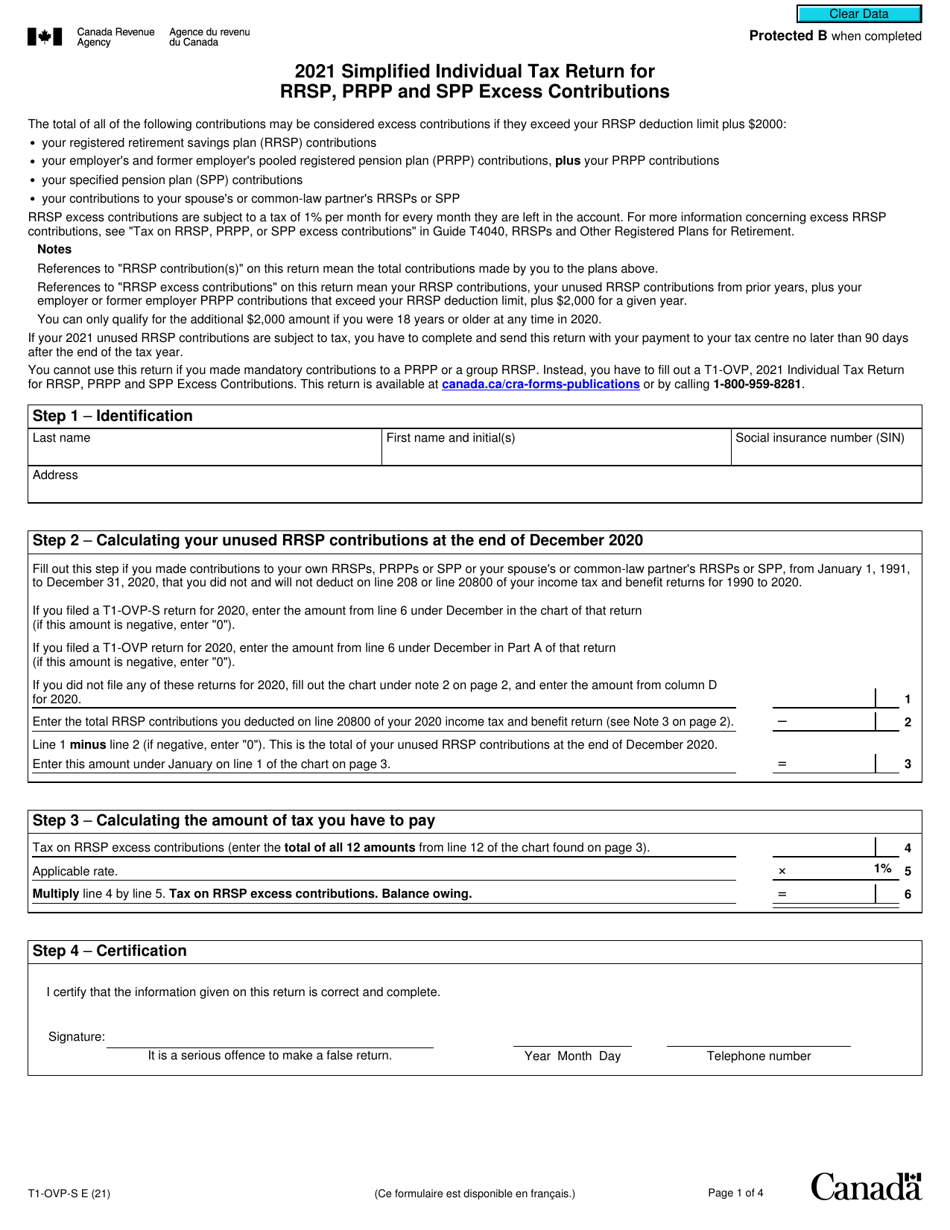

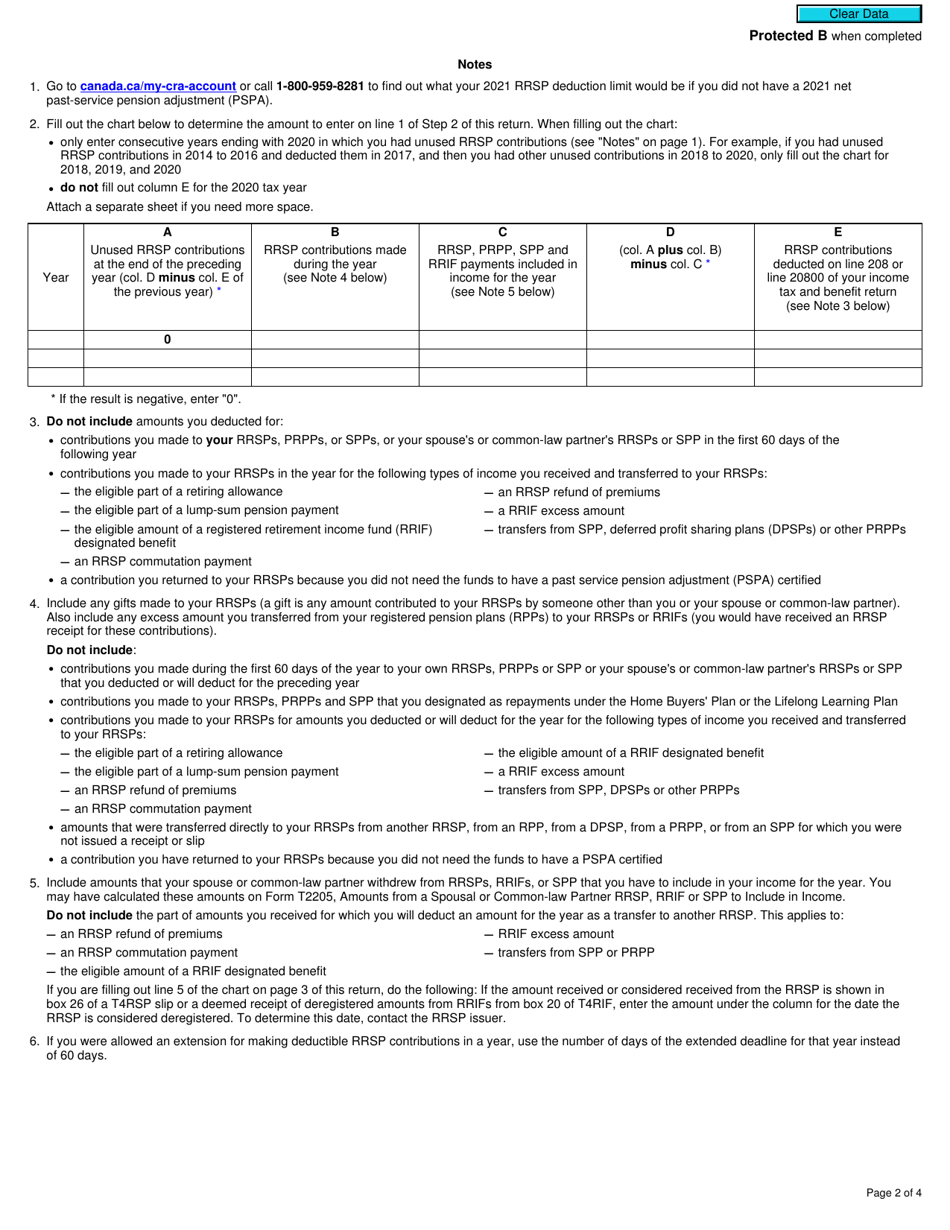

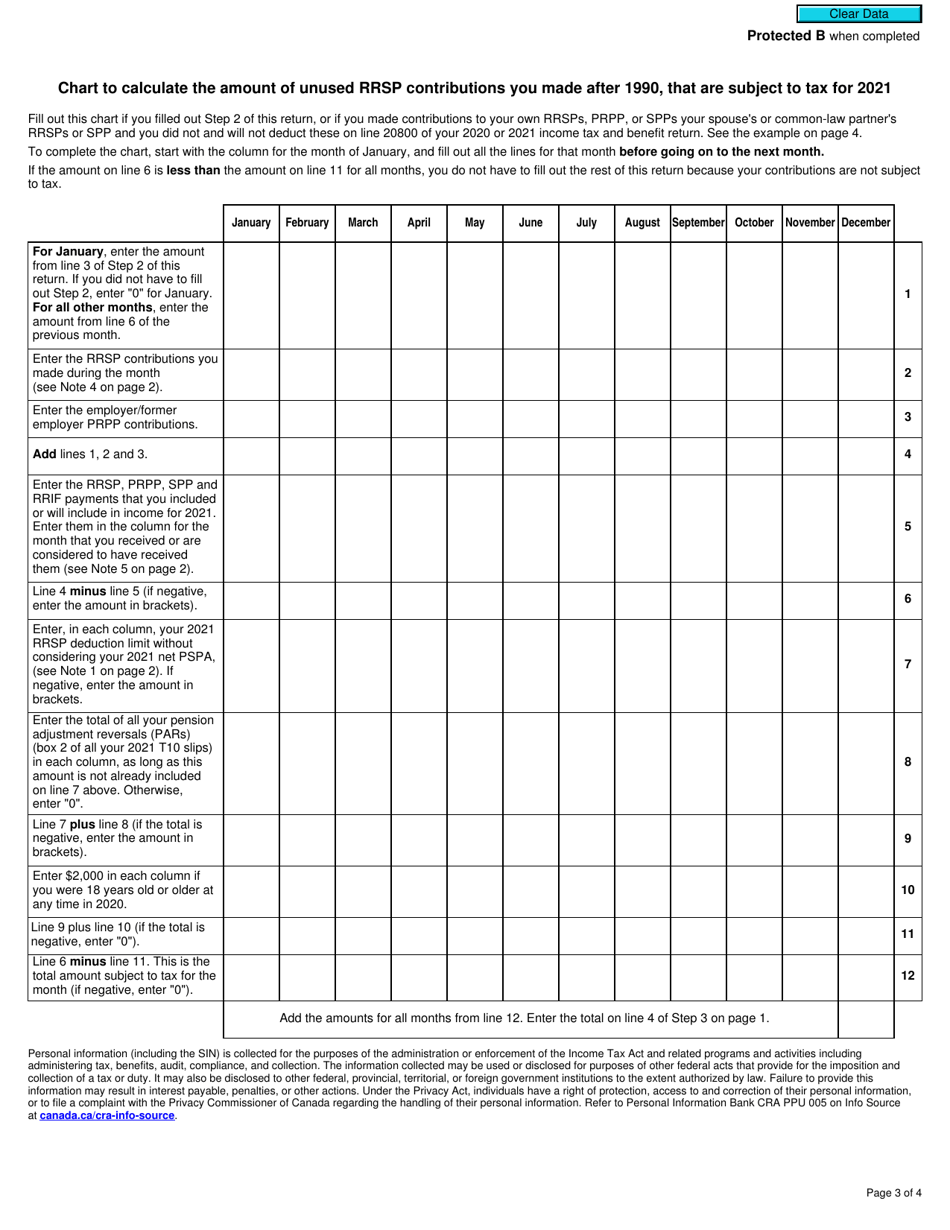

Q: How do I fill out Form T1-OVP-S?

A: To fill out Form T1-OVP-S, you need to provide information about your excess contributions, withdrawals, and other relevant details. You may need to consult the instructions provided with the form or seek professional assistance to ensure accuracy.

Q: What happens if I don't report excess contributions?

A: If you don't report excess contributions, you may be subject to penalties or additional taxes. It's important to accurately report any excess contributions to avoid potential consequences.

Q: When do I need to submit Form T1-OVP-S?

A: Form T1-OVP-S must be submitted by the deadline specified by the CRA. The deadline may vary each year, so it's important to check the current year's tax filing deadlines to ensure compliance.