This version of the form is not currently in use and is provided for reference only. Download this version of

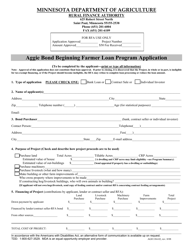

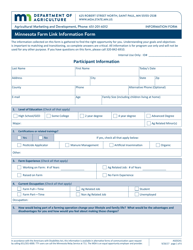

Form AG-03362

for the current year.

Form AG-03362 Minnesota Beginning Farmer Tax Credit Asset Owner Application - Minnesota

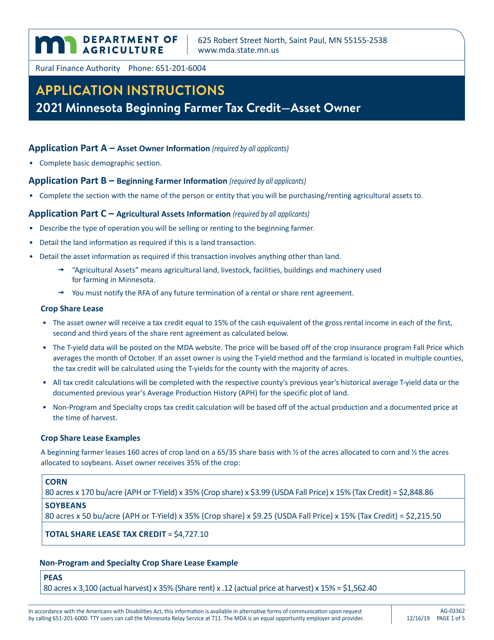

What Is Form AG-03362?

This is a legal form that was released by the Minnesota Department of Agriculture - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AG-03362?

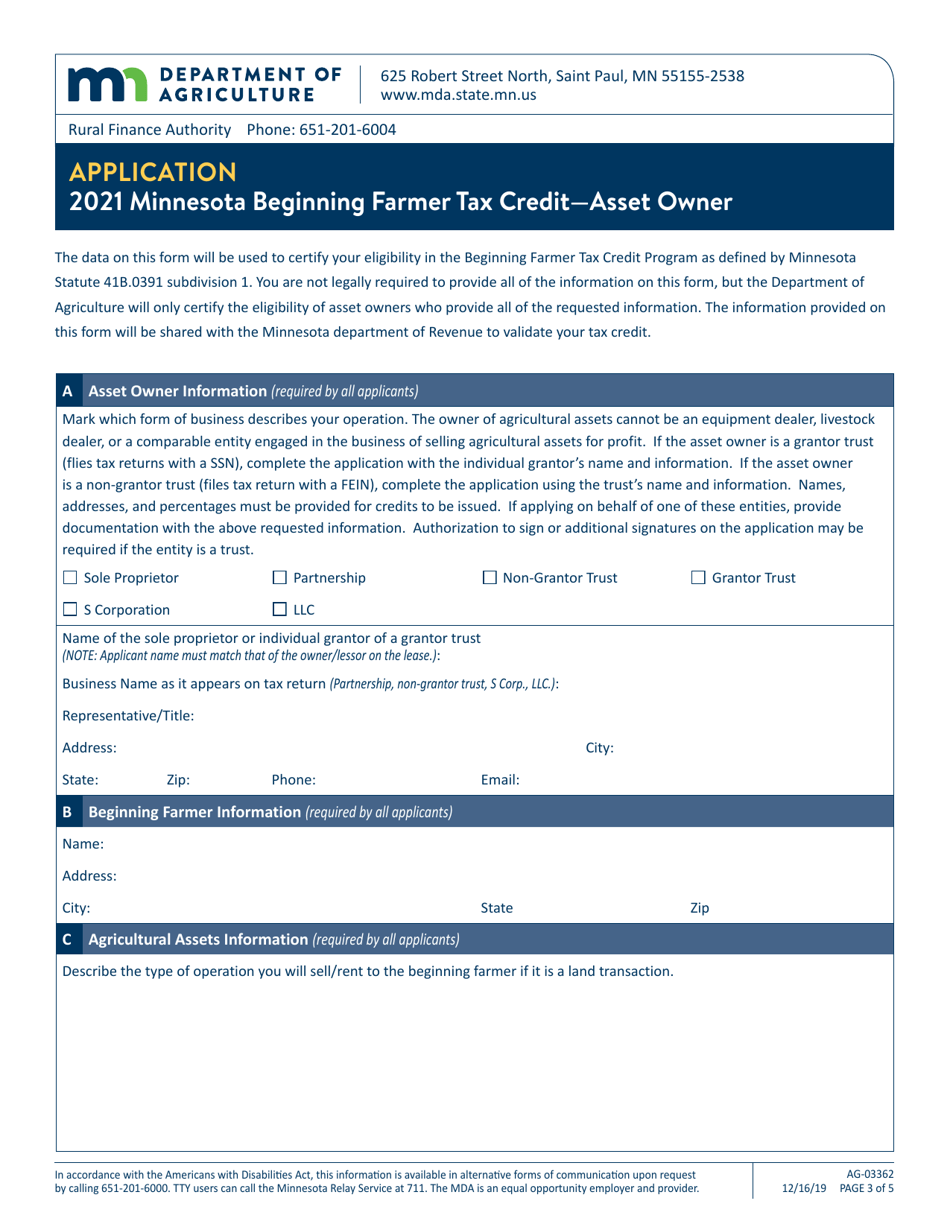

A: The Form AG-03362 is the application for the Minnesota Beginning Farmer Tax Credit Asset Owner.

Q: What is the Minnesota Beginning Farmer Tax Credit?

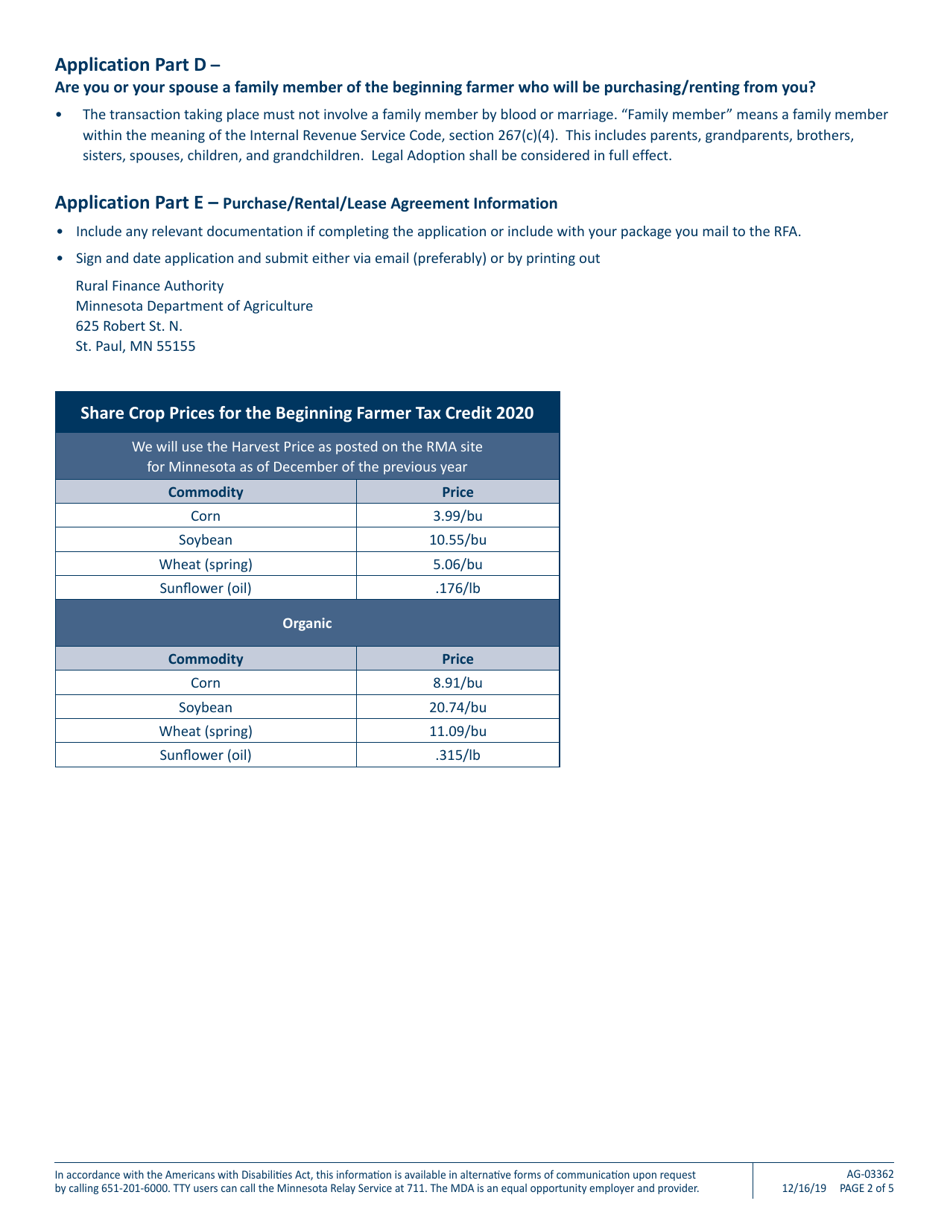

A: The Minnesota Beginning Farmer Tax Credit is a program that provides tax credits to individuals who lease or sell agricultural assets to beginning farmers.

Q: Who can apply for the Minnesota Beginning Farmer Tax Credit?

A: Asset owners who lease or sell agricultural assets to beginning farmers in Minnesota can apply for the tax credit.

Q: What is the purpose of the Minnesota Beginning Farmer Tax Credit?

A: The purpose of the tax credit is to encourage the transfer of agricultural assets to beginning farmers in order to support and promote the next generation of farmers in Minnesota.

Q: How can I apply for the Minnesota Beginning Farmer Tax Credit?

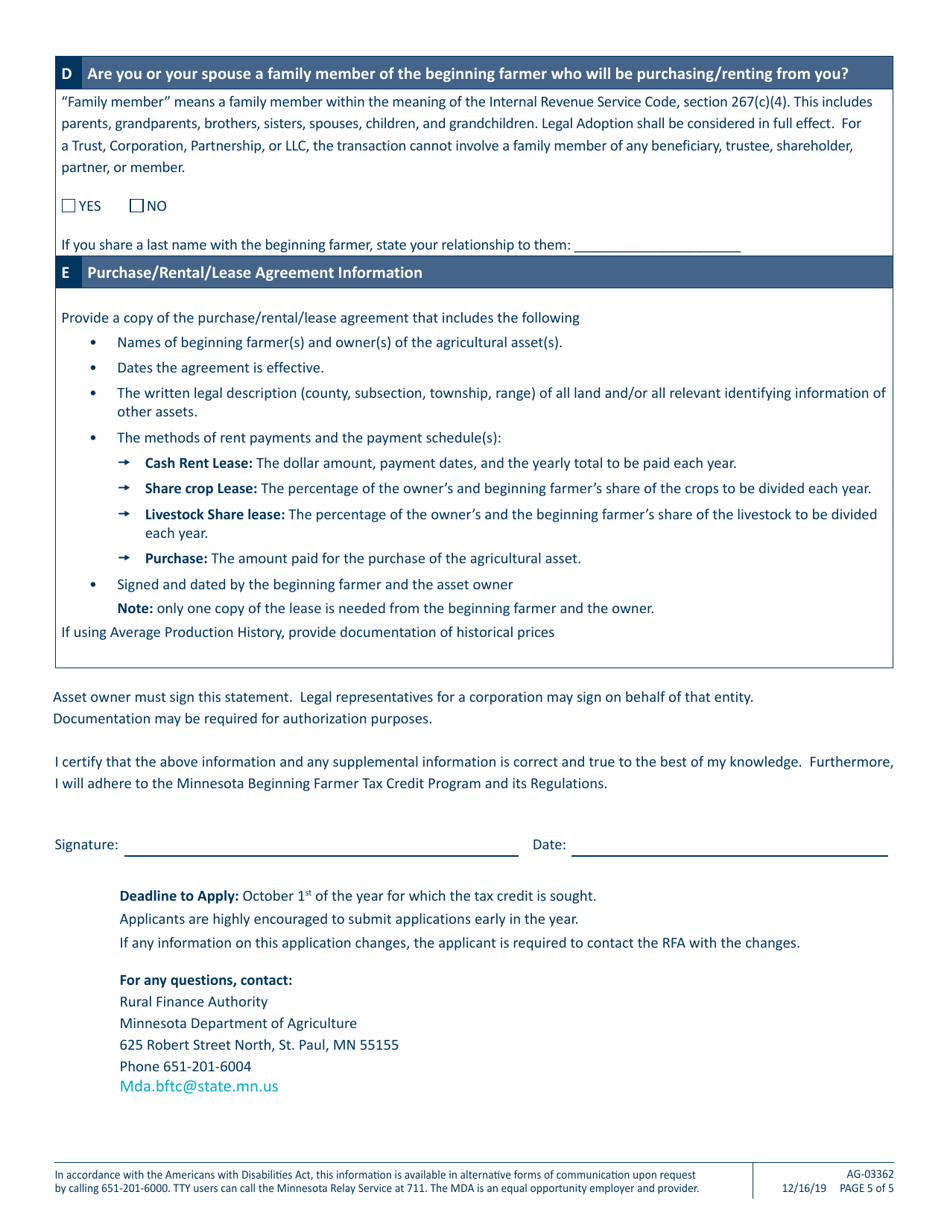

A: You can apply for the tax credit by completing and submitting the Form AG-03362.

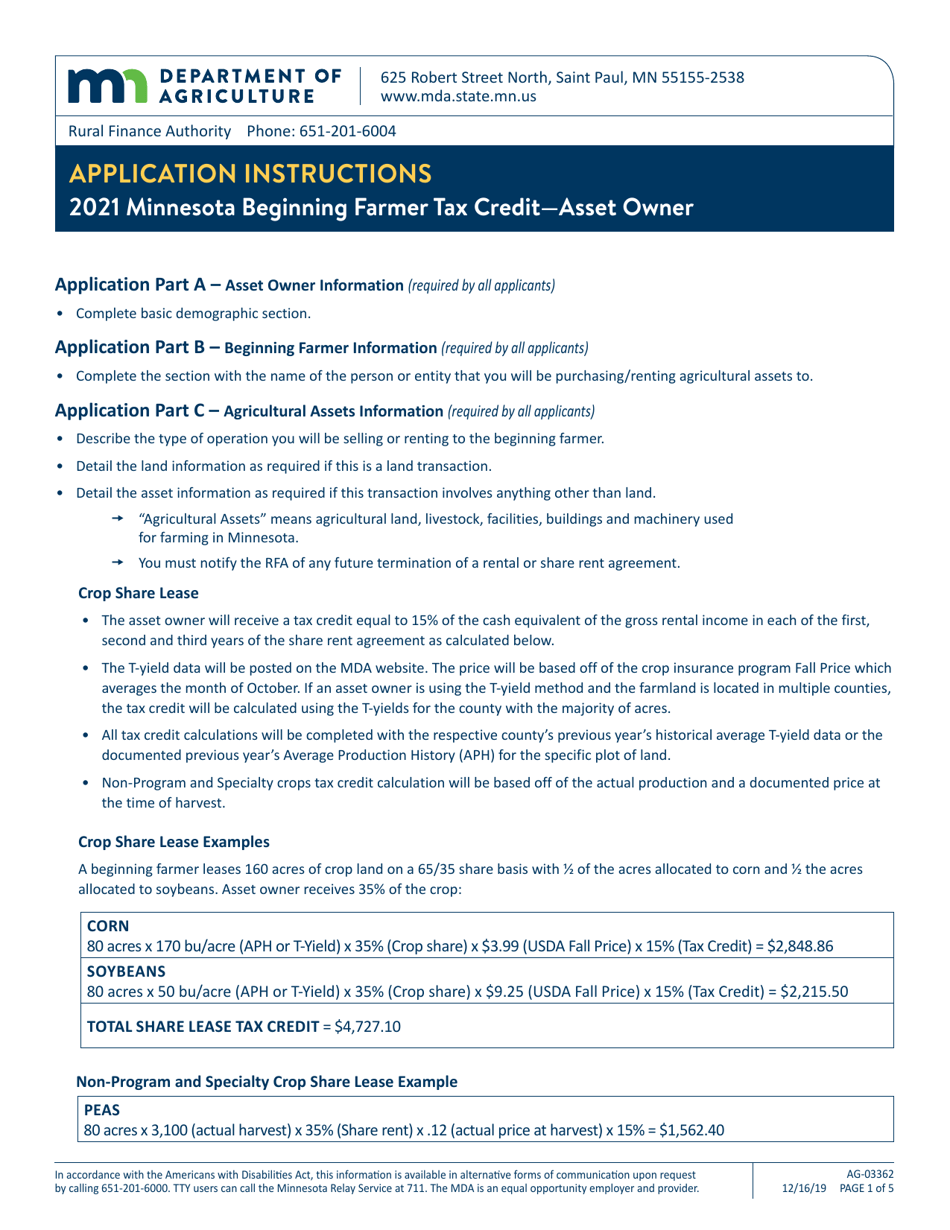

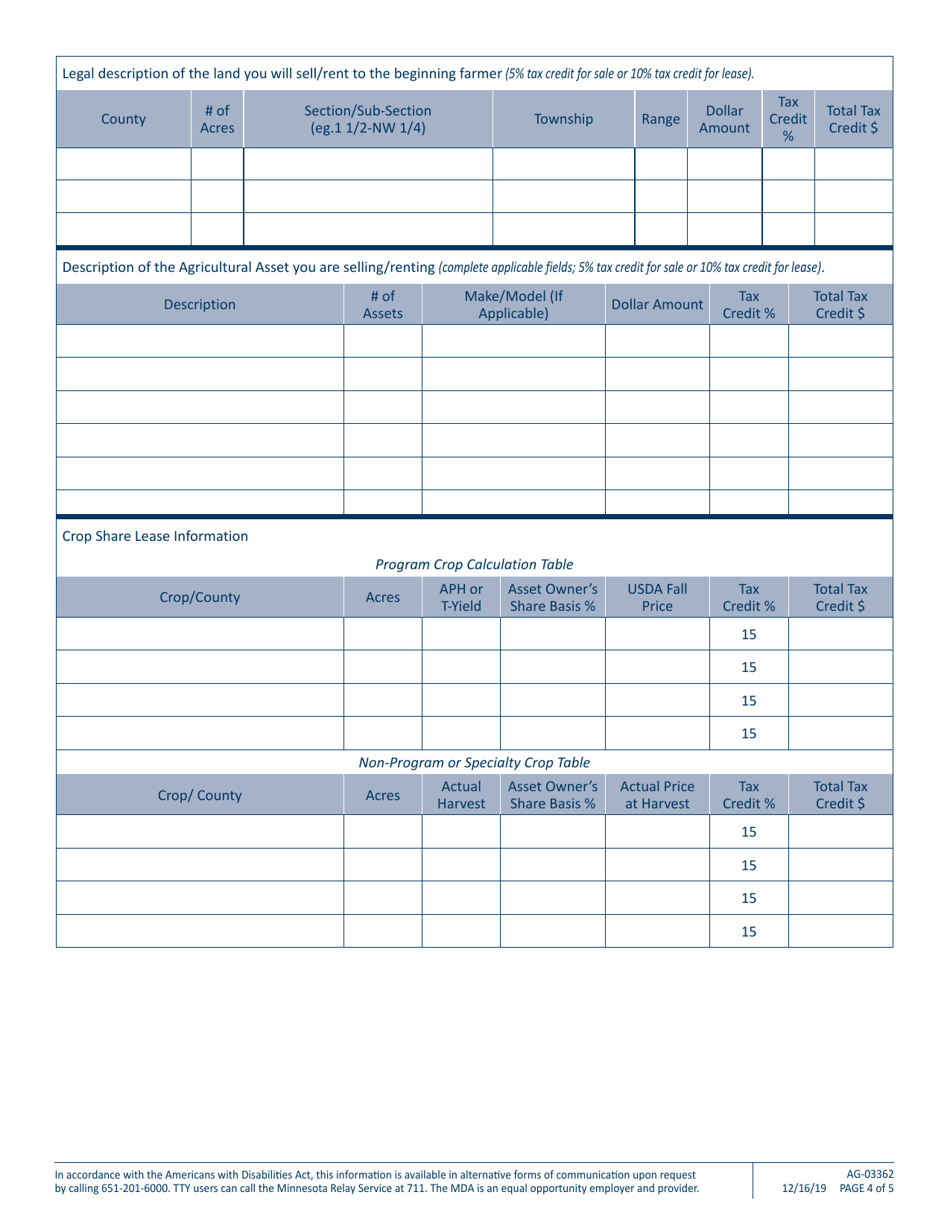

Q: What information do I need to provide on the Form AG-03362?

A: The form requires information about the asset owner, the beginning farmer, and the details of the lease or sale transaction.

Q: What are the eligibility requirements for the Minnesota Beginning Farmer Tax Credit?

A: To be eligible for the tax credit, the asset owner must have no more than $2 million in gross sales of agricultural products in the previous year and the beginning farmer must meet certain qualifications.

Q: How much tax credit can I receive through the Minnesota Beginning Farmer Tax Credit?

A: The amount of the tax credit can vary, but it is generally equal to 5% of the value of the agricultural asset leased or sold to the beginning farmer.

Q: When is the deadline to submit the Form AG-03362?

A: The deadline to submit the form is December 31 of the year following the year in which the lease or sale transaction occurred.

Form Details:

- Released on December 16, 2019;

- The latest edition provided by the Minnesota Department of Agriculture;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AG-03362 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Agriculture.