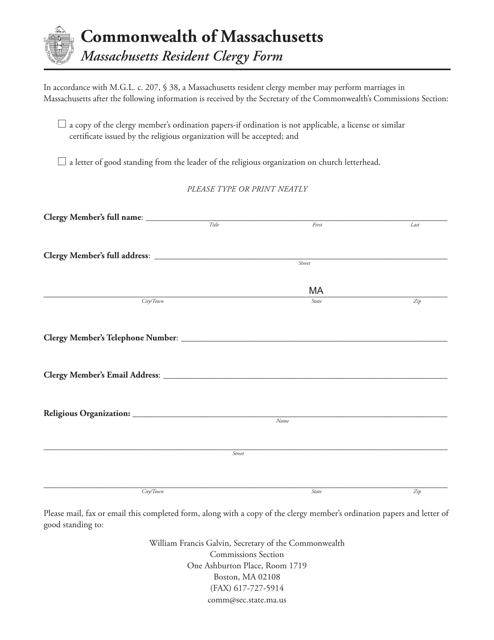

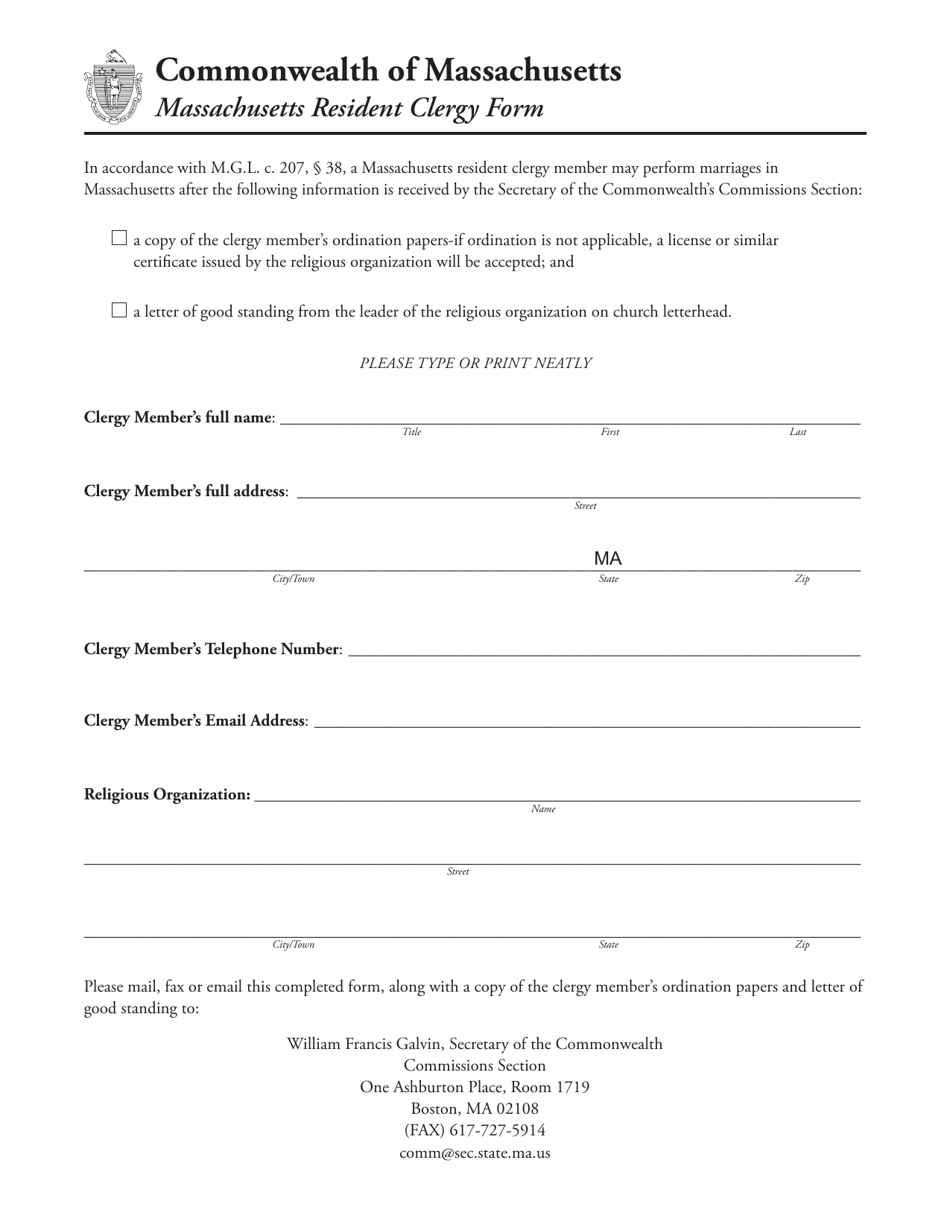

Massachusetts Resident Clergy Form - Massachusetts

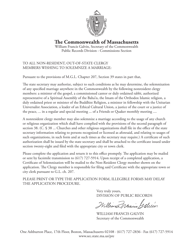

Massachusetts Resident Clergy Form is a legal document that was released by the Secretary of the Commonwealth of Massachusetts - a government authority operating within Massachusetts.

FAQ

Q: What is the Massachusetts Resident Clergy Form?

A: The Massachusetts Resident Clergy Form is a document that clergy members who reside in Massachusetts must complete for tax purposes.

Q: Who needs to complete the Massachusetts Resident Clergy Form?

A: Clergy members who live in Massachusetts must complete this form for tax purposes.

Q: What is the purpose of the Massachusetts Resident Clergy Form?

A: The purpose of the form is to determine the tax treatment of income for clergy members who live in Massachusetts.

Q: Are there any specific requirements for completing the Massachusetts Resident Clergy Form?

A: Yes, clergy members must meet certain criteria to be eligible to use this form, such as being ordained or being recognized as a religious leader by their religious organization.

Q: When is the deadline for submitting the Massachusetts Resident Clergy Form?

A: The deadline for submitting the form is usually April 15th, the same as the federal tax deadline.

Q: Is there a fee for filing the Massachusetts Resident Clergy Form?

A: No, there is no fee for filing the form.

Q: What should I do if I have questions or need assistance with the Massachusetts Resident Clergy Form?

A: If you have any questions or need assistance, you can contact the Massachusetts Department of Revenue for help.

Form Details:

- The latest edition currently provided by the Secretary of the Commonwealth of Massachusetts;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Secretary of the Commonwealth of Massachusetts.