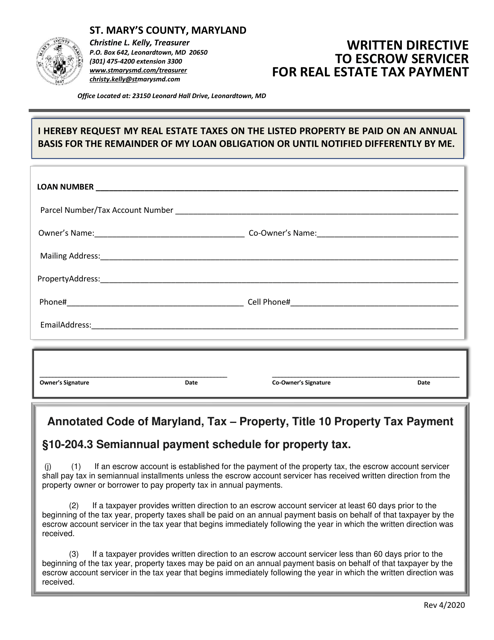

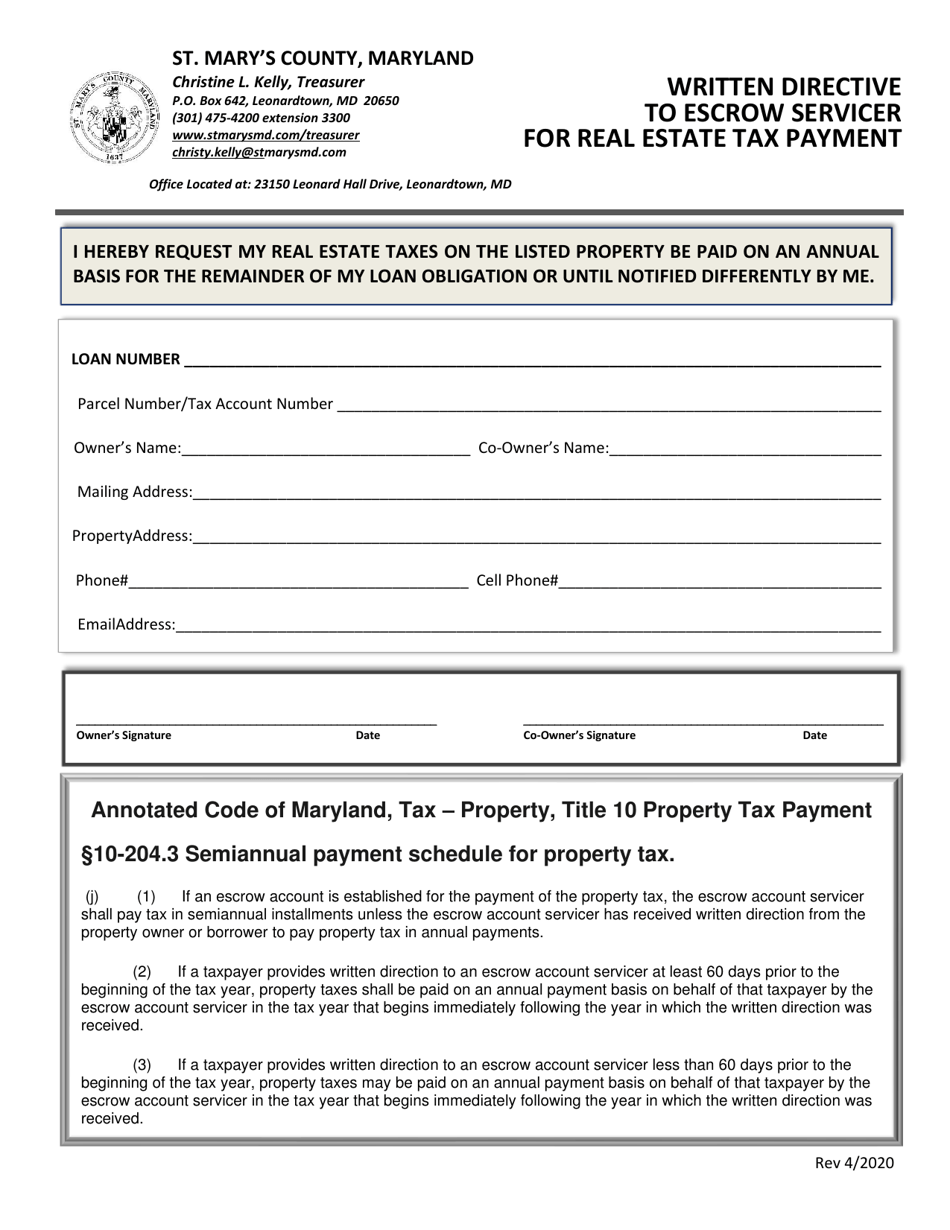

Written Directive to Escrow Servicer for Real Estate Tax Payment - St. Mary's County, Maryland

Written Directive to Escrow Servicer for Real Estate Tax Payment is a legal document that was released by the Office of the County Treasurer - St. Mary’s County, Maryland - a government authority operating within Maryland. The form may be used strictly within St. Mary's County.

FAQ

Q: What is the purpose of a written directive to an escrow servicer for real estate tax payment?

A: The purpose is to instruct the escrow servicer to pay real estate taxes on behalf of the property owner.

Q: Why would someone need to provide a written directive for real estate tax payment?

A: Some mortgage lenders require borrowers to escrow funds for tax payments, and a written directive ensures that the taxes are paid on time.

Q: What is an escrow servicer?

A: An escrow servicer is a third-party company that holds and disburses funds on behalf of the borrower and lender for specific purposes, such as paying property taxes.

Q: What are real estate taxes?

A: Real estate taxes are taxes imposed by local governments on the value of a property, typically used to fund public services and infrastructure.

Q: What is St. Mary's County, Maryland?

A: St. Mary's County is a county located in the state of Maryland in the United States.

Form Details:

- Released on April 1, 2020;

- The latest edition currently provided by the Office of the County Treasurer - St. Mary’s County, Maryland;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the County Treasurer - St. Mary’s County, Maryland.