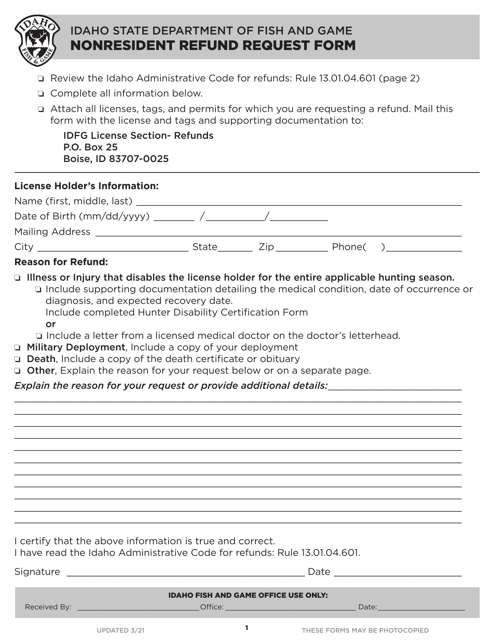

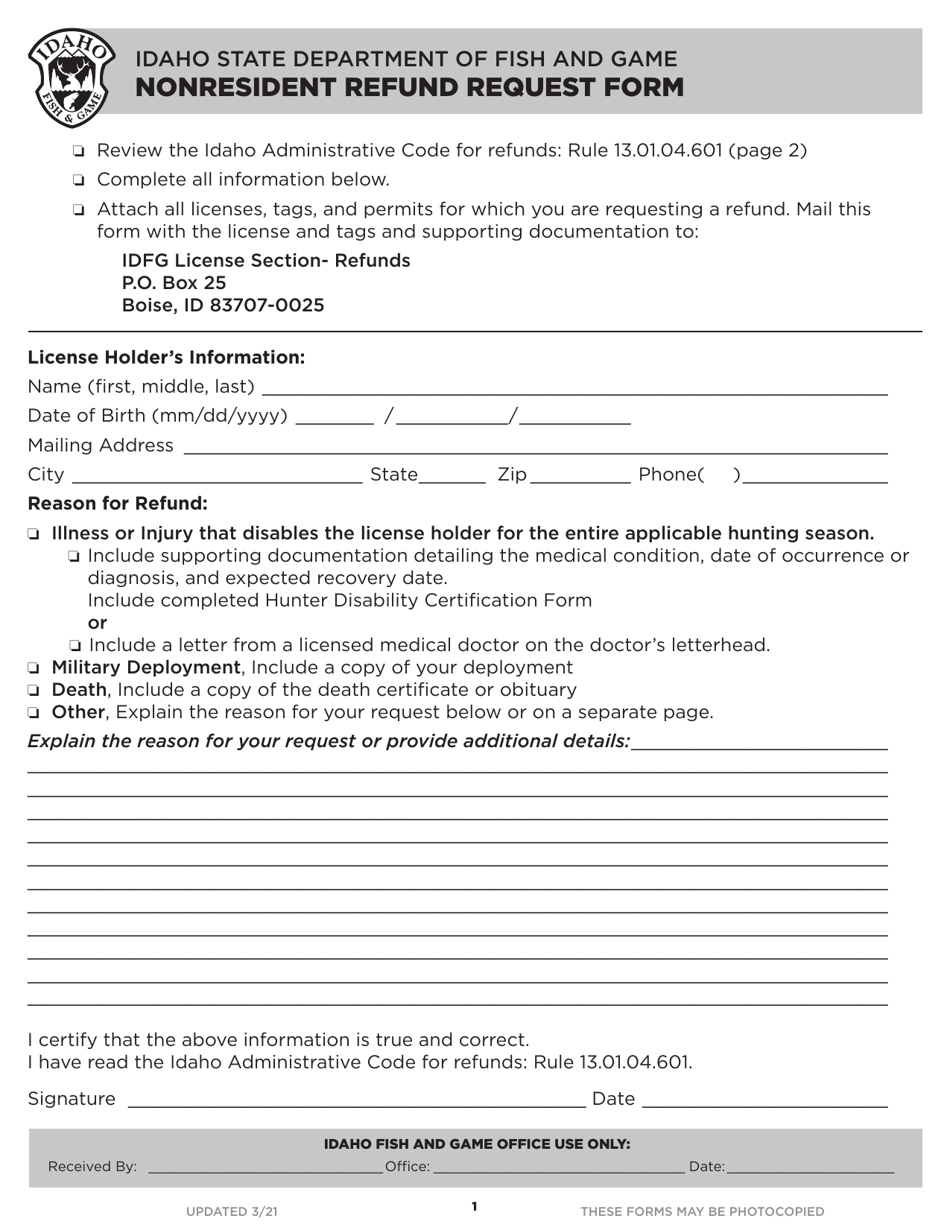

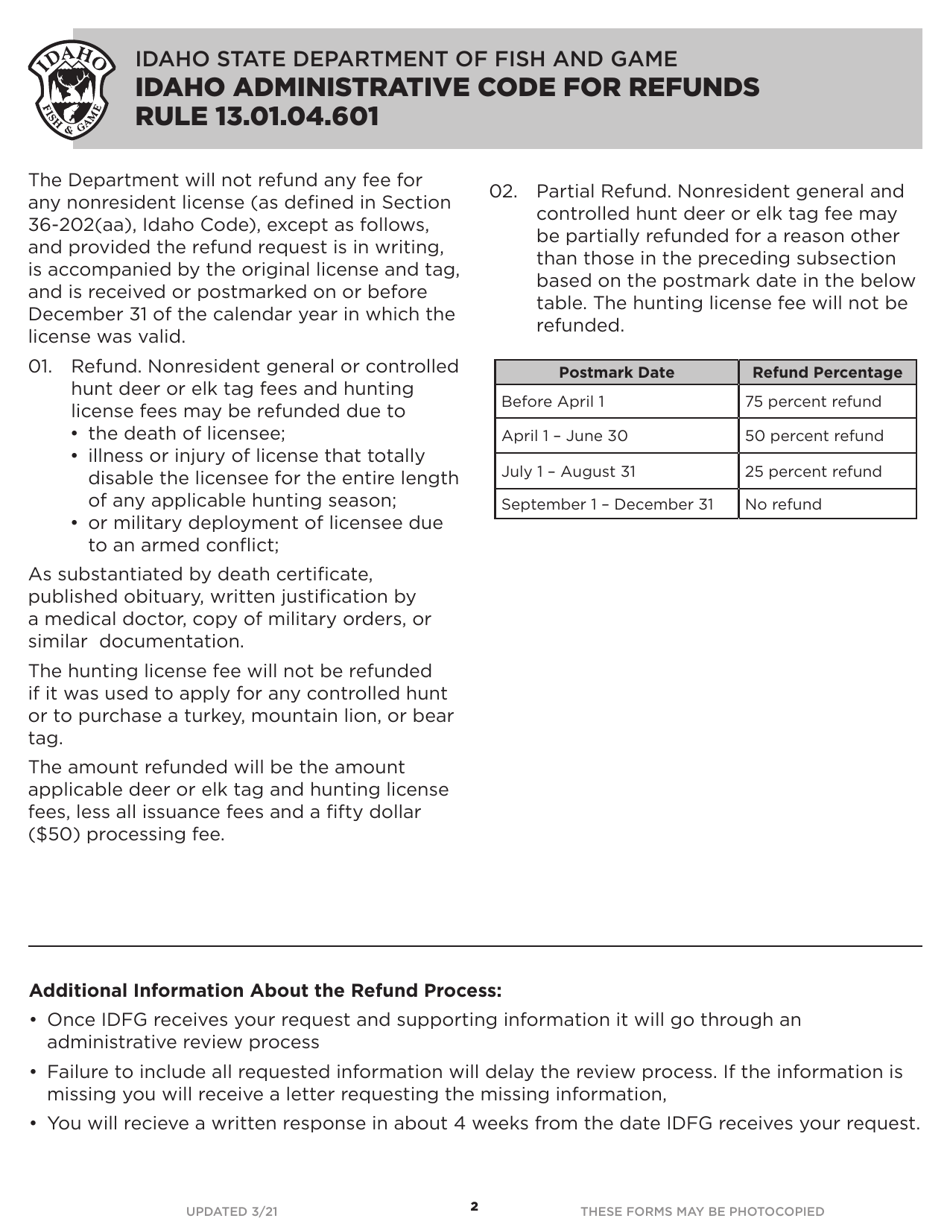

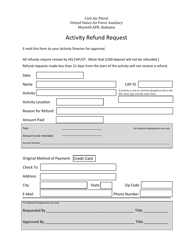

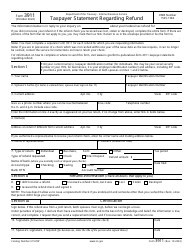

Nonresident Refund Request Form - Idaho

Nonresident Refund Request Form is a legal document that was released by the Idaho Department of Fish and Game - a government authority operating within Idaho.

FAQ

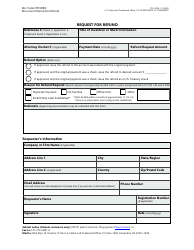

Q: What is the Nonresident Refund Request Form?

A: The Nonresident Refund Request Form is a form used to request a refund of income tax withheld from wages in Idaho by nonresidents.

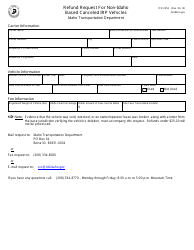

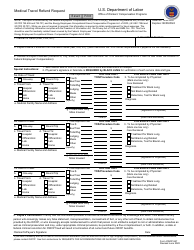

Q: Who is eligible to use the Nonresident Refund Request Form?

A: Nonresidents who had income tax withheld from wages in Idaho and want to request a refund of that amount.

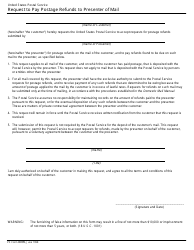

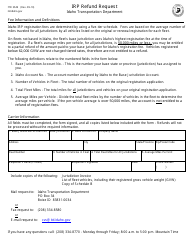

Q: Is there a deadline for submitting the Nonresident Refund Request Form?

A: Yes, the Nonresident Refund Request Form must be filed within three years from the due date of the tax return or two years from the date the tax was paid, whichever is later.

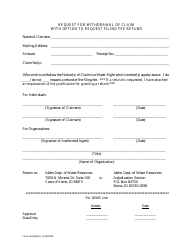

Q: What documentation should be included with the Nonresident Refund Request Form?

A: You should include copies of your W-2 forms and any other supporting documentation that shows the amount of Idaho income tax withheld from your wages.

Q: How long does it take to process the Nonresident Refund Request?

A: It may take up to 12 weeks to process the Nonresident Refund Request.

Q: Can I request a direct deposit of my refund?

A: Yes, you can request a direct deposit of your refund by providing your bank account information on the Nonresident Refund Request Form.

Form Details:

- Released on March 1, 2021;

- The latest edition currently provided by the Idaho Department of Fish and Game;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Fish and Game.