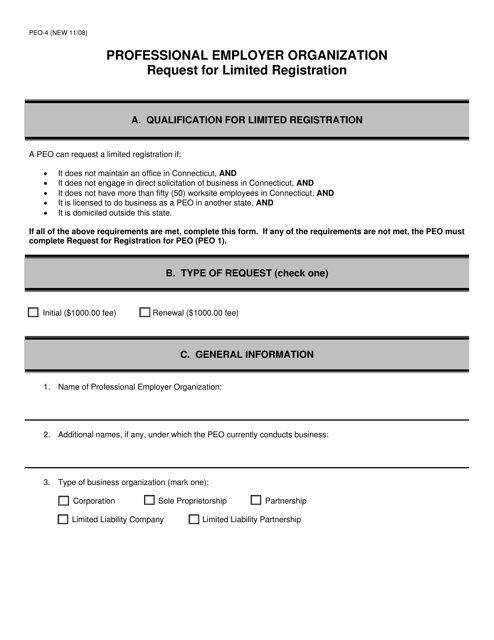

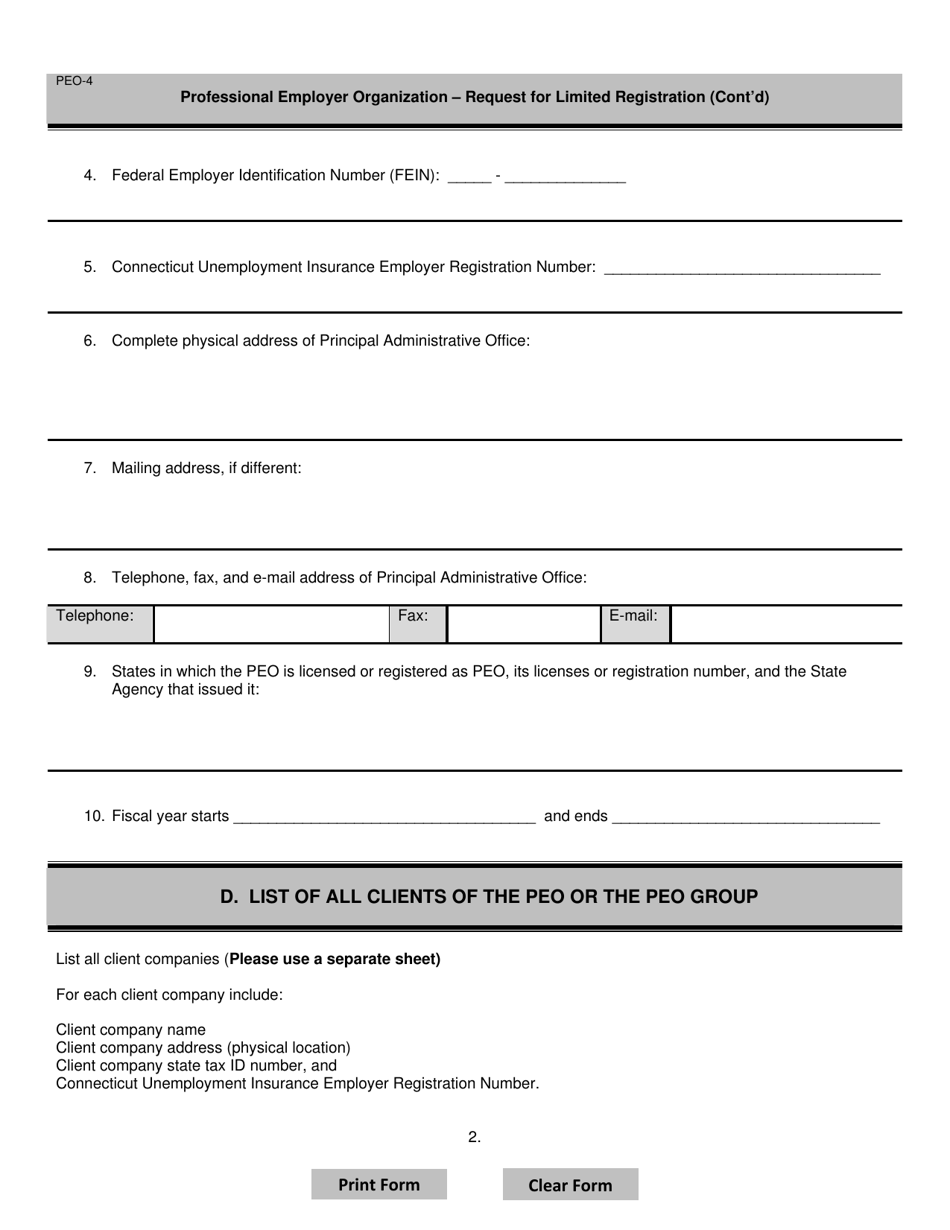

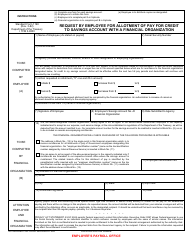

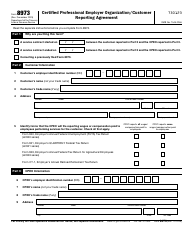

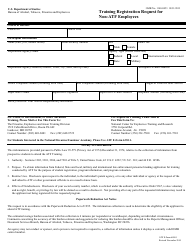

Form PEO-4 Request for Limited Registration - Professional Employer Organization - Connecticut

What Is Form PEO-4?

This is a legal form that was released by the Connecticut Department of Labor - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form PEO-4?

A: The Form PEO-4 is a request for limited registration for Professional Employer Organizations (PEOs) in Connecticut.

Q: What is a Professional Employer Organization (PEO)?

A: A Professional Employer Organization (PEO) is a company that provides comprehensive HR solutions and assumes certain employer responsibilities for its clients' employees.

Q: Who needs to file the Form PEO-4?

A: Any Professional Employer Organization (PEO) seeking limited registration to operate in Connecticut needs to file the Form PEO-4.

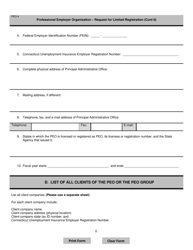

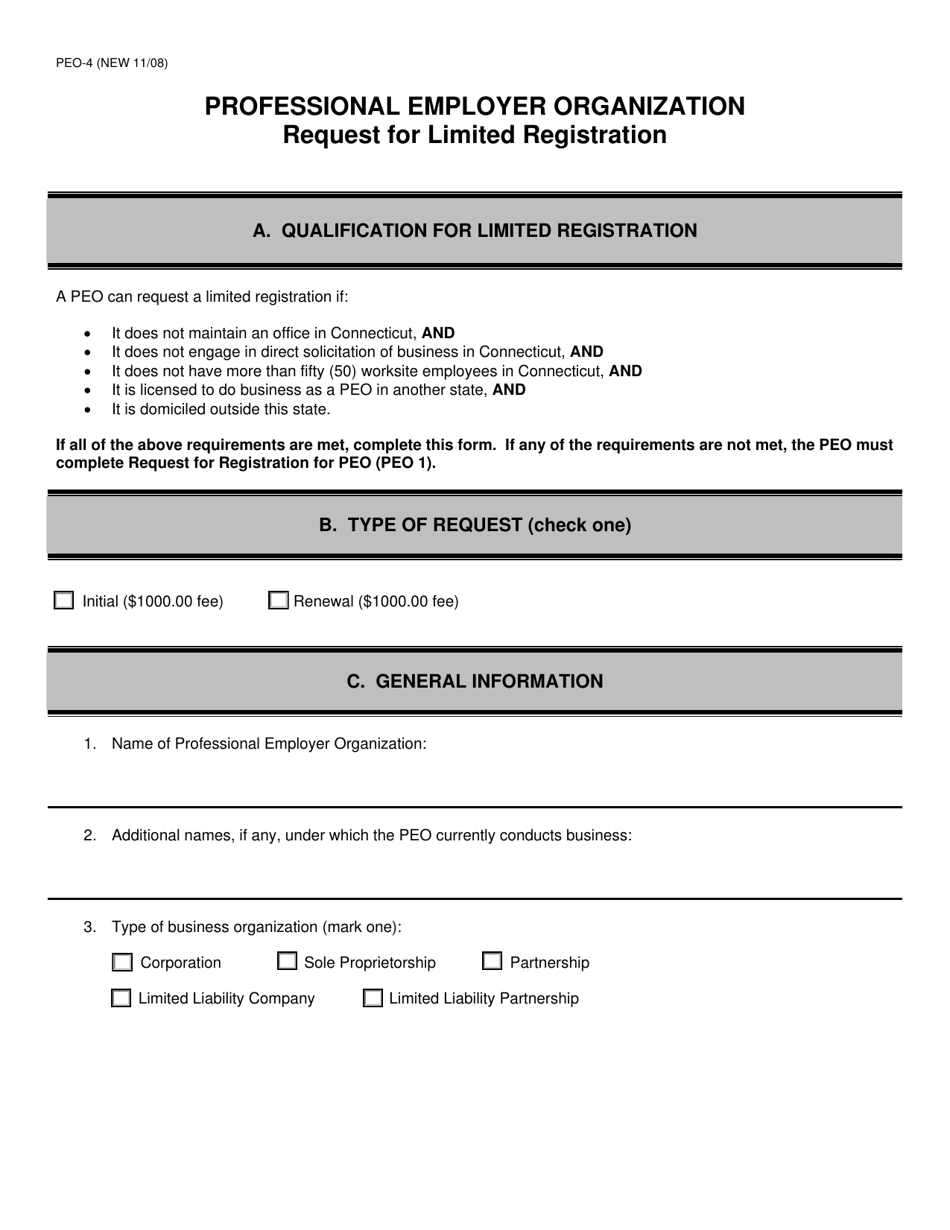

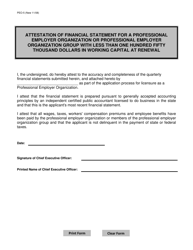

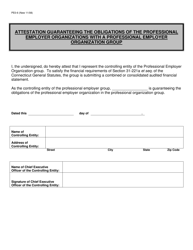

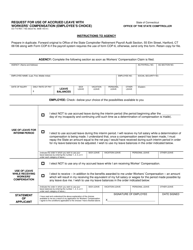

Q: What information is required on the Form PEO-4?

A: The Form PEO-4 requires information about the PEO's name, address, contact information, financial statements, and other details related to its operations and compliance with Connecticut laws.

Q: What are the filing fees for the Form PEO-4?

A: The filing fees for the Form PEO-4 are specified in the Connecticut General Statutes and regulations. It is recommended to check the current fee schedule or contact the Connecticut Department of Labor for the most accurate information.

Q: How long does it take to process the Form PEO-4?

A: The processing time for the Form PEO-4 may vary. It is advisable to submit the form well in advance of the desired registration date to allow for processing and review.

Q: What are the consequences of not filing the Form PEO-4?

A: Failure to file the Form PEO-4 may result in penalties and legal consequences for the PEO, including the inability to operate legally in Connecticut.

Form Details:

- Released on November 1, 2008;

- The latest edition provided by the Connecticut Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PEO-4 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.