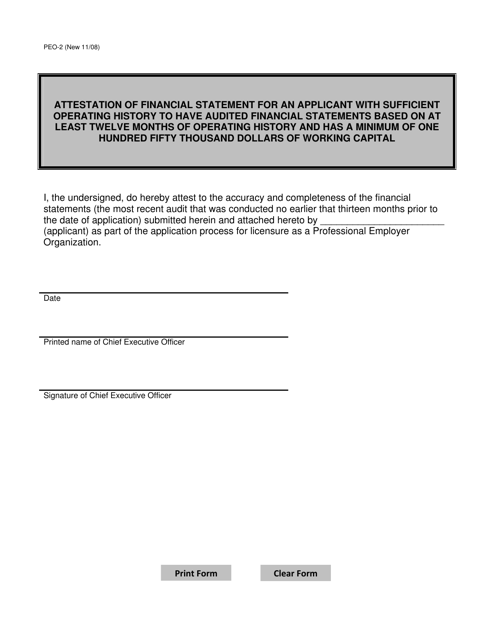

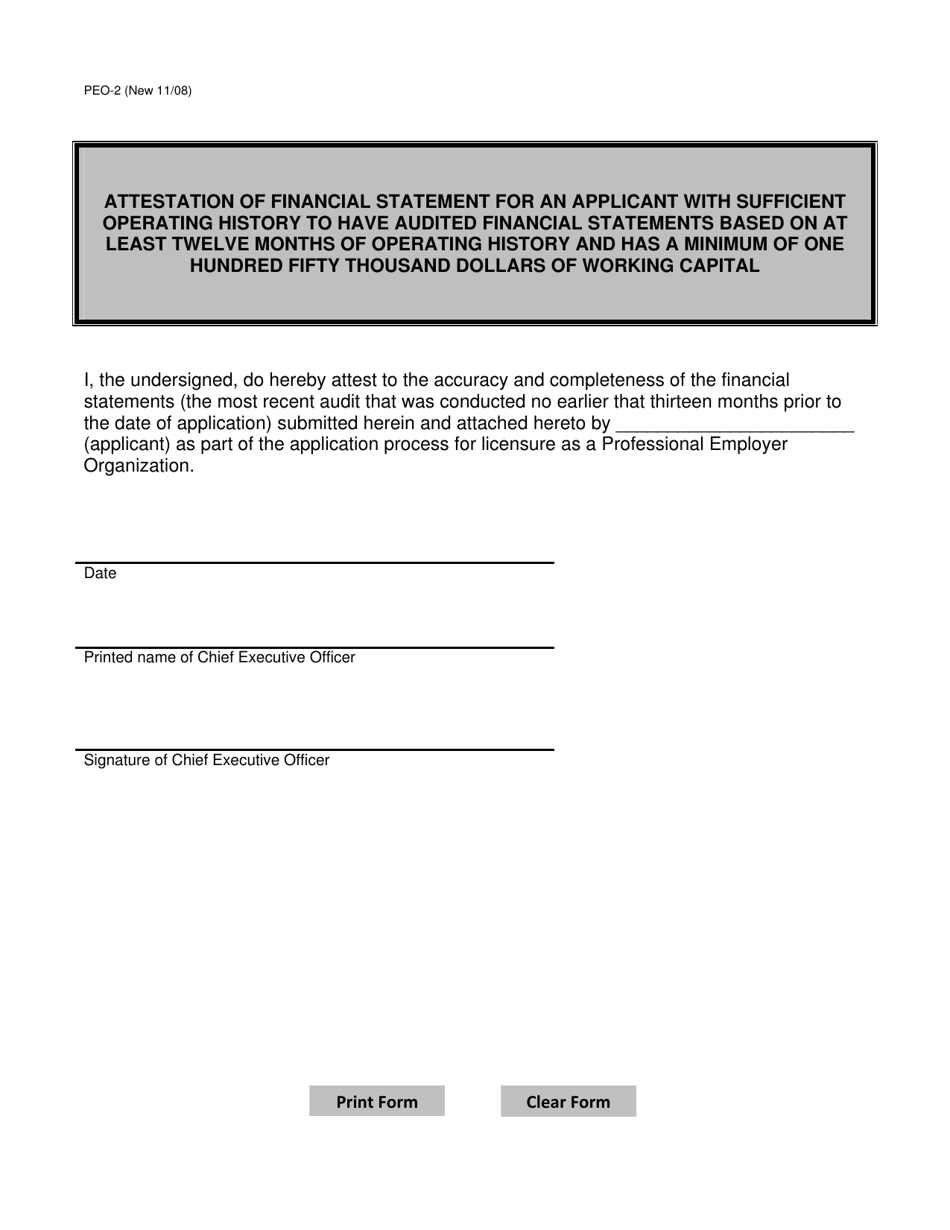

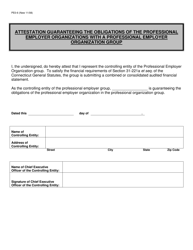

Form PEO-2 Attestation of Financial Statement for an Applicant With Sufficient Operating History to Have Audited Financial Statements Based on at Least Twelve Months of Operating History and Has a Minimum of One Hundred Fifty Thousand Dollars of Working Capital - Connecticut

What Is Form PEO-2?

This is a legal form that was released by the Connecticut Department of Labor - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PEO-2?

A: Form PEO-2 is an attestation of financial statement for an applicant.

Q: Who is required to submit Form PEO-2?

A: Applicants with sufficient operating history to have audited financial statements based on at least twelve months of operating history and has a minimum of one hundred fifty thousand dollars of working capital in Connecticut are required to submit Form PEO-2.

Q: What is the purpose of Form PEO-2?

A: The purpose of Form PEO-2 is to attest to the financial statements of an applicant.

Q: What is the minimum operating history required to submit Form PEO-2?

A: Applicants must have at least twelve months of operating history to submit Form PEO-2.

Q: How much working capital is required to submit Form PEO-2?

A: Applicants must have a minimum of one hundred fifty thousand dollars of working capital to submit Form PEO-2.

Form Details:

- Released on November 1, 2008;

- The latest edition provided by the Connecticut Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PEO-2 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Labor.