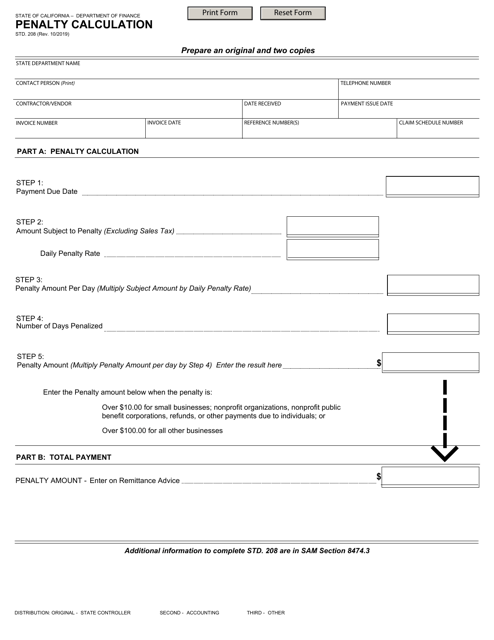

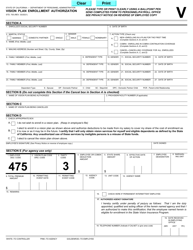

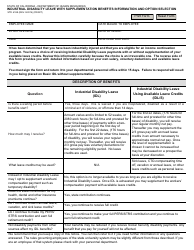

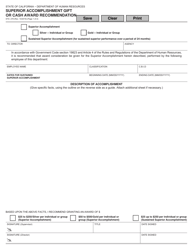

Form STD.208 Penalty Calculation - California

What Is Form STD.208?

This is a legal form that was released by the California Department of Finance - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STD.208?

A: Form STD.208 is a penalty calculation form used in California.

Q: What is the purpose of Form STD.208?

A: The purpose of Form STD.208 is to calculate penalties.

Q: Who uses Form STD.208?

A: Form STD.208 is used by employers in California.

Q: What penalties does Form STD.208 calculate?

A: Form STD.208 calculates penalties for non-compliance with various labor laws, such as failure to pay wages on time or failure to provide meal and rest breaks.

Q: How does Form STD.208 work?

A: Form STD.208 uses specific formulas and calculations to determine the amount of penalties owed.

Q: Are employers required to use Form STD.208?

A: Yes, employers in California are required to use Form STD.208 when calculating penalties.

Q: Is Form STD.208 specific to California?

A: Yes, Form STD.208 is specific to California and is not used in other states.

Q: Can Form STD.208 be used for any type of penalty calculation?

A: Form STD.208 is specifically for penalty calculations related to labor law violations in California, and may not be suitable for other types of penalty calculations.

Q: Are there any penalties for not using Form STD.208?

A: There may be penalties for non-compliance with labor laws, but the specific consequences for not using Form STD.208 may vary depending on the situation.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California Department of Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD.208 by clicking the link below or browse more documents and templates provided by the California Department of Finance.