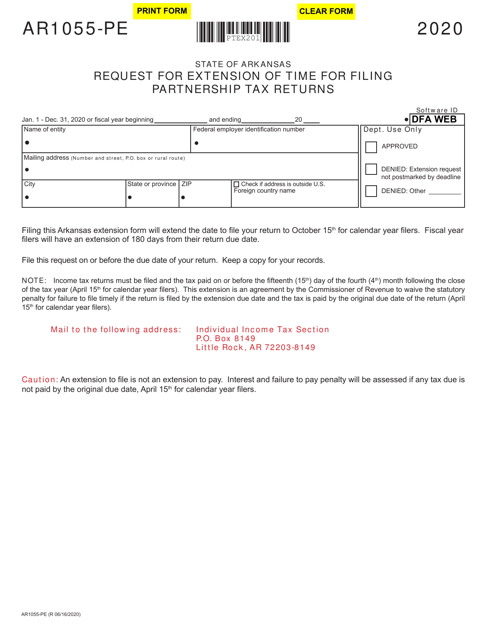

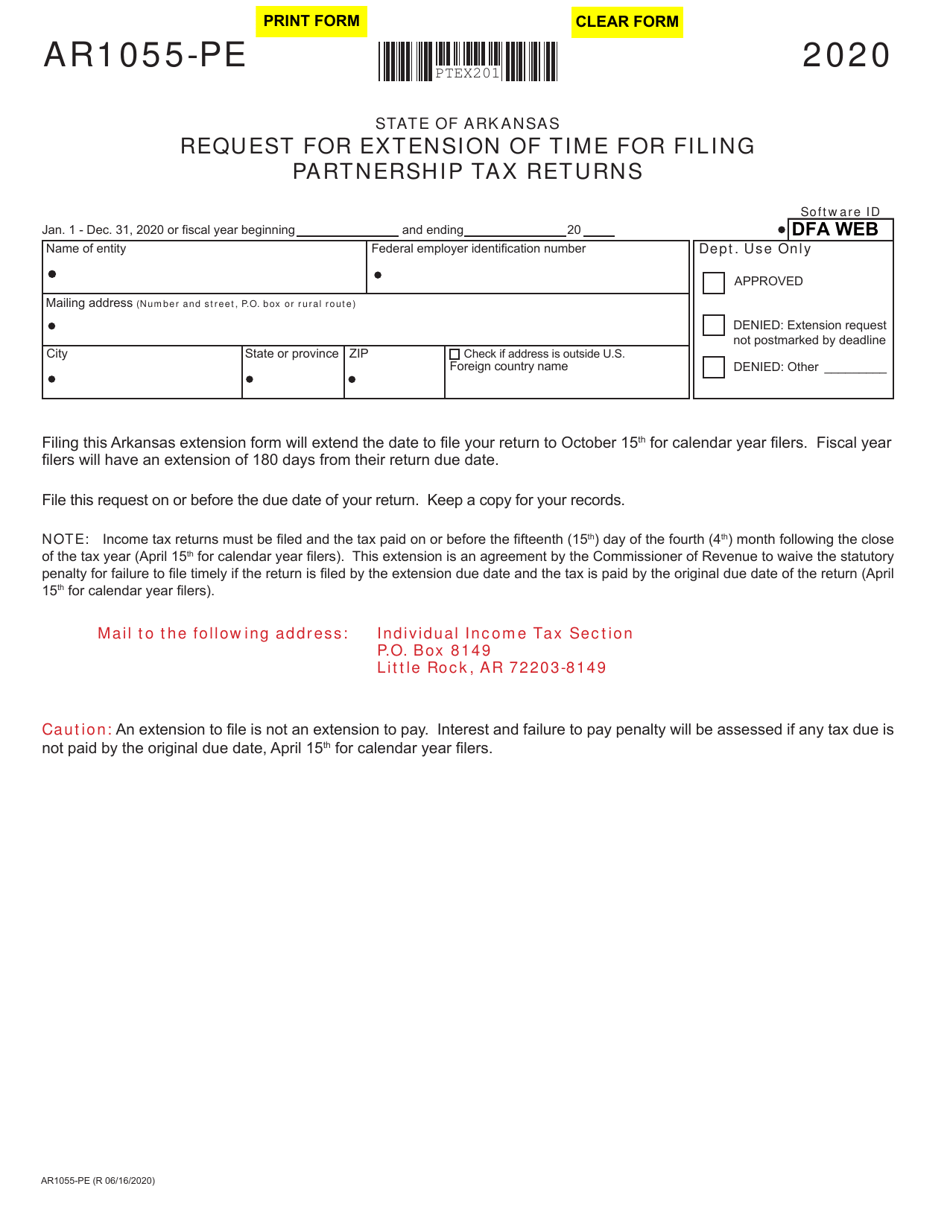

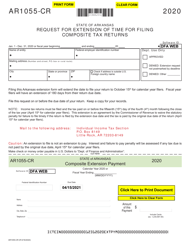

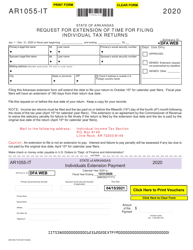

Form AR1055-PE Request for Extension of Time for Filing Partnership Tax Returns - Arkansas

What Is Form AR1055-PE?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1055-PE?

A: Form AR1055-PE is a request for extension of time for filing partnership tax returns in Arkansas.

Q: Who needs to file Form AR1055-PE?

A: Partnerships in Arkansas that need more time to file their tax returns.

Q: What is the purpose of Form AR1055-PE?

A: The purpose of this form is to request an extension of time to file partnership tax returns in Arkansas.

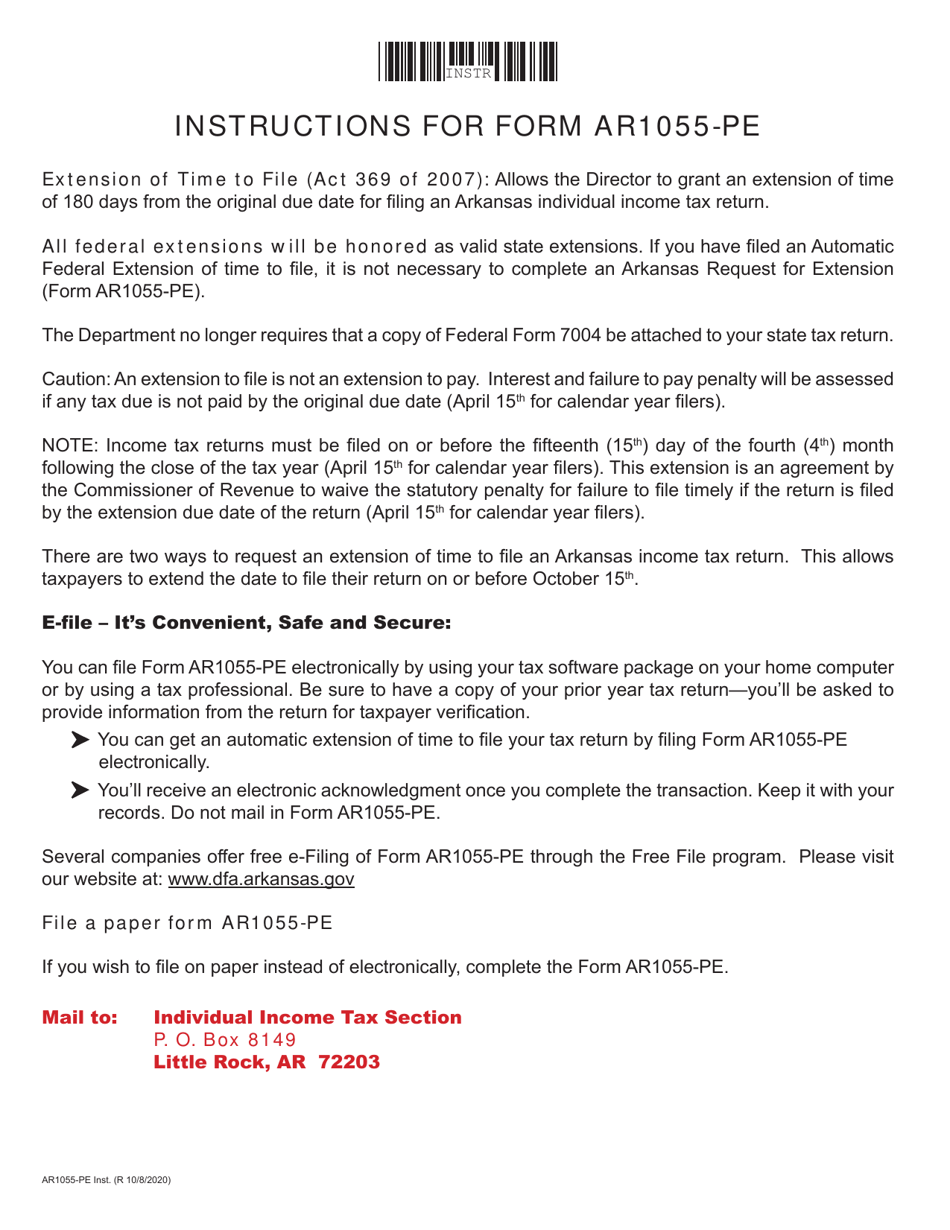

Q: How do I file Form AR1055-PE?

A: You can file Form AR1055-PE by mail or electronically.

Q: Is there a fee for filing Form AR1055-PE?

A: No, there is no fee for filing this form.

Q: What is the deadline for filing Form AR1055-PE?

A: The deadline for filing Form AR1055-PE is the same as the deadline for filing the partnership tax return, usually March 15th.

Q: Can I request an extension for filing Form AR1055-PE?

A: Yes, you can request an extension by filing Form AR1055-PE before the original filing deadline.

Q: What happens if I don't file Form AR1055-PE?

A: If you don't file Form AR1055-PE and don't file your partnership tax return on time, you may be subject to penalties and interest.

Q: Can I e-file Form AR1055-PE?

A: Yes, you can e-file this form if you meet the requirements.

Form Details:

- Released on October 8, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1055-PE by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.