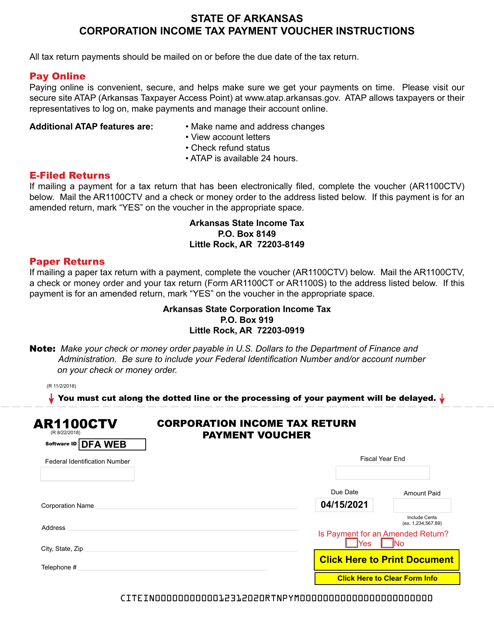

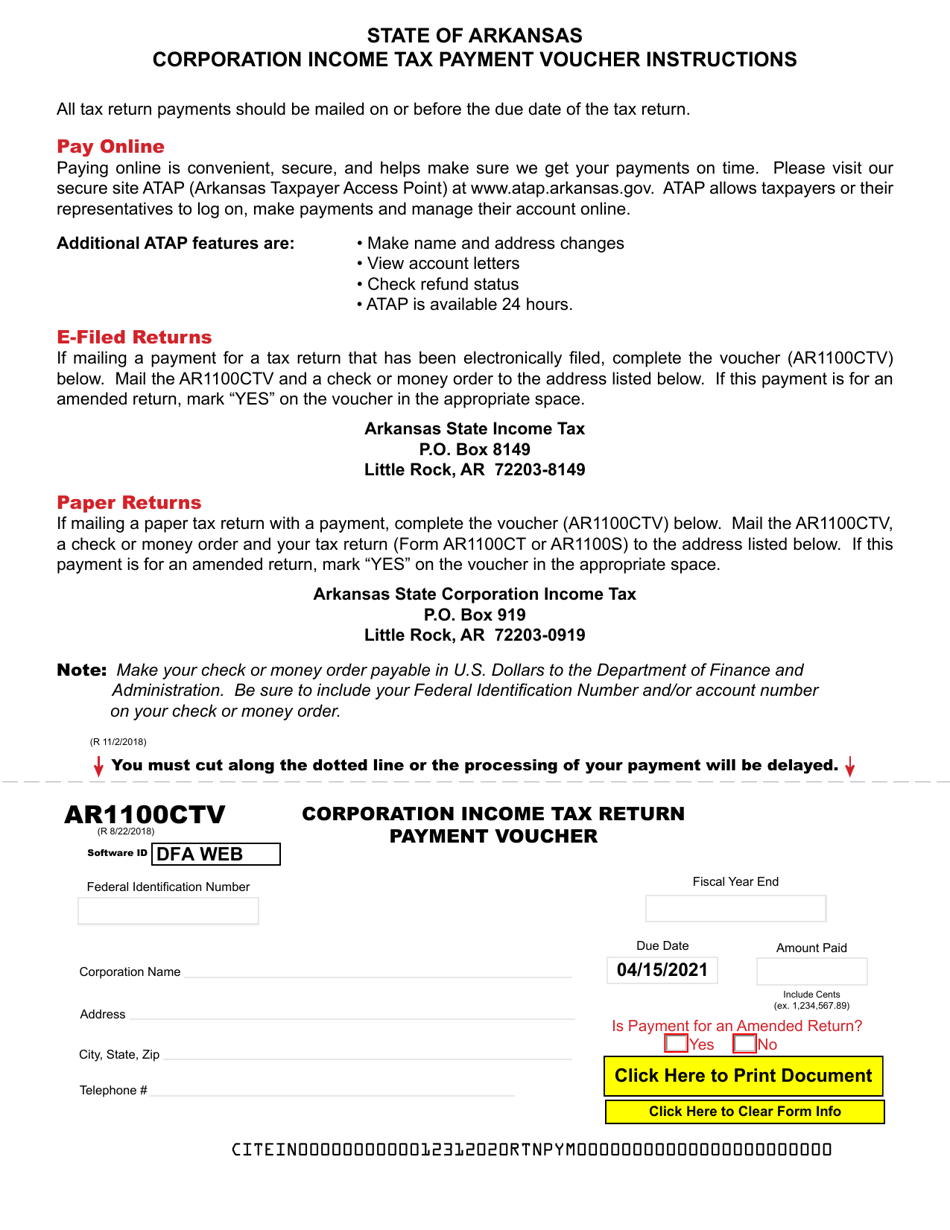

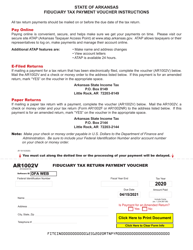

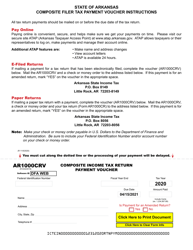

Form AR1100CTV Corporation Income Tax Return Payment Voucher - Arkansas

What Is Form AR1100CTV?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1100CTV?

A: Form AR1100CTV is the Corporation Income TaxReturn Payment Voucher for Arkansas.

Q: Who uses Form AR1100CTV?

A: This form is used by corporations in Arkansas to make payments towards their income tax returns.

Q: What is the purpose of Form AR1100CTV?

A: The purpose of Form AR1100CTV is to provide a payment voucher for corporations to remit payments towards their income tax returns in Arkansas.

Q: Is Form AR1100CTV specific to a certain tax year?

A: Yes, Form AR1100CTV is specific to a particular tax year and should be used for that year's income tax return payments.

Q: Do I need to include Form AR1100CTV with my tax return?

A: No, Form AR1100CTV is a payment voucher and should not be included with the actual tax return. It is used solely for making payment towards the tax liability.

Form Details:

- Released on November 2, 2018;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1100CTV by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.