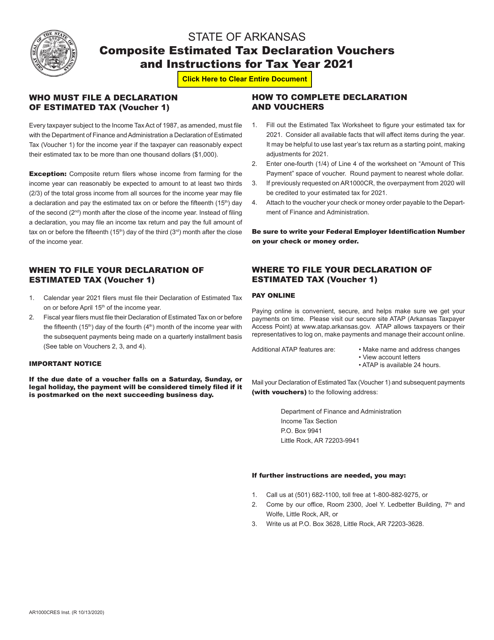

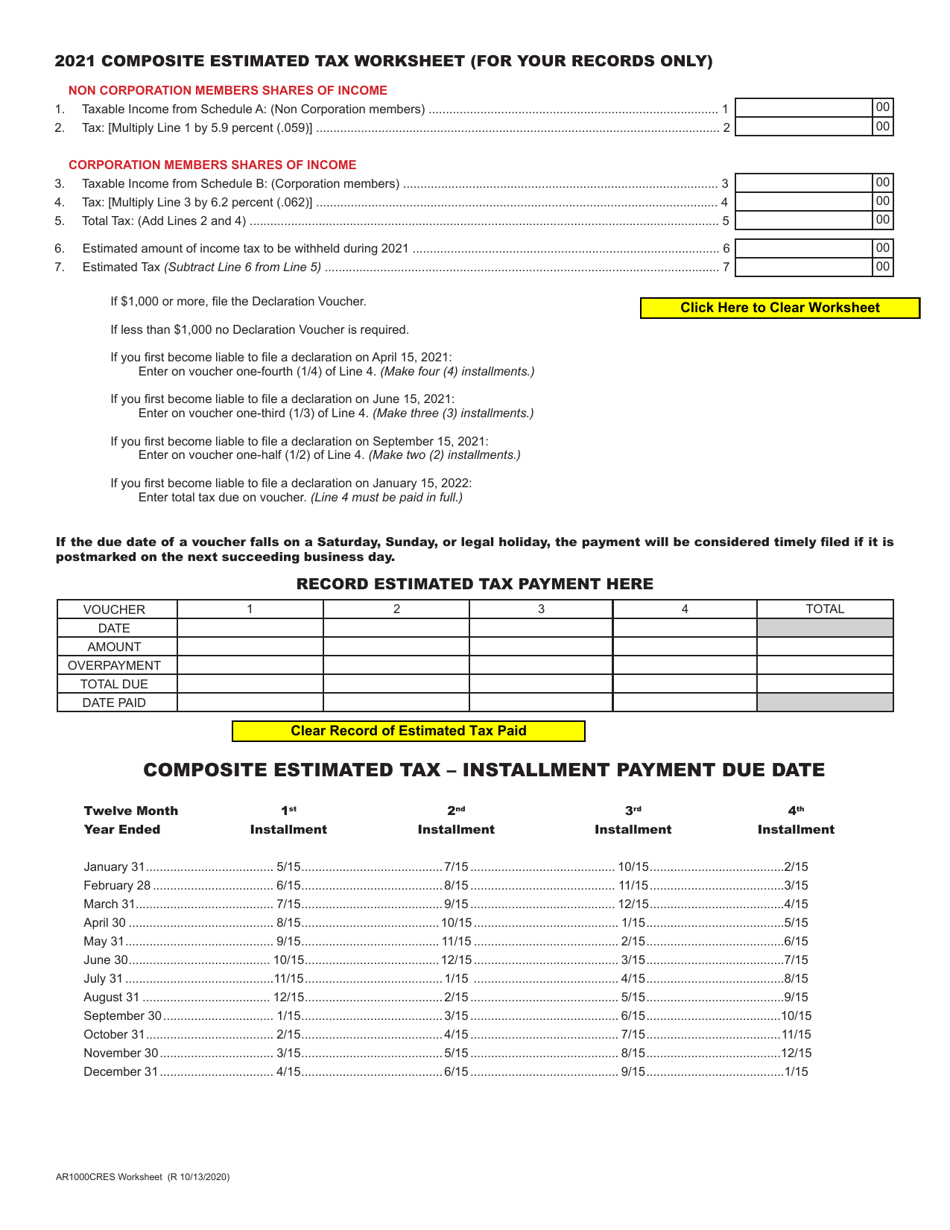

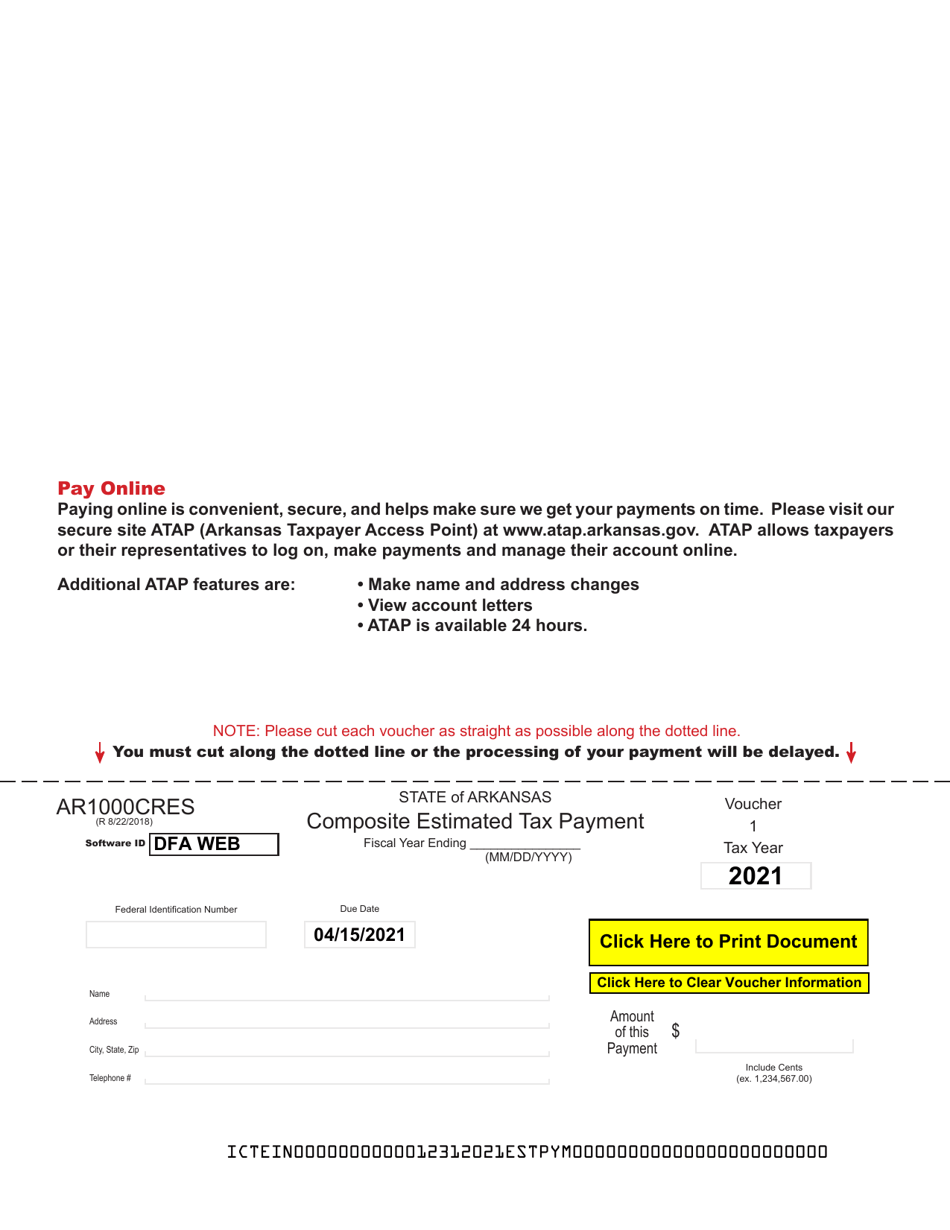

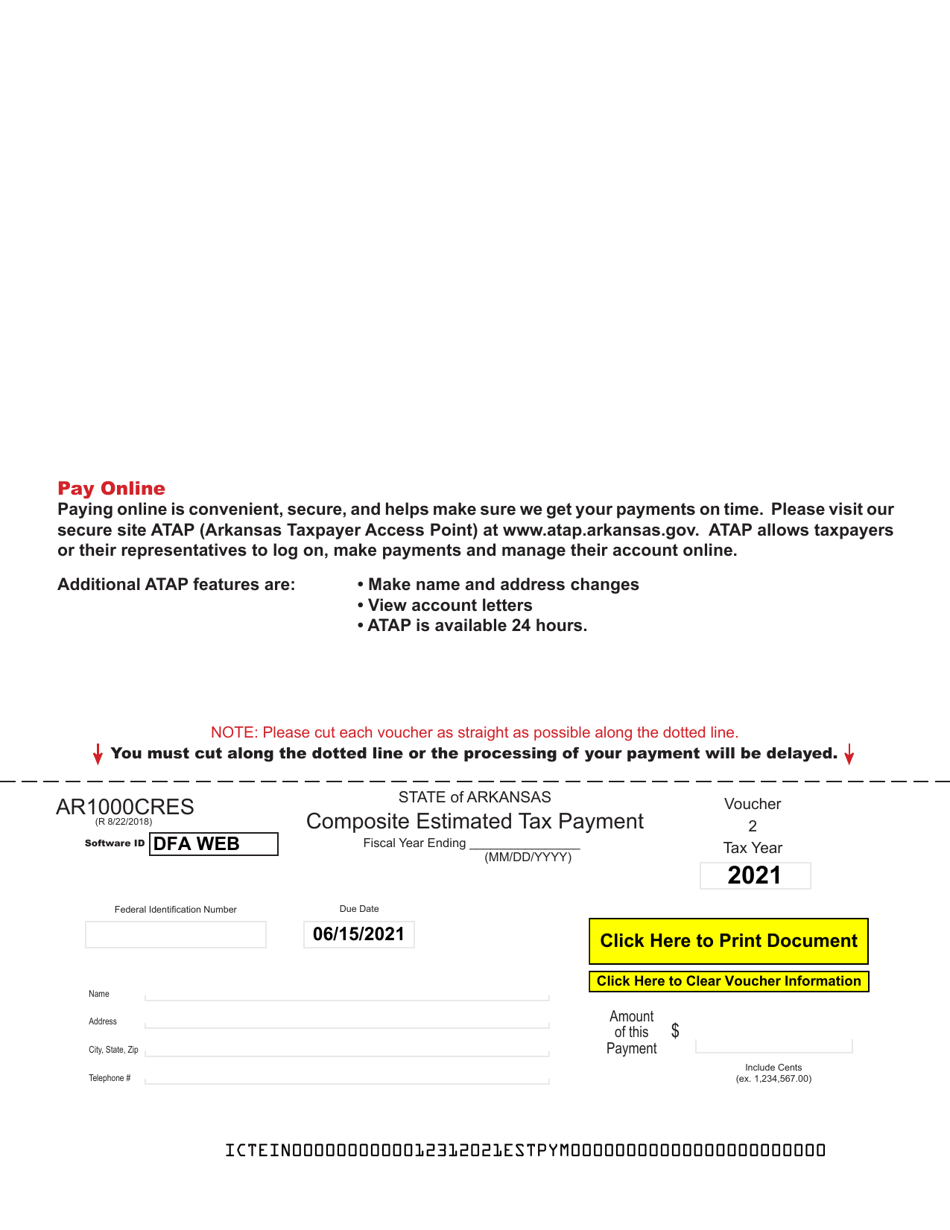

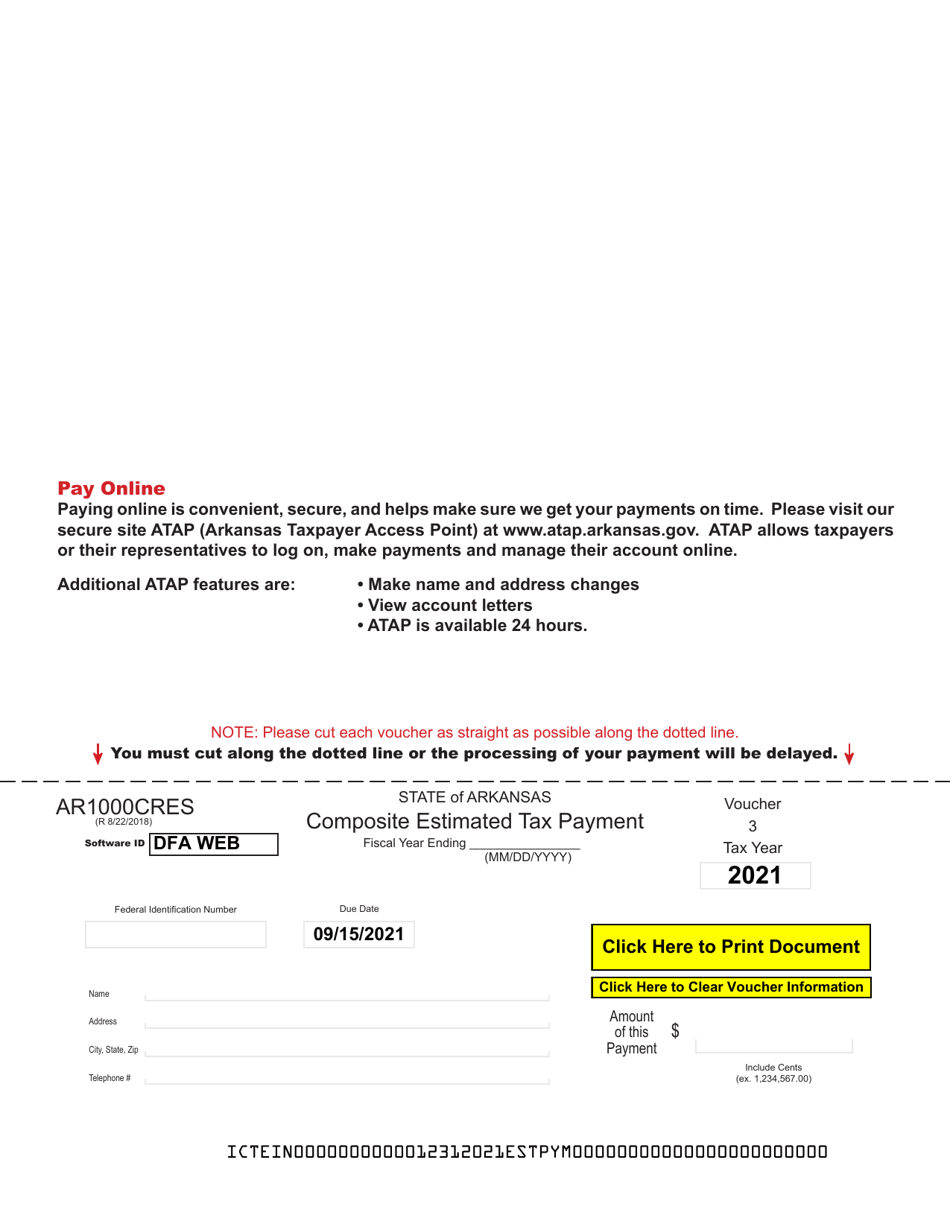

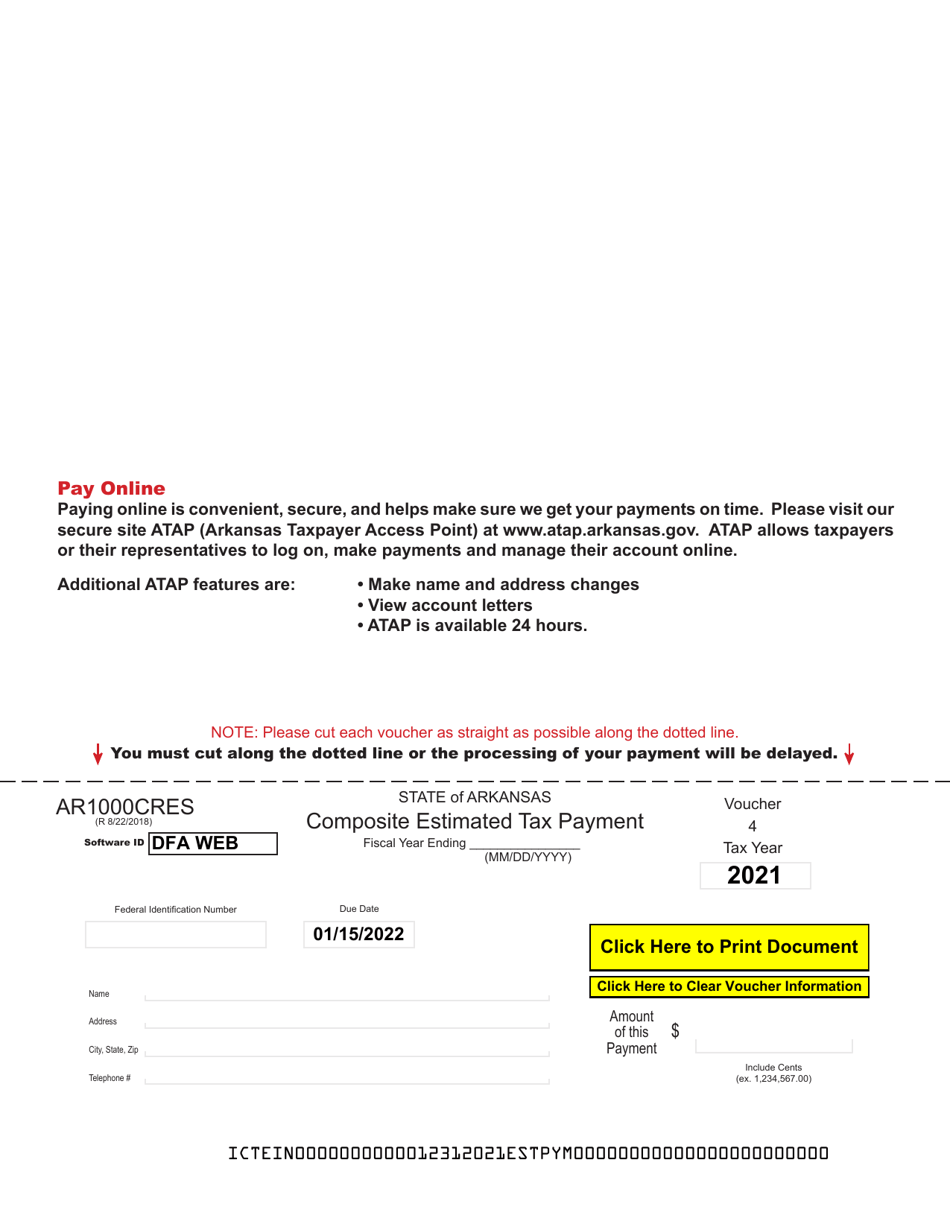

Form AR1000CRES Composite Estimated Tax Declaration Vouchers - Arkansas

What Is Form AR1000CRES?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AR1000CRES?

A: Form AR1000CRES is a composite estimated tax declaration voucher used in Arkansas.

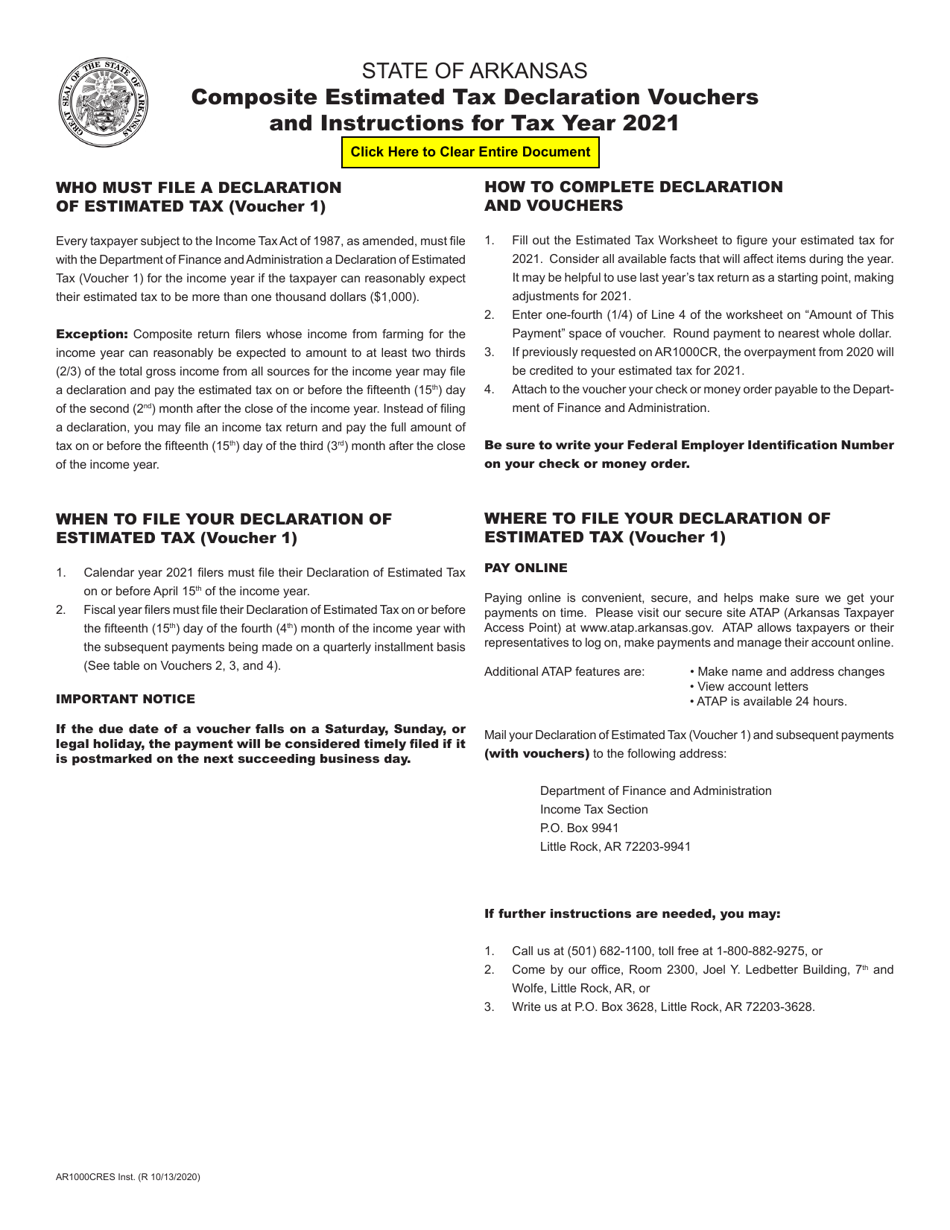

Q: Who needs to file Form AR1000CRES?

A: Individuals or entities who are part of a composite return in Arkansas may need to file Form AR1000CRES.

Q: What is a composite return?

A: A composite return is a tax return filed on behalf of multiple nonresident individuals or entities by a designated agent.

Q: What is the purpose of Form AR1000CRES?

A: Form AR1000CRES is used to report and remit estimated income tax payments on behalf of nonresident participants of a composite return.

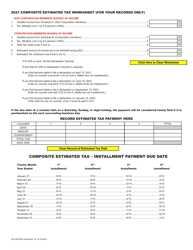

Q: How often do I need to file Form AR1000CRES?

A: Form AR1000CRES is typically filed on a quarterly basis, along with the corresponding payment of estimated taxes.

Q: Do I need to include supporting documentation with Form AR1000CRES?

A: Generally, supporting documentation is not required to be submitted with Form AR1000CRES unless specifically requested by the Arkansas Department of Finance and Administration.

Q: What happens if I fail to file Form AR1000CRES?

A: Failure to file Form AR1000CRES or pay the estimated taxes can result in penalties and interest charges imposed by the Arkansas Department of Finance and Administration.

Q: Can I amend Form AR1000CRES if I made an error?

A: Yes, you can file an amended Form AR1000CRES to correct any errors or omissions on the original form.

Form Details:

- Released on October 13, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000CRES by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.