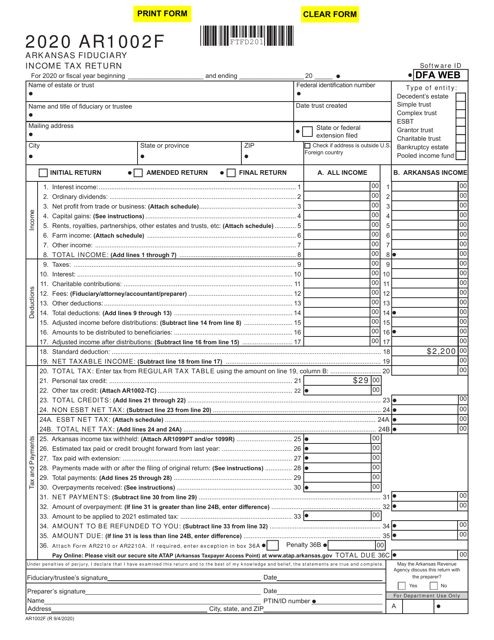

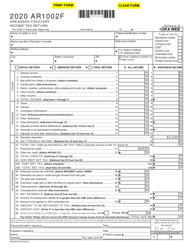

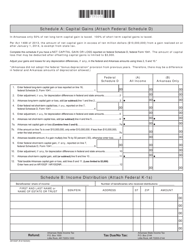

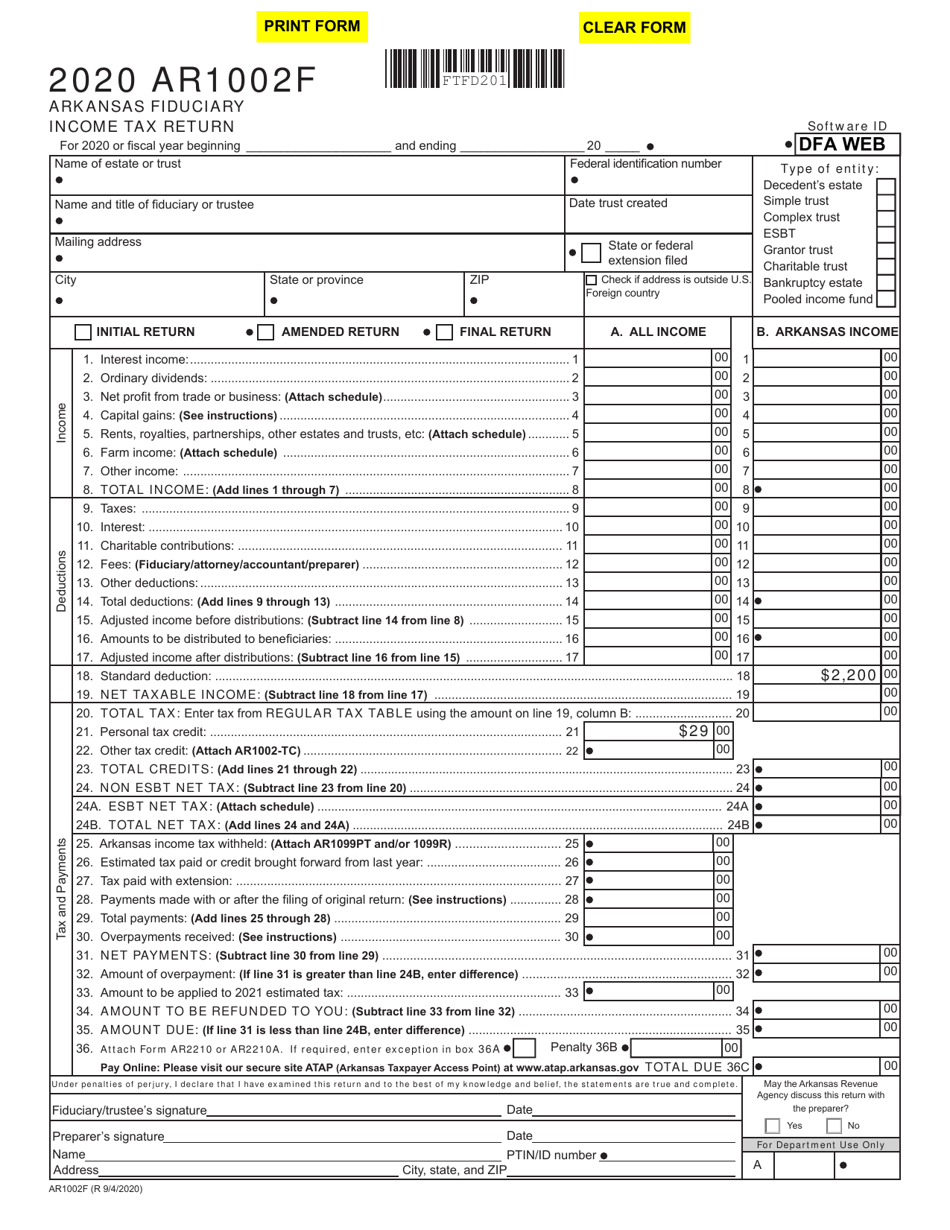

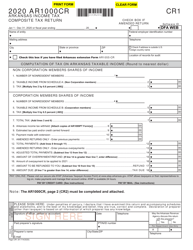

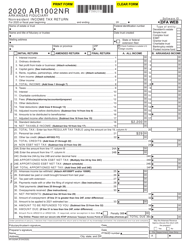

Form AR1002F Arkansas Fiduciary Income Tax Return - Arkansas

What Is Form AR1002F?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form AR1002F?

A: Form AR1002F is the Arkansas Fiduciary Income Tax Return.

Q: Who should file Form AR1002F?

A: Form AR1002F should be filed by fiduciaries, such as trustees or executors, who are responsible for filing income tax returns for trusts and estates in Arkansas.

Q: What is the purpose of Form AR1002F?

A: The purpose of Form AR1002F is to report the income, deductions, credits, and tax liability of a trust or estate in Arkansas.

Q: When is the deadline to file Form AR1002F?

A: The deadline to file Form AR1002F is on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any extensions available for filing Form AR1002F?

A: Yes, you can request an extension of time to file Form AR1002F by filing Form AR1155F, Arkansas Fiduciary Income Tax Extension Request.

Q: Is there a minimum income threshold for filing Form AR1002F?

A: Yes, if the trust or estate's Arkansas gross income is less than $500, then you are not required to file Form AR1002F.

Q: What if I have income from sources outside of Arkansas?

A: If you have income sourced from outside of Arkansas, you may be required to file additional forms, such as federal Form 1041 and any other applicable state tax returns.

Form Details:

- Released on September 4, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1002F by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.