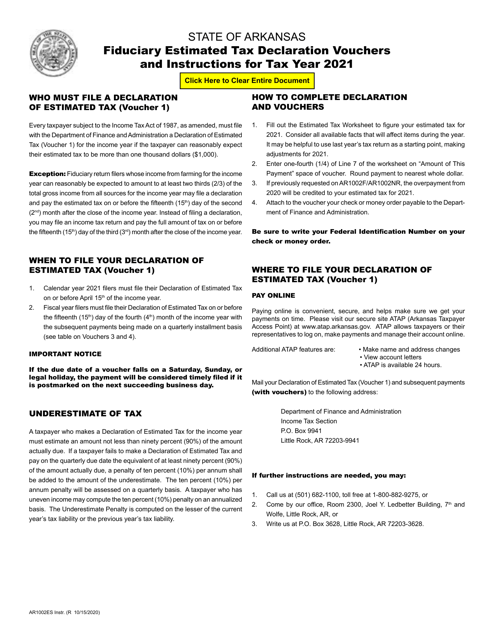

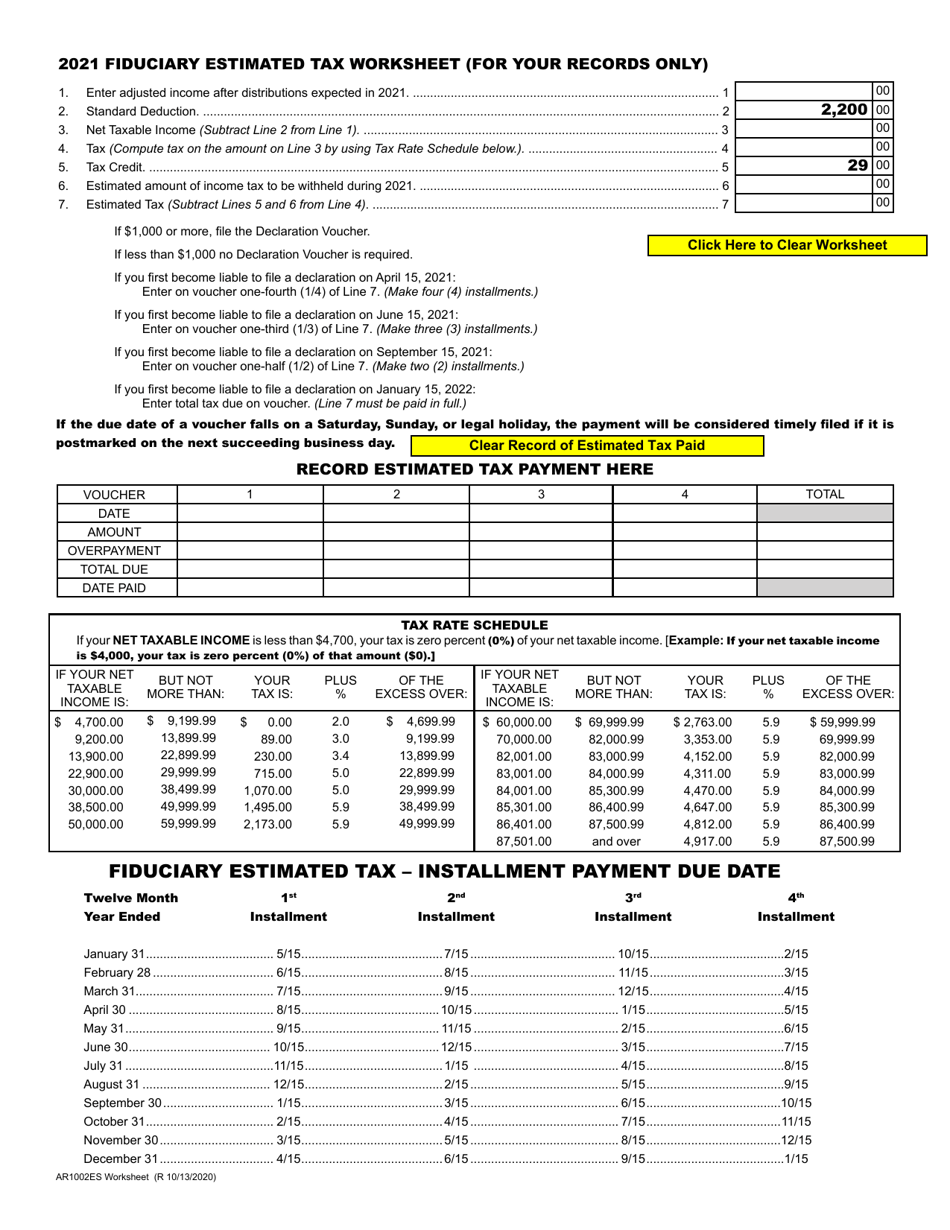

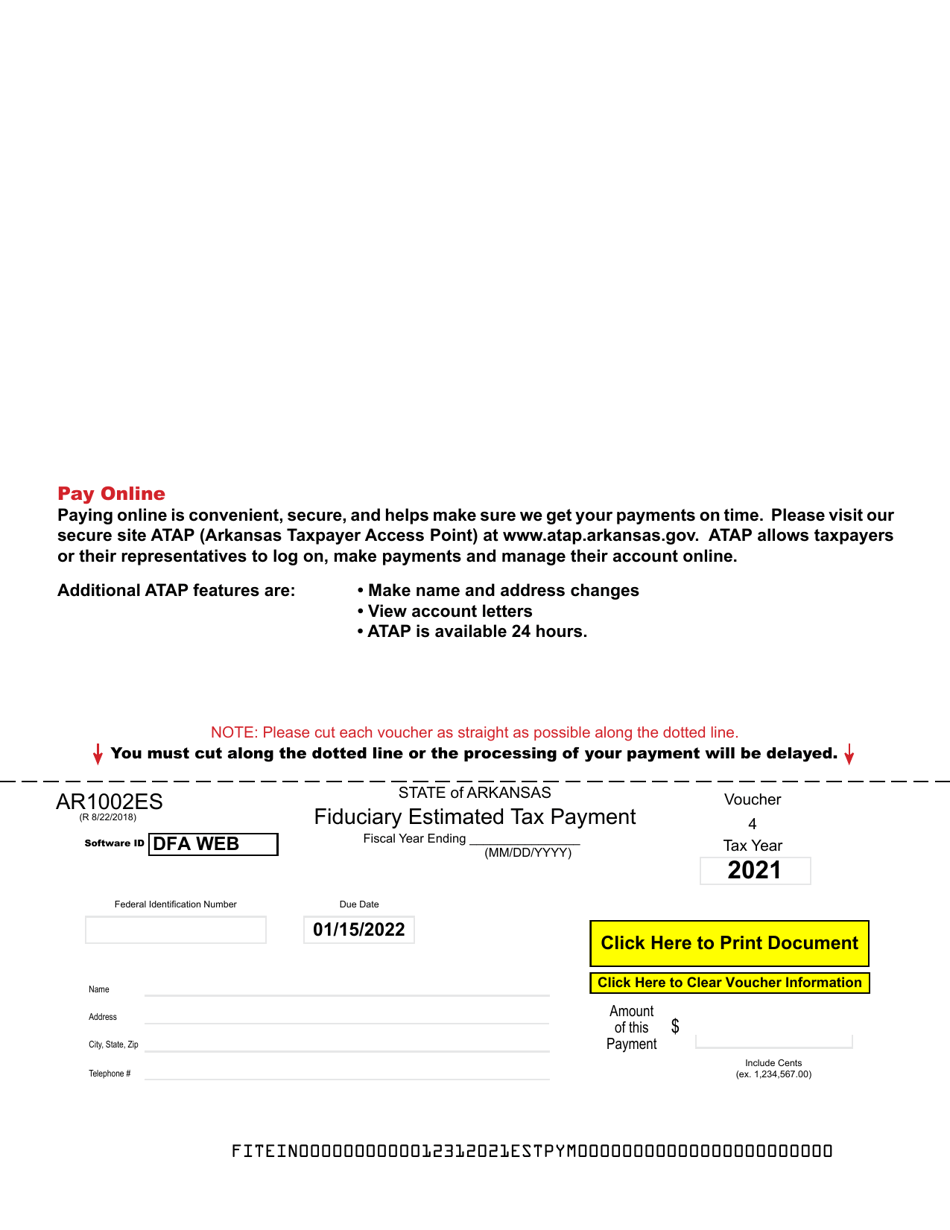

Form AR1002ES Fiduciary Estimated Tax Declaration Vouchers - Arkansas

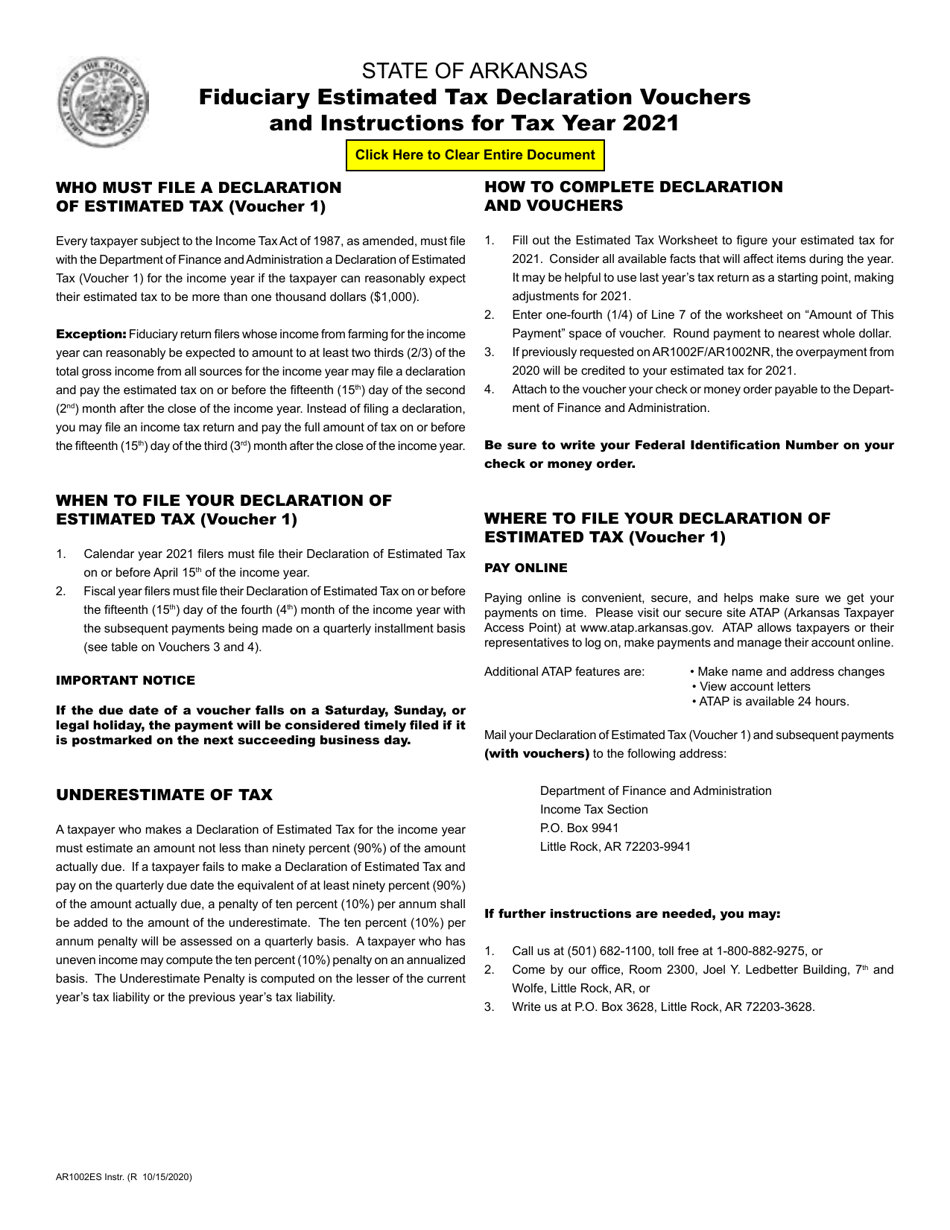

What Is Form AR1002ES?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1002ES?

A: Form AR1002ES is the Fiduciary Estimated Tax Declaration Vouchers for Arkansas.

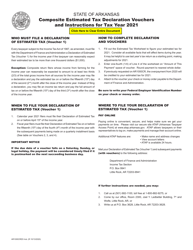

Q: Who needs to file Form AR1002ES?

A: Fiduciaries who need to make estimated tax payments in Arkansas need to file Form AR1002ES.

Q: What is the purpose of Form AR1002ES?

A: Form AR1002ES is used to declare and pay estimated taxes for fiduciary entities in Arkansas.

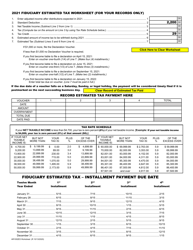

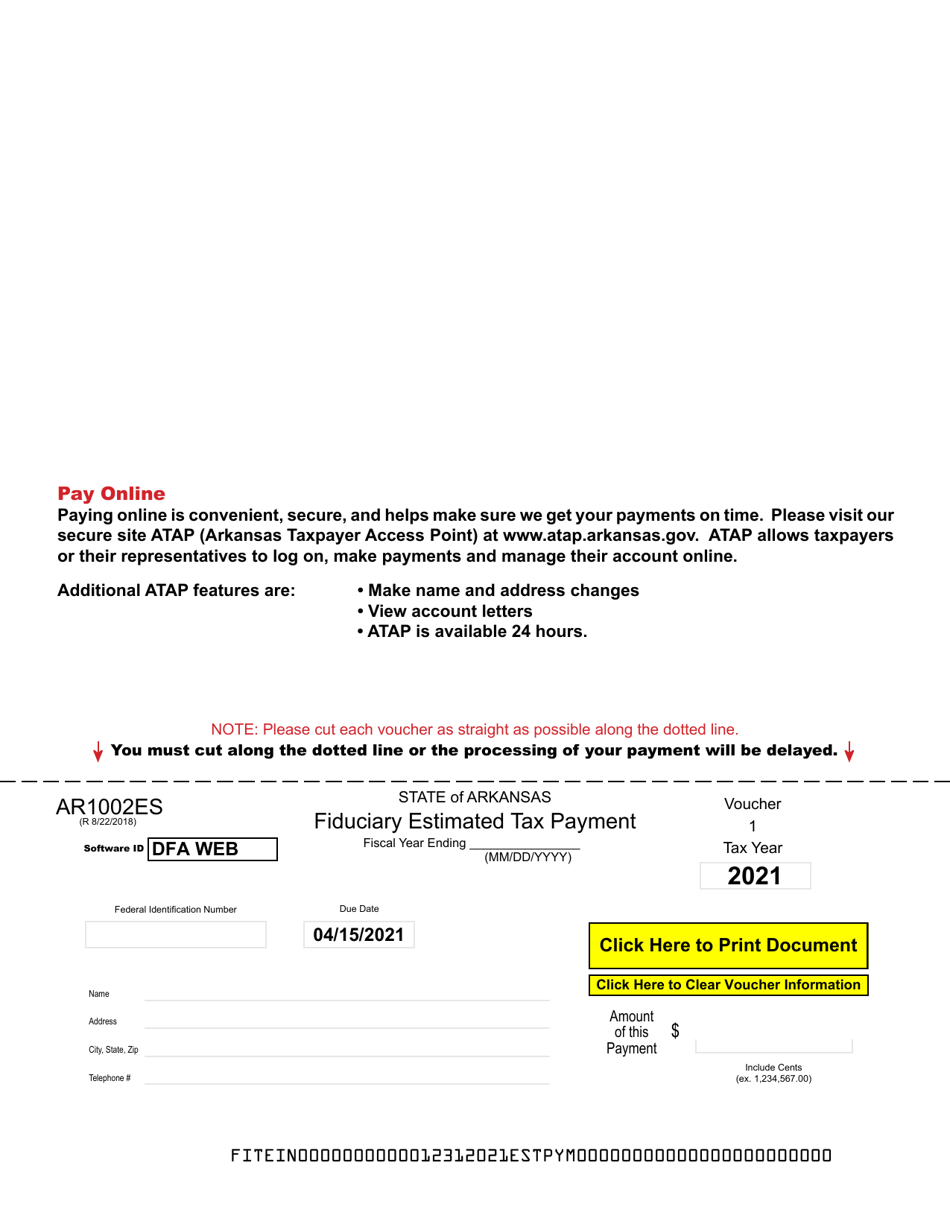

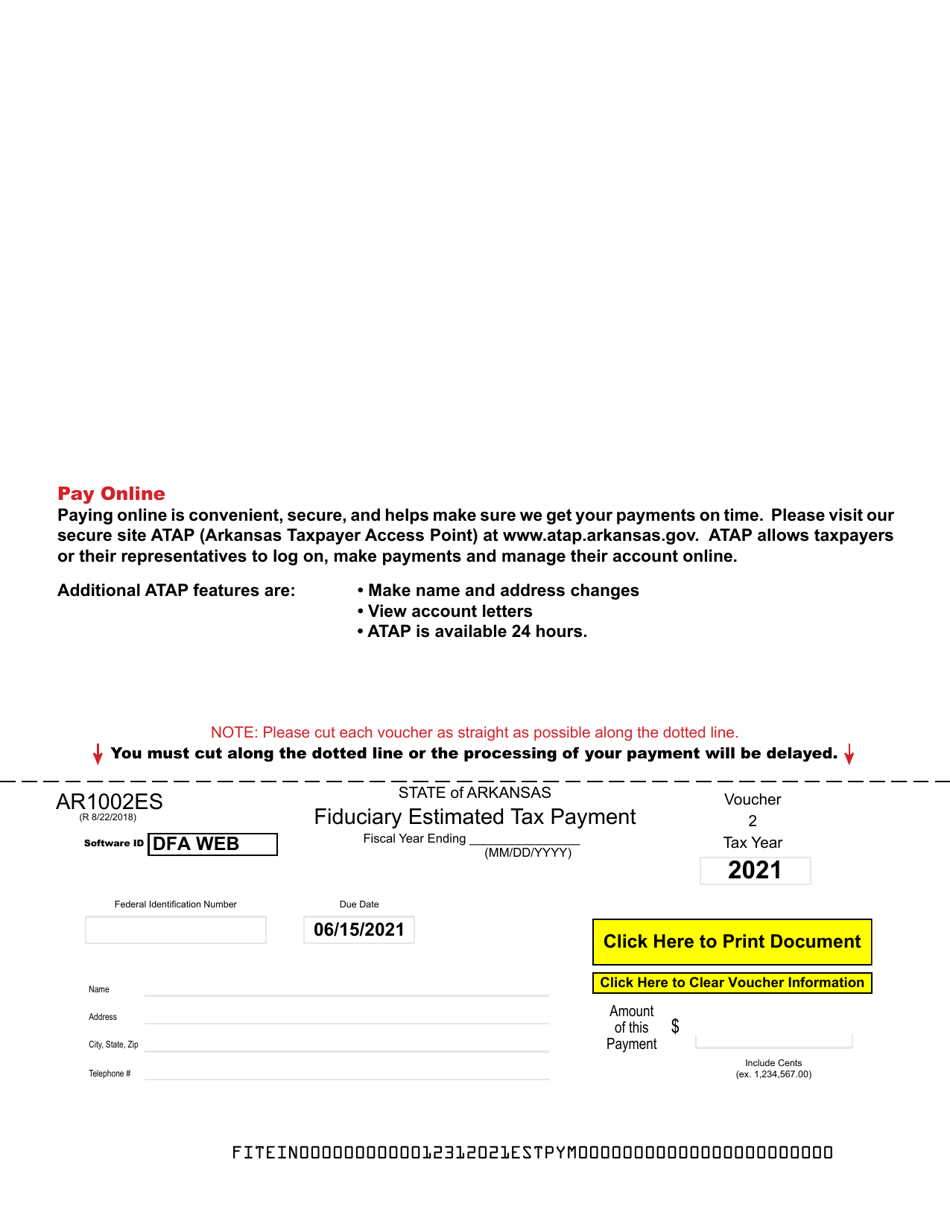

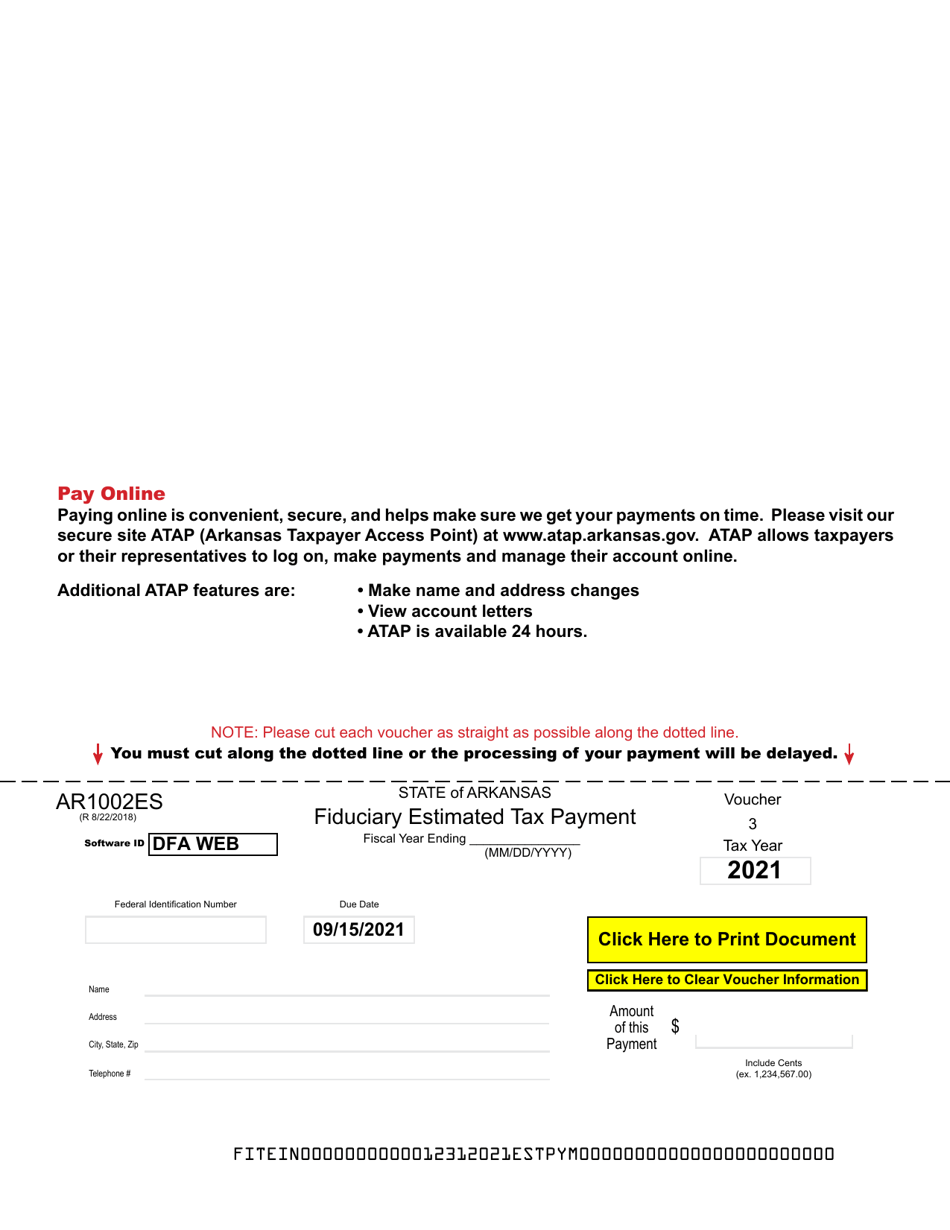

Q: When is Form AR1002ES due?

A: Form AR1002ES is due by the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year.

Form Details:

- Released on October 15, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

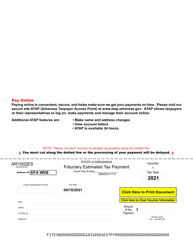

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1002ES by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.