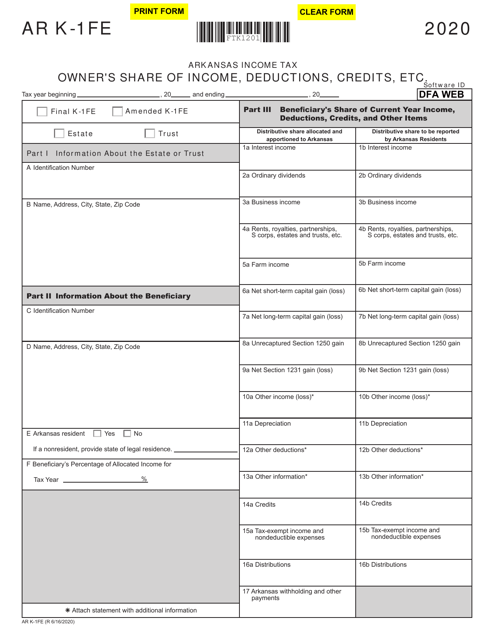

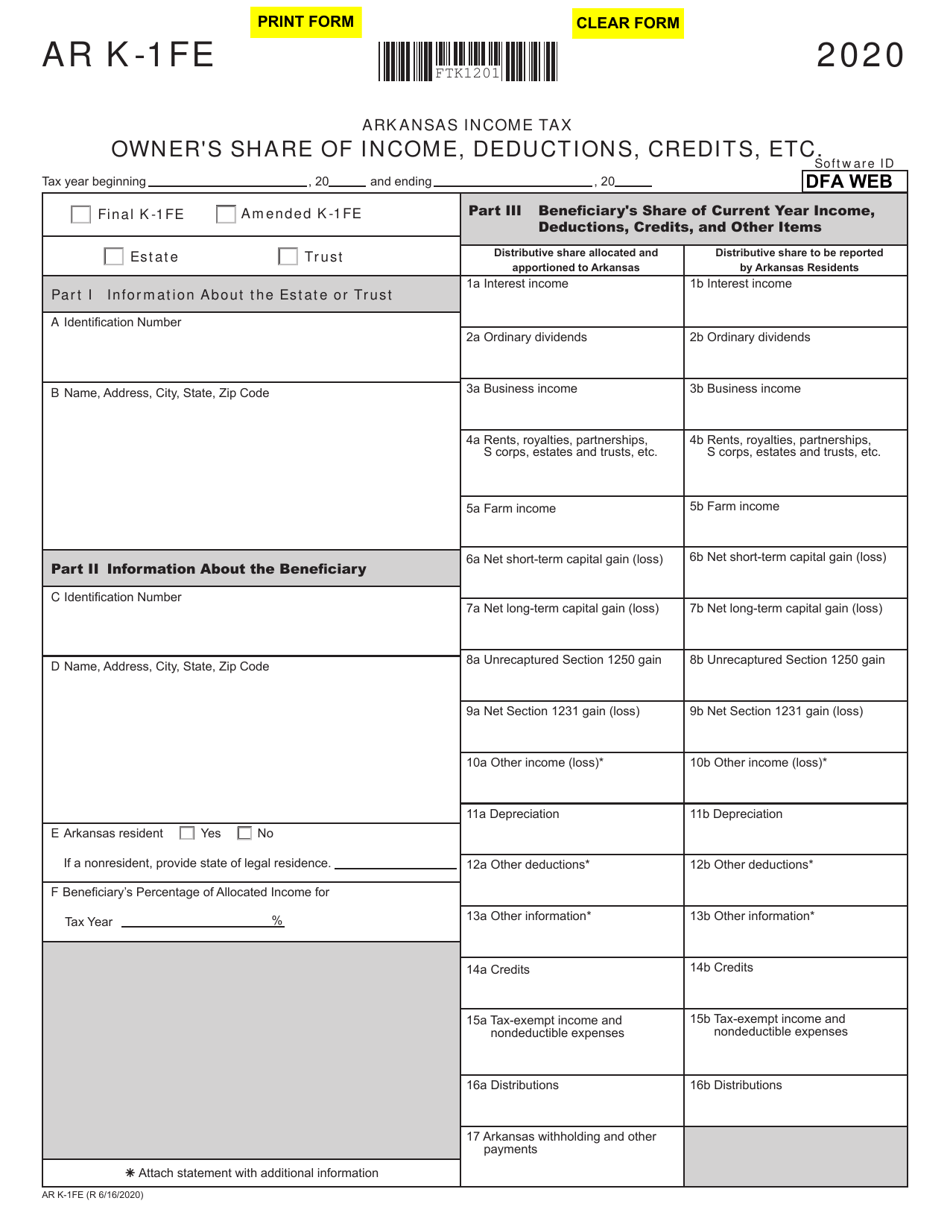

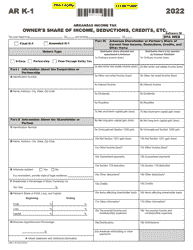

Form AR K-1FE Arkansas Income Tax Owner's Share of Income, Deductions, Credits, Etc. - Arkansas

What Is Form AR K-1FE?

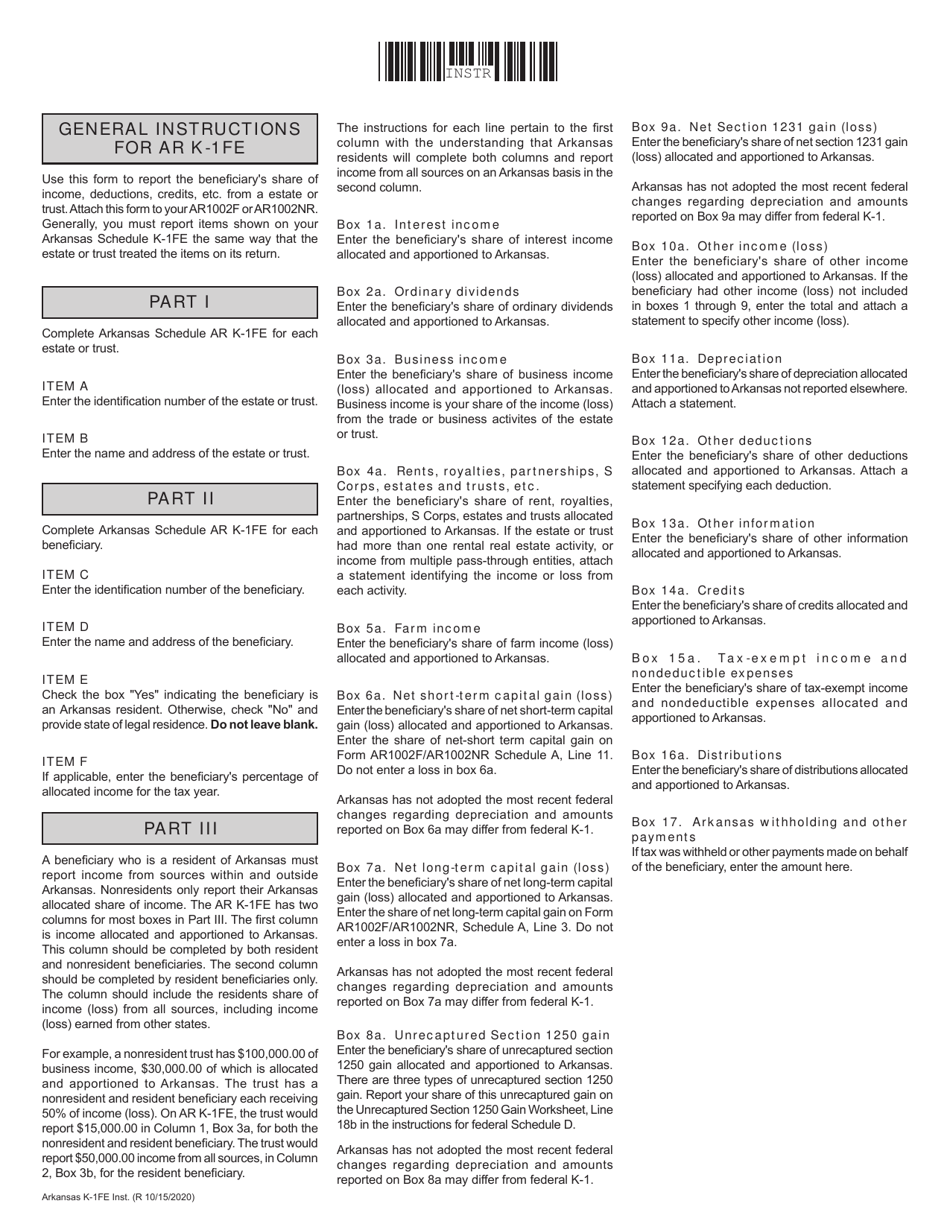

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an AR K-1FE form?

A: AR K-1FE is a form used to report an owner's share of income, deductions, credits, etc. for Arkansas income tax purposes.

Q: Who needs to file an AR K-1FE form?

A: Anyone who is an owner of a business or partnership in Arkansas and needs to report their share of income, deductions, credits, etc. for state tax purposes.

Q: What information is required on the AR K-1FE form?

A: The AR K-1FE form requires you to provide information about your share of income, deductions, credits, and other relevant details.

Q: When is the deadline to file an AR K-1FE form?

A: The deadline to file an AR K-1FE form is typically the same as the deadline for filing your Arkansas income tax return, which is usually April 15th.

Q: Is the AR K-1FE form only for individuals?

A: No, the AR K-1FE form is also used by businesses and partnerships to report their owners' share of income, deductions, credits, etc.

Q: Do I need to file an AR K-1FE form if I don't have any income or deductions?

A: If you don't have any income or deductions to report, you may not need to file an AR K-1FE form. However, it is always recommended to consult with a tax professional or the Arkansas Department of Finance and Administration.

Q: What happens if I don't file an AR K-1FE form?

A: Failing to file an AR K-1FE form when required may result in penalties and interest charges imposed by the Arkansas Department of Finance and Administration.

Form Details:

- Released on October 15, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR K-1FE by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.