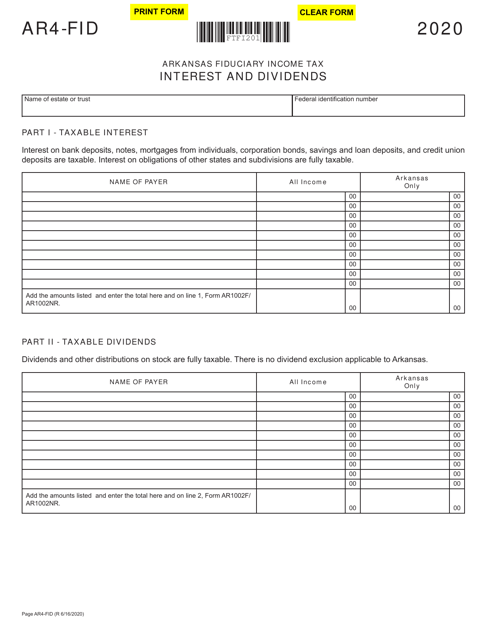

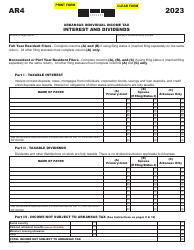

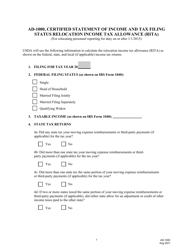

Form AR4-FID Arkansas Fiduciary Income Tax Interest and Dividends - Arkansas

What Is Form AR4-FID?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR4-FID?

A: Form AR4-FID is the Arkansas Fiduciary IncomeTax Interest and Dividends form.

Q: Who needs to file Form AR4-FID?

A: Form AR4-FID needs to be filed by fiduciaries who have received interest and dividend income in Arkansas.

Q: What is the purpose of Form AR4-FID?

A: The purpose of Form AR4-FID is to report interest and dividend income and calculate the related tax liability for fiduciaries in Arkansas.

Q: When is Form AR4-FID due?

A: Form AR4-FID is due on or before April 15th of each year.

Q: Is there a penalty for filing Form AR4-FID late?

A: Yes, there is a penalty for filing Form AR4-FID late. The penalty is calculated based on the amount of tax due and the number of days the return is late.

Form Details:

- Released on June 16, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR4-FID by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.