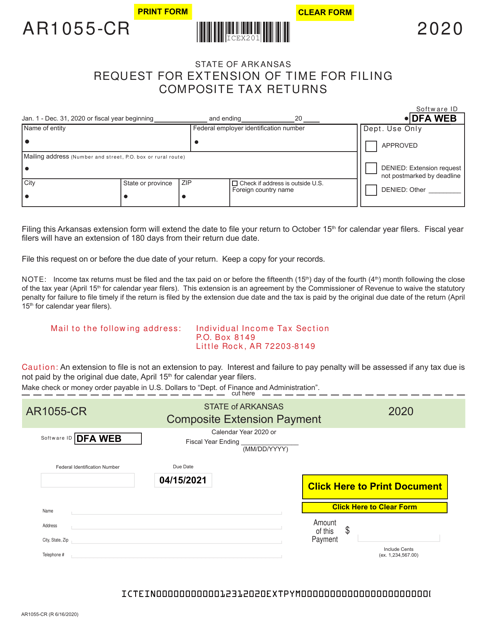

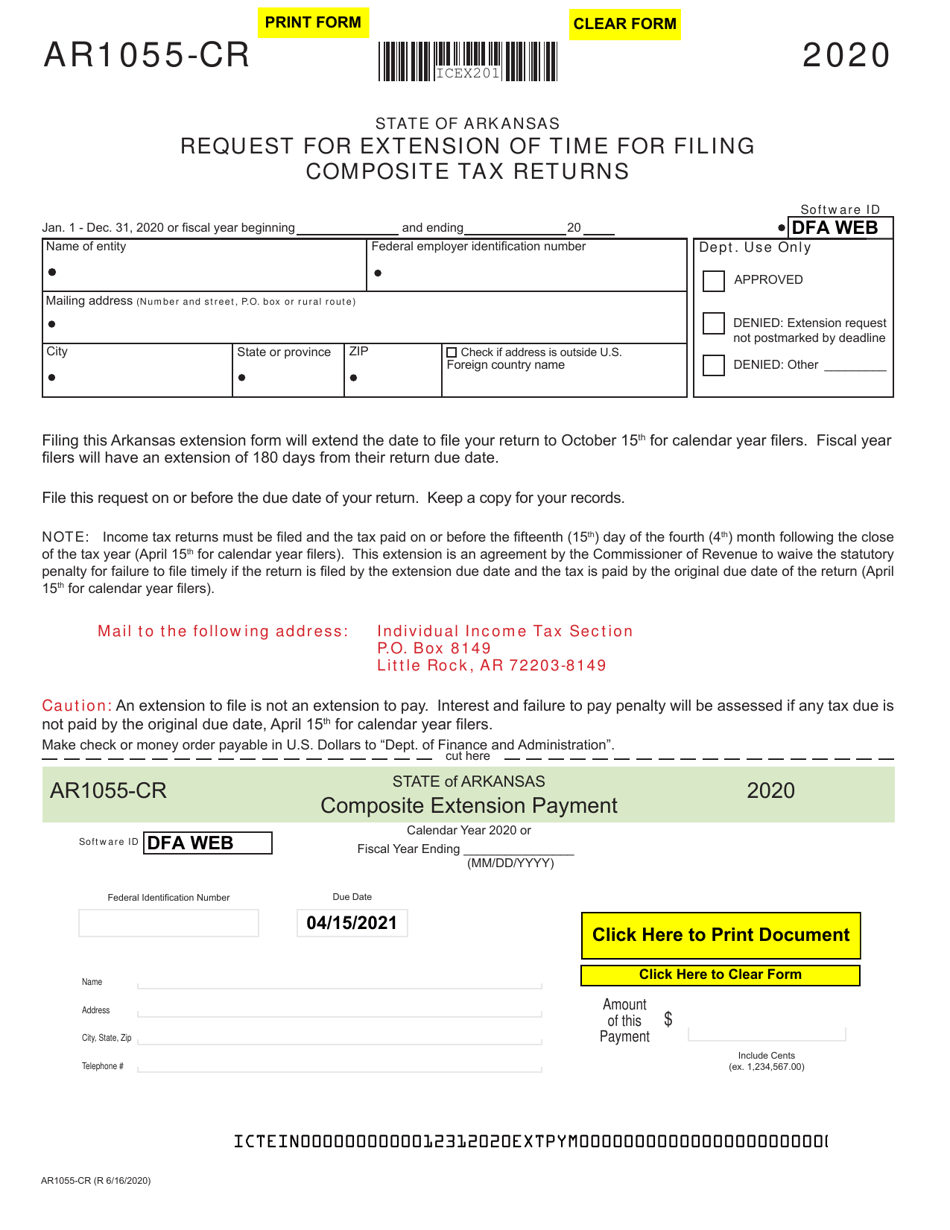

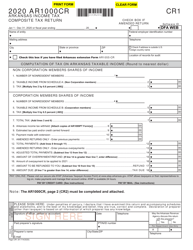

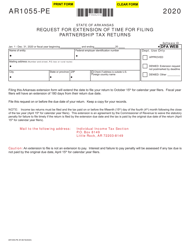

Form AR1055-CR Request for Extension of Time for Filing Composite Tax Returns - Arkansas

What Is Form AR1055-CR?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1055-CR?

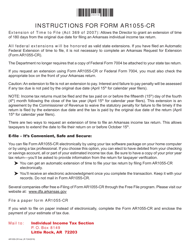

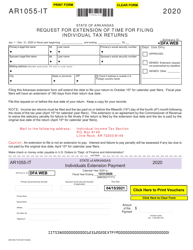

A: Form AR1055-CR is a request for an extension of time for filing composite tax returns in Arkansas.

Q: Who can use Form AR1055-CR?

A: Individuals or fiduciaries who are required to file composite tax returns in Arkansas can use Form AR1055-CR to request an extension of time for filing.

Q: What is a composite tax return?

A: A composite tax return is a tax return filed by a pass-through entity on behalf of its nonresident members.

Q: Why would someone need to file a composite tax return?

A: Someone would need to file a composite tax return if they are a nonresident member of a pass-through entity and want the entity to pay their Arkansas income tax.

Q: How long is the extension of time requested with Form AR1055-CR?

A: The extension of time requested with Form AR1055-CR is for 180 days.

Form Details:

- Released on June 16, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1055-CR by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.