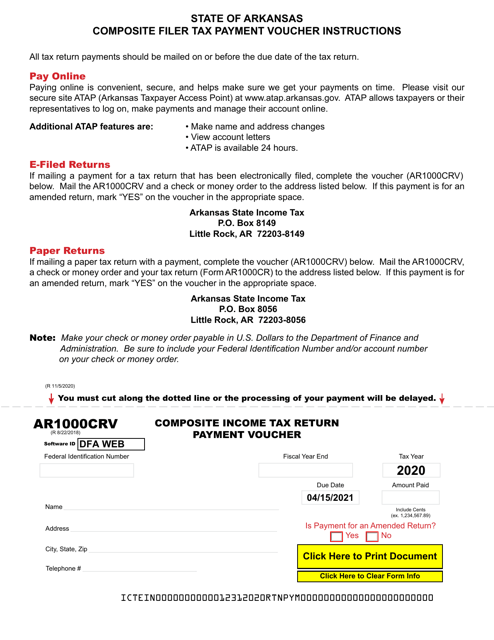

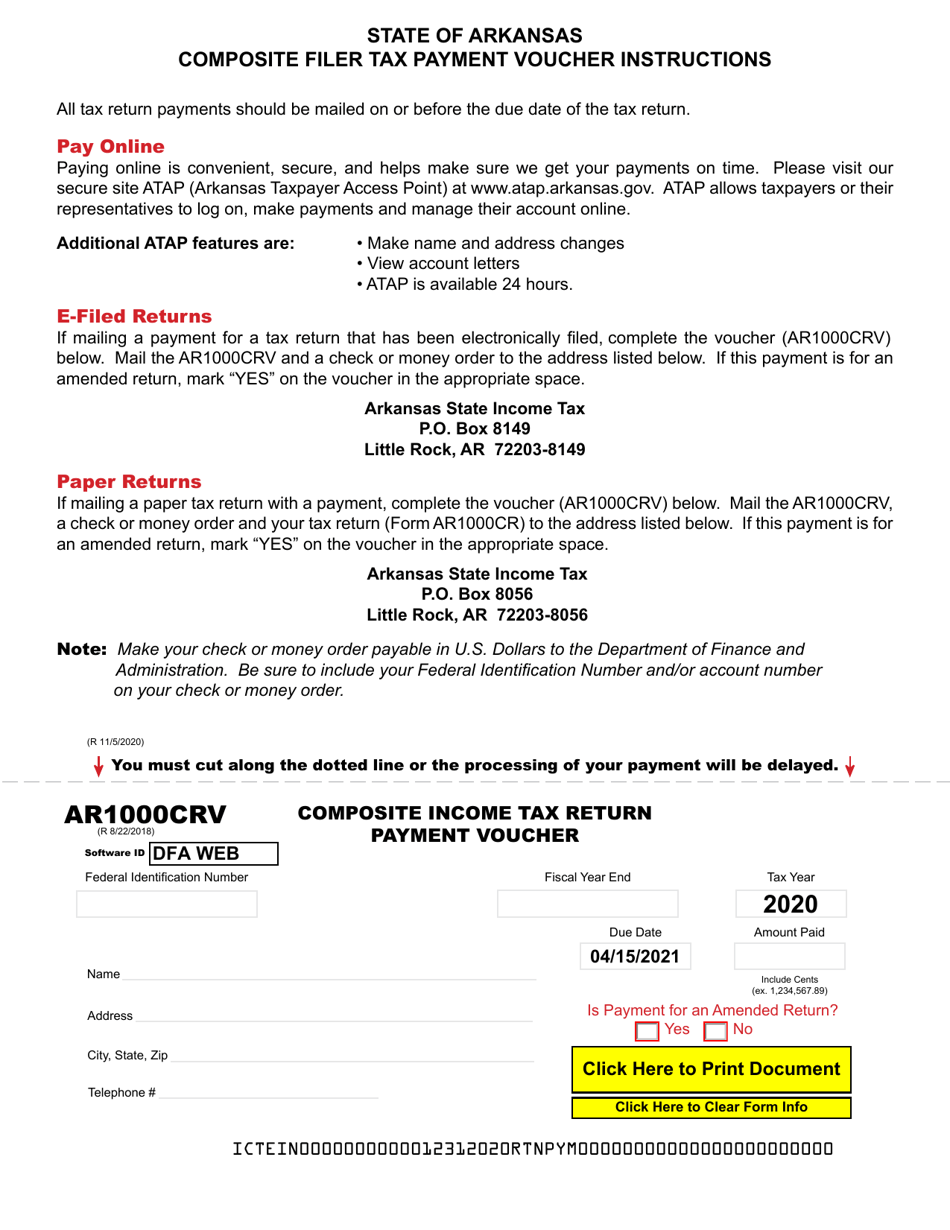

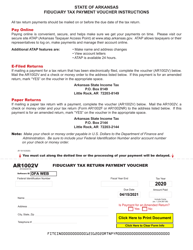

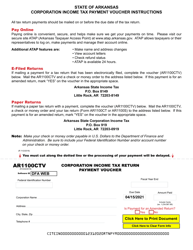

Form AR1000CRV Composite Income Tax Return Payment Voucher - Arkansas

What Is Form AR1000CRV?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AR1000CRV?

A: Form AR1000CRV is a Composite Income TaxReturn Payment Voucher for the state of Arkansas.

Q: How do I use Form AR1000CRV?

A: Form AR1000CRV is used to make a payment for your composite income tax return in Arkansas.

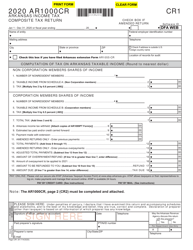

Q: What is a composite income tax return?

A: A composite income tax return is a return filed on behalf of nonresident partners or shareholders in a pass-through entity.

Q: Do I need to file a composite income tax return in Arkansas?

A: You need to file a composite income tax return in Arkansas if you are a nonresident partner or shareholder in a pass-through entity.

Q: What kind of payments can be made using Form AR1000CRV?

A: Form AR1000CRV can be used to make payments for composite income tax, estimated tax, or any other tax liability in Arkansas.

Q: What is the deadline for filing Form AR1000CRV?

A: The deadline to file Form AR1000CRV for composite income tax is on or before the due date of the pass-through entity's income tax return.

Q: Can Form AR1000CRV be e-filed?

A: No, currently Form AR1000CRV cannot be filed electronically. It must be filed by mail or in person.

Form Details:

- Released on November 5, 2020;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AR1000CRV by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.