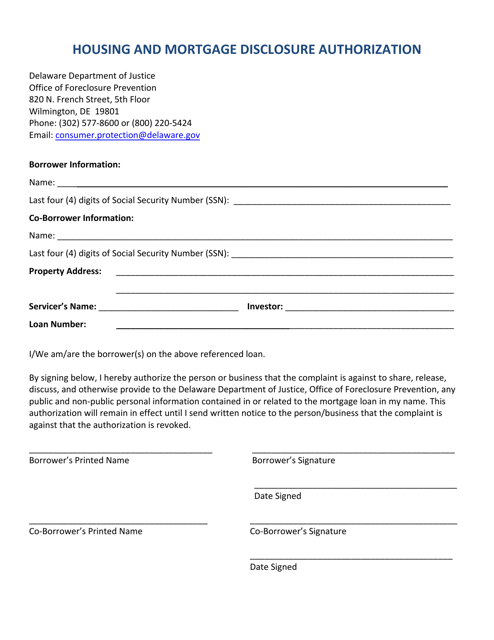

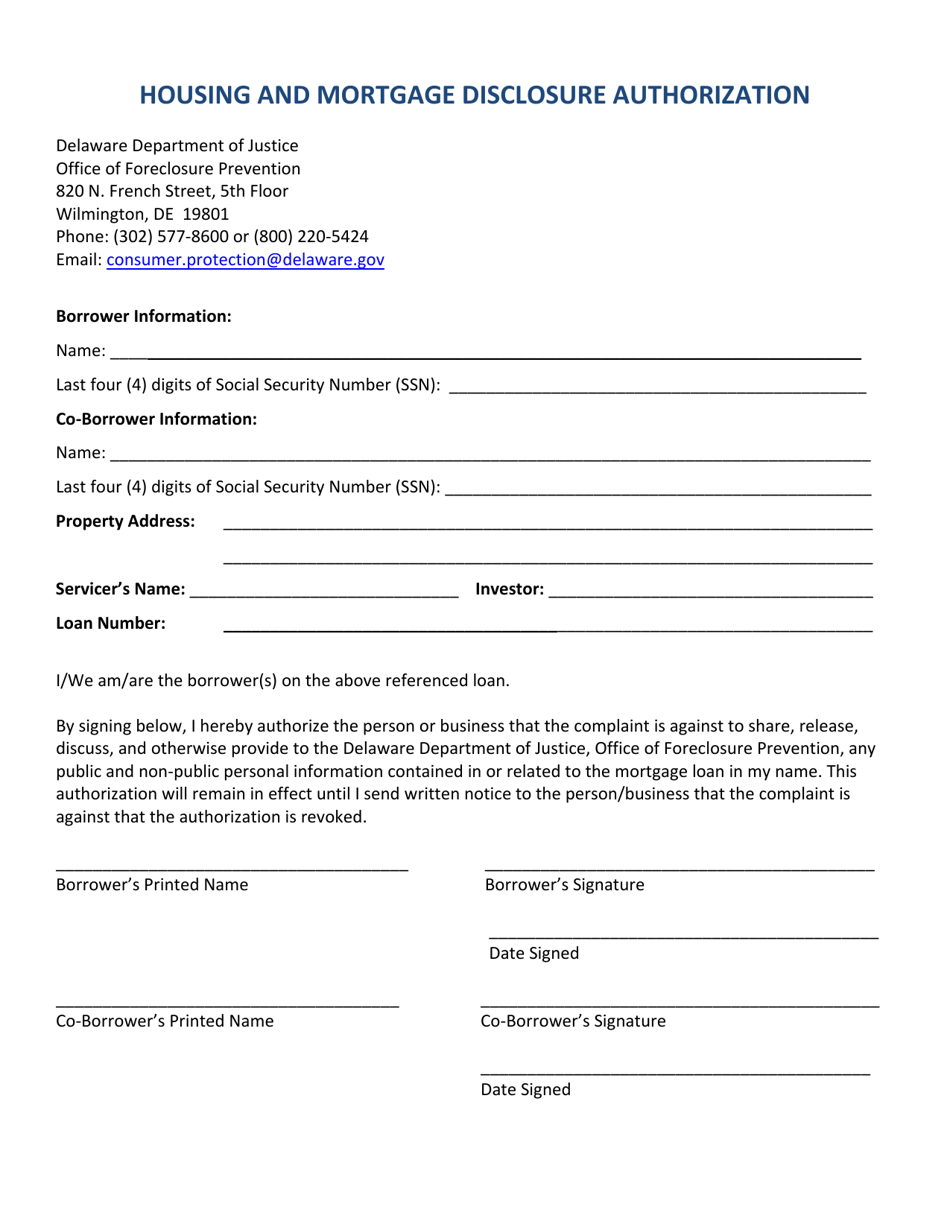

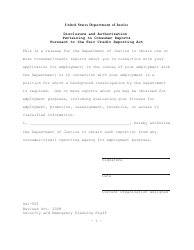

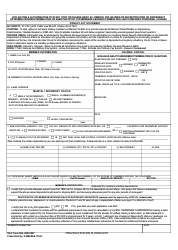

Housing and Mortgage Disclosure Authorization - Delaware

Housing and Mortgage Disclosure Authorization is a legal document that was released by the Delaware Department of Justice - a government authority operating within Delaware.

FAQ

Q: What is the Housing and Mortgage Disclosure Authorization in Delaware?

A: The Housing and Mortgage Disclosure Authorization in Delaware is a document that allows lenders to obtain information about a borrower's housing and mortgage history.

Q: Why do lenders need a Housing and Mortgage Disclosure Authorization?

A: Lenders need a Housing and Mortgage Disclosure Authorization to verify a borrower's housing and mortgage payment history as part of the loan application process.

Q: What information can lenders obtain with a Housing and Mortgage Disclosure Authorization?

A: Lenders can obtain information such as the borrower's rental payment history, eviction records, and mortgage payment history with a Housing and Mortgage Disclosure Authorization.

Q: Is a Housing and Mortgage Disclosure Authorization required in Delaware?

A: Yes, a Housing and Mortgage Disclosure Authorization is required in Delaware for most mortgage loan applications.

Q: How can borrowers provide a Housing and Mortgage Disclosure Authorization?

A: Borrowers can provide a Housing and Mortgage Disclosure Authorization by signing the document provided by the lender or mortgage broker.

Form Details:

- The latest edition currently provided by the Delaware Department of Justice;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Delaware Department of Justice.